Press release

Cement Manufacturing Plant DPR - 2026: CapEx/OpEx Analysis with Profitability Forecast

Cement Manufacturing Plant Project Report 2026: A Comprehensive Investment Guide:The global cement manufacturing industry stands as one of the largest and most indispensable segments of heavy industry, underpinning virtually every facet of physical infrastructure across the planet. Driven by rapid urbanisation, record-scale government infrastructure programmes, housing demand in emerging economies, and the continuous need to repair and upgrade ageing built environments, the cement sector is experiencing sustained volume growth coupled with an intensifying focus on product innovation and carbon-reduction technologies. At the heart of this transformation lies cement-the binding agent that gives concrete its strength and durability.

As nations commit to ambitious infrastructure targets while simultaneously pursuing decarbonisation roadmaps, establishing a cement manufacturing plant presents a strategically compelling business opportunity for investors and industrialists seeking to capitalise on a large, structurally growing, and essential market.

Cement Plant Capacity and Production Scale:

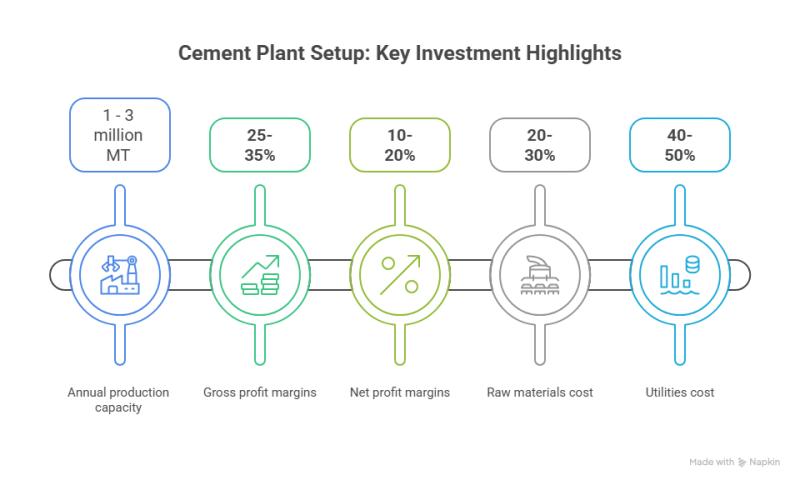

The proposed cement manufacturing facility is designed with an annual production capacity ranging between 1-3 million MT, enabling economies of scale while maintaining operational flexibility. This capacity range positions the plant to supply a broad spectrum of end-use segments-from residential and commercial construction, national highway and bridge projects, and dam and hydropower structures to precast concrete manufacturing, ready-mix concrete operations, and large-scale industrial infrastructure-ensuring steady demand and consistent revenue streams across multiple high-volume construction verticals.

See the Data First: Download Your Sample Report: https://www.imarcgroup.com/cement-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis:

The cement manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 25-35%

• Net Profit Margins: 10-20%

These margins are supported by non-discretionary demand tied to construction activity across residential, commercial, and infrastructure sectors, the critical and non-substitutable nature of cement in concrete production, and value-added specialty cement lines such as sulphate-resistant, rapid-setting, and low-carbon blended cements. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established building-materials or mining companies looking to diversify into a high-volume, strategically important segment of the industrial economy.

Operating Cost Structure:

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a cement manufacturing plant is primarily driven by:

• Raw Materials: 20-30% of total OpEx

• Utilities: 40-50% of OpEx

Other Expenses: Including labour, packaging, logistics, maintenance, depreciation, and taxes

Cement manufacturing is one of the most energy-intensive industrial processes in the world, which is why utilities constitute the single largest component of operating costs. The rotary kiln must sustain temperatures exceeding 1,450°C to convert raw meal into clinker, demanding enormous volumes of thermal and electrical energy. Fuel mix optimisation-including the increasing substitution of alternative fuels such as waste tyres, biomass, municipal solid waste, and industrial by-products-is a critical lever for managing this cost.

Raw materials, principally limestone, clay, and minor corrective additives such as iron ore and silica sand, form the second-largest cost category. Securing long-term quarry-rights or supply contracts for high-grade limestone helps stabilise input costs and ensures consistent raw-meal chemistry throughout the production cycle.

Capital Investment Requirements:

Setting up a cement manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to limestone and clay quarries is paramount, as raw-material transport costs escalate sharply with distance. Proximity to major construction demand centres and arterial road or rail networks minimises finished-product distribution costs. The site must feature sufficient land area to accommodate the kiln complex, raw-material stockyards, clinker storage, and buffer zones mandated by environmental and safety regulations. Robust water supply, reliable power connectivity, and compliance with local zoning, mining, and environmental clearance requirements must all be ensured.

Machinery and Equipment: The largest and most technically demanding portion of capital expenditure (CapEx) covers the heavy-duty processing equipment that defines a cement plant. Key machinery includes:

• Crushers and grinding mills for reducing quarried limestone and clay to fine powder; typically jaw crushers or gyratory crushers for primary reduction followed by hammer mills or impact crushers for secondary sizing.

• Raw-meal preparation and blending systems including ball mills or vertical roller mills for grinding raw materials to the precise fineness and chemical composition required for consistent clinker formation.

• Rotary kiln and associated firing system the core of the plant; a massive rotating cylinder lined with refractory bricks that sustains temperatures above 1,450°C to convert raw meal into clinker through a series of chemical reactions.

• Clinker cooler typically a grate cooler or planetary cooler that rapidly cools the red-hot clinker exiting the kiln to preserve its mineralogical composition and recover waste heat for reuse in the process.

• Cement grinding and finish mills ball mills or vertical roller mills that grind clinker and gypsum (and supplementary cementitious materials for blended cements) to the final cement fineness specification.

• Preheater and pre-calciner tower a multi-stage cyclone system that preheats and partially calcines raw meal using kiln exhaust gases, significantly reducing fuel consumption and improving thermal efficiency.

• Dust collectors and emission-control systems baghouse filters, electrostatic precipitators, and selective catalytic reduction (SCR) units for capturing particulate matter and reducing NOx emissions to regulatory limits.

• Bulk conveying and storage systems belt conveyors, bucket elevators, and silo banks for moving raw materials, clinker, and finished cement through the plant and into dispatch.

• Packing and dispatch lines automated bag-filling machines, palletisers, and stretch-wrapping equipment for bagged cement, alongside bulk-loading facilities for tanker and rail dispatch.

• Quality-control laboratory and online analysers for continuous monitoring of raw-meal composition, clinker mineralogy, and final cement physical and chemical properties to ISO and national standards.

Civil Works: Massive reinforced-concrete and steel structures including the kiln house, preheater tower (often exceeding 80 metres in height), crusher buildings, raw-mill and cement-mill houses, clinker and raw-material stockyards, silos, control rooms, and administrative facilities. The layout must be engineered for efficient material flow from quarry face through to dispatch, with clearly demarcated zones for quarry operations, crushing, raw-meal preparation, kiln and clinker cooling, cement grinding, storage, packing, and bulk loading.

Other Capital Costs: Quarry development and mining-equipment procurement, pre-operative expenses, heavy machinery installation and commissioning, environmental and mining clearances, BIS and ISO certifications, initial working capital requirements, and contingency provisions for unforeseen geological or regulatory circumstances during plant establishment.

Major Applications and Market Segments:

Cement products find extensive applications across diverse market segments, demonstrating their indispensable role in the built environment:

• Residential Construction: Ordinary Portland cement (OPC) and blended cements are the primary binders used in the concrete foundations, walls, columns, slabs, and roofing systems of housing projects ranging from individual dwellings to large-scale affordable-housing programmes.

• Commercial and Institutional Buildings: High-strength and rapid-setting cements are critical in the structural frameworks of office towers, shopping malls, hospitals, schools, and government buildings where durability, speed of construction, and fire resistance are paramount.

• Infrastructure and Transport: Sulphate-resistant and ultra-high performance cements are employed in highway pavements, bridges, tunnels, metro structures, and airport runways where long-term durability under heavy traffic loads and adverse environmental exposure is essential.

• Dams and Hydropower Structures: Low-heat and expansive cements are specifically formulated for massive concrete pours in gravity dams, arch dams, and hydropower-plant foundations, where controlling heat of hydration and minimising cracking are critical engineering requirements.

• Precast Concrete Manufacturing: Rapid-hardening and sulphate-resistant cement grades support the production of precast beams, columns, pipes, pavers, and prefabricated housing components where early strength gain and dimensional precision are essential.

• Ready-Mix Concrete Operations: Bulk cement supply to batching plants is one of the largest single-customer segments, with ready-mix producers consuming cement continuously across residential, commercial, and infrastructure project sites.

• Industrial and Specialty Applications: Oil-well cements, refractory cements, waterproof cements, and geopolymer-blended cements serve niche but high-value markets in petroleum well casing, industrial flooring, water-retaining structures, and sustainable construction.

End-use sectors include residential, commercial, and institutional construction, transport infrastructure, dams and hydropower, precast manufacturing, ready-mix concrete, and industrial and specialty applications, all of which contribute to sustained and structurally robust market demand.

Talk to Our Analyst - Get a Tailored Investment Plan: https://www.imarcgroup.com/request?type=report&id=7287&flag=C

Why Invest in Cement Manufacturing?

Several compelling factors make cement manufacturing an attractive investment opportunity:

• Massive and Non-Discretionary Demand Base: Cement is consumed in virtually every construction activity worldwide. Unlike many industrial commodities, demand is driven by population growth, urbanisation, and government infrastructure spending-all of which exhibit persistent, long-duration secular growth trends.

• Record Infrastructure Investment Cycles: Governments across Asia, Africa, the Middle East, and the Americas are deploying unprecedented capital into highways, metro networks, smart cities, affordable housing, and water infrastructure-all of which are intensely cement-consuming project categories.

• Urbanisation Megatrend: The world's population is rapidly concentrating in cities. By 2050, an additional 2.5 billion people are projected to live in urban areas, requiring enormous volumes of new housing, commercial space, and urban infrastructure-all cement-intensive.

• Import Substitution and Local-Content Mandates: Many developing nations are actively incentivising domestic cement capacity through local-content policies, preferential government procurement rules, and import duties, creating favourable conditions for new plant entrants.

• Alternative-Fuel and Waste-to-Energy Synergies: The kiln's ability to co-process waste streams-including municipal solid waste, tyre-derived fuel, biomass, and industrial residues-creates a revenue-generating waste-processing capability that simultaneously reduces fuel costs and supports circular-economy objectives.

• Low-Carbon and Blended Cement Innovation: Rising carbon-pricing regimes and sustainability mandates are accelerating the shift toward slag cement, fly-ash blended cements, and novel supplementary cementitious materials (SCMs). Plants capable of producing these grades command premium pricing and secure forward-looking procurement contracts from green-building developers.

• Clinker and Cement Export Potential: Geographically well-positioned plants can serve not only domestic markets but also export clinker or finished cement to neighbouring countries with constrained domestic capacity, diversifying revenue and smoothing demand cycles.

• Waste-Heat Recovery and Power Generation: Cement kilns generate substantial quantities of high-temperature exhaust gas. Waste-heat recovery power plants (WHRPPs) can convert this heat into on-site electricity, reducing grid dependency by 25-30% and meaningfully lowering operating costs over the plant's lifetime.

Manufacturing Process Excellence:

The cement manufacturing process involves several precision-controlled stages:

• Quarrying and Crushing: Limestone and clay are extracted from open-pit quarries and crushed in stages to reduce lump ore to a manageable size for subsequent grinding.

• Raw-Meal Preparation: Crushed limestone, clay, and minor corrective additives (iron ore, silica sand) are ground together in a raw mill to produce a fine, precisely blended powder called raw meal, with composition tightly controlled by online X-ray fluorescence analysers.

• Raw-Meal Storage and Homogenisation: Raw meal is stored in blending silos and continuously homogenised to achieve uniform chemical composition before entering the kiln system.

• Preheating and Pre-Calcination: Raw meal descends through a multi-stage cyclone preheater tower, progressively heated by rising kiln exhaust gases; a pre-calciner burner decomposes the majority of calcium carbonate before the meal enters the kiln, reducing fuel demand.

• Clinker Formation in the Rotary Kiln: Pre-heated and pre-calcined meal enters the rotating kiln and travels through successively hotter zones. At temperatures exceeding 1,450°C in the burning zone, complex calcium silicate and aluminate minerals form, producing dense clinker nodules.

• Clinker Cooling: Red-hot clinker (around 1,400°C) is rapidly cooled in a grate cooler using forced-air fans, preserving the desired mineralogy and recovering thermal energy that is redirected to the preheater or power-generation systems.

• Clinker Storage: Cooled clinker is conveyed to covered stockyards or silos for storage, allowing further cooling and providing operational flexibility for downstream grinding.

• Cement Grinding: Clinker is ground with gypsum (and supplementary cementitious materials for blended cements) in a finish mill to the specified particle-size distribution and specific-surface area, converting clinker into cement.

• Quality Testing: Finished cement is sampled continuously and tested for setting time, strength development at 3, 7, and 28 days, fineness, and chemical composition in accordance with applicable national and international standards.

• Packing and Dispatch: Cement is loaded into bulk silos for tanker or rail dispatch, or filled into standardised bags on automated packing lines for transport to dealers and construction sites.

Industry Leadership:

The global cement industry is led by large, diversified building-materials conglomerates with extensive production footprints, deep distribution networks, and strong research and development programmes. Key industry players include:

• CEMEX S.A.B. de C.V.

• HeidelbergCement

• InterCement Participações S.A.

• Holcim Ltd.

• CRH plc

• The Siam Cement Group

• Titan Cement Company S.A.

• UltraTech Cement Limited

Conclusion:

The cement manufacturing sector presents a strategically positioned investment opportunity at the intersection of global urbanisation, record-scale infrastructure development, and the fundamental need to build and maintain the physical foundations of modern economies.

With favourable profit margins ranging from 25-35% gross profit and 10-20% net profit, powerful market drivers including non-discretionary construction demand, massive government infrastructure programmes, rapid urbanisation across emerging markets, import-substitution incentives, and the growing imperative to produce lower-carbon cement products, establishing a cement manufacturing plant offers significant potential for long-term business success and sustainable returns.

The combination of cement's indispensable role in every built environment, diversified end-use applications, waste-to-energy and heat-recovery synergies, and the ability to produce a full range of specialty cement grades creates an attractive value proposition for serious building-materials investors committed to quality manufacturing and operational excellence.

How IMARC Can Help?

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cement Manufacturing Plant DPR - 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4375160 • Views: …

More Releases from IMARC Group

Latin America Online Grocery Market Size, Share & Growth Projections 2025-2033: …

Market Overview

The Latin America online grocery market was valued at USD 3.8 Billion in 2024 and is projected to reach USD 10.1 Billion by 2033, growing at a CAGR of 10.95% during the forecast period from 2025 to 2033. The growth is driven by increasing internet penetration, changing consumer lifestyles, urbanization, competitive pricing, the impact of the COVID-19 pandemic, and expanding logistics infrastructure. Online grocery shopping offers convenience and contactless…

The State of Europe Fintech Market: Industry Dynamics and Key Performance Indica …

Market Overview

The Europe fintech market size was valued at USD 113.42 Billion in 2025 and is projected to reach USD 461.57 Billion by 2034. It is expected to grow at a compound annual growth rate (CAGR) of 16.88% during the forecast period from 2026 to 2034. This growth is driven by increased adoption of digital technology, government support for fintech growth, and consumer acceptance of innovative financial services. The market…

Coconut Shell Powder Manufacturing Plant Setup - 2026, Business Plan, Investment …

The global push toward sustainable manufacturing, circular economy principles, and eco-friendly industrial materials is rapidly reshaping how industries source raw materials and develop value-added products. At the forefront of this green transformation stands coconut shell powder-a finely milled, renewable material derived from dried coconut shells, a by-product of the coconut processing industry that would otherwise constitute agricultural waste. Renowned for its exceptional hardness, low moisture content, and high carbon composition,…

Automotive Adaptive Front Lighting System Market to Grow at a CAGR of 7.16% duri …

Market Overview

The global Automotive adaptive front lighting system market size reached USD 2.4 Billion in 2025., with expectations to grow to USD 4.5 Billion by 2034 at a CAGR of 7.16% during 2026-2034. This increase is mainly attributed to the demand for better visibility during nighttime driving, supportive government regulations, and technological advancements such as LED and laser lighting.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Market Key Takeaways

• Current Market…

More Releases for Cement

Cement Clinker And Cement Market Global Outlook 2020-2026: UltraTech Cement, Ssa …

The report titled “Cement Clinker And Cement Market” has recently added by MarketInsightsReports to get a stronger and effective business outlook. It provides an in-depth analysis of different attributes of industries such as trends, policies, and clients operating in several regions. The qualitative and quantitative analysis techniques have been used by analysts to provide accurate and applicable data to the readers, business owners and industry experts.

Click the link to get…

2019 Concrete and Cement Market | By Key Competitors: Anhui Conch Cement, CNBM, …

Concrete and Cement Market report begins from overview of Industry Chain structure, and describes industry environment, then analyses market size and forecast to 2024 by product, region and application. In addition, this 78 pages of report introduces market competition situation among the vendors and company profile, besides, market price analysis and value chain features are covered in this report.

Click here to get sample report copy @

https://www.reporthive.com/enquiry.php?id=1576978&req_type=smpl&utm_source=SN

Company Coverage (Sales Revenue,…

Cement Market Outlook to 2023 - Shanshui Cement, Hongshi Group, Taiwan Cement, T …

The Global Cement Market report is a proficient and deep dive study on the Cement current state also focuses on the major drivers, Cement market strategies and impressive growth of the key players. Worldwide Cement Industry also offers granular study of the dynamics, revenue, Cement segmentation, share forecasts and allows you to take better business decision. The report serves vital statistics on the Cement market stature of the Cement leading…

Cement Market Outlook to 2023 - Shanshui Cement, Hongshi Group, Taiwan Cement, T …

The Global Cement Market report is a proficient and deep dive study on the Cement current state also focuses on the major drivers, Cement market strategies and impressive growth of the key players. Worldwide Cement Industry also offers granular study of the dynamics, revenue, Cement segmentation, share forecasts and allows you to take better business decision. The report serves vital statistics on the Cement market stature of the Cement leading…

Cement Market Global Forecast 2018| Studied By CNBM, Hongshi Group, Shanshui Cem …

UpMarketResearch published an exclusive report on “Cement market” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 113 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability. This report focuses on the Cement market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report…

Cement Market 2023 by Top Companies like: CNBM, Anhui Conch Cement, Tangshan Jid …

In this report, RRI Information covers the present scenario (with the base year being 2017) and the growth prospects of global Cement market for 2018-2023.

Cement is a fine mineral powder manufactured with very precise processes. Mixed with water, this powder transforms into a paste that binds and hardens when submerged in water. Because the composition and fineness of the powder may vary, cement has different properties depending upon its makeup.

Cements…