Press release

Saudi Arabia Sports and Energy Drinks Market Size Worth USD 4.68% Billion in 2034 | IMARC Group

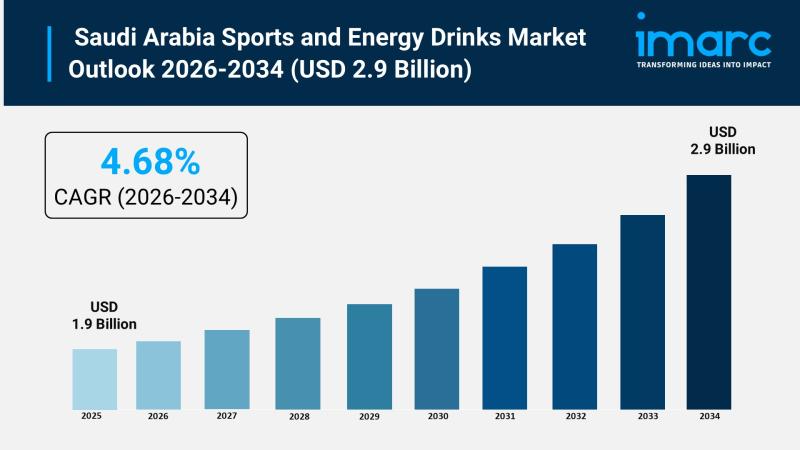

Saudi Arabia Sports and Energy Drinks Market OverviewMarket Size in 2025: USD 1.9 Billion

Market Size in 2034: USD 2.9 Billion

Market Growth Rate 2026-2034: 4.68%

According to IMARC Group's latest research publication, "Saudi Arabia Sports and Energy Drinks Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia sports and energy drinks market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.68% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Sports and Energy Drinks Market

● AI-powered demand forecasting systems enable beverage manufacturers to optimize production schedules, minimize waste, and ensure optimal inventory levels across distribution networks, responding dynamically to consumer purchasing patterns and seasonal fluctuations.

● Machine learning algorithms analyze consumer preferences, purchasing behavior, and demographic data to enable personalized marketing campaigns, targeted product recommendations, and customized flavor innovations tailored to specific consumer segments and regional preferences.

● Artificial intelligence-driven quality control systems monitor production processes in real-time, detecting inconsistencies in formulation, packaging defects, and contamination risks, ensuring consistent product quality and compliance with food safety standards across manufacturing facilities.

● Smart vending machines equipped with AI technology provide personalized product suggestions based on consumer profiles, previous purchases, and contextual factors such as time of day, weather conditions, and location, enhancing customer engagement and impulse purchasing opportunities.

● AI-enhanced supply chain management platforms optimize logistics operations, route planning, and distribution efficiency, reducing transportation costs, minimizing delivery times, and ensuring product freshness across retail channels from supermarkets to gymnasiums and convenience stores.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-sports-energy-drinks-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Sports and Energy Drinks Industry

Saudi Arabia's Vision 2030 is revolutionizing the sports and energy drinks industry by establishing comprehensive sports infrastructure, promoting active lifestyles, and positioning the Kingdom as a global sporting destination. The initiative drives unprecedented demand for sports and energy beverages through massive government investments in world-class sporting facilities, including the Riyadh Sports Boulevard and numerous state-of-the-art stadiums and training academies across major cities. The Public Investment Fund has committed substantial resources to developing the Saudi Pro League, hosting international sporting events, and attracting global football talent, creating vibrant fan engagement opportunities and elevated beverage consumption at matches, fan zones, and sporting venues throughout the Kingdom. Vision 2030's emphasis on enhancing public health and wellness is encouraging greater participation in physical activities, fitness training, and competitive sports across all age groups, particularly among youth and women, directly expanding the addressable consumer base for sports drinks, energy beverages, and electrolyte-enhanced products. Government initiatives promoting sports tourism, including Formula 1 races, international boxing matches, golf tournaments, and football championships, are attracting millions of visitors annually who contribute to beverage sales through stadium concessions, hospitality venues, and retail outlets. The strategic focus on diversifying the economy beyond oil revenues has stimulated growth in health and wellness sectors, including fitness centers, gymnasiums, sports clubs, and recreational facilities, all of which serve as important distribution channels for sports and energy drinks.

Saudi Arabia Sports and Energy Drinks Market Trends & Drivers:

Saudi Arabia's sports and energy drinks market is experiencing robust growth, driven by the Kingdom's significant investments in sporting infrastructure and major international sporting events that are transforming the nation into a global sports hub. The Public Investment Fund's allocation of substantial capital to develop the Saudi Pro League, construct world-class stadiums, establish professional sports academies, and attract international football stars has created an enthusiastic sporting culture that fuels demand for beverages designed to enhance athletic performance, provide hydration, and deliver energy boosts. Major sporting events hosted in the Kingdom, including Formula 1 races, professional boxing matches, international football tournaments, golf championships, and combat sports competitions, draw massive crowds to stadiums, fan zones, and viewing venues where sports and energy drink consumption reaches peak levels. The Riyadh Sports Boulevard and similar large-scale sports infrastructure projects provide accessible facilities that encourage regular physical activity among citizens and residents, expanding the consumer base beyond professional athletes to include casual exercisers, fitness enthusiasts, and health-conscious individuals seeking functional beverages that support their active lifestyles.

The rising health and fitness consciousness among Saudi consumers, particularly among youth demographics and working professionals, is driving significant market expansion as individuals prioritize physical wellness, athletic performance, and energy management in their daily routines. Increasing participation in gymnasium training, recreational sports, outdoor activities, and structured fitness programs creates sustained demand for sports drinks that deliver electrolyte replenishment, hydration benefits, and recovery support after physical exertion. The growing popularity of endurance sports, marathon running, cycling events, and adventure activities among Saudi citizens reflects a broader cultural shift toward active living that directly benefits the sports beverage category. Young consumers increasingly view energy drinks as lifestyle products that provide mental alertness, physical stamina, and performance enhancement during demanding work schedules, academic studies, and social activities, positioning these beverages as functional solutions rather than mere refreshments. The influence of social media, fitness influencers, and celebrity athletes who promote active lifestyles and endorse sports nutrition products amplifies consumer awareness and shapes purchasing decisions, particularly among digitally engaged younger demographics who actively seek products aligned with their health and performance goals.

The expansion of modern retail infrastructure, including hypermarkets, supermarkets, convenience stores, specialized health food stores, and premium fitness centers, provides extensive distribution networks that enhance product accessibility and visibility across urban and suburban areas. The rapid growth of e-commerce platforms and online retail channels enables consumers to conveniently purchase sports and energy drinks through digital applications, websites, and delivery services, offering expanded product variety, competitive pricing, and direct-to-home convenience that appeals to tech-savvy consumers. Digital payment systems, loyalty programs, and promotional campaigns implemented through online channels drive customer engagement and repeat purchases, while data analytics enable brands to understand consumer preferences, optimize product offerings, and deliver personalized marketing messages. The proliferation of international and domestic beverage brands competing in the Saudi market stimulates product innovation, introduces diverse flavor profiles, and expands consumer choice across price segments from premium international brands to value-oriented local products. Manufacturers are responding to evolving consumer preferences by developing sugar-free formulations, natural ingredient variants, organic options, and functional beverages enriched with vitamins, amino acids, and plant-based components that address health-conscious consumers' desire for clean-label products with transparent nutritional profiles and reduced artificial additives.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=33059&flag=E

Saudi Arabia Sports and Energy Drinks Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Sports Drinks

● Energy Drinks

● Electrolyte-Enhanced Water

Target Audience Insights:

● Athletes

● Fitness Enthusiasts

● Active Individuals

● Health-Conscious Consumers

Distribution Channel Insights:

● Supermarkets/Hypermarkets

● Convenience Stores

● Health Food Stores

● Online Retail

● Gymnasiums

Packaging Insights:

● Bottles

● Cans

● Pouches

● Cartons

● Concentrates

Ingredient Insights:

● Carbohydrates

● Electrolytes (Sodium, Potassium, Magnesium)

● Caffeine

● Vitamin B

● Antioxidants

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Sports and Energy Drinks Market

● February 2026: Leading beverage manufacturers announced strategic partnerships with major Saudi fitness center chains and sports clubs to establish exclusive distribution agreements, positioning their sports and energy drink portfolios as official partners for athlete hydration and performance support programs.

● January 2026: International energy drink brands launched new product lines specifically formulated for the Saudi market, featuring reduced sugar content, natural ingredients, and flavor profiles tailored to local consumer preferences while maintaining compliance with regional nutritional regulations.

● December 2025: Major sports and energy drinks companies expanded their e-commerce presence across Saudi Arabia through partnerships with leading online retail platforms, implementing targeted digital marketing campaigns and offering exclusive online promotions to capture growing demand from digitally engaged consumers.

● November 2025: Several beverage companies introduced innovative packaging formats including resealable bottles, portable pouches, and multi-pack offerings designed to meet diverse consumption occasions from on-the-go refreshment to post-workout recovery and extended athletic training sessions.

● October 2025: Industry leaders participated in major health and wellness exhibitions held in Riyadh, showcasing advanced formulations featuring functional ingredients such as electrolyte blends, natural energy sources, amino acids, and vitamin complexes targeting health-conscious consumers and performance-focused athletes.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Sports and Energy Drinks Market Size Worth USD 4.68% Billion in 2034 | IMARC Group here

News-ID: 4387439 • Views: …

More Releases from IMARC Group

BOPP Films Market Size Worth USD 33.8 Billion, Globally, by 2034 at a CAGR of 4. …

Market Overview:

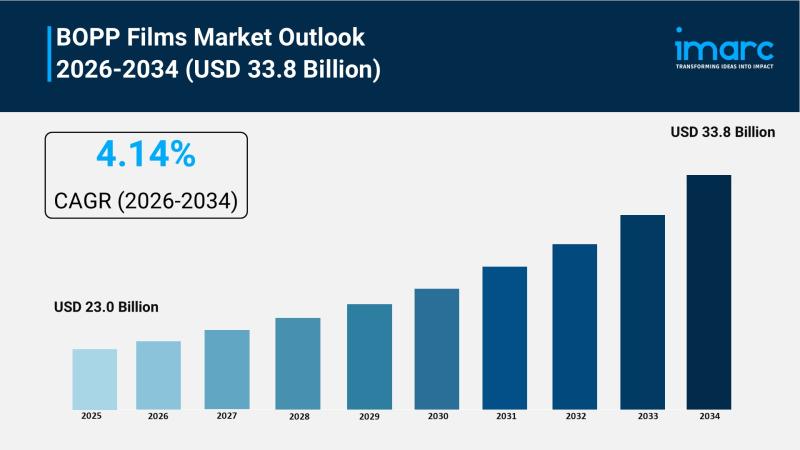

According to IMARC Group's latest research publication, "BOPP Films Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global BOPP films market size was valued at USD 23.0 Billion in 2025. The market is projected to reach USD 33.8 Billion by 2034, exhibiting a CAGR of 4.14% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts.…

Saudi Arabia Digital Signature Market Size To Worth USD 852.49 Million By 2034 | …

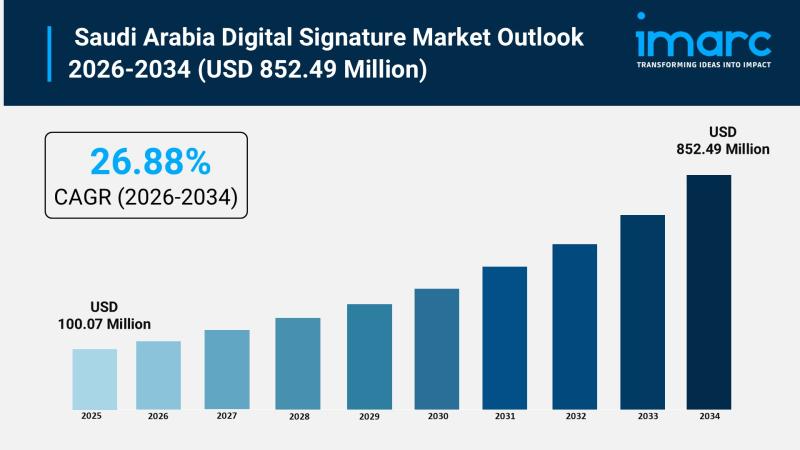

Saudi Arabia Digital Signature Market Overview

Market Size in 2025: USD 100.07 Million

Market Size in 2034: USD 852.49 Million

Market Growth Rate 2026-2034: 26.88%

According to IMARC Group's latest research publication, "Saudi Arabia Digital Signature Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia digital signature market size was valued at USD 100.07 Million in 2025. Looking forward, IMARC Group projects the market to reach USD 852.49 Million by…

India Wellness Tourism Market to Reach USD 57,238.0 Million by 2033 (CAGR of 6.3 …

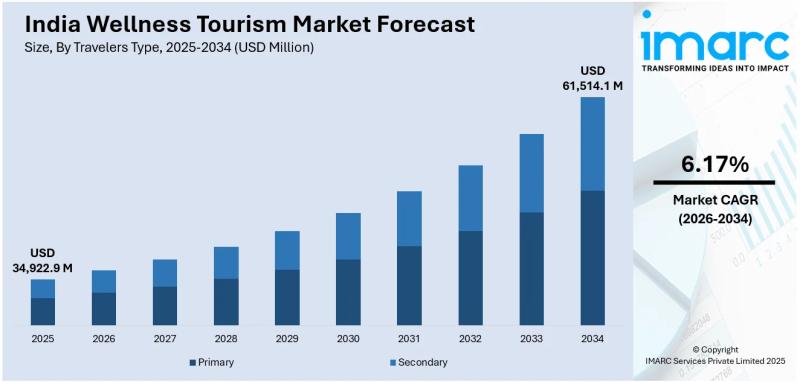

Introduction:

According to IMARC Group's report titled "India Wellness Tourism Market Size, Share, Trends and Forecast by Travelers Type, Service Type, Location, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Wellness Tourism Market Overview:

The India wellness tourism market size reached USD 32,833.1 Million in 2024. The market is expected to grow at a CAGR of 6.37% during the…

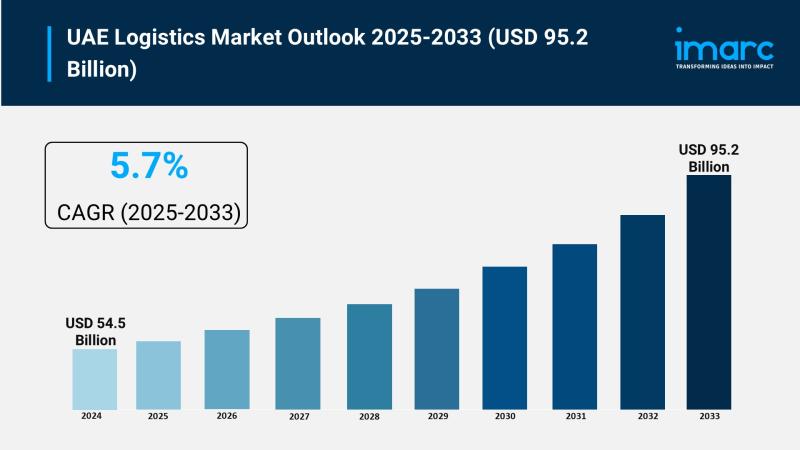

UAE Logistics Market Size to Hit USD 95.2 Billion by 2033 | With a 5.7% CAGR

UAE Logistics Market Overview

Market Size in 2024: USD 54.5 Billion

Market Size in 2033: USD 95.2 Billion

Market Growth Rate 2025-2033: 5.7%

According to IMARC Group's latest research publication, "UAE Logistics Market Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the UAE Logistics market size was valued at USD 54.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 95.2 Billion by 2033, exhibiting a CAGR of 5.7% from…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…