Press release

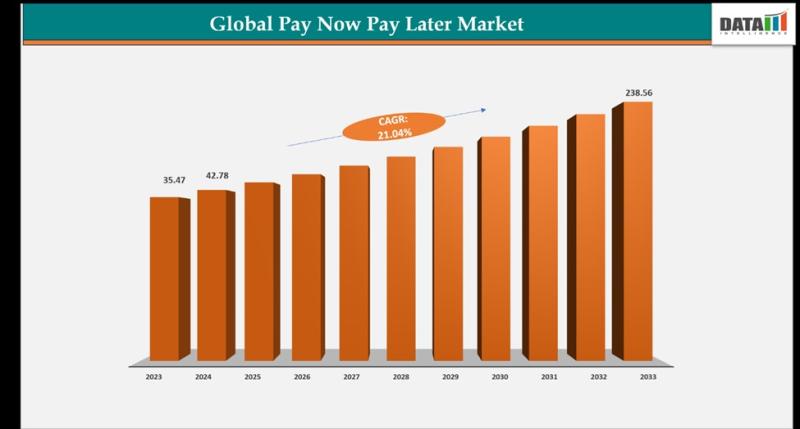

Buy Now Pay Later (BNPL) Market to Reach US$ 238.56 Billion by 2033 at 21.04% CAGR | North America Leads with 35% Share | Key Players Affirm, Klarna, PayPal

The Buy Now Pay Later (BNPL) market reached US$ 35.47 billion in 2023, increased to US$ 42.78 billion in 2024, and is expected to reach US$ 238.56 billion by 2033, growing at a CAGR of 21.04% during the forecast period 2025-2033. The market is experiencing strong momentum driven by rising consumer preference for flexible and interest-free payment options, rapid digitalization of commerce, and high adoption among younger demographics. The expansion of e-commerce platforms, growing smartphone penetration, and continuous fintech innovation are accelerating BNPL adoption across sectors such as retail, travel, healthcare, and lifestyle services.Merchant adoption of BNPL solutions is further fueling market growth, as these offerings help improve conversion rates, increase average order values, and enhance customer loyalty. Expanding financial inclusion in emerging economies, along with strategic partnerships between retailers and fintech providers, is creating new growth opportunities. In parallel, advancements in payment security, AI-driven credit assessment, and risk management technologies are strengthening consumer trust, improving user experience, and supporting regulatory compliance, positioning the BNPL market for sustained long-term expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/buy-now-pay-later-market?sai-v

The Buy Now Pay Later (BNPL) market refers to the sector of financial services that allows consumers to purchase goods immediately and pay for them in installments over time, often with low or no interest.

Key Developments

✅ January 2026: In Japan, the Buy Now Pay Later (BNPL) market witnessed accelerated adoption across e-commerce and physical retail, driven by deeper integration with mobile wallets and QR-based checkout systems. Clear regulatory guidance emphasized transparent disclosures and responsible lending, improving consumer trust and merchant participation.

✅ January 2026: Across the United States and Canada, the BNPL market continued strong growth as payment platforms expanded merchant partnerships and consumer financing options, supporting higher adoption for both online and in-store purchases while strengthening risk management and fraud prevention capabilities.

✅ January 2026: Throughout Europe, increased regulatory focus on consumer protection and credit transparency reshaped BNPL offerings, with providers adjusting underwriting models and repayment structures while expanding usage across travel, healthcare, and essential service payments.

✅ December 2025: Across Asia-Pacific markets outside Japan, rapid e-commerce growth and rising digital wallet penetration accelerated BNPL adoption, with consumers favoring seamless, mobile-first installment payment options across multiple retail categories.

✅ December 2025: Globally, integration of AI-driven credit assessment, personalized financing offers, and real-time payment processing improved approval accuracy and reduced default risks, enabling wider merchant adoption and more resilient BNPL ecosystems.

✅ November 2025: In Latin America, BNPL adoption increased among underbanked and younger consumer segments, supporting financial inclusion as flexible payment options became embedded within digital commerce and social shopping platforms.

✅ October 2025: Worldwide, expansion of BNPL into new verticals such as healthcare services, education, and travel broadened market reach, while tighter integration with point-of-sale systems improved checkout conversion rates and customer retention.

Mergers & Acquisitions

✅ January 2026: A global payment platform acquired a BNPL infrastructure provider to expand financing solutions and accelerate merchant onboarding across digital commerce ecosystems.

✅ December 2025: A regional fintech company acquired an AI-based credit risk analytics firm to strengthen BNPL underwriting accuracy, fraud detection, and consumer segmentation capabilities.

✅ November 2025: A digital wallet and super-app provider acquired a BNPL specialist to integrate flexible installment payments directly into its mobile finance ecosystem and enhance overall user experience.

Key Players

Affirm, Inc. | Klarna Inc. | Splitit USA Inc. | Sezzle | Perpay Inc. | Zip Co., Ltd. | Afterpay | Openpay | PayPal Holdings, Inc. | LatitudePay Financial Services

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

- Rapid growth in e-commerce and digital payments driving widespread adoption of Buy Now Pay Later (BNPL) solutions across retail, travel, and service sectors.

- Increasing consumer preference for flexible payment options, interest-free installments, and better budgeting tools supporting BNPL use among millennials and Gen Z shoppers.

- Expansion of smartphone penetration, digital wallets, and online checkout platforms enabling seamless integration of BNPL at point-of-sale (POS) and online carts.

- Retailers' focus on enhancing customer experience, increasing average order values (AOV), and improving conversion rates through embedded BNPL offerings.

- Advancements in fintech platforms, real-time credit decisioning, and API-driven BNPL integrations improving accessibility, risk management, and scalability.

Industry Developments

- Integration of BNPL features into digital wallets, buy-now-pay-later apps, and point-of-sale fintech ecosystems to offer unified payment experiences.

- Strategic partnerships between BNPL providers, major e-commerce marketplaces, payment processors, and banks to expand merchant coverage and customer reach.

- Introduction of data-driven credit assessment tools, AI-based underwriting, and fraud prevention systems to improve risk profiling and reduce defaults.

- Growth of "interest-free" and flexible repayment models along with subscription-based BNPL solutions to enhance consumer loyalty and retention.

- Emergence of regulation-ready BNPL frameworks and compliance models to address transparency, consumer protection, and responsible lending standards.

Regional Insights

North America - 35% share: "Driven by high digital commerce penetration, strong fintech adoption, widespread retail partnerships, and demand for flexible payment options."

Europe - 28% share: "Supported by growing e-commerce demand, increasing acceptance of alternative payment methods, and expanding BNPL provider ecosystem across major markets."

Asia Pacific - 27% share: "Fueled by rapid digital payments growth, expanding mobile commerce, rising middle-class consumer base, and strong fintech innovation."

Latin America - 6% share: "Driven by expanding digital commerce infrastructure, increasing financial inclusion initiatives, and rising interest in installment payment solutions."

Middle East & Africa - 4% share: "Supported by developing fintech ecosystems, growing digital payment adoption, and increasing consumer awareness of BNPL options."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/buy-now-pay-later-market?sai-v

Key Segments

By Channel

Online channels dominate the market, driven by rapid growth in e-commerce, mobile payments, and digital wallets. Point-of-sale (POS) transactions continue to hold a significant share, supported by widespread deployment of contactless terminals and in-store digital payment acceptance.

By Enterprise Size

Large enterprises account for a major share due to high transaction volumes, advanced payment infrastructure, and early adoption of integrated payment solutions. Small and medium-sized enterprises (SMEs) are the fastest-growing segment, supported by affordable POS systems, mobile payment platforms, and government initiatives promoting cashless transactions.

By End-User

BFSI leads adoption as digital payments are central to banking, lending, and financial services operations. Retail and consumer electronics sectors drive strong demand through omnichannel sales and high-frequency transactions. Fashion and lifestyle brands leverage digital payments to enhance customer experience and loyalty programs. Healthcare adoption is increasing with digital billing and insurance integration. Media and entertainment use digital payments for subscriptions and in-app purchases, while other end-users include hospitality, transportation, and education.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later (BNPL) Market to Reach US$ 238.56 Billion by 2033 at 21.04% CAGR | North America Leads with 35% Share | Key Players Affirm, Klarna, PayPal here

News-ID: 4376865 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Treatment for alcohol disorder (AUD) market size to reach US$ 2.45 billion by 20 …

Alcohol Use Disorder Treatment Market size was over USD 1.35 billion in 2025 and is poised to exceed USD 2.45 billion by 2035, growing at over 6.0% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alcohol use disorder treatment is estimated at USD 1.42 billion.

Alcohol Use Disorder Treatment market growth is driven by rising alcohol dependence, growing mental health awareness, government funding,…

US Travel eSIM Market Opportunities Emerging from Smart Travel and Mobile-First …

DataM Intelligence has published a new research report on "Travel eSIM Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

United States 3D Printing High Performance Plastic Market Landscape for Engineer …

DataM Intelligence has published a new research report on "3D Printing High Performance Plastic Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of…

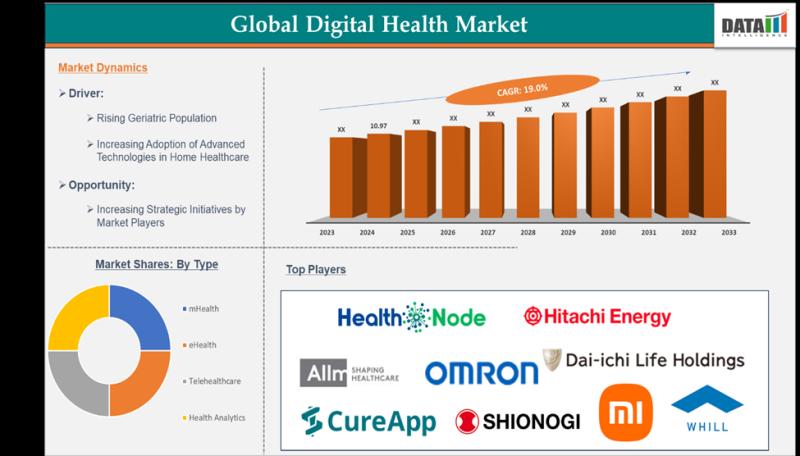

Japan digital health market size is set to reach US$ 51.42 Billion by 2033, at a …

The Japan digital health market reached US$ 10.96 billion in 2024 and is expected to reach US$ 51.42 Billion by 2033, growing at a CAGR of 19.0% during the forecast period of 2025-2033.

Japan's digital health market is growing due to aging population demand, strong government support for healthcare innovation, rising chronic diseases, widespread tech adoption, and investment in AI-powered remote care and health data integration.

Get a Free Sample PDF Of…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…