Press release

Investment Expert Joseph Grinkorn: The US Economy to Dominate Globally in 2026

Image: https://www.abnewswire.com/upload/2026/02/48d741b080a882190696c0f90fcf6879.jpgInvestment expert and Morris Group CEO Joseph Grinkorn forecasts that global capital will continue pouring into U.S. markets in 2026, fueling strong gains across equities, dividend portfolios, pensions, and real estate investments.

According to Joseph Grinkorn, the United States is positioned to outperform every major economy in 2026 as capital concentrates in American equities, consumer spending strengthens, and falling interest rates reignite growth.

"U.S. markets remain the most attractive destination for global capital. We will continue to see profits grow across all sectors, from growth stocks to dividend portfolios and retirement funds," said Grinkorn.

He believes investors, pension funds, and long-term portfolio managers will benefit from a sustained upside as U.S. economic conditions improve and capital inflows accelerate.

Smart Money Keeps Flowing Into U.S. Stocks

Grinkorn says the world's most sophisticated investors are doubling down on U.S. markets because of their stability, liquidity, and profit potential.

According to his outlook:

*

U.S. stocks across all sectors will continue rising

*

Corporate profits will expand

*

Dividend yields and retirement portfolios will strengthen

*

Investor confidence will remain high

"Whether you're investing for growth, income, or long-term retirement, U.S. markets will continue delivering," Grinkorn stated.

Falling Interest Rates Will Ignite a New Growth Cycle

One of the most powerful catalysts in Grinkorn's 2026 outlook is a major decline in interest rates.

Lower rates will:

*

Increase affordability for households

*

Reduce borrowing costs for businesses

*

Stimulate corporate investment

*

Accelerate consumer spending

Grinkorn says this shift will unlock a new wave of economic expansion as both families and corporations gain easier access to capital.

"Lower rates change everything. When borrowing becomes affordable again, spending rises, investment surges, and growth accelerates," he said.

Mortgage Rates Will Supercharge Real Estate

Grinkorn points to mortgage rates as one of the most important drivers of the next U.S. economic boom.

With lower interest rates:

*

Homebuyers will return to the market

*

Investors will become more aggressive

*

Residential, commercial, and rental properties will surge

*

Housing demand will expand across all price ranges

"Real estate will see a major boost across every class. When mortgage costs fall, it creates one of the strongest wealth-creation engines in the economy," Grinkorn said.

Credit Card Interest Cap Will Boost Consumers

Grinkorn also highlighted the administration's cap on credit card interest rates at 10% as a major victory for American households.

With consumer debt having risen sharply during high-inflation years, the cap will:

*

Reduce monthly interest burdens

*

Improve household cash flow

*

Increase disposable income

*

Drive more consumer spending

"This policy directly helps working families who were crushed by rising debt and inflation. It puts money back in their pockets and stimulates the economy," Grinkorn explained.

Energy Prices Continue to Fall

Another major tailwind for the U.S. economy is declining energy prices, particularly in oil and gas.

Grinkorn points to:

*

Large-scale imports from Venezuela and other regions

*

Increased global supply

*

Lower production costs

These factors are pushing energy prices toward multi-year lows, helping to keep inflation down and boosting affordability for consumers and businesses alike.

"Lower energy costs mean lower transportation, manufacturing, and household expenses. That fuels profits and raises living standards," he said.

Grinkorn's Track Record of Accuracy

Joseph Grinkorn's bullish outlook carries weight because his previous market predictions have consistently proven accurate.

His past calls on:

*

Interest rate trends

*

Sector growth

*

Capital flows

*

Real estate cycles

... have aligned closely with real-world market movements, earning him a reputation as one of Wall Street's most reliable forward-looking strategists.

Significant Upside Ahead for Investors

Grinkorn says 2026 will be a powerful year for:

*

Stock market investors

*

Dividend portfolios

*

Retirement and pension funds

*

Real estate owners

*

U.S. consumers

"The combination of falling rates, cheaper energy, consumer debt relief, and rising capital investment creates the perfect environment for sustained growth," he said.

America's Economic Leadership Returns

Grinkorn believes the U.S. is entering a new era of global economic leadership.

"The United States is once again becoming the center of global capital. Investors around the world are betting on America's economy, its markets, and its long-term growth," Grinkorn stated.

With interest rates falling, consumer affordability improving, and real estate rebounding, he sees the U.S. economy positioned to dominate world markets throughout 2026 and beyond.

Morris Group's Ongoing Role

Founded in 2007, Morris Group operates across three divisions:

*

Morris Group Financial: Equity and market investments

*

Morris Group Properties: High-return real estate investments

*

Morris Group Funding: Commercial and alternative financing

The firm focuses on data-driven investment strategies, transparency, and long-term value creation.

More information about Morris Group is available at www.Morris-Group.co [http://www.morris-group.co/]

Media Contact

Company Name: Morris Group

Contact Person: Public Relations Department

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=investment-expert-joseph-grinkorn-the-us-economy-to-dominate-globally-in-2026]

City:

State:

Country: United States

Website: http://www.Morris-Group.co

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Expert Joseph Grinkorn: The US Economy to Dominate Globally in 2026 here

News-ID: 4379291 • Views: …

More Releases from ABNewswire

Leo Liangda Hu Presents "Mr. Ma's in New York": A Cross-Cultural Theatrical Expl …

NEW YORK - A staged reading of Mr. Ma's in New York, written by Chinese playwright and theater artist Leo Liangda Hu, was presented Nov. 21-22, 2025, at Gibney: Agnes Varis Performing Arts Center, offering an intimate portrayal of cross-cultural encounters among immigrant families in 1990s New York.

Image: https://www.abnewswire.com/upload/2026/02/1770329896.jpg

Produced by Dreamborne Theater Inc., the reading took place in Studio H at 280 Broadway and was offered to the public. Set…

Capsicum Market Size to Reach USD 30.4 Billion by 2030 - Mordor Intelligence

Mordor Intelligence has published a new report on the Capsicum Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Global Capsicum Market Growth Outlook

According to Mordor Intelligence, the global Capsicum Market size [https://www.mordorintelligence.com/industry-reports/capsicum-market?utm_source=marketersmedia] has recorded steady expansion, supported by rising consumption of fresh produce and increasing downstream demand from processed food and nutraceutical industries. The market was valued at USD 21.8 billion in 2024 and is projected to…

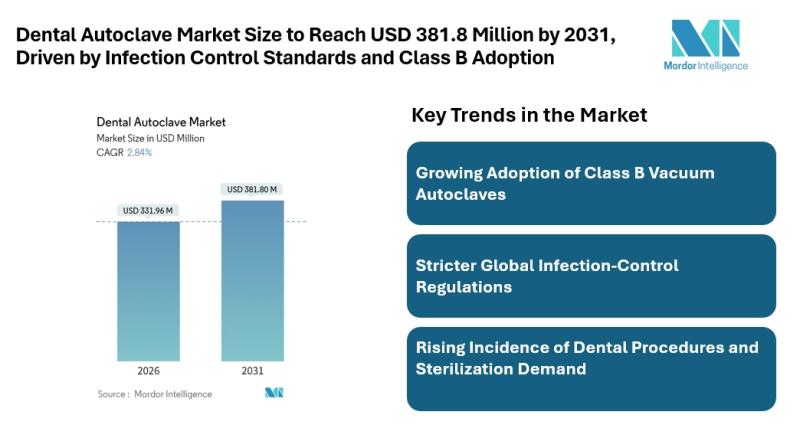

Dental Autoclave Market Size to Reach USD 381.8 Million by 2031, Driven by Infec …

Mordor Intelligence has published a new report on the dental autoclave market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction: Dental Autoclave Market Analysis

According to Mordor Intelligence, The dental autoclave market size [https://www.mordorintelligence.com/industry-reports/dental-autoclave-market?utm_source=abnewswire] continues to show steady expansion as infection prevention remains a core requirement across dental care settings. According to Mordor Intelligence, the dental autoclave market size is valued at USD 322.79 million in 2025 and…

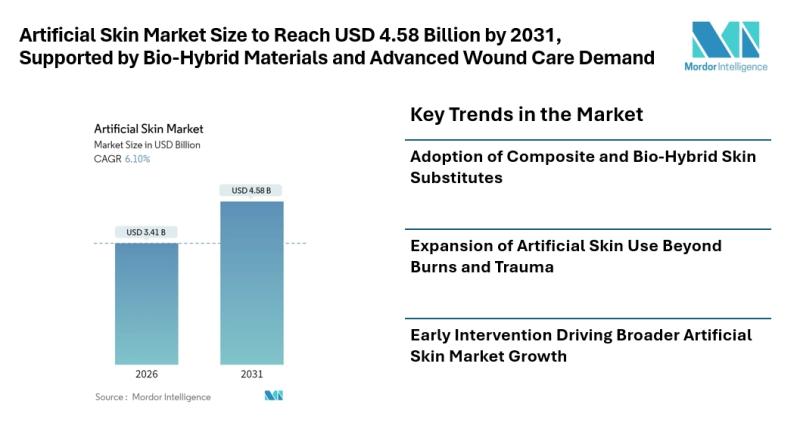

Artificial Skin Market Size to Reach USD 4.58 Billion by 2031, Supported by Bio- …

Mordor Intelligence has published a new report on the artificial skin market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Artificial Skin Market Overview

According to Mordor Intelligence, The artificial skin market size [https://www.mordorintelligence.com/industry-reports/artificial-skin-market?utm_source=abnewswire] is gaining steady attention across healthcare systems as clinicians and providers look for reliable solutions to manage complex wounds, burns, and skin loss. According to Mordor Intelligence, the artificial skin market size stood at USD…

More Releases for Grinkorn

Joseph Grinkorn: Tech Will Continue to Reign King of Wall Street in 2026

Image: https://www.abnewswire.com/upload/2025/12/564bc96dc00701a51cd0a27802b69d9e.jpg

Joseph Grinkorn, investment expert & CEO of Morris Group, predicts that technology stocks will continue to outperform major market indices in 2026, driven by artificial intelligence expansion, emerging technologies, and favorable macroeconomic conditions.

The NASDAQ Composite has surged nearly 22% in 2025, with several tech giants posting triple-digit gains. Micron Technology (MU) leads with a 185.42% year-to-date return, followed by Palantir Technologies (PLTR) at 125.94% and Intel (INTC) at 114.78%.

Market…

Joseph Grinkorn: Wall Street and U.S. Economy Surge as Liberation Day Sparks Rec …

Investment Expert and Morris Group CEO Highlights Historic Economic Turnaround Driven by Trade Wins and Global Investment

May 27, 2025 - New York, NY - Joseph Grinkorn, investment magnet and CEO of the Morris Group, announced today that Wall Street and the broader U.S. economy are entering a powerful new phase of expansion, following the unprecedented success of Liberation Day initiatives. According to Grinkorn, recent economic developments signal record-breaking growth potential,…

Joseph Grinkorn: Wall St Will Continue to Roar in 2025, the S&P 500 Could Rise 1 …

Joseph Grinkorn investment expert and CEO of Morris group predicts S&P 500 and the stock market will continue to run hot in 2025 to record highs. A potential Return of high interest rates and inflation could postpone the rally.

Joseph Grinkorn, investment expert and Chief Executive Officer of Morris Group, has forecasted another strong year for Wall Street in 2025. Drawing upon online data and industry research, Grinkorn predicts that the…

Joseph Grinkorn: The Trump Bull Market is Here - Markets Set to Hit New Highs by …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

December 10, 2024 - In an insightful forecast, Joseph Grinkorn, CEO of Morris Group, asserts that the financial markets are primed for unprecedented growth following Donald Trump's return as the 47th President of the United States. Grinkorn believes that implementing Trump's aggressive economic policies is…

Joseph Grinkorn: The Trump Bull Market is Here - Markets Set to Hit All-New High …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

December 2, 2024 - In an insightful forecast, Joseph Grinkorn, CEO of Morris Group, asserts that the financial markets are primed for unprecedented growth following Donald Trump's return as the 47th President of the United States. Grinkorn believes that implementing Trump's aggressive economic policies is…

Joseph Grinkorn: The Trump Bull Market is Here. Markets will hit All-New Highs i …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

Image: https://www.abnewswire.com/uploads/5a470c48f02cbedbfb06221cdf216526.jpg

November 22, 2024 - Joseph Grinkorn, seasoned investment expert and CEO of Morris Group, predicts that the U.S. financial markets are on track for a historic surge under President Donald Trump's leadership. With Trump now serving as the 47th President of the United States,…