Press release

Pectin Manufacturing Plant Setup Cost 2026: Complete DPR with Process Flow, Machinery & Profitability

The global pectin manufacturing industry is witnessing robust growth driven by the rapidly expanding food and beverage, pharmaceutical, and cosmetics sectors and increasing demand for natural gelling agents, thickening agents, and stabilizers. At the heart of this expansion lies a critical functional ingredient-pectin. As consumers worldwide seek clean-label, plant-based food additives and pharmaceutical manufacturers require natural stabilizers for drug formulations, establishing a pectin manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and specialty ingredients investors seeking to capitalize on this growing and essential market.IMARC Group's report, "Pectin Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The pectin manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Market Overview and Growth Potential

The global pectin market demonstrates a strong growth trajectory, valued at USD 1,256.7 Million in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 2,318.1 Million by 2034, exhibiting a robust CAGR of 7.0% from 2026-2034. This sustained expansion is driven by rising demand in the food and beverage industry for natural gelling agents, growing consumer preference for plant-based ingredients, and expanding use of pectin in the pharmaceutical sector as a stabilizer in drug formulations.

Pectin, a natural polysaccharide, is mainly obtained from fruits such as apples and citrus peel. It finds major applications in food and beverages and pharmaceutical industries as a gelling and thickening agent. It acts as an essential compound for manufacturing different types of jams, jellies, candies, and pharmaceutical formulations for controlled drug delivery systems. It forms gel in presence of sugar and acid, becoming integral for various products, and finds use as a stabilizer in pharmaceutical formulations and as a binder in tablets.

The pectin market is projected to maintain its growth path as demand for natural food and clean-label products is increasingly needed across the food and beverages sector. With growing demand from health-aware customers seeking plant-based food free from preservatives, the industry is seeing growing popularity of jams, jellies, and beverages. Asia Pacific is also growing significantly due to growth of the food/beverage sector coupled with rising fruit production from where the ingredient is extracted.

Request for a Sample Report: https://www.imarcgroup.com/pectin-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed pectin manufacturing facility is designed with an annual production capacity ranging between 2,000 - 5,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from jams, jellies, and beverages to pharmaceutical stabilizers and cosmetic formulations-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The pectin manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit: 35-45%

• Net Profit: 15-20%

These margins are supported by stable demand across food and beverages, pharmaceuticals, and cosmetics sectors, value-added natural ingredient positioning, and the critical nature of pectin in clean-label food formulations. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established specialty ingredients manufacturers looking to diversify their product portfolio in the natural food additives segment.

Speak to Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=7301&flag=C

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a pectin manufacturing plant is primarily driven by:

• Raw Materials: 50-60% of OpEx

• Utilities: 25-30% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with dried citrus peel (lemon, lime, orange) or apple pomace, extraction chemicals, and processing aids being the primary input materials. Establishing long-term relationships with fruit processing facilities and juice manufacturers helps ensure consistent quality raw material supply, which is critical given that citrus peel and apple pomace procurement represents the most significant cost factor in pectin manufacturing.

Buy Now: https://www.imarcgroup.com/checkout?id=7301&method=2175

Capital Investment Requirements

Setting up a pectin manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to fruit processing facilities, citrus juice plants, and apple processing units for reliable raw material supply. Proximity to food, pharmaceutical, and cosmetics manufacturing markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws, food safety regulations, and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized production equipment essential for manufacturing. Key machinery includes:

• Wash systems and cleaning equipment for removing impurities, residual sugars, and dirt from dried citrus peel or apple pomace before extraction

• Choppers and size reduction equipment for mechanical breakdown of raw materials to increase surface area for efficient extraction

• Hot water extractors and hydrolysis reactors for controlled acid extraction of pectin from plant cell walls under optimal temperature and pH conditions

• Filtration presses and clarification systems for removing solid residues, proteins, and colloidal particles from crude pectin extract

• Evaporators and concentration units for reducing water content and increasing pectin concentration before precipitation

• Alcohol precipitation tanks for precipitating purified pectin from concentrated solution using isopropanol or ethanol

• Drying units including vacuum dryers or spray dryers for controlled moisture removal while maintaining pectin functionality and gel strength

• Milling systems and grinding equipment for producing uniform pectin powder with controlled particle size distribution for various applications

• Packaging machines for automated filling, sealing, and labeling of finished pectin products in food-grade containers for distribution

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure strict food safety standards, and maintain the highest quality control throughout the production process. The layout should be optimized with separate areas for raw material storage, washing and preparation zone, extraction section, filtration unit, concentration area, precipitation tanks, drying section, milling and powder processing area, quality control laboratory, finished goods warehouse, utility block, effluent treatment facility, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, food safety and pharmaceutical regulatory compliance certifications including HACCP and GMP, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Pectin products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Food and Beverages: Used extensively in jams, jellies, fruit fillings, and beverages where pectin provides gelling, texture, mouthfeel, and stabilization properties essential for consistent product quality.

Pharmaceuticals: Utilized for drug stabilization and controlled drug release systems where pectin serves as a natural, biocompatible excipient meeting stringent pharmaceutical quality standards.

Cosmetics and Personal Care: Employed in skin creams, lotions, and hair products where pectin's thickening and film-forming properties contribute to product texture and consumer satisfaction.

Why Invest in Pectin Manufacturing?

Several compelling factors make pectin manufacturing an attractive investment opportunity:

Natural Ingredient Trend: Pectin is highly sought-after in the natural and clean-label food movement, driving demand in food and beverage industries for healthier, plant-based alternatives to synthetic additives.

Expanding Pharmaceutical Uses: Increasing use of pectin in pharmaceutical formulations, particularly in drug delivery systems, opens new avenues for growth and diversification beyond traditional food applications.

Moderate Entry Barriers: While pectin manufacturing requires capital investment for extraction and processing equipment, established demand in food and beverage sectors, coupled with local raw material sourcing, makes it relatively accessible.

Megatrend Alignment: Growing focus on plant-based foods, healthy alternatives, and sustainable sourcing positions pectin manufacturing as key player in broader natural ingredient market with expanding pharmaceutical and nutraceutical sectors.

Policy and Infrastructure Support: Government policies supporting natural and organic food production, alongside investments in pharmaceutical sector, provide favorable environment for pectin manufacturers to thrive.

Local Supply Chain Opportunities: Proximity to raw material sources, such as fruit processing industries and citrus juice plants, reduces logistics costs and supports establishment of locally sourced pectin production facilities.

Byproduct Utilization: Pectin production utilizes agricultural byproducts from fruit processing industry, creating value from materials that would otherwise require disposal, supporting circular economy principles.

Manufacturing Process Excellence

The pectin manufacturing process involves several precision-controlled stages:

• Extraction: Dried citrus peel or apple pomace is treated with hot acidified water to hydrolyze and extract pectin from plant cell walls under controlled temperature and pH conditions

• Filtration: Crude pectin extract undergoes filtration using filter presses to remove solid residues, cellulose fibers, and other insoluble materials from liquid extract

• Evaporation: Filtered pectin solution is concentrated through vacuum evaporation to reduce water content and increase pectin concentration for subsequent precipitation

• Alcohol Precipitation: Concentrated pectin is precipitated by adding isopropanol or ethanol, causing pectin to separate from solution and form recoverable precipitate

• Drying: Precipitated pectin is washed, pressed, and dried using vacuum or spray drying to achieve target moisture content while preserving gel strength and functionality

• Milling and Powder Processing: Dried pectin is ground, blended, and sieved to produce uniform powder with specified particle size distribution meeting customer requirements

• Quality Control and Packaging: Finished pectin undergoes comprehensive testing for gel strength, degree of esterification, pH, moisture, and microbiological safety before packaging in food-grade containers for distribution

Industry Leadership

The global pectin industry is led by established specialty ingredients companies with extensive production capabilities and diverse application portfolios. Key industry players include:

• Naturex

• Cargill

• DowDuPont

• Agrana

• Ingredion

These companies serve diverse end-use sectors including food and beverages, pharmaceuticals, cosmetics, and nutraceuticals, demonstrating the broad market applicability of pectin products.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pectin Manufacturing Plant Setup Cost 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4379750 • Views: …

More Releases from IMARC Group

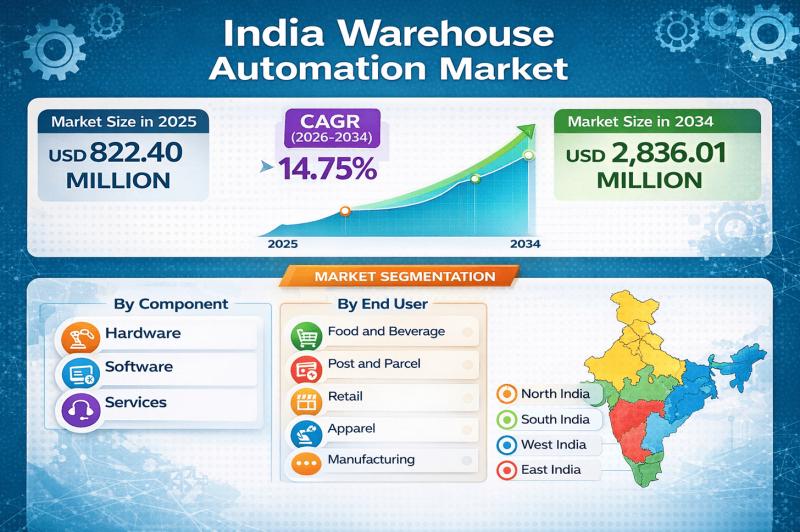

India Warehouse Automation Market Outlook 2026-2034: E-commerce Growth, Emerging …

According to IMARC Group's report titled "India Warehouse Automation Market Size, Share, Trends and Forecast by Component, End User, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Warehouse Automation Market Overview

The India warehouse automation market size was valued at USD 822.40 Million in 2025 and is projected to reach USD 2,836.01 Million by 2034, growing at a compound…

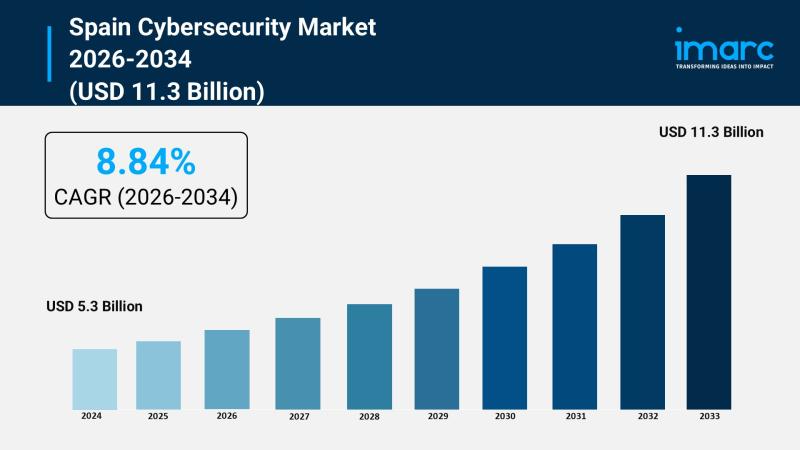

Spain Cybersecurity Market to Reach USD 11.3 Billion by 2034 with 8.84% CAGR

Market Overview

The Spain Cybersecurity Market size reached USD 5.3 Billion in 2025 and is expected to grow to USD 11.3 Billion by 2034. The market is projected to rise at a CAGR of 8.84% during the forecast period of 2026-2034. Growth is driven by increasing digital transformation, escalating cyber threats, the rise of cloud services, stringent regulations like GDPR, and growing awareness among companies about cyber threats.

Study Assumption Years

• Base Year:…

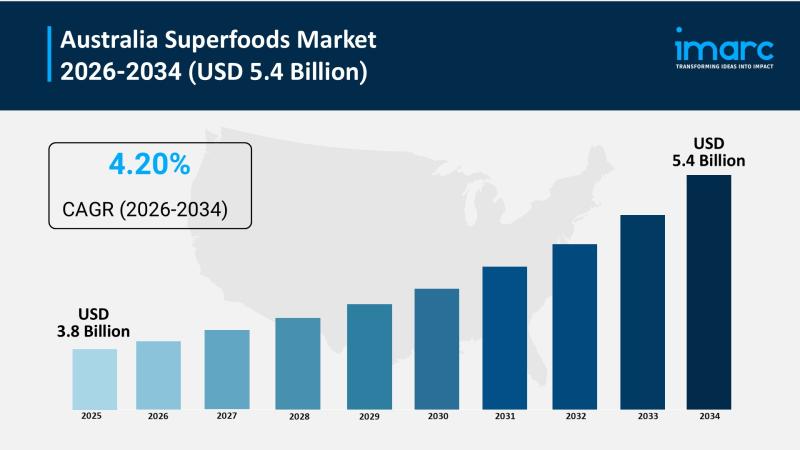

Australia Superfoods Market Estimated to Reach USD 5.4 Billion By 2026-2034

Market Overview

The Australia Superfoods Market reached a size of USD 3.8 Billion in 2025 and is projected to expand to USD 5.4 Billion by 2034. The market is poised for sturdy expansion fueled by growing health awareness, demand for nutrient-rich foods, and government initiatives promoting sustainable farming and processing. Enhanced trade partnerships and innovative products are bolstering Australia's global competitiveness and increasing consumer adoption. The forecast period spans 2026 to…

Brazil Medical Cannabis Market to Hit USD 1,546.74 Million by 2034 with a Robust …

The Brazil medical cannabis market was valued at USD 856.53 Million in 2025 and is forecast to grow to USD 1,546.74 Million by 2034, reflecting a CAGR of 6.79% during the period 2026-2034. Growth is driven by increasing therapeutic uses, advances in cultivation techniques, and digital integration enhancing patient access and treatment efficiency. Regulatory support and clinical acceptance are also promoting adoption.

Sample Request Link: https://www.imarcgroup.com/brazil-medical-cannabis-market/requestsample

Study Assumption Years

Base Year: 2025

Historical Years:…

More Releases for Pectin

Citrus Pectin Market Thriving Worldwide: Cargill, CP Kelco, DSM Andre Pectin

HTF MI introduces new research on Citrus Pectin covering the micro level of analysis by competitors and key business segments (2024-2030). The Citrus Pectin explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing.

Some of the major key players profiled…

Global Pectin Market 2019 - Yantai Andre Pectin, Silvateam, Naturex, Jinfeng Pec …

Pectin is a structural heteropolysaccharide contained in the primary cell walls of terrestrial plants. It is produced commercially as a white to light brown powder, mainly extracted from citrus fruits, and is used in food as a gelling agent, particularly in jams and jellies. It is also used in fillings, medicines, sweets, as a stabilizer in fruit juices and milk drinks, and as a source of dietary fiber.

Pectin is a…

Global Fruit Pectin Market 2019 Key Players:Cargill, Yantai Andre Pectin, DuPont …

Fruit Pectin Market:

WiseGuyReports.com adds “Fruit Pectin Market 2019 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting 2025” reports tits database.

Executive Summary

Pectin has become a prominent ingredient in processed dessert fillings, drinks, sweets, etc. The product is also used as a stabilizer in various types of fruit juice and milk drink as well as added in food products to increase their fiber content. The consumption of processed food has reached…

HM Pectin Dominates Citrus Pectin Demand, LM Pectin Sales Growing on the Back of …

Global consumption of citrus pectin is expected to reach nearly 10,000 tonnes in 2018, a marginal rise of 400 tonnes over 2017, according to Fact.MR’s new study. Overall growth of the Citrus Pectin Market can be attributed to,

Considerable demand for natural hydrocolloid emulsifiers in the food and beverage sector

Promising results regarding modified citrus pectin’s anti-cancer properties

FDA’s recent guidance on certain non-digestible carbohydrates including citrus fibers to be termed as dietary…

Pectin Market Report 2018 Companies included CP Kelco, Danisco (DuPont), Cargill …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Global Pectins Market: Top Manufacturers - Yantai Andre Pectin, Silvateam, Natur …

Latest industry research report on: Global Pectins Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

Request For Sample Report @ http://www.marketresearchreports.biz/sample/sample/1070753

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Pectins in these regions, from 2012 to 2022 (forecast), covering

North America

Europe

China

Japan

Southeast Asia

India

Global Pectins market competition by top manufacturers, with production, price, revenue (value) and…