Press release

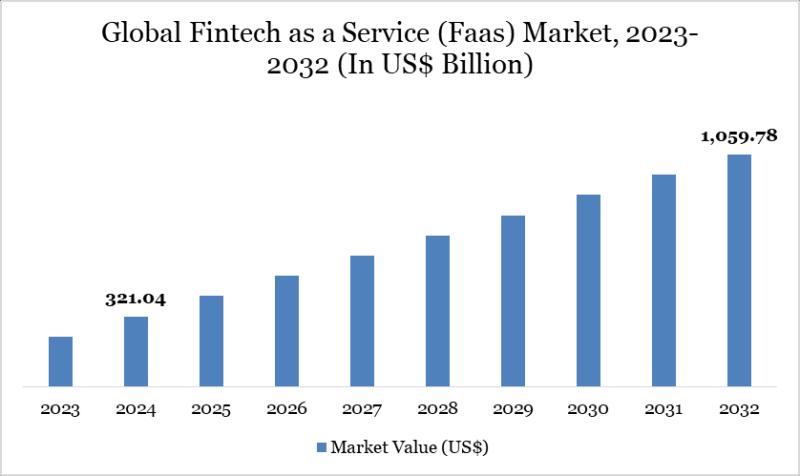

Fintech as a Service (Faas) Market size is set to reach US$ 1,059.78 billion by 2032, at a strong CAGR of 16.10%. North America leads the market with 44% market share | Market trends, challenges & opportunities.

Global Fintech as a Service (Faas) Market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing with a CAGR of 16.10% during the forecast period 2025-2032.Fintech as a Service market growth is fueled by rapid digital banking adoption, API-driven platforms, lower infrastructure costs, faster product launches, regulatory support, and rising demand for embedded finance across industries.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?prtk

United States: Key Industry Developments

✅ January 2026: Galileo launched Galileo 360 FaaS platform with generative AI lending APIs, powering 15K fintechs to deploy compliant credit decisions in 24 hours across 50 states.Processes 1B transactions monthly with 95% auto-approval rates for SMB loans.

✅ December 2025: Marqeta debuted FaaS Card Issuing 3.0 with embedded virtual cards, enabling 8K platforms to launch BNPL wallets processing $50B annual volume.

Reduces fraud 60% via machine learning risk scoring integrated with Plaid ACH.

✅ November 2025: Synctera rolled out Banking-as-a-Service 2.0 with FDIC pass-through insurance, onboarding 3M consumer accounts via API-driven compliance automation.

Asia Pacific / Japan: Key Industry Developments

✅ January 2026: GMO Payment Gateway launched FaaS Core with MyNumber KYC, connecting 12K Japanese merchants to QR/wallet payments processing ¥5T ($33B) annually.

Supports cross-border e-commerce for 3M SMEs with real-time forex settlement.

✅ December 2025: PayU India debuted NeoFaaS suite with UPI instant loans, issuing 1M micro-loans daily to unbanked merchants under RBI digital lending guidelines.

Facilitates 500M monthly transactions while embedding insurance products.

✅ October 2025: SBI FinTech Solutions Japan released FaaS Marketplace for LINE ecosystem, enabling 400K chat-based banking services compliant with FSA open API standards.

Fintech as a Service Market Recent M&A activities:-

→ In January 2026, Capital One Financial Corp. agreed to acquire Brex Inc., a U.S.-based corporate expense management and business fintech platform, in a **cash and stock transaction valued at approximately USD 5.15 billion. The acquisition is intended to deepen Capital One's technology-driven corporate payments and fintech capabilities and is expected to close in mid-2026, subject to regulatory approvals.

→ In December 2025, Zaggle Prepaid Ocean Services Ltd. acquired Rio.Money, an Indian fintech startup specializing in UPI payments and co-branded consumer credit cards, for a cash consideration of ₹22 crore (approximately USD 2.5 million). The acquisition enables Zaggle to expand into consumer payments and credit-on-UPI offerings, with planned further investment to scale products.

Fintech as a Service Market key Players:-

Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase and among others.

Top 5 Key Players Analysis:-

Stripe, Inc. - Holds the largest share (24.8%) in the FaaS market, led by its developer-first payment APIs and broad adoption in embedded finance globally.

Finastra - Commands about 19.6% share with comprehensive banking and payment software, strong core banking foothold, and global financial institution partnerships.

Backbase - With 14.3% market share, Backbase focuses on digital engagement banking platforms and strong UX for retail and challenger banks.

Rapyd Financial Network Ltd. - Around 11.7% share, driven by its global payments, cross-border APIs, and embedded finance infrastructure spanning 100+ countries.

SAP Fioneer - Holds 9.4% of the market, leveraging SAP-integrated financial services and AI-enhanced compliance tools for large enterprises and banks.

Fintech as a Service Market Top Technological Partnerships (2026 & 2025):-

✅ January 2026: Stripe partnered with Plaid on embedded KYC APIs, enabling 20K platforms to launch compliant digital wallets with real-time income verification for SMB lending.

Processes 2B transactions monthly while cutting fraud 45% through federated machine learning models.

✅ November 2025: Galileo collaborated with NVIDIA on AI-powered credit decisioning, deploying GPU-accelerated risk engines across 10K neobanks serving 50M underbanked users.

Achieves 92% approval accuracy with 2-second latency for $100B annual loan volume.

✅ October 2025: Marqeta teamed with Chainlink for blockchain-anchored card issuing, powering 5K crypto wallets with instant USD conversions compliant with NYDFS BitLicense.

Facilitates $15B cross-border remittances with 99.99% settlement finality.

📌 Buy Now & Unlock 360° Market Intelligence:https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market?prtk

Fintech as a Service Market Market Drivers :-

Consumers and businesses are shifting to digital wallets, real-time payments, and cashless commerce. This surge in digital payment usage is a key catalyst, driving FaaS demand for secure, scalable payment rails.

API-driven FaaS solutions allow companies to embed banking, lending, and payment capabilities in weeks instead of years accelerating go-to-market and enabling flexible, modular financial ecosystems.

Cloud adoption reduces operational costs and enables seamless scalability institutions can expand services like real-time settlements and fraud detection without heavy legacy system investments.

AI and machine learning advances power predictive analytics, real-time fraud detection, personalized financial products, and automated compliance increasing FaaS uptake across financial players.

Companies across retail, travel, and gig economy platforms embed finance (payments, lending, wallets) into core services. This embedded finance trend dramatically expands the use cases for FaaS solutions.

Strict KYC/AML requirements and rising financial crime are pushing firms to adopt automated compliance and reporting tools a strong growth driver for FaaS platforms.

Asia Pacific is poised for fast CAGR acceleration, driven by smartphone penetration, UPI-like real-time systems, and fintech adoption expanding FaaS reach beyond traditional Western markets.

Fintech as a Service Market Regional Insights:-

North America

North America holds the largest share of the global Fintech as a Service market, estimated around 44%, led by the U.S. and Canada with advanced digital finance adoption and strong regulatory support.

The region's dominance is driven by robust fintech infrastructure, widespread embedded finance use, and continuous investment in API and cloud-based financial solutions.

Europe

Europe accounts for approximately 29% of the global market, supported by open banking frameworks (e.g., PSD2) and rising demand for digital banking and compliance solutions.

The UK, Germany, and France lead regional adoption, with established fintech ecosystems and growing collaboration between banks and fintech providers.

Asia Pacific

Asia Pacific represents roughly 35% of the market, often cited as the fastest-growing region due to rapid digitization, mobile payments, and large underbanked populations in China, India, and Southeast Asia.

Growth is propelled by strong government initiatives promoting digital finance and financial inclusion across developing markets.

Market Opportunities & Challenges: Fintech as a Service (FaaS) Market 2026

Opportunities: A "Composable Banking" shift is accelerating adoption as enterprises embed payments, lending, and KYC via APIs; global FaaS revenues are projected to grow at 19% CAGR. Open Banking mandates, real-time payments (RTP), and Banking-as-Code models lower time-to-market for non-banks and vertical SaaS players.

Challenges: Intensifying regulatory scrutiny (data residency, AML, consumer protection) raises compliance costs, while margin pressure grows from hyperscalers and neo-core platforms. Vendor concentration risk and outages demand resilient, multi-cloud architectures and strong SLAs.

Strategic Verdict: Scalable API platforms enabling embedded finance for SMEs, marketplaces, and cross-border commerce-especially payments-plus-lending stacks-will be the primary value creators by 2026.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/fintech-as-a-service-market?prtk

Fintech as a Service Market Market Segmentation

By Type

Banking as a Service (BaaS) (35%): Stripe Treasury powers 15K neobanks with embedded accounts processing $2T deposits annually.

Payments as a Service (30%): Marqeta issues 500M virtual cards monthly for BNPL platforms with 98% approval automation.

Lending as a Service (20%): Galileo enables 10K lenders with AI credit scoring serving 50M SMBs.

Insurance as a Service (10%): Embedded policies generate $150B premiums via API-triggered micro-insurance.

Others (5%): WealthTech, RegTech platforms.

By Deployment

Cloud-Based (75%): AWS/GCP host 90% FaaS infrastructure scaling to 10B daily API calls with 99.99% uptime.

Hybrid (20%): Banks retain core banking on-prem while embedding cloud payment rails.

On-Premises (5%): Legacy institutions maintain compliance-sensitive workloads.

By Technology

API-based Services (60%): Plaid connects 12K institutions with 4B annual data aggregations.

AI & Machine Learning (25%): Fraud detection blocks $50B illicit flows using real-time behavioral analytics.

Blockchain (10%): Smart contract wallets process $20B cross-border remittances.

RPA (5%): Automates 80% KYC workflows cutting onboarding from 7 days to 7 minutes.

By Application

Banks & FIs (30%): 5K banks white-label FaaS for digital challenger brands.

Fintech Startups (25%): 50K startups launch via Galileo/Synctera in

This research report delivers actionable insights, data-driven analysis, and future-ready perspectives that enable informed decision-making, reduce market risks, and uncover growth opportunities across the industry

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service (Faas) Market size is set to reach US$ 1,059.78 billion by 2032, at a strong CAGR of 16.10%. North America leads the market with 44% market share | Market trends, challenges & opportunities. here

News-ID: 4378423 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Commercial Aviation Crew Management Software Market to Reach USD 4.66 Billion by …

Commercial Aviation Crew Management Software Market reached USD 1.82 billion in 2024 and is expected to reach USD 4.66 billion by 2032, growing at a CAGR of 12.2% during the forecast period 2025 to 2032.

The market growth is being driven by increasing airline fleet expansions, growing emphasis on operational efficiency, and stringent regulatory requirements demanding precise crew scheduling and compliance. Crew management software enables commercial airlines to optimize crew rostering,…

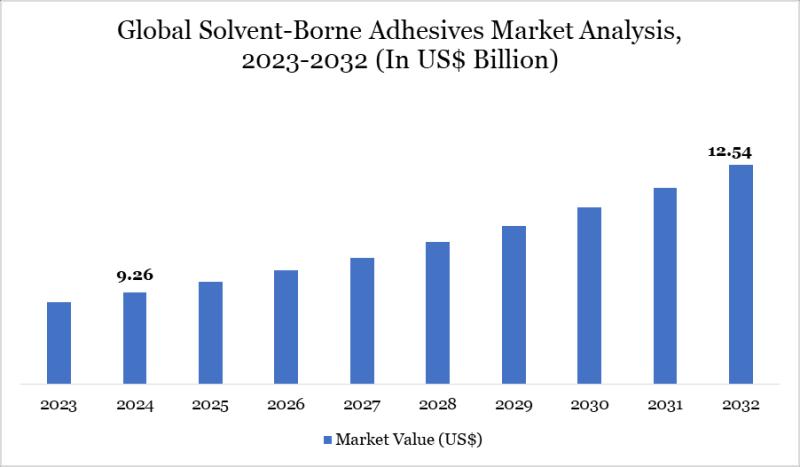

Germany Solvent-Borne Adhesives Market Size, Growth Drivers | Driven by automoti …

As per DataM Intelligence research report, "Germany Solvent-Borne Adhesives Market", the market forms a critical part of the European adhesives landscape. While Europe accounts for 25% of global demand, Germany remains the largest contributor, supported by its strong automotive manufacturing base, advanced construction sector, and high-performance industrial packaging ecosystem.

Download your exclusive sample report today (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/solvent-borne-adhesives-market?prasad

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Solvent…

Immersive Technologies Market to Reach USD 125.8 Billion by 2032 at 18.8% CAGR | …

Immersive Technologies Market reached USD 30.84 billion in 2024 and is expected to reach USD 125.8 billion by 2032, growing at a CAGR of 18.8% during the forecast period 2025 to 2032.

The immersive technologies market encompasses virtual reality (VR), augmented reality (AR), mixed reality (MR), and extended reality (XR) solutions that create interactive digital environments and enhance user engagement across industries. Increasing demand for enhanced user experiences in gaming, entertainment,…

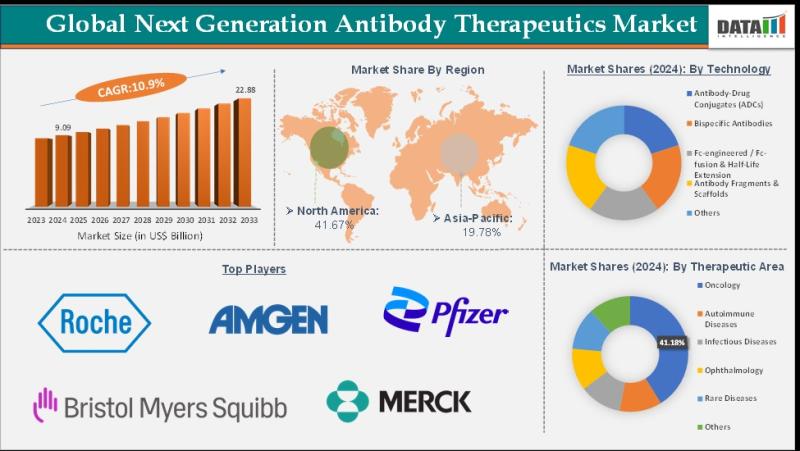

Next-Generation Antibody Therapeutics Market to Reach US$ 22.88 Billion by 2033 …

Next-Generation Antibody Therapeutics Market reached US$ 9.09 billion in 2024, rising from US$ 8.28 billion in 2023, and is expected to reach US$ 22.88 billion by 2033, growing at a CAGR of 10.9% during the forecast period 2025 to 2033.

Market growth is being driven by rapid advancements in antibody engineering technologies, including bispecific antibodies, antibody drug conjugates (ADCs), and Fc engineered monoclonal antibodies that deliver improved targeting precision, enhanced efficacy,…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…