Press release

Joseph Grinkorn: Wall St Will Continue to Roar in 2025, the S&P 500 Could Rise 10%.

Joseph Grinkorn investment expert and CEO of Morris group predicts S&P 500 and the stock market will continue to run hot in 2025 to record highs. A potential Return of high interest rates and inflation could postpone the rally.Joseph Grinkorn, investment expert and Chief Executive Officer of Morris Group, has forecasted another strong year for Wall Street in 2025. Drawing upon online data and industry research, Grinkorn predicts that the S&P 500 could rise by as much as 10 percent, suggesting that the market will continue its upward trajectory. While he acknowledges that a potential return of high interest rates and inflation could delay the positive shift, he remains confident in the natural progression of the market cycle and the resilience of major U.S. indices.

Image: https://www.abnewswire.com/upload/2025/01/fa355c3e5ef4805f666a1296c1bfc245.jpg

Joseph Grinkorn's assessment is rooted in several factors that underscore the robust momentum witnessed in recent market activity. Leading economic indicators signal sustained consumer spending, further supported by a stable employment rate and generally positive corporate earnings reports. According to publicly available data, the stock market often performs well when businesses demonstrate steady profitability and consumer confidence remains high. This combination of conditions helps create an environment where the S&P 500 can advance.

In Grinkorn's view, ongoing consumer demand for goods and services, along with healthy corporate balance sheets, can help drive equity valuations higher. He explains that these elements, when coupled with supportive fiscal policies, have historically contributed to extended periods of market growth. Some economists have suggested that any potential headwinds, such as a Federal Reserve decision to raise interest rates to combat inflation, could slow the pace of this growth but may not necessarily reverse the positive trend.

Grinkorn also points to broader economic patterns that show the natural cycle of expansions and contractions in the market. Even if interest rates rise and inflation persists, he believes these factors may not derail the overall upward trajectory if companies continue to innovate and adapt to evolving consumer demands. While some sectors might experience periods of adjustment due to changing monetary policies, he remains optimistic about the market's core strength.

In a statement Grinkorn commented, "Investors have expressed enthusiasm for 2025 based on tangible data that supports ongoing gains. There is a clear alignment between robust consumer spending, corporate profitability, and overall market sentiment. While potential challenges, such as higher interest rates, cannot be discounted, the fundamentals appear supportive of a continued bull run. A 10 percent increase in the S&P 500 is well within reach if the current economic environment prevails."

Financial observers concur that if inflationary pressures remain within manageable levels and interest rate policies are carefully calibrated, the market could maintain the momentum that has propelled it over the past several months. The combination of technology sector growth, stabilized global supply chains, and consistent demand for consumer goods further reinforces the bullish outlook for U.S. equities.

For more information visit www.Morris-Group.co [http://www.morris-group.co/].

About Morris Group

Morris Group, founded by Joseph Grinkorn in 2007, specializes in high-return real estate investments, commercial and residential financing, and strategic equity placements in technology and alternative assets. Guided by extensive market research, Morris Group seeks to maximize returns and provide well-rounded investment strategies for its clients.

Media Contact

Company Name: Morris Group

Contact Person: Joseph Grinkorn

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=joseph-grinkorn-wall-st-will-continue-to-roar-in-2025-the-sp-500-could-rise-10]

Phone: (646) 673-8404

Country: United States

Website: http://www.Morris-Group.co

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Joseph Grinkorn: Wall St Will Continue to Roar in 2025, the S&P 500 Could Rise 10%. here

News-ID: 3844753 • Views: …

More Releases from ABNewswire

Newman's Brew Proves Smooth, Flavorful Coffee Begins with Ethical Sourcing and P …

Newman's Brew has built its reputation on delivering the smoothest coffee available by combining organic bean sourcing with fresh-per-order roasting. The rapidly expanding company demonstrates that ethical business practices and exceptional product quality are not mutually exclusive, while supporting abandoned animal feeding programs as part of its commitment to positive social impact.

In an industry where freshness is often sacrificed for operational convenience, Newman's Brew has chosen a different path. The…

Playground Play Equipment Innovation Sets New Benchmark for Safe, Engaging Space …

As schools, communities, and commercial venues worldwide continue to invest in healthier and more inclusive outdoor environments, playground play equipment [https://www.indooroutdoorplayground.com/what-makes-playground-play-equipment-truly-safe-and-engaging/] is entering a new era-one defined by higher safety standards, smarter design, and broader community engagement. Golden Times (Wenzhou Golden Times Amusement Toys CO., LTD.) today announced an expanded product and market strategy focused on delivering next-generation playground solutions that balance safety, durability, and creativity.

Industry expectations for playgrounds have…

Time.so Reports 300% Growth in Business Users

Time.so reports 300% growth in business users as global teams rely on its fast world clock, city times, time zones, and weather for planning.

Jan 31, 2026 - Time.so today announced a 300% increase in business users, reflecting rising demand for dependable time data across distributed teams, global customer support, and cross border operations.

The surge follows a clear shift in how companies schedule work. Meetings span continents. Deadlines move with daylight…

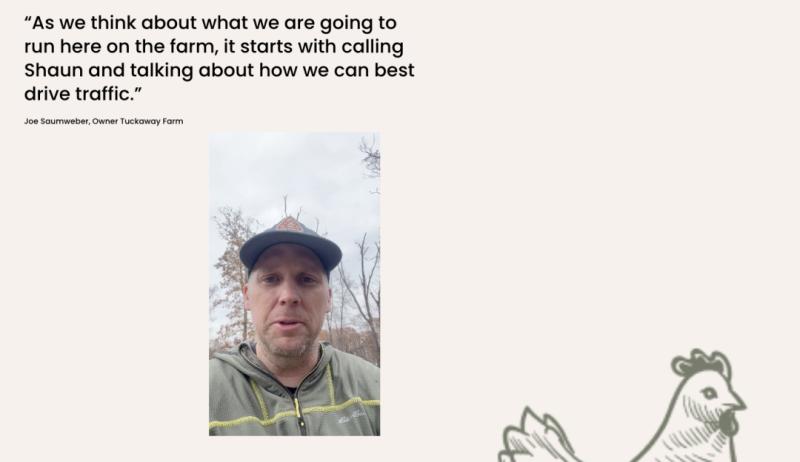

Shaun Savvy Helps Tuckaway Farm in Bentonville, Arkansas Sell Out Two CSA Season …

Buffalo-based SEO consultant Shaun Savvy partnered with Tuckaway Farm in Bentonville, Arkansas to help the farm sell out two consecutive CSA seasons, generating over $80,000 in revenue while spending less than $1,000 on paid advertising through a strategic blend of local SEO, high-intent content, and targeted social media campaigns.

Shaun Savvy, a Buffalo-based SEO and digital marketing consultant, announced a successful local marketing case study showcasing how Tuckaway Farm sold out…

More Releases for Grinkorn

Joseph Grinkorn: Tech Will Continue to Reign King of Wall Street in 2026

Image: https://www.abnewswire.com/upload/2025/12/564bc96dc00701a51cd0a27802b69d9e.jpg

Joseph Grinkorn, investment expert & CEO of Morris Group, predicts that technology stocks will continue to outperform major market indices in 2026, driven by artificial intelligence expansion, emerging technologies, and favorable macroeconomic conditions.

The NASDAQ Composite has surged nearly 22% in 2025, with several tech giants posting triple-digit gains. Micron Technology (MU) leads with a 185.42% year-to-date return, followed by Palantir Technologies (PLTR) at 125.94% and Intel (INTC) at 114.78%.

Market…

Joseph Grinkorn: Wall Street and U.S. Economy Surge as Liberation Day Sparks Rec …

Investment Expert and Morris Group CEO Highlights Historic Economic Turnaround Driven by Trade Wins and Global Investment

May 27, 2025 - New York, NY - Joseph Grinkorn, investment magnet and CEO of the Morris Group, announced today that Wall Street and the broader U.S. economy are entering a powerful new phase of expansion, following the unprecedented success of Liberation Day initiatives. According to Grinkorn, recent economic developments signal record-breaking growth potential,…

Joseph Grinkorn: The Trump Bull Market is Here - Markets Set to Hit New Highs by …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

December 10, 2024 - In an insightful forecast, Joseph Grinkorn, CEO of Morris Group, asserts that the financial markets are primed for unprecedented growth following Donald Trump's return as the 47th President of the United States. Grinkorn believes that implementing Trump's aggressive economic policies is…

Joseph Grinkorn: The Trump Bull Market is Here - Markets Set to Hit All-New High …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

December 2, 2024 - In an insightful forecast, Joseph Grinkorn, CEO of Morris Group, asserts that the financial markets are primed for unprecedented growth following Donald Trump's return as the 47th President of the United States. Grinkorn believes that implementing Trump's aggressive economic policies is…

Joseph Grinkorn: The Trump Bull Market is Here. Markets will hit All-New Highs i …

According to Morris Group CEO Joseph Grinkorn, Trump's return and aggressive economic policies are already shaping a strong future for Wall Street, with significant growth expected.

Image: https://www.abnewswire.com/uploads/5a470c48f02cbedbfb06221cdf216526.jpg

November 22, 2024 - Joseph Grinkorn, seasoned investment expert and CEO of Morris Group, predicts that the U.S. financial markets are on track for a historic surge under President Donald Trump's leadership. With Trump now serving as the 47th President of the United States,…

Joseph Grinkorn: There could be Market Correction on Wall Street, Markets Could …

Investment expert warns of major potential downturn due to persistent inflation, high interest rates, and weakening job data.

Joseph Grinkorn [http://www.morris-group.co/], renowned investment expert and CEO of Morris Group, has issued a stark warning about an impending global market correction. With Wall Street grappling with persistent high inflation, elevated interest rates, and disappointing job data, Grinkorn predicts a potential downturn that could see indices like the S&P 500, NASDAQ, and…