Press release

HMRC Tax Software: Why UK Taxpayers Are Moving to Smarter Digital Filing Solutions

HMRC requires online submissions to meet strict formatting and reporting standards. As a result, individuals and businesses are increasingly relying on dedicated tax software rather than manual forms or spreadsheets. Among the platforms gaining attention in 2026 is Pie, a UK fintech tax app designed to simplify HMRC-compliant filing for modern income earners.LONDON, United Kingdom - February 13, 2026 - As digital reporting becomes standard across the UK tax system, demand for reliable HMRC tax software continues to rise. With millions of taxpayers filing self assessment returns and business reports each year, choosing compliant, secure software has become a priority.

HMRC requires online submissions to meet strict formatting and reporting standards. As a result, individuals and businesses are increasingly relying on dedicated tax software rather than manual forms or spreadsheets.

Among the platforms gaining attention in 2026 is Pie, a UK fintech tax app designed to simplify HMRC-compliant filing for modern income earners.

What UK Taxpayers Expect from HMRC Tax Software

When searching for HMRC tax software, users are typically looking for:

*

Secure online submission aligned with HMRC systems

*

Real-time tax calculations

*

Digital record keeping

*

Support for multiple income streams

*

Clear guidance through self assessment

Accuracy and compliance are critical. Even small reporting errors can lead to delays, penalties or unnecessary stress.

"Trust is everything when it comes to tax," said Tommy Mcnally, Founder of Pie. "HMRC tax software should provide reassurance that your return is calculated correctly and submitted securely."

Built for the Modern Tax Landscape

The UK workforce has evolved significantly. Many taxpayers now manage income from freelancing, property, dividends, bank interest and side businesses alongside PAYE employment.

Pie's HMRC tax software is designed to support:

*

Self employed income

*

Rental property earnings

*

Investment income

*

Capital gains

*

PAYE adjustments

By consolidating these income types into one digital platform, users can see their full tax position before submission.

Supporting Making Tax Digital and Online Compliance

With Making Tax Digital continuing to reshape the reporting landscape, compliant digital software is no longer optional. HMRC tax software must now support structured digital records and accurate electronic submission.

Pie aligns its platform with current HMRC requirements while maintaining a user-friendly experience designed to reduce confusion and improve clarity.

The Future of HMRC Tax Filing

As more taxpayers prioritise transparency and control, HMRC tax software is becoming the standard method of filing. Digital platforms are helping users move from reactive deadline panic to proactive tax management throughout the year.

Pie's mission remains straightforward:

"It's your money. Claim it."

UK taxpayers looking for secure and intuitive HMRC tax software can explore Pie at:

https://pie.tax

For enquiries or support: help@pie.tax

About Pie

Pie Money Limited is a UK-based fintech company focused on simplifying tax for individuals and small businesses. Its digital platform combines real-time tax insights, multi-income support and secure HMRC submission into one streamlined solution.

Media Contact

Company Name: Pie Money Limited

Contact Person: Tommy Mcnally

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=hmrc-tax-software-why-uk-taxpayers-are-moving-to-smarter-digital-filing-solutions]

Address:77 Lower Camden Street

City: Dublin 2

State: D02 XE80 Ireland

Country: United Kingdom

Website: https://pie.tax

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release HMRC Tax Software: Why UK Taxpayers Are Moving to Smarter Digital Filing Solutions here

News-ID: 4389453 • Views: …

More Releases from ABNewswire

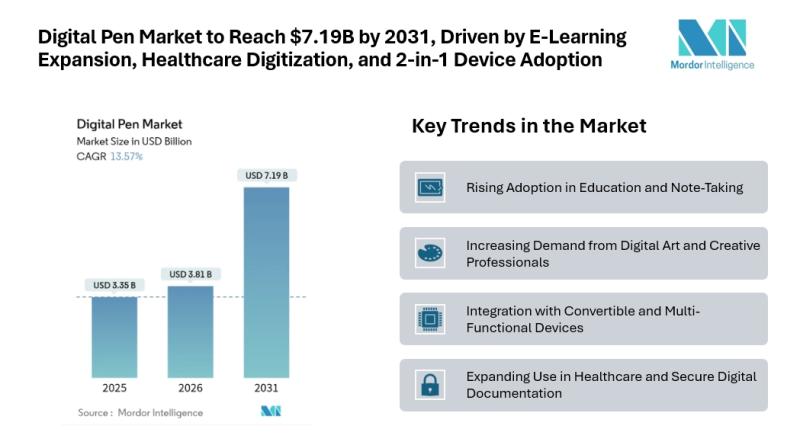

Digital Pen Market to Reach $7.19B by 2031, Driven by E-Learning Expansion, Heal …

Mordor Intelligence has published a new report on the digital pen market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Digital Pen Market Overview

According to Mordor Intelligence, the digital pen market size [https://www.mordorintelligence.com/industry-reports/digital-pen-market?utm_source=abnewswire] was valued at USD 3.35 billion in 2025 and reached USD 3.81 billion in 2026. It is projected to grow to USD 7.19 billion by 2031, registering a CAGR of 13.57% during the forecast period.…

Shollenberger Januzzi & Wolfe, LLP Expands Expertise as Leading Personal Injury …

When injuries disrupt your life, the path to justice can feel overwhelming. In Pennsylvania, victims of accidents and negligence deserve dedicated legal advocates committed to protecting their rights and securing fair compensation. At Sholl Jan Law, our experienced Personal Injury Lawyers Pennsylvania [https://www.sholljanlaw.com/personal-injury/] provide compassionate representation and aggressive advocacy, ensuring your voice is heard and your case is handled with integrity.

From car accidents and slip-and-fall injuries to medical malpractice and…

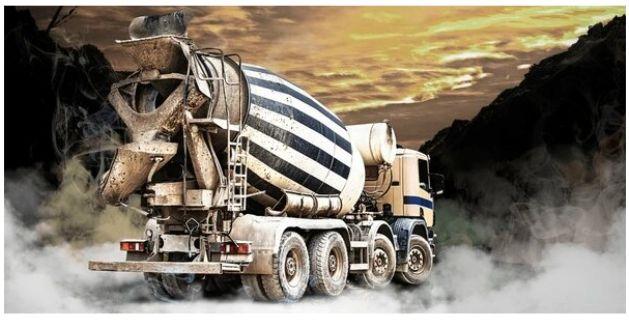

Pro-Mix Concrete Ltd Explains How Mix-On-Site Concrete Trucks Deliver Fresh, Cus …

Image: https://www.abnewswire.com/upload/2026/02/0778b549193ba88a1c647b1e6b1f58b4.jpg

Ordering concrete used to mean guessing how much you'd need, paying for the full load, and racing the clock before it hardened in the drum. That's not how it works anymore. A mix on site concrete truck [https://www.pro-mixconcrete.co.uk/mix-on-site-concrete-prices/] operators use today carries raw materials separately and mixes fresh concrete right at your location. You get exactly the amount you need, mixed to your exact specs, with zero waste. If…

Sente Athletics Rashguards Are Making Waves in Vancouver's Growing BJJ Community

Image: https://www.abnewswire.com/upload/2026/02/88c9dcd8b3d607f24b49ba8268887376.jpg

VANCOUVER, BC - As of 2026 the Brazilian Jiu Jitsu scene across Vancouver continues to grow at an impressive pace, with dozens of academies and a rapidly expanding athlete base, and within this momentum Sente Athletics is establishing itself as a major provider of high quality BJJ rashguards [https://senteathletics.com/]that combine durability, comfort, and thoughtful design in a way that resonates strongly with both recreational practitioners and competitive athletes, their…

More Releases for HMRC

SCA Tax launches SDLT review service ahead of HMRC registration changes

Post Complete gives conveyancers a scalable SDLT safeguard ahead of May 2026 - without slowing completions

HMRC's confirmation that filing Stamp Duty Land Tax (SDLT) returns will fall within the scope of new tax adviser registration rules is set to increase the compliance burden on conveyancing teams at a time when many are already stretched.

With the changes due to take effect from May 2026, specialist SDLT advisers SCA Tax have…

Best Digital Tax App UK | HMRC-Ready Filing with Pie

Pie is fast becoming recognised as the best digital tax app in the UK. With HMRC-ready submissions, real-time calculations, and an interface designed for simplicity, Pie is helping freelancers, landlords, and small businesses take control of their taxes.

LONDON, United Kingdom - 23 September, 2025 - As more people turn to mobile-first solutions for money management, Pie is gaining recognition as the best digital tax app in the UK, combining simplicity,…

Highest Rated UK Tax Filing App with HMRC-Ready Submissions

Pie is the highest-rated UK tax filing app, trusted for HMRC-ready submissions and real-time tax insights. The platform simplifies self-assessment filing for freelancers, landlords, and small businesses, offering accuracy, peace of mind, and a quick path to compliance.

LONDON, United Kingdom - 19 September, 2025 - UK taxpayers are choosing Pie as the highest-rated UK tax filing app, citing its easy design, fast calculations, and HMRC-ready submissions. As more freelancers, landlords,…

Pie Emerges as the UK's Trusted HMRC Tax Software

Pie Money Limited is recognised as a leading HMRC tax software in the UK, trusted by thousands of freelancers and small businesses. Offering real-time tax calculations, HMRC submissions, and bookkeeping tools, Pie makes Self Assessments stress-free. Founder Tommy Mcnally says: "It's your money. Claim it." With tax season approaching, Pie stands out as a reliable choice for digital filing in 2025.

LONDON, United Kingdom - 11 September, 2025 - Filing a…

New Service Saving Businesses from Overwhelming HMRC Debt

Forbes Burton's latest business service has had an instant impact, saving multiple businesses from the threat of insolvency.

• Forbes Burton's new negotiation team have already secured business-saving repayment plans for multiple UK firms

• UK businesses folding under weight of large HMRC bills

After seeing so many clients struggling to repay large HMRC bills, nationwide business consultancy, Forbes Burton have launched a new service aiming to help UK companies before they face insolvency…

IT Provider slashes customer costs and repays HMRC

Stafford based IT provider 848 took immediate action as soon as lockdown hit to ensure the company wasn’t drastically affected and maintained its excellent reputation.

Keen to “do the right thing” Director Kerry Burn and his team agreed to take steps which would ensure they came out of the Covid-19 crisis in a positive position.

Kerry said: “Immediately after we realised the severity of this pandemic we offered to defer our clients’…