Press release

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.The regulatory framework demands sophisticated technical implementations that go far beyond simple payment processing. Affordability assessments, real-time creditworthiness evaluations, and enhanced dispute resolution mechanisms will require completely new API architectures and data processing capabilities. For technology professionals working in ecommerce, fintech, or payment processing, understanding these changes isn't just about compliance-it's about anticipating the next generation of payment infrastructure that will define online commerce.

Currently, BNPL integrations operate with remarkable simplicity from a technical perspective. Most implementations involve straightforward API calls that check basic eligibility criteria before approving transactions in milliseconds. This frictionless experience has been central to BNPL's success, with 42% of UK adults using these services in the past year. However, the new regulations will fundamentally alter this technical landscape, requiring systems that can perform comprehensive affordability assessments without destroying the user experience that made BNPL popular.

The Technical Complexity of Affordability Checks

The most significant technical challenge lies in implementing real-time affordability assessments that satisfy regulatory requirements whilst maintaining the speed and simplicity that consumers expect. Traditional credit checks often take several minutes and require extensive personal information, but BNPL's appeal stems from near-instantaneous approval processes that require minimal user input. Developing systems that can perform meaningful affordability assessments within the few seconds available at checkout represents a significant engineering challenge.

Payment platforms will need to integrate with multiple data sources simultaneously, including open banking APIs, credit reference agencies, and internal transaction histories. The technical architecture must handle high-throughput scenarios where thousands of affordability checks occur simultaneously during peak shopping periods. This requires robust caching strategies, efficient database queries, and intelligent risk assessment algorithms that can process complex financial data in real-time without causing checkout abandonment.

Machine learning models will become essential components of BNPL systems, analysing spending patterns, account balances, and historical payment behaviour to make rapid creditworthiness decisions. However, these models must operate within strict regulatory parameters, ensuring decisions are explainable and auditable. The challenge for development teams is creating algorithms sophisticated enough to assess affordability accurately whilst remaining transparent enough to satisfy regulatory scrutiny.

"The regulatory changes will require significant investment in new technology infrastructure," explains Sam Foster, Head of Marketing & Communications at Evlo https://www.evlo.co.uk/, an established UK consumer lender. "Traditional lenders have spent years developing sophisticated risk assessment systems, and BNPL providers will need to rapidly implement similar capabilities whilst maintaining the seamless user experience that drove their initial adoption."

Ecommerce Platform Integration Challenges

For ecommerce platforms and retailers, the regulatory changes create complex integration challenges that extend far beyond updating payment processing code. The requirement for enhanced dispute resolution and faster refund processes means that order management systems, customer service platforms, and financial reporting tools must all be updated to handle new data requirements and process flows.

Retailers will need to implement new webhooks and API endpoints to handle regulatory notifications, dispute escalations, and compliance reporting. The joint liability provisions mean that ecommerce platforms must maintain detailed transaction logs and customer interaction records that can be accessed rapidly if disputes arise. This data architecture must be designed with privacy regulations in mind, ensuring that sensitive financial information is handled securely whilst remaining accessible for regulatory purposes.

The FCA authorisation requirement adds another layer of technical complexity, as retailers may need to implement new authentication systems and compliance monitoring tools. Payment gateway providers will likely develop new SDKs and APIs that handle regulatory compliance automatically, but retailers using custom payment implementations will face significant development overhead to ensure their systems meet regulatory standards.

Mobile commerce presents particular challenges, as affordability assessments must operate efficiently on devices with limited processing power and potentially unreliable internet connections. Progressive web apps and native mobile applications will need to implement sophisticated caching and offline capabilities to ensure that BNPL options remain available even when network connectivity is poor. The user interface design must also balance regulatory requirements for clear information disclosure with the streamlined checkout flows that mobile users expect.

The broader implications for the UK's fintech ecosystem are substantial. Payment orchestration platforms, checkout optimisation tools, and ecommerce analytics services will all need significant updates to handle the new regulatory environment. API documentation, developer resources, and integration guides must be completely rewritten to reflect the new compliance requirements, whilst maintaining backwards compatibility for existing implementations.

As these regulations reshape the technical landscape of online payments, successful implementation will require close collaboration between technology teams, compliance specialists, and user experience designers. The companies that can successfully navigate this transition whilst maintaining excellent customer experiences will likely emerge as leaders in the next phase of ecommerce evolution. For technology professionals, understanding these regulatory changes represents an opportunity to shape the future of payment processing and create more responsible, sustainable financial technology solutions.

The transformation ahead is substantial, but it also represents an opportunity to build more robust, secure, and user-friendly payment systems that can serve as a foundation for the next decade of digital commerce innovation.

P.O Bagarji Town Bagarji Village Ghumra Thesil New Sukkur District Sukkur Province Sindh Pakistan 65200.

Wiki Blogs News always keeps careful online users to provide purposeful information and to keep belief to provide solution based information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure here

News-ID: 4096709 • Views: …

More Releases from Wikiblogsnews

Build Your First Health App Fast: Simple Steps for Beginners

Building your first medical tool doesn't have to take years. According to experts at https://topflightapps.com/healthcare/healthcare-app-developer/, the right approach can significantly shorten the path to market. In 2026, healthcare mobile application development is more accessible than ever before. Many beginners think they need a massive team and millions in funding to start, but that isn't true. You can quickly launch a Minimum Viable Product by focusing on core utility rather than…

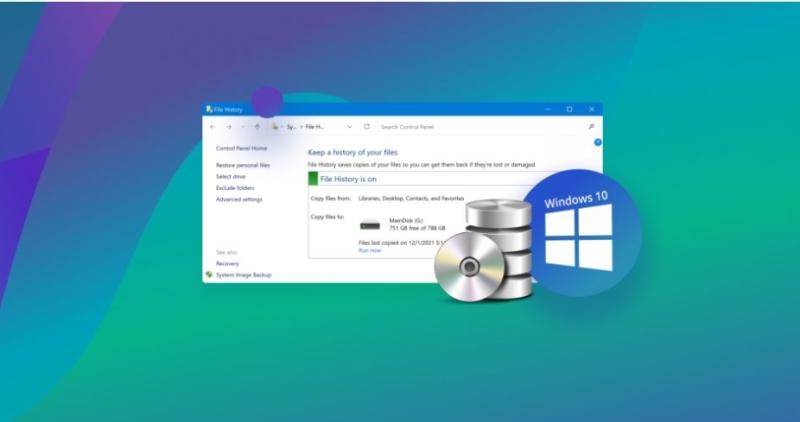

Stop Making System Image Backups That Might Fail. Here's What to Do Instead

You followed the instructions. You went to Control Panel, opened "Backup and Restore (Windows 7)," clicked Create system image Windows 10, and waited. You felt responsible, like you were doing the right thing. But then a quiet doubt appeared: "If my hard drive dies tomorrow will this actually work?" That doubt isn't paranoia. It's intuition. And it's correct. This guide isn't here to teach you how to use Windows Backup.…

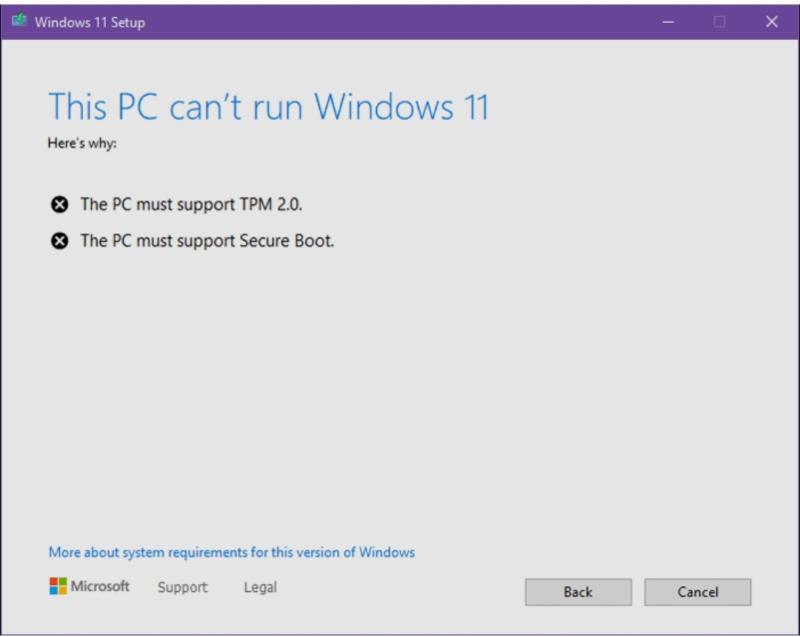

Windows 11 Says "This PC Can't Run Windows 11"? It Might Just Be Your Partition …

You downloaded the PC Health Check app and clicked "Check now," hoping for good news. Instead, you got a message: "This PC can't run Windows 11." That sinking feeling hit instantly. Your computer is only a few years old. It runs fine. Why is Windows saying it's obsolete? Most users believe that they are only left with two options to either purchase a new PC or remain on windows 10…

The E-Bike Market Enters a More Practical Phase

For much of its early growth, the e-bike market was fueled by possibility. New technology promised longer rides, higher speeds, and a redefinition of what cycling could be. That sense of novelty played an important role in expanding awareness and attracting early adopters.

Today, the market feels different.

As e-bikes become more common in everyday settings, the conversation around them is shifting. The focus is moving away from what e-bikes can do…

More Releases for BNPL

Abzer Expands UAE Digital Payment Capabilities Through BNPL Collaboration with T …

Abzer, an enterprise technology company delivering digital payment, invoicing, and revenue automation platforms, has announced a strategic collaboration with Tamara to introduce Buy Now, Pay Later (BNPL) capabilities across its payment ecosystem in the United Arab Emirates.

The collaboration is designed to support enterprises and small-to-medium businesses seeking greater flexibility within their customer payment journeys. By integrating Tamara's BNPL functionality into Abzer's Payment Orchestration and Invoicing Suite, businesses can offer installment-based…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in the UAE is Expec …

The buy now, pay later (BNPL) trend is picking pace in the UAE as more financial technology platforms align with retailers to make shopping convenient and more accessible in these cost-conscious times. Apart from the surge in e-commerce shopping, the BNPL movement has become the most significant retail trend that the local retail sector has witnessed since the onset of the global pandemic. According to PayNXT360’s Q2 2021 BNPL Survey,…