Press release

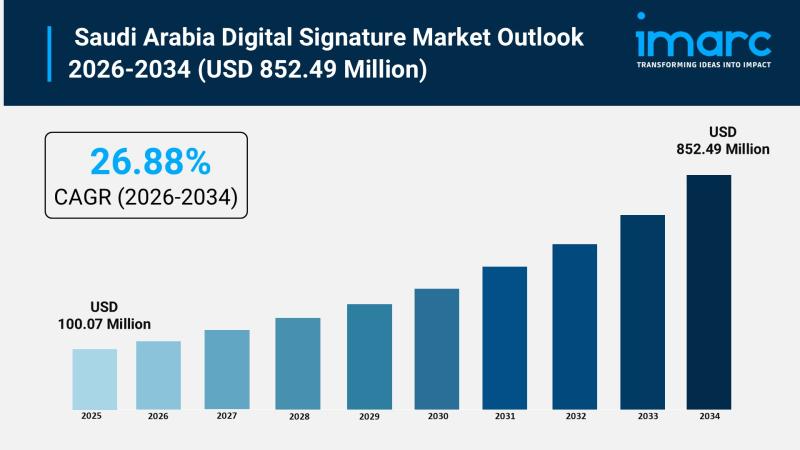

Saudi Arabia Digital Signature Market Size To Worth USD 852.49 Million By 2034 | CAGR of 26.88%

Saudi Arabia Digital Signature Market OverviewMarket Size in 2025: USD 100.07 Million

Market Size in 2034: USD 852.49 Million

Market Growth Rate 2026-2034: 26.88%

According to IMARC Group's latest research publication, "Saudi Arabia Digital Signature Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia digital signature market size was valued at USD 100.07 Million in 2025. Looking forward, IMARC Group projects the market to reach USD 852.49 Million by 2034, exhibiting a growth rate (CAGR) of 26.88% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Digital Signature Market

● AI-powered identity verification systems enhance digital signature authentication processes, utilizing facial recognition, biometric analysis, and behavioral patterns to ensure secure signer identification across government and enterprise platforms.

● Machine learning algorithms detect fraudulent signature attempts and document tampering in real-time, analyzing signature patterns, user behavior anomalies, and transaction characteristics to protect against cybersecurity threats and unauthorized access.

● Artificial intelligence-driven document processing automates signature placement, field recognition, and workflow routing, reducing manual intervention while improving accuracy and speed in contract management and approval processes.

● Natural language processing technologies enable intelligent document analysis and metadata extraction, allowing digital signature platforms to automatically identify signature requirements, classify documents, and route them to appropriate signers based on content analysis.

● AI-enhanced compliance monitoring systems ensure digital signatures meet regulatory standards by continuously analyzing signature protocols, certificate validity, encryption strength, and adherence to Electronic Transactions Law requirements across all transactions.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-digital-signature-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Digital Signature Industry

Saudi Arabia's Vision 2030 is revolutionizing the digital signature industry by accelerating digital transformation initiatives, eliminating paper-based processes, and establishing the Kingdom as a regional leader in secure electronic transaction infrastructure. The comprehensive Digital Government Strategy 2023-2030 mandates that government entities digitize remaining services and achieve full electronic document processing capabilities, creating unprecedented demand for digital signature solutions across public sector organizations managing millions of transactions annually. Vision 2030's emphasis on establishing Saudi Arabia among the top three countries globally in digital government maturity by 2030 drives substantial investments in digital identity infrastructure, public key infrastructure, and certified trust service providers essential for widespread digital signature adoption. The government's target to complete digitization of the remaining services by the end of 2025 and achieve universal digital identity uptake compels both public and private sectors to implement robust digital signature frameworks supporting seamless authentication and document execution. The National Digital Identity Management System, operational since 2008 and now serving over 36 million users with access to more than 2,000 government online services, provides the foundational infrastructure enabling secure digital signature deployment across government, healthcare, education, banking, and commercial sectors. Strategic initiatives promoting paperless government operations, e-participation, and digital-by-design principles eliminate traditional document workflows, compelling organizations to adopt digital signature technology as the standard method for contract execution, regulatory compliance, and business transactions. The integration of platforms like Absher, Tawakkalna, and Najiz with digital signature capabilities streamlines citizen services including legal documentation, healthcare records, property transactions, and business registrations, demonstrating government commitment to electronic service delivery.

Saudi Arabia Digital Signature Market Trends & Drivers:

Saudi Arabia's digital signature market is experiencing exponential growth, driven by comprehensive government mandates requiring digital transformation across all public sector entities and service delivery channels under the Digital Government Strategy 2023-2030. Regulatory frameworks established through the Electronic Transactions Law (Royal Decree No. M/18) and implementing regulations provide clear legal recognition for digital signatures, ensuring their admissibility in courts and enforceability in commercial transactions, thereby encouraging widespread business adoption. The establishment and licensing of certified trust service providers including emdha, operating under the Saudi National Root CA and regulated by the Digital Government Authority and Communications, Space and Technology Commission, delivers the technical infrastructure necessary for legally compliant digital signature deployment. Growing awareness of cybersecurity threats, data breaches, and document fraud drives organizations to implement digital signatures as a security measure, leveraging public key infrastructure cryptography, AES-256 encryption, and tamper-proof audit trails to protect sensitive information and verify document integrity.

The rapid expansion of e-commerce platforms, online banking services, and digital payment systems creates substantial demand for secure authentication mechanisms, with digital signatures enabling trusted identity verification and transaction authorization across financial services, retail, and telecommunications sectors. Corporate initiatives to reduce operational costs, eliminate paper consumption, streamline approval workflows, and improve productivity motivate enterprises to replace traditional wet signatures with digital alternatives, achieving significant savings in printing, storage, courier services, and administrative overhead. Integration of digital signatures with national digital identity systems including Nafath authentication ensures seamless signer verification through mobile applications, reducing friction in the signing process while maintaining high security standards aligned with know-your-customer requirements. The healthcare sector's transition toward electronic medical records, digital prescriptions, and telemedicine services necessitates secure digital signature solutions for patient consent forms, medical documentation, insurance claims, and regulatory compliance filings mandated by healthcare authorities. Educational institutions adopting online learning platforms, digital examination systems, and remote student services require digital signatures for enrollment documents, certificates, transcripts, and administrative approvals, accelerating technology adoption across Saudi universities and training centers. The real estate industry's movement toward digital property transactions, electronic title transfers, and online mortgage processing drives demand for digital signatures enabling remote contract execution, reducing transaction timelines from weeks to hours while ensuring legal validity. Growing emphasis on environmental sustainability and corporate social responsibility encourages organizations to eliminate paper-based processes, with digital signatures supporting paperless operations aligned with Vision 2030's sustainability objectives and global climate commitments. The increasing sophistication of digital signature platforms offering advanced features including bulk signing, template management, workflow automation, mobile compatibility, and multi-language support enhances user experience and broadens market appeal across diverse business sectors and individual users.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=28940&flag=E

Saudi Arabia Digital Signature Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

● Hardware

● Software

● Services

Deployment Model Insights:

● On-premises

● Cloud-based

Enterprise Size Insights:

● Small and Medium-sized Enterprises

● Large Enterprises

Industry Vertical Insights:

● BFSI

● Education

● Human Resource

● IT and Telecommunication

● Government

● Healthcare and Life Science

● Real Estate

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Digital Signature Market

● February 2026: The Digital Government Authority announced enhanced regulatory guidelines for digital signature service providers, introducing stricter compliance requirements for certificate authorities and trust service providers to strengthen security standards across electronic transaction platforms.

● January 2026: Leading Saudi enterprises across banking, insurance, and telecommunications sectors reported significant increases in digital signature adoption for customer onboarding, contract execution, and regulatory compliance processes as part of their digital transformation initiatives.

● December 2025: The government accelerated integration of digital signature capabilities across multiple e-government platforms including Absher and Najiz, enabling citizens and residents to execute legal documents, property transactions, and business registrations entirely through electronic channels.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Digital Signature Market Size To Worth USD 852.49 Million By 2034 | CAGR of 26.88% here

News-ID: 4387420 • Views: …

More Releases from IMARC Group

Biosimilar Market Size, Share, Industry Trends and Forecast 2026-2034

IMARC Group, a leading market research company, has recently released a report titled "Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the global biosimilar market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Biosimilar Market Key Highlights:

• The Biosimilar Market is…

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

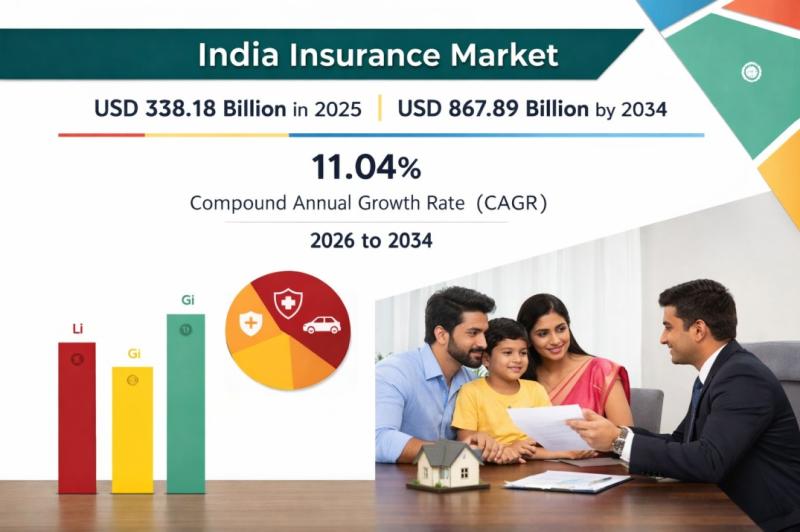

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…