Press release

Phosphoric Acid Production Plant (DPR) 2026: Cost Structure, Market Outlook, and Profitability Analysis

The global chemical industry is experiencing transformative growth driven by agricultural intensification, industrial processing expansion, and increasing food safety standards. At the center of this evolution stands a fundamental industrial chemical-phosphoric acid. As the backbone of phosphate fertilizer production and a critical intermediate across multiple industrial applications, establishing a phosphoric acid manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this structurally important market driven by rising agricultural productivity demands and preference for standardized, high-purity grades across downstream users.IMARC Group's report, "Phosphoric Acid Production Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a production plant. The phosphoric acid production plant report offers insights into the production process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/phosphoric-acid-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global phosphoric acid market demonstrates robust growth trajectory and structural stability. The market was valued at USD 48.81 Billion in 2025. According to IMARC Group estimates, the market is projected to reach USD 71.30 Billion by 2034, exhibiting a CAGR of 4.09% from 2026 to 2034. This sustained expansion reflects the essential role phosphoric acid plays in global agricultural value chains and industrial processing applications.

Phosphoric acid is an inorganic acid typically produced as a clear, colorless, odorless liquid (or as a concentrated syrupy solution) and commonly supplied in industrial and food-grade concentrations. It is non-volatile and strongly acidic, offering excellent buffering and chelation characteristics, which makes it valuable in pH adjustment, rust removal, and phosphate salt production. Depending on the production route and purification intensity, it is marketed in multiple grades-technical/industrial grade and higher-purity grades suitable for regulated end uses.

The phosphoric acid industry is shaped by steady downstream pull from fertilizer value chains and a parallel demand stream from industrial and food-grade applications. Agricultural nutrient requirements continue to support baseline volumes, while shifts toward higher-efficiency farming and balanced fertilization practices sustain long-term consumption of phosphate-based inputs. In industrial markets, phosphoric acid remains a preferred chemistry for pH adjustment, metal surface treatment, and phosphate salt production, supported by consistent manufacturing activity and water-treatment needs. On the specialty side, food and beverage processors rely on controlled-quality grades for acidulation and taste stabilization, keeping demand resilient even when bulk cycles soften. According to FICCI, the Indian food and beverage packaged industry is expected to grow from USD 33.7 Billion in 2023 to USD 46.3 Billion in 2028. Regionally, demand is strongest where phosphate fertilizer production is concentrated and where industrial processing capacity is expanding.

Plant Capacity and Production Scale

The proposed phosphoric acid production facility is designed with an annual production capacity ranging between 100,000-500,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from bulk fertilizer-grade supplies to higher-purity industrial and food-grade applications-ensuring steady demand and consistent revenue streams across multiple industry verticals. The facility utilizes wet-process acidulation technology (phosphate rock + acid) with purification and concentration capabilities that can be adjusted based on grade requirements and customer specifications.

Financial Viability and Profitability Analysis

The phosphoric acid manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 25-35%

• Net Profit Margins: 10-20%

These margins are supported by stable demand across fertilizer and industrial sectors, value-added manufacturing capabilities through grade differentiation, and the critical nature of phosphoric acid in agricultural input chains and chemical processing. The project demonstrates strong return on investment (ROI) potential, supported by comprehensive financial analysis including liquidity analysis, profitability analysis, payback period determination, net present value (NPV) calculations, internal rate of return assessment, profit and loss account projections, uncertainty analysis, sensitivity analysis, and economic analysis-making it an attractive proposition for both new entrants and established industrial players looking to integrate backward into phosphate value chains.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a phosphoric acid manufacturing plant is primarily driven by:

• Raw Materials: 60-70% of total OpEx

• Utilities: 15-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with phosphate rock and sulfuric acid being the primary input materials. Phosphate rock accounts for approximately 60-70% of total operating expenses, making raw material sourcing strategy the most critical cost factor in phosphoric acid production. Additional operating expenses include utility costs for electricity, water, and steam requirements essential for concentration and purification processes, transportation costs for raw material procurement and finished product distribution, packaging costs for acid handling and storage, salaries and wages for skilled labor across production and quality control functions, depreciation on specialized equipment, and other miscellaneous expenses.

Establishing long-term contracts with reliable phosphate rock and sulfuric acid suppliers helps mitigate price volatility and ensures consistent material supply, which is critical given that raw material price fluctuations represent the most significant cost factor in phosphoric acid manufacturing. In the first year of operations, the operating cost is projected to be significant. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, potential rises in the cost of key materials, supply chain disruptions, rising consumer demand, and shifts in the global economy.

Capital Investment Requirements

Setting up a phosphoric acid manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: The location must offer easy access to key raw materials such as phosphate rock and sulfuric acid. Proximity to target markets-particularly fertilizer manufacturing complexes and industrial chemical consumers-helps minimize distribution costs significantly. The site must provide robust infrastructure, including reliable transportation networks, utilities, and comprehensive waste management systems capable of handling gypsum byproduct and effluent streams. Compliance with local zoning laws and stringent environmental regulations must be ensured during site selection. The cost of land and site development, including charges for land registration, boundary development, and related expenses, forms a substantial part of the overall investment.

Machinery and Equipment: Machinery costs account for the largest portion of capital expenditure in phosphoric acid production. Essential equipment includes crushers and grinders for phosphate rock beneficiation, sulfuric acid plants for integrated operations, reaction vessels including digesters or reactors for acidulation processes, filtration systems such as vacuum belt filters for separating phosphoric acid from gypsum, concentration units for achieving required acid strengths, cooling systems for temperature management, and storage tanks for acid handling with appropriate corrosion-resistant materials. All machinery must comply with industry standards for safety, efficiency, and reliability. High-quality, corrosion-resistant equipment tailored specifically for phosphoric acid production ensures long-term operational excellence and minimizes maintenance costs.

Civil Works: Building construction and factory layout optimization are designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the acidulation, filtration, and concentration processes. Separate designated areas are established for raw material storage, production operations including digestion and filtration, quality control inspection laboratories, and finished goods warehousing with appropriate containment systems. Adequate space provisions for gypsum byproduct handling and storage must be incorporated to accommodate waste management requirements.

Other Capital Costs: Additional capital requirements include pre-operative expenses, machinery installation costs, regulatory compliance certifications for chemical manufacturing, initial working capital to support operations during ramp-up phases, and contingency provisions for unforeseen circumstances during plant establishment. This allocation ensures a solid foundation for safe and efficient plant operations.

Buy Now: https://www.imarcgroup.com/checkout?id=7601&method=2175

Major Applications and Market Segments

Phosphoric acid serves extensive applications across diverse industrial sectors, demonstrating its fundamental importance in global manufacturing:

• Fertilizer Manufacturing: Phosphoric acid production via wet-process digestion of phosphate rock serves as the primary feedstock for producing phosphate fertilizers including Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP), and Triple Superphosphate (TSP), which collectively represent the largest consumption segment globally.

• Agriculture Applications: Phosphate fertilizers derived from phosphoric acid support crop nutrition programs worldwide, directly impacting agricultural productivity and food security across all farming regions.

• Food & Beverage Industry: Food-grade phosphoric acid serves as an acidulant for pH control and flavor enhancement in carbonated beverages, processed foods, and various food products requiring precise acidity regulation.

• Industrial Processing: Used extensively in metal treatment for rust removal and surface preparation, detergent formulations, water treatment for pH adjustment and corrosion inhibition, and as chemical intermediates in phosphate salt production.

• Electronics Sector: High-purity grades are employed in semiconductor etching and cleaning processes, requiring stringent quality specifications and consistent product performance.

• Pharmaceutical Applications: Pharmaceutical-grade phosphoric acid is utilized in drug formulation processes and as a pH adjusting agent in pharmaceutical manufacturing.

End-use industries span fertilizers, food and beverages, electronics, metal treatment, pharmaceuticals, and water treatment, all of which contribute to sustained market demand and revenue diversification opportunities.

Why Invest in Phosphoric Acid Manufacturing?

Several compelling factors make phosphoric acid manufacturing an attractive investment opportunity:

Anchor Chemical for Fertilizers: A large share of global phosphoric acid consumption is tied to phosphate fertilizers, making it a structurally important product in agricultural input chains. This connection to food security and agricultural productivity provides long-term demand stability transcending economic cycles.

Value-Upside Through Grade Strategy: Producers can improve realizations by integrating purification and concentration capabilities to serve higher-specification segments alongside bulk demand. Food-grade, industrial-grade, and electronic-grade products command premium pricing compared to fertilizer-grade material, creating margin enhancement opportunities.

Supply-Chain Localization Benefits: Regional production can reduce dependence on imports, improve delivery reliability for large fertilizer and chemical consumers, and mitigate logistics-driven cost volatility. Proximity to phosphate rock sources and sulfuric acid production further enhances competitive positioning.

Process Integration Opportunities: Heat recovery systems, optimized filtration technologies, and gypsum handling improvements can materially reduce unit costs and enhance operational stability over time. Producers are increasingly focused on operational efficiency, particularly energy use in concentration, filtration performance, and byproduct gypsum management-gain significant competitive advantages.

Stable Demand Fundamentals: Agricultural nutrient requirements, industrial processing needs, and specialty applications provide diversified demand streams that support capacity utilization across market cycles. The market outlook remains stable to positive, with growth prospects improving for plants that combine reliable feedstock sourcing with flexible grade capability.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=7601&flag=C

Industry Leadership

The global phosphoric acid manufacturing industry features established players with extensive production capabilities and diverse application portfolios serving markets worldwide. Leading producers include:

• The Mosaic Company - Major integrated producer serving fertilizer and industrial markets with significant global production capacity

• OCP Group - Leading phosphate rock miner and phosphoric acid producer with vertically integrated operations

• Nutrien - Global fertilizer and agricultural products company with substantial phosphoric acid production capabilities

• ICL Group - Diversified specialty minerals and chemicals producer serving fertilizer and industrial phosphate markets

• Prayon - Specialized phosphate chemicals manufacturer focusing on high-purity grades for industrial and specialty applications

These industry leaders serve end-use sectors including fertilizers, food and beverage, electronics, metal treatment, pharmaceuticals, and water treatment, demonstrating the broad market applicability and structural importance of phosphoric acid across global manufacturing value chains.

Recent Industry Developments

May 2025: Caitlyn India Private Ltd. announced an investment of ₹400 crore to establish a 50,000 tonne per annum (TPA) integrated phosphoric acid plant in India. The facility will be in a port-accessible industrial zone, with the company currently evaluating options in southern India, demonstrating significant corporate confidence in the Indian phosphoric acid manufacturing sector.

January 2025: The Mosaic Company announced completion of its transaction with Saudi Arabian Mining Company (Ma'aden) to sell its interest in Ma'aden Wa'ad Al Shamal Phosphate Company (MWSPC) and establish the company as a shareholder in Ma'aden. In this transaction, Mosaic received 111,012,433 shares of Ma'aden-valued at approximately USD 1.5 Billion on the closing date-in exchange for Mosaic's 25% stake in MWSPC, previously a joint venture among Mosaic, Ma'aden and Saudi Basic Industries Corporation, signaling strategic portfolio optimization among global phosphate industry leaders.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Phosphoric Acid Production Plant (DPR) 2026: Cost Structure, Market Outlook, and Profitability Analysis here

News-ID: 4378722 • Views: …

More Releases from IMARC Group

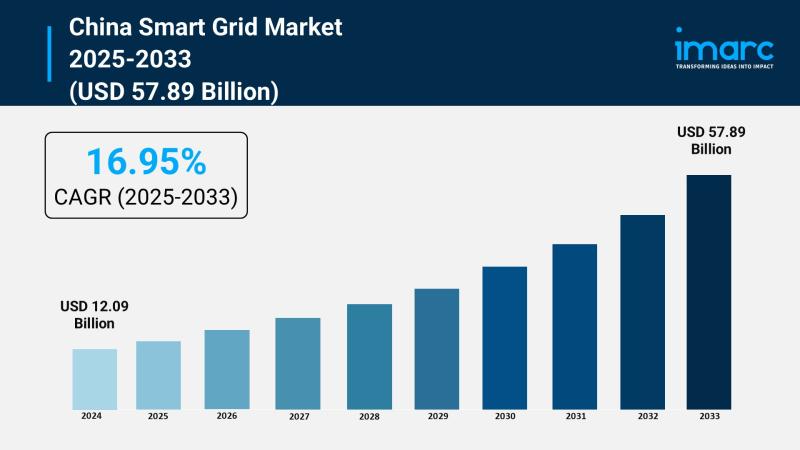

China Smart Grid Market Report: Industry Size, CAGR of 16.95% and Future Outlook …

Market Overview

The China Smart Grid Market reached USD 12.09 Billion in 2024 and is projected to reach USD 57.89 Billion by 2033, growing at a CAGR of 16.95% during the forecast period 2025-2033. This growth is driven by rapid urbanization, rising electricity demand, and strong governmental support aimed at energy efficiency and integrating renewable sources. Technological advancements such as IoT, AI, and big data analytics are further enhancing grid automation…

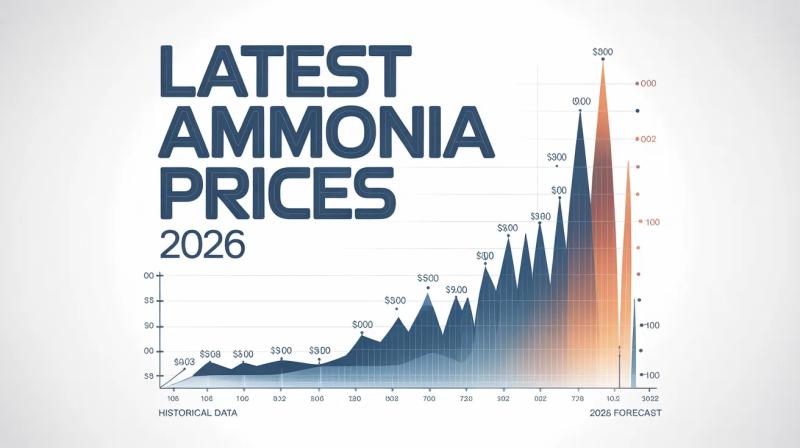

Ammonia Prices Update 2026: Global Price Index, Trend Shifts & Forecast

Global Ammonia Prices recorded mixed movement toward late 2025 and early 2026 as fluctuating energy costs, supply-side adjustments, and fertilizer demand reshaped market sentiment. The Ammonia Price Index remains a key benchmark for tracking these changes, reflecting regional cost pressures and trade dynamics. As ammonia continues to play a critical role in fertilizers, chemicals, and clean energy applications, market participants are closely monitoring price trends, historical patterns, and near-term forecasts…

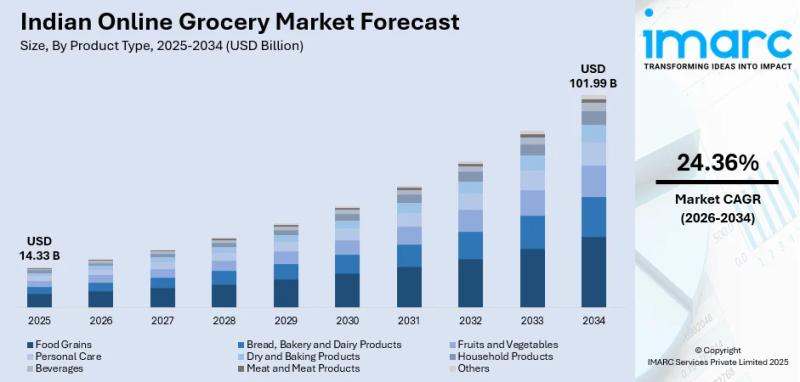

Indian Online Grocery Market Size to Surpass USD 101.99 Billion by 2034 | Expand …

Indian Online Grocery Market Overview 2026-2034:

According to IMARC Group's report titled "Indian Online Grocery Market Size, Share | Report 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The Indian online grocery market was valued at USD 14.33 Billion in 2025 and is projected to reach USD 101.99 Billion by 2034. It is expected to grow at a robust compound annual growth…

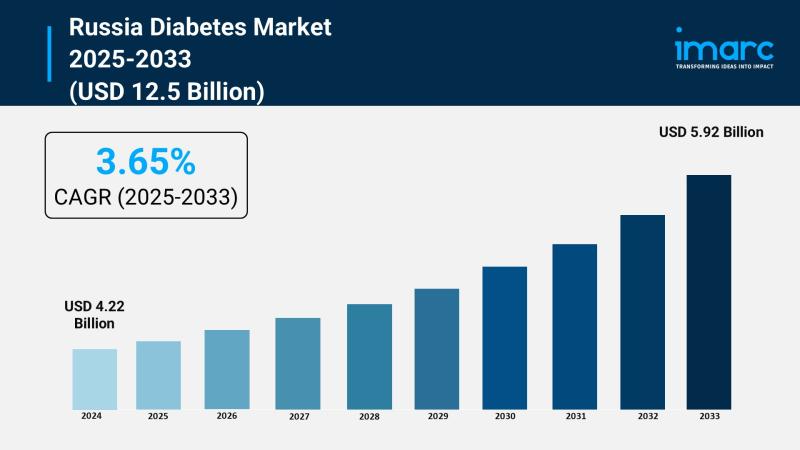

Russia Diabetes Market Therapeutics, Devices, and Care Pathways Analysis, 2025-2 …

Market Overview

The Russia diabetes market was valued at USD 4.22 Billion in 2024 and is projected to reach USD 5.92 Billion by 2033, growing at a CAGR of 3.65% during the forecast period of 2025-2033. This growth is driven by increasing diabetes prevalence, an aging population, and greater healthcare awareness supported by government initiatives. Technological advancements in diabetes care and expanded reimbursement policies also contribute to market expansion.

Study Assumption…

More Releases for Phosphoric

High Purity Phosphoric Acid for Semiconductor Market

High Purity Phosphoric Acid for Semiconductor Market Overview

High purity phosphoric acid (HPPA) for semiconductor manufacturing is a specialized form of phosphoric acid with an exceptionally low level of impurities, which is critical for producing high-quality semiconductors. In the semiconductor industry, HPPA is used primarily for etching and cleaning silicon wafers during the fabrication process. The purity of the acid ensures that no unwanted contaminants interfere with the delicate processes involved…

Prominent Phosphoric Acid Market Share Share Trend for 2025: Technological Advan …

What industry-specific factors are fueling the growth of the phosphoric acid Market Share Share?

The phosphoric acid Market Share Share is experiencing substantial growth because of the escalating need for Di-ammonium Phosphate (DAP) fertilizers. DAP, a type of soluble ammonium phosphate salt, is produced when ammonia reacts with phosphoric acid. A major component of fertilizer production, phosphoric acid, mixed with finely ground phosphate, generates triple superphosphate (TSP), monoammonium phosphate…

Phosphoric Acid Market 2031 Competitor Analysis

The Phosphoric Acid Market is expected to register a CAGR of 4% from 2024 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

Access PDF: https://www.theinsightpartners.com/sample/TIPRE00012559/?utm_source=OpenPR&utm_medium=10864

Based on Apllication Type, By Application Fertilizers, Food and Feed Phosphate, Detergents, Water Treatment Chemicals, Industrial, Electronics.

Major Companies operating in the Phosphoric Acid Market are:

• Arkema Group

• J.R. Simplot Company

• Nutrien Ltd.

• OCP Group

• PJSC PhosAgro

• Prayon Group

• Solvay

• Spectrum Chemical Manufacturing Corporation

• The…

Phosphoric Acid Market Size, Share, Growth 2031

Global Phosphoric Acid Market Size was estimated at USD 37180 million in 2021 and is projected to reach USD 43300 million by 2028, exhibiting a CAGR of 2.2% during the forecast period.

The Phosphoric Acid Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It…

Phosphoric Acid Market was Dominated by Agricultural-Grade Phosphoric Acid

The phosphoric acid market was USD 45,671.2 million in 2022, and it will grow at a rate of 4.1% in the years to come, to touch USD 63,186.8 million by 2030, as stated by a market research institution P&S Intelligence.

The diammonium hydrogen phosphate market will grow significantly in the years to come with a rate of about 5%, because of the growing need for manure to increase agricultural yields.

Explore…

Global Phosphoric Acid Market Size

According to a new market research report published by Global Market Estimates, the Global Phosphoric Acid Market is expected to grow from USD 46.5 Billion in 2023 to USD 58.2 Billion by 2028 and is projected to grow at a CAGR of 4.44% from 2023 to 2028.

The growing export value and volume of fertilizers, increased demand for phosphoric acid from the food and beverage and pharmaceutical industries, and increasing concerns…