Press release

Enterprise Risk Management Market by Deployment Mode and End User: Market Insights and Forecast to 2032

nterprise Risk Management Market was valued at USD 5.84 Bn in 2024, and total global Enterprise Risk Management Market revenue is expected to grow at a CAGR of 5.1% and reach nearly USD 8.69 Bn from 2025 to 2032.Enterprise Risk Management Market Overview:

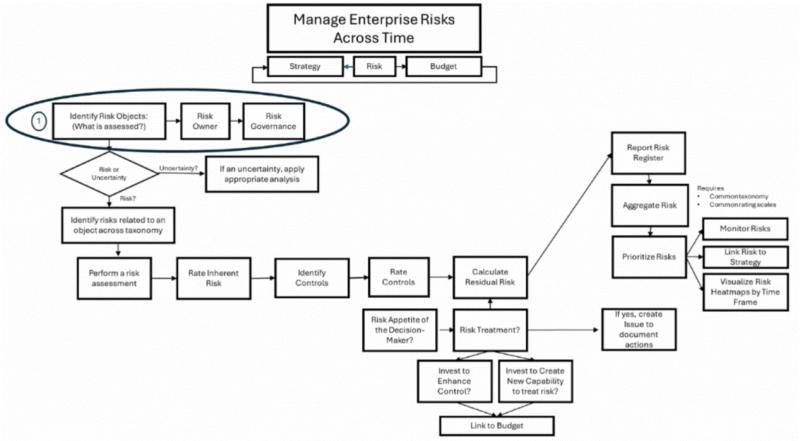

The Enterprise Risk Management market encompasses software platforms, frameworks, and services designed to help organizations identify, assess, monitor, and mitigate risks across strategic, operational, financial, and compliance domains. ERM solutions enable enterprises to move from siloed risk management approaches toward integrated, enterprise-wide risk visibility and governance. These systems are widely adopted across industries such as banking, insurance, healthcare, manufacturing, energy, and IT services, where regulatory scrutiny and operational complexity are high. Modern ERM platforms combine risk assessment tools, internal controls management, audit workflows, reporting dashboards, and scenario analysis. Increasingly, ERM is positioned not only as a compliance function but as a strategic decision-support capability that aligns risk appetite with business objectives. The market includes on-premise and cloud-based deployments, with growing preference for scalable, subscription-based solutions. As organizations face interconnected risks ranging from cyber threats to supply chain disruptions, ERM systems are becoming central to corporate governance structures. This evolution underscores the market's shift from reactive risk reporting toward proactive, data-driven risk intelligence.

Download Free Sample & Check the Latest Market Analysis: https://www.maximizemarketresearch.com/request-sample/39991/

Enterprise Risk Management Market Dynamics:

The Enterprise Risk Management market is shaped by dynamic interactions between regulatory demands, technological innovation, and evolving enterprise risk profiles. Organizations are managing increasingly complex risk environments driven by digitalization, global operations, and heightened stakeholder expectations. Regulatory frameworks related to data protection, financial reporting, environmental compliance, and corporate governance continue to expand, increasing the need for structured risk oversight. On the technology side, ERM vendors are integrating analytics, automation, and real-time monitoring capabilities to improve risk visibility. However, adoption dynamics vary by organization size, with large enterprises favoring comprehensive platforms while small and mid-sized firms seek modular, cost-effective solutions. Integration challenges with existing enterprise systems such as ERP and cybersecurity platforms influence purchasing decisions. Internal factors, including organizational risk culture and executive buy-in, also impact ERM implementation success. Additionally, the growing role of boards and senior leadership in risk governance is elevating demand for consolidated reporting and scenario modeling. These dynamics collectively influence solution design, deployment strategies, and long-term market adoption.

Enterprise Risk Management Market Key Drivers of Growth:

Growth in the Enterprise Risk Management market is primarily driven by rising regulatory complexity and increasing awareness of enterprise-wide risk exposure. Organizations are facing intensified scrutiny from regulators, investors, and customers, requiring transparent and auditable risk management practices. The frequency of high-impact events such as cyberattacks, supply chain disruptions, and financial volatility has reinforced the need for structured risk frameworks. Digital transformation initiatives introduce new operational and technology risks, further expanding the scope of ERM adoption. Boards of directors are placing greater emphasis on risk governance, driving demand for enterprise-level risk dashboards and reporting tools. Cloud adoption and remote work models have also increased exposure to cybersecurity and data privacy risks, making integrated risk management essential. Additionally, insurers and financial institutions are leveraging ERM to improve capital allocation and stress testing. As risk management shifts from a defensive function to a strategic enabler, organizations increasingly view ERM platforms as essential tools for resilience, compliance, and informed decision-making.

Get a Customized Market View in One Click: https://www.maximizemarketresearch.com/market-report/global-enterprise-risk-management-market/39991/

Enterprise Risk Management Market Segment Analysis:

by Component

Hardware

Software

Services

by Institution

Banks

Credit Unions

Specialty Finance

Thrifts

by Risk Type

Hazard risk

Financial risk

Operational risk

Strategic risks

by Deployment Mode

On-Premises

Cloud-Based

by Industry Vertical

Banking, Financial Services, and Insurance (BFSI)

IT & Telecom

Healthcare & Life Sciences

Government & Public Sector

Others

Enterprise Risk Management Market Regional Analysis:

Regional adoption of Enterprise Risk Management solutions varies based on regulatory environments, digital maturity, and industry concentration. North America represents a mature market, supported by stringent regulatory requirements, advanced corporate governance practices, and widespread adoption of enterprise software. Organizations in this region emphasize integrated ERM platforms with advanced analytics and reporting capabilities. Europe follows closely, driven by complex regulatory frameworks related to data protection, financial compliance, and sustainability reporting. The Asia-Pacific region is experiencing rapid growth as enterprises expand globally and governments strengthen corporate governance standards. Increased digitalization and exposure to supply chain risks are driving ERM adoption across emerging economies in the region. Latin America shows steady uptake, particularly in financial services and energy sectors, although budget constraints influence solution selection. The Middle East and Africa are emerging markets, with adoption concentrated in regulated industries and multinational organizations. Overall, regional demand is influenced by regulatory pressure, enterprise digitization, and the maturity of risk governance practices.

Opportunities in the Enterprise Risk Management Market:

The Enterprise Risk Management market offers significant opportunities through technology integration, sector expansion, and evolving risk frameworks. One major opportunity lies in the adoption of cloud-based ERM platforms, which lower deployment costs and improve scalability. Integration of ERM with cybersecurity, ESG, and business continuity management systems allows vendors to deliver holistic risk solutions. Growing emphasis on environmental, social, and governance reporting creates opportunities for ERM platforms to support non-financial risk assessment and disclosure. Small and mid-sized enterprises represent an underserved segment seeking simplified, modular ERM solutions. Advanced analytics, including predictive risk modeling and scenario simulation, offer differentiation opportunities for vendors. Industry-specific ERM solutions tailored to healthcare, manufacturing, and financial services can address unique risk profiles. Additionally, consulting and managed services around ERM implementation and maturity assessment provide value-added revenue streams. Vendors that align product development with evolving regulatory and strategic risk needs are well positioned to capture emerging opportunities.

Download Free Sample & Check the Latest Market Analysis: https://www.maximizemarketresearch.com/request-sample/39991/

Enterprise Risk Management Market Future Outlook:

The future outlook for the Enterprise Risk Management market indicates continued expansion as organizations prioritize resilience and governance in uncertain environments. ERM is expected to become increasingly embedded within enterprise decision-making processes, rather than operating as a standalone compliance function. Technology advancements will enhance automation, real-time risk monitoring, and data-driven insights. Cloud-native architectures and API-based integrations will improve interoperability with other enterprise systems. Regulatory developments related to cybersecurity, sustainability, and operational resilience will further reinforce ERM adoption. Demand is expected to grow across both large enterprises and mid-sized organizations as risk complexity increases. Vendors will focus on usability, configurability, and analytics to differentiate offerings. As enterprises recognize the strategic value of risk intelligence, ERM platforms will evolve into central components of enterprise performance and governance frameworks, supporting long-term organizational stability and growth.

Some of the most prominent and loved players in the Enterprise Risk Management Market from

all over the world are:

1. LogicManager

2. MetricStream

3. Fidelity National Information Services

4. Capgemini

5. BWise

6. Dell EMC

7. Infosys Limited

8.IBM Corporation

9. Oracle

10. SAP SE

11. COSO Enterprise

12. Risk International

13. Risk Management Association of India

14. MYRICK Enterprise

15. Risk Cooperative

16. XYLEM Technologies

17. CYBERCYTE LTD

18. ITgma

What are the major key trends in the Enterprise Risk Management Market:

Several key trends are shaping the Enterprise Risk Management market. One prominent trend is the integration of ERM with broader GRC platforms, enabling unified governance and compliance oversight. Advanced analytics and artificial intelligence are being used to identify emerging risks and support scenario analysis. Cyber risk and third-party risk management are gaining prominence as organizations rely on complex digital ecosystems. ESG risk integration is becoming a priority, driven by investor and regulatory expectations. Cloud-based and SaaS ERM solutions are increasingly preferred for flexibility and cost efficiency. User-centric design and executive dashboards are improving adoption among senior leaders. Additionally, continuous risk monitoring is replacing periodic risk assessments, reflecting a shift toward proactive risk management. These trends indicate a market moving toward real-time, integrated, and strategic risk intelligence.

Trending Reports:

Packaged software market https://www.maximizemarketresearch.com/market-report/packaged-software-market/78854/

Background Check Software Market https://www.maximizemarketresearch.com/market-report/global-background-check-software-market/90192/

Sports Simulators Market https://www.maximizemarketresearch.com/market-report/global-sports-simulators-market/81518/

Information Technology Market https://www.maximizemarketresearch.com/market-report/global-information-technology-market/23601/

Data Broker Market https://www.maximizemarketresearch.com/market-report/global-data-broker-market/55670/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Enterprise Risk Management Market by Deployment Mode and End User: Market Insights and Forecast to 2032 here

News-ID: 4382355 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Luxury Perfume Market Analysis: Revenue Growth, Consumer Trends and Regional Out …

Luxury Perfume Market size was valued at USD 15.95 Billion in 2025 and the total Luxury Perfume revenue is expected to grow at a CAGR of 5.3% from 2026 to 2032, reaching nearly USD 22.90 Billion by 2032.

Luxury Perfume Market Overview:

The luxury perfume market represents a high-value segment within the global beauty and personal care industry, driven by exclusivity, craftsmanship, and emotional branding. Luxury perfumes are positioned as aspirational products,…

Procurement Software Market Forecast: Automation, Analytics and Cloud Adoption

Procurement Software Market size was valued at USD 8.18 billion in 2024, and the total revenue is expected to grow at CAGR of 10.8 % from 2025 to 2032, reaching nearly USD 18.58 billion.

Procurement Software Market Overview:

The procurement software market is a core component of enterprise digital transformation, enabling organizations to automate, standardize, and optimize purchasing activities across goods and services. Procurement software solutions support functions such as supplier discovery,…

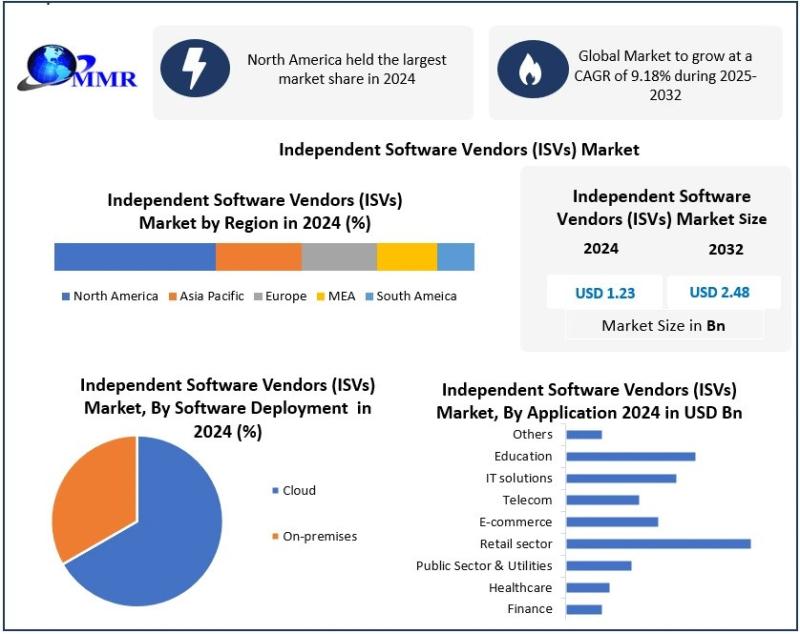

What Is Driving Growth in the Independent Software Vendors (ISVs) Market?

Independent Software Vendors (ISVs) Market was valued at USD 1.23 Bn in 2024, and total global Independent Software Vendors (ISVs) Market revenue is expected to grow at a CAGR of 9.18% and reach nearly USD 2.48 Bn from 2025 to 2032. Driven by Rising Demand for Multi-cloud & Hybrid Cloud.

Independent Software Vendors (ISVs) Market Overview:

The Independent Software Vendors (ISVs) market represents a critical layer of the global software ecosystem, delivering…

India Lighting Market Analysis: Industry Dynamics and Growth Forecast

India Lighting Market size was valued at USD 4139.2 Million in 2024 and the total India Lighting Market size is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 7674 Million by 2032.

India Lighting Market Overview:

The India lighting market is a rapidly evolving sector driven by urbanization, infrastructure expansion, and the transition toward energy-efficient illumination solutions. Lighting demand spans residential, commercial, industrial, and outdoor…

More Releases for Risk

RiskWatch Launches Risk Management Software: Streamlined Risk Assessments and In …

RiskWatch International, a leading provider of compliance and risk management solutions, has announced the launch of its comprehensive Risk Management Software. This user-friendly platform empowers organizations of all sizes to proactively identify, assess, and mitigate risks, fostering a culture of resilience and success.

RiskWatch Risk Management Software delivers a robust suite of features, including:

● Comprehensive Risk Templates: Build a customized library of risk templates tailored to your specific needs, encompassing…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…