Press release

Latest Iron Ore Price Index Q4 2025: Trend & Forecast Insights

The Iron Ore Price Index remains a critical benchmark for tracking global steel industry dynamics and raw material cost movements. In 2025-2026, Iron Ore Prices have shown notable volatility due to supply adjustments, shifting Chinese demand, and freight fluctuations. Businesses closely monitor the Iron Ore price index, price chart, and forecast trends to assess procurement strategies, manage risk exposure, and evaluate the future price of Iron Ore in global markets.Iron Ore Current Price Movements:

Recent Iron Ore Prices have reflected mixed global sentiment during Q4 2025. Market participants observed short-term corrections driven by inventory normalization across Asia and moderated construction activity in China. However, supply-side constraints, freight volatility, and controlled mining output supported price stability in several regions.

According to insights from IMARC Group's price intelligence platform, the price of Iron Ore continues to be influenced by steel sector demand, infrastructure spending, port inventory levels, and export flows. Buyers and traders are closely monitoring the Iron Ore price today to optimize procurement strategies amid shifting global trade dynamics.

Iron Ore Prices Outlook - Q4 2025

• USA: USD 104/MT

• China: USD 97/MT

• United Kingdom: USD 107/MT

• Canada: USD 94/MT

• France: USD 96/MT

These regional variations in Iron Ore Prices reflect differences in freight costs, demand intensity, import dependency, and contract structures. The UK recorded comparatively higher pricing due to logistics and energy-linked cost factors, while Canada and France observed relatively moderate levels supported by stable supply conditions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/iron-ore-price-trend/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Iron Ore Price Snapshot (2026):

In early 2026, the Iron Ore price index signals moderate recovery compared to late 2025 levels. Key producing regions, including Australia and Brazil, maintained steady export volumes, while Asian steel mills adjusted procurement volumes cautiously.

The Iron Ore price today varies regionally depending on grade (62% Fe benchmark), freight agreements, and contractual terms. The global benchmark remains sensitive to macroeconomic conditions, especially infrastructure spending and manufacturing PMI indicators.

Iron Ore Price Trend Analysis:

The ongoing Iron Ore Price Trend Analysis highlights three major phases

1. Early 2025 Softening - Triggered by weaker steel margins and high port inventories.

2. Mid-2025 Stabilization - Supported by infrastructure stimulus measures.

3. Late 2025 Recovery Signals - Driven by supply discipline and seasonal restocking.

The Iron Ore Prices trajectory demonstrates how closely the commodity is linked to global steel output. Short-term fluctuations often mirror Chinese construction demand, while long-term trends align with industrial growth cycles and sustainability-driven production changes.

Iron Ore Price Chart & Index - What It Suggests:

The Iron Ore price chart provides valuable insight into volatility bands and cyclical corrections. Over the past year, the Iron Ore price index has indicated consolidation rather than extreme swings.

Technical indicators from the Iron Ore price chart suggest

• Support levels forming near production cost thresholds

• Gradual upward bias during restocking seasons

• Price sensitivity to macroeconomic announcements

For procurement teams, monitoring the Iron Ore price index helps forecast cost cycles and hedge against sudden market disruptions.

Iron Ore Price Historical Analysis Data:

A review of Iron Ore price history shows significant cyclical movement over the past decade. Prices peaked during periods of strong Chinese infrastructure expansion and declined during global economic slowdowns.

Key historical observations include

• Pandemic-era supply disruptions temporarily elevated the price of Iron Ore

• Oversupply phases led to multi-quarter corrections

• Long-term demand from emerging economies supported structural price resilience

Understanding Iron Ore price history enables investors and manufacturers to anticipate pattern-based fluctuations and identify strategic buying windows.

Factors Driving Recent Iron Ore Price Trend Increases:

Several market forces are influencing current Iron Ore Prices

• Steel Production Recovery: Increased output in Asia and Europe

• Infrastructure Spending: Government-backed construction projects

• Mining Output Constraints: Weather disruptions and operational challenges

• Freight & Energy Costs: Higher logistics expenses impacting delivered prices

• Inventory Restocking Cycles: Seasonal buying momentum

These factors collectively shape the short-term direction of the Iron Ore future price and market sentiment.

Iron Ore Price Forecast Next 12 Months:

The 12-month outlook for Iron Ore Prices suggests controlled volatility with moderate upside potential, assuming stable steel demand and disciplined mining output. Analysts anticipate the Iron Ore future price to remain supported by:

• Green steel transition investments

• Emerging market infrastructure development

• Stable Chinese policy measures

However, downside risks include weaker global manufacturing growth and potential oversupply from expanded mining capacity. The Iron Ore price index will continue serving as the primary benchmark for tracking these shifts.

Regional Price Differences for Iron Ore:

Regional variations in the price of Iron Ore depend on freight costs, contract structures, and ore grade differentials.

• Asia-Pacific: Dominates global demand, benchmark-linked pricing

• Europe: Influenced by energy costs and carbon compliance policies

• Middle East & Africa: Growing steel production capacity impacting demand

Monitoring regional spreads in Iron Ore Prices helps global buyers optimize sourcing strategies and reduce procurement risk.

Current & Near-Term Prices (Late 2025 - Early 2026):

During late 2025 and early 2026, the Iron Ore price today shows stabilization after prior corrections. Market participants are cautiously optimistic, supported by balanced supply-demand fundamentals.

Short-term projections suggest

• Limited downside due to cost-floor support

• Seasonal demand uplift in Q1-Q2 2026

• Controlled speculative activity

The near-term Iron Ore future price outlook remains moderately constructive, barring unexpected macroeconomic shocks.

Summary - Key Points:

• The Iron Ore Price Index remains stable with moderate volatility.

• Iron Ore Prices are influenced by steel demand, mining output, and logistics costs.

• Historical data reveals cyclical but resilient pricing behavior.

• Regional differences shape procurement strategies.

• The 12-month forecast suggests balanced market conditions with gradual recovery potential.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=38942&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, Iron Ore Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Iron Ore price trend, offering key insights into global Iron Ore market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Iron Ore demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Iron Ore Price Index Q4 2025: Trend & Forecast Insights here

News-ID: 4386952 • Views: …

More Releases from IMARC Goup

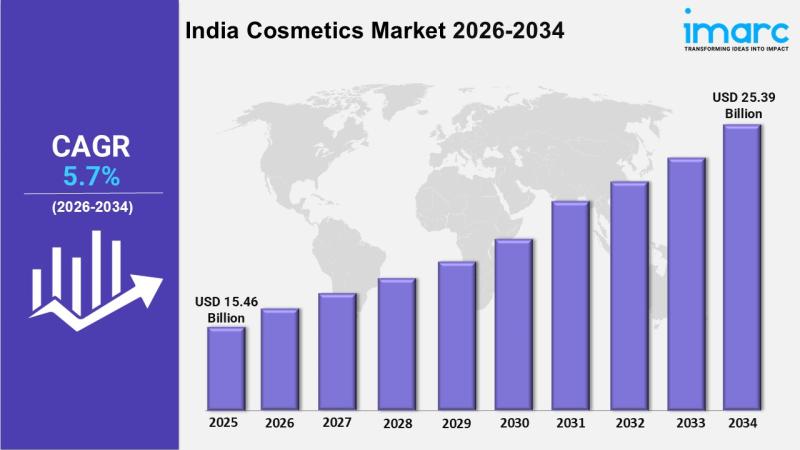

India Cosmetics Market to Reach USD 25.39 Billion by 2034 | 5.7% CAGR | Get Free …

According to IMARC Group's report titled "India Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Cosmetics Market Overview

The India cosmetics market size was valued at USD 15.46 Billion in 2025 and is expected to reach USD 25.39 Billion by 2034, growing at a compound…

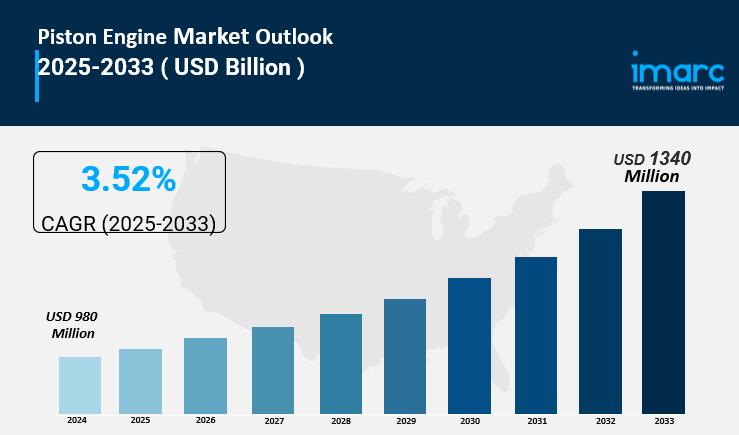

Piston Engine Market is Anticipated to Rise USD 540.4 Billion by 2033 | At CAGR …

IMARC Group, a leading market research company, has recently released a report titled " Piston Engine Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033."The study provides a detailed analysis of the industry, including the Piston Engine market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Piston Engine Market Overview

The…

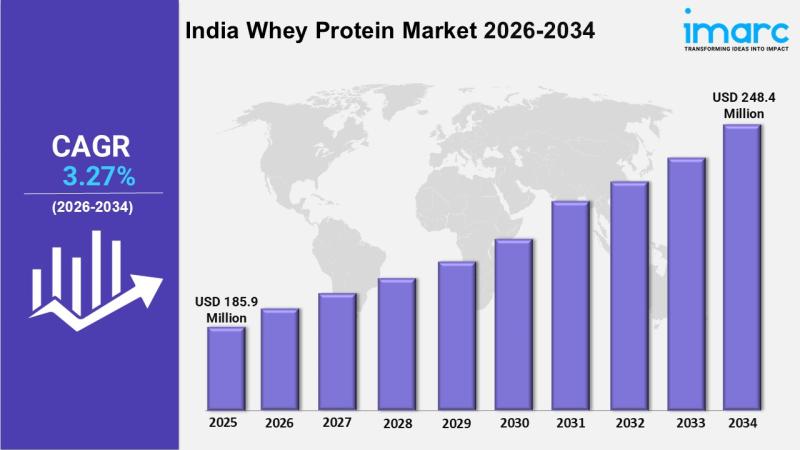

India Whey Protein Market to Reach USD 248.4 Million by 2034 | 3.27% CAGR | G …

According to IMARC Group's report titled "India Whey Protein Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Whey Protein Market Outlook

The India whey protein market size reached USD 185.9 Million in 2025. It is projected to grow at a CAGR of 3.27% during the forecast period from 2026…

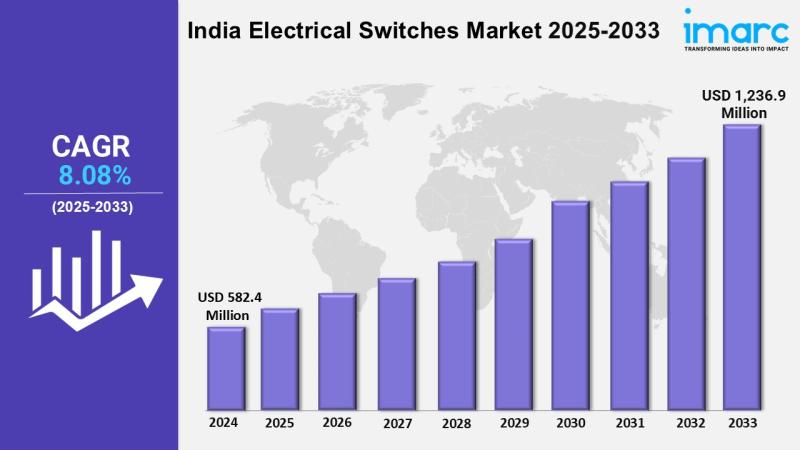

India Electrical Switches Market to Reach USD 1,236.9 Million by 2033 at a CAGR …

According to IMARC Group's report titled "India Electrical Switches Market Size, Share, Trends and Forecast by Type, Distribution Channel, Switch Type, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Electrical Switches Market Outlook

The India electrical switches market size reached USD 582.4 Million in 2024. The market is projected to grow at a CAGR of 8.08% during the…

More Releases for Iron

Faster Anemia Recovery: When to Switch From Iron Pills to IV Iron

Iron deficiency anemia is exhausting. When your iron is low, everyday tasks feel heavier, your focus slips, and even simple workouts become harder. Oral iron supplements are usually the first step, but they don't always work fast enough-especially if your levels are very low or your body struggles to absorb iron.

That's where IV iron becomes a more efficient option. It delivers iron directly into your bloodstream, giving your body what…

Iron Sharpens Iron Business Network Launches

The Iron Sharpens Iron Business Network has launched in Southwest Florida. The membership organization exists to drive customer referrals, social media visibility, brand exposure and business profits. Small businesses and upstarts can come together within the grass roots network and feel comfortable, not intimidated, wherever they are on their growth journey.

Membership levels can be reviewed and setup at ironsharpensironbn.com. Members of the network will have access to online educational…

Iron Warrior Review 2022: (Buyers Beware!) Is Iron Warrior Actually Working?

As you age, you begin to physically deteriorate and experience a range of challenges in daily life. You begin to feel weak and lose your physical strength after a certain age, among other things.

You start to experience problems in both your personal and professional lives, and you constantly feel exhausted.

Even though frequenting the gym might help you stay in shape, given today's busy lifestyle and competitive job market,…

Global Carbonyl Iron Market, Global Carbonyl Iron Industry, Covid-19 Impact Glob …

Carbonyl iron is an iron replacement product. You primarily get the iron from the foods you eat. Iron assists your body introduce red blood cells that carry oxygen through your blood to tissues and organs. Carbonyl iron is utilized to cure and safeguard the iron deficiency and iron deficiency anemia. In addition, the carbonyl iron may also be utilized for the determinations not listed in this medication guide.

According to…

Iron Ore Concentrate (Pellet Feed) Market forecast to 2025: Exceptional Business …

Report Ocean recently published a new report on the Global Iron Ore Concentrate (Pellet Feed) Market. The study has an in-depth analysis of the forecast period from 2021-2025. The report reveals a comprehensive picture of the Iron Ore Concentrate (Pellet Feed) Market situation, taking into consideration all major trends, market dynamics, and competitive factors. Additionally, the report contains key statistics concerning the Iron Ore Concentrate (Pellet Feed) Market situation of…

Global Iron Ore Mining Market to 2022| Vale S.A., Rio Tinto Group, BHP Billiton, …

Researchmoz added Most up-to-date research on "Global Iron Ore Mining to 2022" to its huge collection of research reports.

GlobalData's "Global Iron Ore Mining to 2022" provides a comprehensive coverage on global iron ore industry. It provides historical and forecast data on iron ore production by country, grade, iron ore reserves, consumption to 2022. The trade section also provides information on major exporters and importers. The report also includes a demand…