Press release

Philippines Foreign Exchange Market Projected to Reach USD 31,880.09 Million From 2026 to 2034

Market OverviewThe Philippines foreign exchange market was valued at USD 18,354.80 Million in 2025 and is projected to reach USD 31,880.09 Million by 2034, exhibiting a growth of 6.33% CAGR during forecast period of 2026-2034. This robust expansion is fueled by remittance inflows from overseas Filipino workers, increasing cross-border trade, and widespread digital banking adoption. The market is also supported by rising FDI, a booming business process outsourcing sector, and tourism enhancement.

Request a Sample Report with the Latest 2026 Edition: https://www.imarcgroup.com/philippines-foreign-exchange-market/requestsample

How AI is Reshaping the Future of Philippines Foreign Exchange Market:

• AI-driven predictive analytics enhance forex trading accuracy by analyzing transaction patterns, reducing risks tied to currency volatility.

• Machine learning algorithms optimize digital payment platforms and mobile wallets, accelerating real-time currency conversions, and improving user experience.

• AI-powered fraud detection systems strengthen cybersecurity, safeguarding against increasing digital fraud and cyber threats prevalent in forex transactions.

• Intelligent automation streamlines regulatory compliance, reducing operational risks and enabling faster foreign exchange transaction processing.

• AI facilitates enhanced liquidity management by forecasting market liquidity needs, empowering reporting dealers to optimize forex operations efficiently.

• Partnership between fintech firms and banks harness AI for sophisticated hedging products, addressing corporate demand amidst peso fluctuations.

Market Growth Factors

Sustained Overseas Filipino Worker Remittance Inflows significantly contribute to the Philippines foreign exchange market. Remittances reached a record USD 38.34 Billion in 2024, providing vital dollar inflows that support currency liquidity and household consumption. These inflows stabilize the peso, reduce market volatility during external shocks, and invigorate foreign exchange supply. Increasing usage of digital remittance and banking platforms further channels these funds efficiently through formal financial systems, reinforcing market depth and confidence among financial institutions.

Expanding Digital Banking and Fintech Ecosystem drives transaction efficiency and market accessibility. The Philippines digital payments market size reached USD 616.3 Million in 2025, with mobile wallets and fintech platforms facilitating faster currency conversion and cross-border payments. Digital banking expansion, supported by regulation, widens financial inclusion and competition, enhancing service pricing transparency. These innovations reduce reliance on informal exchange channels, increase turnover, and accelerate the modernization of currency transaction networks.

Progressive Regulatory Reforms and Market Liberalization by the Bangko Sentral ng Pilipinas (BSP) enhance market expansion by easing foreign exchange policies and simplifying documentation. Streamlined transactions for foreign investments and refined central bank intervention frameworks improve transparency, liquidity, and market efficiency. Additionally, regional payment connectivity initiatives reduce settlement costs, encouraging broader participation and supporting the Philippines' integration into regional financial networks while maintaining prudential risk controls.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/philippines-foreign-exchange-market

Market Segmentation

Counterparty Insights:

• Counterparty

• Reporting Dealers

• Other Financial Institutions

• Non-financial Customers

Type Insights:

• Currency Swap

• Outright Forward and FX Swaps

• FX Options

Regional Insights

• Luzon

• Visayas

• Mindanao

Key Players

• BDO Unibank, Inc.

• Bank of the Philippine Islands

Recent Development & News

• October 2025: The Bank of the Philippine Islands launched BPI Remit, offering free direct fund transfers from the United States for amounts above USD 250. This initiative targets about 4.6 Million Filipinos in America, reducing remittance costs and enhancing accessibility for overseas workers sending money digitally. Beneficiaries in the Philippines could access funds quickly and enjoy favorable exchange rates.

• September 2025: The BSP improved its central bank market intervention framework, using gross international reserves of USD 112.0 Billion to stabilize peso movements through managed float systems. This has contributed to reduced volatility and reassured investors, strengthening the resilience and orderly functioning of the foreign exchange market.

• August 2025: Digital payment platforms witnessed significant growth, supporting faster cross-border remittance flows and trade settlements. This was bolstered by government participation in regional payment connectivity schemes, improving transaction efficiency and transparency that enhanced trust among banks, exporters, and overseas Filipinos.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to an analyst for a customized report sample: https://www.imarcgroup.com/request?type=report&id=41366&flag=C

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Foreign Exchange Market Projected to Reach USD 31,880.09 Million From 2026 to 2034 here

News-ID: 4379588 • Views: …

More Releases from IMARC Group

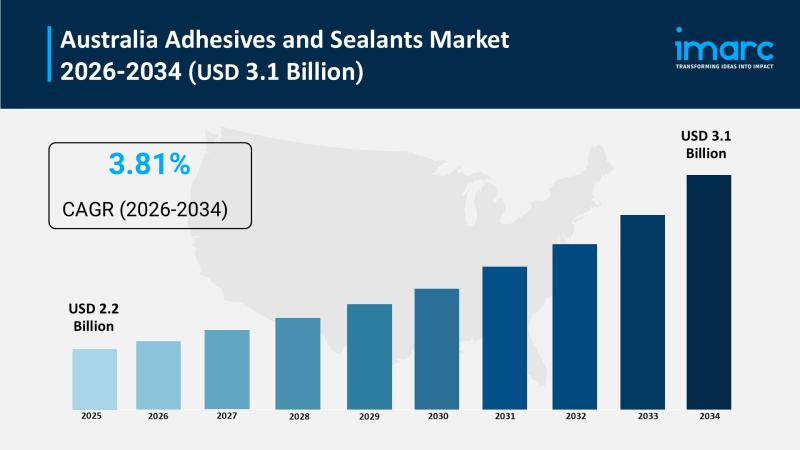

Australia Adhesives and Sealants Market Estimated to Exceed USD 3.1 Billion By 2 …

Market Overview

The Australia adhesives and sealants market size was valued at USD 2.2 Billion in 2025 and is expected to reach USD 3.1 Billion by 2034. The market is projected to grow at a CAGR of 3.81% during the forecast period of 2026-2034. Growth is propelled by construction activities, automotive repair services, and packaging demand influenced by e-commerce. Other factors include infrastructure development, medical device assembly, electronics manufacturing, shipbuilding needs,…

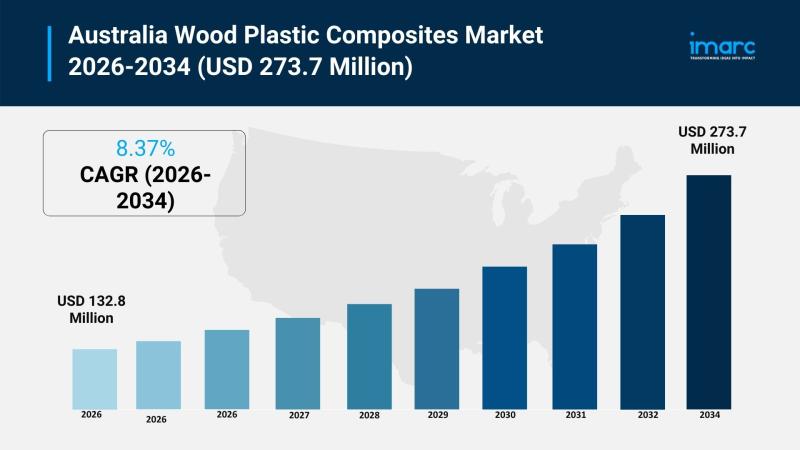

Australia Wood Plastic Composites Market Projected to Reach USD 273.7 Million by …

Market Overview

The Australia Wood Plastic Composites Market reached a market size of USD 132.8 Million in 2025. It is anticipated to expand to USD 273.7 Million by 2034, reflecting significant growth during the forecast period of 2026-2034. Driven by rising demand for sustainable and eco-friendly construction materials, wood plastic composites offer durable, low-maintenance alternatives suited to Australia's diverse climate and growing urban infrastructure needs.

https://www.imarcgroup.com/australia-wood-plastic-composites-market

How AI is Reshaping the Future of…

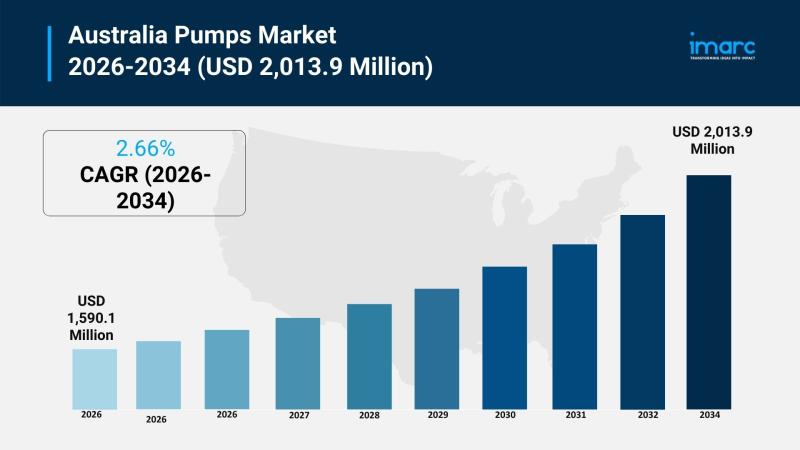

Australia Pumps Market Projected to Reach USD 2,013.9 Million by 2034

Market Overview

The Australia pumps market size reached USD 1,590.1 Million in 2025 and is expected to grow to USD 2,013.9 Million by 2034. The market will expand at a CAGR of 2.66% during the forecast period 2026-2034. Growth is driven by rising demand in mining, oil and gas, and water treatment industries, alongside technological progress in pump efficiency, automation, and energy savings. The market is also influenced by increasing needs…

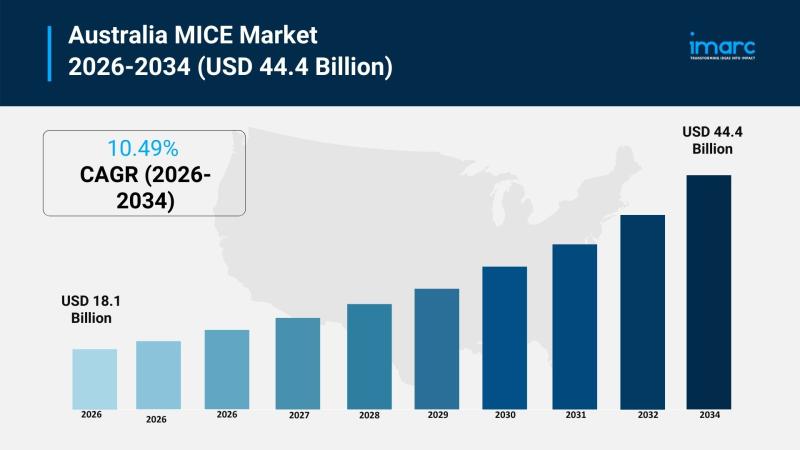

Australia MICE Market Projected to Reach USD 44.4 Billion by 2034

Market Overview

The Australia MICE market size reached USD 18.1 Billion in 2025 and is projected to grow to USD 44.4 Billion by 2034 within the forecast period of 2026-2034, showcasing a CAGR of 10.49%. Key drivers include Australia's world-class event infrastructure, strategic geographic location and connectivity through major cities such as Sydney and Melbourne, government support initiatives, advanced airport facilities, and the adoption of sustainable and flexible venue solutions. The…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…