Press release

Instant Coffee Powder Manufacturing Plant Cost 2026: Raw Materials Requirement and Profit Margin

The global instant coffee powder manufacturing industry stands as a dynamic component of modern beverage production systems worldwide, positioned at the intersection of convenience food trends, evolving consumer lifestyles, and coffee culture expansion. As a soluble coffee product created by dehydrating brewed coffee extract into powder or granule form, instant coffee represents a technological innovation delivering rapid preparation, extended shelf life, and consistent quality-transforming coffee consumption patterns across diverse demographics and geographies. This comprehensive guide provides an authoritative exploration of the technical, financial, and strategic dimensions of establishing an instant coffee powder manufacturing plant, leveraging current market intelligence and industry insights to support informed investment decision-making in this strategically positioned and rapidly growing food processing sector.Market Overview and Growth Potential

The instant coffee powder manufacturing sector is experiencing robust and sustained growth driven by powerful, interconnected market forces that reflect fundamental transformations in consumer lifestyles, urbanization patterns, retail infrastructure development, and coffee consumption democratization. The industry's expansion is propelled by several critical factors:

• Changing consumer lifestyles favoring convenient, ready-to-consume beverages

• Rising demand for quick preparation coffee solutions compatible with busy schedules

• Rapid urbanization creating time-pressed consumer segments

• Expanding café culture introducing coffee consumption in traditionally tea-drinking markets

• Increasing penetration of organized retail and e-commerce channels improving product accessibility

• Growing working population seeking convenient office and home beverage options

The global instant coffee powder market was valued at USD 15.36 Billion in 2025, establishing a substantial foundation reflecting the product's widespread adoption across household, foodservice, and industrial applications.

According to comprehensive market analysis, the industry is projected to reach USD 22.83 Billion by 2034, exhibiting a CAGR of 4.5% during 2026-2034. This solid growth trajectory significantly outpaces traditional ground coffee markets, reflecting instant coffee's expanding penetration across emerging markets and evolving consumer preferences toward convenience-oriented products.

The market expansion is fundamentally driven by profound lifestyle transformations and urbanization trends globally. Rising disposable incomes, expanding working populations, and increasing acceptance of coffee consumption in regions historically dominated by tea are creating favorable market dynamics. The Ministry of Commerce & Industry in India reported that domestic coffee uptake grew from 84,000 tons in 2012 to 91,000 tons in 2023, demonstrating significant market development in traditionally tea-preferring regions where coffee culture adoption is accelerating alongside economic development and Western lifestyle influences.

Consumers are increasingly seeking convenient and quick beverage options compatible with modern lifestyle demands, making instant coffee a preferred choice for busy professionals, students, travelers, and households seeking efficiency without compromising coffee experience. The product's instant solubility in hot or cold water, elimination of brewing equipment requirements, and consistent flavor delivery create compelling value propositions supporting market expansion across diverse consumer segments.

Premium variants including specialty blends, single-origin instant coffee, and flavored formulations are enhancing product appeal beyond commodity positioning, attracting discerning consumers willing to pay premium prices for superior quality instant coffee matching café-style experiences. Sustainable sourcing practices including Fair Trade and organic certifications, combined with technological advancements such as freeze-drying improving flavor retention and aroma preservation, are elevating instant coffee's quality perception and supporting premiumization strategies.

The expansion of e-commerce platforms and private-label brands is making instant coffee more accessible and affordable across urban and semi-urban areas, overcoming traditional distribution constraints and supporting market penetration in tier-2 and tier-3 cities. Growing demand from offices providing employee beverages, vending machines in commercial spaces, travel sectors (airlines, hotels, convenience stores), and ready-to-drink beverage formulations incorporating instant coffee as ingredients is further fueling market growth, highlighting the sector's potential for innovation, product diversification, and global export opportunities.

IMARC Group's report, "Instant Coffee Powder Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The instant coffee powder manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Plant Capacity and Production Scale

An instant coffee powder manufacturing plant operates as a sophisticated food processing facility transforming green coffee beans into soluble powder through sequential operations including roasting, extraction, concentration, drying, and packaging. The production methodology represents a technically complex operation involving precise roasting profiles maintaining flavor development, controlled extraction maximizing soluble solids recovery, sophisticated drying technologies (spray drying or freeze drying) preserving aroma compounds, and comprehensive quality control ensuring consistent sensory characteristics.

The proposed manufacturing facility is designed with an annual production capacity ranging between 2,000-5,000 MT (metric tons), enabling substantial economies of scale while maintaining operational flexibility to accommodate diverse product grades (regular, premium, specialty), formulation variations (pure instant coffee, coffee-chicory blends, flavored variants), and customer specifications across retail, foodservice, and industrial segments.

The facility produces instant coffee powder for multiple:

• Household consumption: Retail packaged instant coffee for home preparation offering convenience and consistent quality

• Foodservice and HoReCa: Bulk instant coffee for cafés, hotels, restaurants, catering operations, and institutional foodservice supporting rapid beverage preparation

• Beverage industry: Ingredient for coffee premixes, ready-to-drink (RTD) coffee beverages, and vending machine formulations

• Food processing: Flavoring agent in bakery products, desserts, confectionery, and ice cream providing coffee flavor without liquid addition

• Export markets: International distribution serving markets with established instant coffee preferences or emerging coffee consumption

Production capacity planning must account for green coffee bean quality variations affecting extraction yields and sensory characteristics, processing technology selection (spray drying vs. freeze drying) impacting flavor retention and production costs, product portfolio complexity across regular and premium segments, stringent food safety and quality requirements throughout processing, and aroma preservation systems capturing and reincorporating volatile compounds lost during drying processes.

Request for a Sample Report: https://www.imarcgroup.com/instant-coffee-powder-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The instant coffee powder manufacturing business presents compelling financial characteristics rooted in the transformation of agricultural commodities into value-added convenience products commanding premium pricing relative to raw coffee beans. The project demonstrates healthy profitability potential under normal operating conditions, with gross profit margins typically ranging between 35-45% and net profit margins of 15-25%, supported by convenience value proposition, brand development opportunities, and diverse market applications.

The financial projections developed for this project incorporate comprehensive analysis of capital investment requirements across land acquisition near coffee-growing regions or import ports (for green bean access), specialized facility construction meeting food safety standards (GMP, HACCP), significant equipment procurement including coffee roasters, extraction systems, evaporators, spray or freeze dryers, aroma recovery units, and automated packaging lines, utilities infrastructure supporting substantial steam, electricity, and cooling water requirements, and working capital for green bean inventory, work-in-process during extended processing times, and finished goods supporting retail and export distribution.

Operating cost modeling addresses raw material expenses dominated by green coffee bean procurement (typically 70-80% of operating costs), representing the single largest cost component with commodity price volatility requiring strategic sourcing and potentially futures market hedging. Coffee bean quality selection critically impacts final product characteristics, with Arabica beans commanding premium prices but delivering superior flavor profiles compared to Robusta beans offering cost advantages with bolder, more bitter characteristics suitable for instant coffee applications.

Utilities constitute 10-15% of operating expenses, with substantial energy consumption for roasting operations (thermal energy achieving precise roasting profiles), extraction processes (steam for pressurized extraction), evaporation (concentrating coffee extract), spray drying or freeze drying (the most energy-intensive operations), and cooling systems managing exothermic processes and maintaining quality during storage.

Additional operating costs encompass labor expenses for roasting operators managing complex flavor development, extraction technicians monitoring yields, quality control analysts conducting sensory evaluations and analytical testing, packaging line operators, and maintenance personnel servicing sophisticated processing equipment, maintenance of specialized food processing equipment requiring sanitary design and regular cleaning, quality control costs including sensory panels, analytical instrumentation (moisture analyzers, particle size analyzers), and microbiological testing, food safety compliance including HACCP documentation and third-party audits, packaging materials representing significant costs (jars, pouches, labels, cartons) protecting product from moisture and maintaining freshness, and marketing investments building brand equity in competitive instant coffee markets.

These detailed financial models provide stakeholders with transparent visibility into project economics, including comprehensive capital expenditure (CapEx) breakdowns particularly addressing drying technology selection (spray vs. freeze drying significantly affecting capital costs and product quality), operating expenditure (OpEx) structures with critical emphasis on green coffee procurement strategies given dominant cost position and commodity price volatility, income projections across retail, foodservice, industrial, and export customer segments, expected return on investment (ROI), net present value (NPV) calculations, payback period analysis, and long-term profitability trajectories under various coffee commodity pricing, market penetration, and brand development scenarios.

Operating Cost Structure

Understanding the operating cost structure is fundamental to effective business planning and margin management in instant coffee powder manufacturing. The cost architecture reflects green coffee intensity, substantial energy requirements for drying operations, and the value-added nature of convenience product transformation.

Key Raw Materials Include:

• Green coffee beans: Primary raw material (Arabica, Robusta, or blends) representing 70-80% of operating costs as dominant component

• Process additives: Potentially maltodextrin or similar carriers in certain formulations, though premium instant coffee typically contains only coffee solids

• Packaging materials: Jars, pouches, caps, labels, shrink wrap, and cartons protecting product from moisture absorption (critical for instant coffee stability)

Utilities and Process Requirements:

Substantial utility consumption reflects the energy-intensive nature of roasting and drying operations, covering thermal energy for coffee roasting (precisely controlled temperature profiles developing desired flavor compounds), steam for extraction operations (pressurized extraction maximizing soluble solids recovery), evaporation concentrating coffee extract before drying, electricity for spray drying (atomization pumps, fans) or freeze drying (vacuum pumps, refrigeration), grinding and milling equipment, packaging machinery, and facility operations, cooling water for condensers in evaporation systems and process cooling, and process water for extraction (water quality significantly affecting extraction efficiency and flavor).

Additional operating costs encompass:

• Transportation: Green coffee bean import or domestic procurement from coffee-growing regions, finished product distribution to retail distribution centers, foodservice customers, and export markets

• Packaging: Substantial costs for moisture-barrier packaging (critical for instant coffee shelf life), including glass jars, metallized pouches, printed labels, and secondary packaging

• Salaries and wages: Skilled roasting operators (critical for flavor development requiring expertise and experience), extraction technicians, spray drying or freeze drying operators, quality control sensory panelists and analytical staff, packaging line workers, and food safety specialists

• Depreciation: On substantial capital investments in roasting equipment, extraction systems, evaporators, drying equipment (particularly freeze dryers representing major capital expenditure), and packaging lines

• Quality control: Sensory evaluation panels, analytical instrumentation (moisture content, bulk density, particle size distribution, solubility tests), and microbiological testing

• Food safety compliance: HACCP system implementation and maintenance, third-party audits, laboratory testing, and sanitation programs

• Aroma preservation: Specialized aroma recovery systems capturing volatile compounds during drying and reincorporating them improving sensory characteristics

• Brand development: Marketing and advertising investments building brand recognition in competitive markets

Raw material procurement strategies represent the most critical success factor given green coffee beans' dominant cost position (70-80% of OpEx) and commodity price volatility significantly impacting profitability. Strategic considerations include establishing relationships with coffee bean importers, cooperatives, or direct farm relationships, implementing hedging strategies through coffee futures markets managing price risk, maintaining strategic green bean inventory in climate-controlled facilities balancing carrying costs against price volatility, developing cupping expertise evaluating bean quality and sensory characteristics, exploring direct trade relationships ensuring quality and supporting sustainable sourcing narratives, and optimizing bean selection balancing cost (Arabica vs. Robusta) with target product positioning and consumer preferences.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=10302&flag=C

Capital Investment Requirements

Establishing an instant coffee powder manufacturing plant requires substantial capital investment reflecting the specialized processing equipment, food safety systems, and quality control infrastructure essential for premium instant coffee production.

Capital Expenditure Components:

• Land and Site Development Costs: Land acquisition near coffee bean sources, import ports, or major consumption markets, with adequate space for green bean storage, processing, finished goods warehousing, and logistics

• Civil Works Costs: Food-grade facility construction including climate-controlled storage, processing areas meeting GMP standards, quality control laboratories, and hygiene-controlled packaging areas

• Machinery Costs: Largest portion of CapEx representing sophisticated food processing technology

• Other Capital Costs: Quality testing equipment, food safety systems, initial inventory, certifications, brand development

Site Selection Considerations:

Strategic location selection must evaluate several critical factors:

• Easy access to key raw materials particularly green coffee beans from import ports or domestic coffee-growing regions (India: Karnataka, Kerala, Tamil Nadu; international: Brazil, Vietnam, Colombia), minimizing logistics costs and ensuring consistent supply

• Proximity to target markets particularly major urban consumption centers for retail distribution, foodservice concentrations, and export ports for international markets, minimizing finished product transportation

• Robust infrastructure including reliable utilities (electricity, water, steam generation), transportation networks facilitating both inbound bean logistics and outbound distribution, and telecommunications supporting customer service

• Compliance with local zoning laws and environmental regulations governing food processing facilities, wastewater discharge from extraction processes, and air emissions from roasting operations

• Labor availability particularly skilled personnel for roasting operations (specialized expertise), quality control staff with sensory evaluation training, and food safety professionals

• Space for future expansion accommodating capacity increases, new product lines (flavored variants, specialty blends), or vertical integration opportunities

Essential Machinery Requirements:

High-quality, food-grade equipment represents the technical foundation:

• Coffee roasters: Drum or fluidized bed roasters achieving precise roasting profiles developing desired flavor compounds while maintaining consistency batch-to-batch

• Grinders: Grinding equipment preparing roasted coffee for extraction with controlled particle size distribution optimizing extraction efficiency

• Extraction systems: Pressurized extraction columns or percolation systems maximizing soluble solids recovery while minimizing extraction of undesirable compounds

• Evaporators: Multi-effect or falling film evaporators concentrating coffee extract to solids before drying, improving drying efficiency

• Spray dryers or freeze dryers: Spray drying offering cost-effective production with good quality, or freeze drying delivering superior aroma and flavor retention commanding premium positioning

• Agglomerators: Equipment creating larger, more readily soluble granules from spray-dried powder improving consumer experience

• Aroma recovery units: Systems capturing volatile aroma compounds during drying and reincorporating them enhancing sensory quality

• Automated packaging machines: High-speed filling, capping, labeling, and cartoning equipment for retail and foodservice packaging formats

Supporting infrastructure includes green coffee storage silos with climate control preventing moisture absorption and quality degradation, roasted coffee storage with inert gas flushing preventing oxidation, comprehensive quality control laboratory with sensory evaluation booths, analytical instruments (GC-MS for aroma profiling, moisture analyzers, particle size analyzers), and cupping facilities, clean room or hygiene-controlled packaging areas meeting food safety standards, wastewater treatment managing extraction and cleaning effluents, nitrogen generation for modified atmosphere packaging extending shelf life, and material handling systems including pneumatic conveyors, bucket elevators, and automated storage/retrieval for ingredient and finished goods.

Civil works costs encompass food-grade facility construction with segregated clean and controlled areas, climate-controlled green bean storage preventing quality deterioration, process areas with sanitary design facilitating cleaning and preventing contamination, quality control laboratories with stable environmental conditions for sensory evaluation, packaging rooms with controlled humidity preventing moisture absorption, and administrative offices housing quality assurance, food safety, and commercial functions. Other capital costs include comprehensive quality testing equipment, food safety certifications (HACCP, ISO 22000, FSSAI or equivalent), sensory panel training programs, initial green bean and packaging material inventory, brand development and marketing launch, and contingency reserves.

Manufacturing Process Overview

The instant coffee powder production process involves sophisticated sequential operations designed to extract coffee solids and transform them into stable, soluble powder maintaining sensory characteristics:

Unit Operations Involved:

• Green coffee bean sourcing: Procurement of Arabica, Robusta, or blended beans from origin countries or importers, with quality evaluation through cupping

• Roasting: Thermal treatment developing flavor compounds through Maillard reactions and caramelization, with precise temperature-time profiles achieving desired roast levels

• Grinding: Roasted coffee grinding to controlled particle size optimizing extraction surface area

• Extraction: Hot water percolation or pressurized extraction dissolving soluble coffee components while minimizing extraction of undesirable compounds

• Concentration: Multi-effect evaporation reducing water content, improving drying efficiency

• Drying: Spray drying (hot air atomization) or freeze drying (sublimation under vacuum) removing water producing stable powder

• Agglomeration: Creating larger granules from fine powder improving solubility and consumer appeal

• Aroma recovery: Capturing volatile compounds during processing and reincorporating improving sensory quality

• Quality inspection: Comprehensive testing including moisture content, particle size, bulk density, solubility, color, aroma, and sensory evaluation

• Packaging: Moisture-barrier packaging (jars, metallized pouches) preventing moisture absorption and maintaining freshness

Quality Assurance Criteria:

Comprehensive quality control systems must monitor green bean quality through cupping evaluation assessing acidity, body, flavor, and defects, roasting consistency ensuring reproducible flavor profiles batch-to-batch, extraction efficiency maximizing soluble solids recovery while maintaining quality, drying parameters achieving target moisture content without thermal degradation, sensory characteristics through trained panel evaluation, and physical properties including solubility rate, particle size distribution, and bulk density.

Technical Tests:

Laboratory and sensory analysis includes moisture content determination (critical for shelf life and stability), bulk density measurement affecting packaging volumes, particle size distribution analysis, solubility testing in hot and cold water, color measurement ensuring consistency, pH determination, microbiological testing ensuring safety, sensory evaluation by trained panels assessing aroma, flavor, body, and overall quality, and shelf life studies under accelerated conditions predicting commercial stability.

Major Applications and Market Segments

Instant coffee powder manufacturing serves multiple essential applications across diverse consumer and commercial categories:

Primary Applications:

• Hot and cold coffee beverages: Primary application as convenient coffee preparation for consumers at home, office, or travel

• Coffee premixes: Ingredient in 3-in-1 or 2-in-1 formulations combining instant coffee with sugar and creamer/whitener

• Ready-to-drink products: Manufacturing ingredient for canned or bottled RTD coffee beverages

• Bakery flavoring: Coffee flavor in cakes, cookies, pastries, and desserts without moisture addition

• Confectionery: Flavoring agent in candies, chocolates, and ice cream

• Foodservice applications: Bulk instant coffee for cafés, restaurants, hotels, and catering operations

End-Use Industries:

• Retail distribution: Supermarkets, grocery stores, specialty food retailers distributing consumer packages

• HoReCa (Hotel-Restaurant-Café): Foodservice establishments requiring convenient, consistent coffee solutions

• Vending services: Vending machine operators providing instant coffee in offices, public spaces, travel hubs

• Food processing: Manufacturers incorporating instant coffee as ingredient in various products

• Institutional catering: Schools, hospitals, corporate cafeterias, and military foodservice

The diversity of applications creates multiple revenue opportunities and market positioning strategies, from value-oriented commodity instant coffee to premium specialty blends commanding higher margins through superior quality, sustainable sourcing, and brand equity.

Why Invest in Instant Coffee Powder Manufacturing?

Multiple strategic factors converge to make instant coffee powder manufacturing an exceptionally attractive investment proposition:

✓ Rising Demand for Convenient Beverages: Busy lifestyles and time-pressed consumers are driving preference for quick and easy coffee solutions, with instant coffee offering unmatched preparation speed and consistency.

✓ Expanding Urban Population and Café Culture: Growing urbanization and café trends are boosting instant coffee consumption, particularly as coffee culture penetrates traditionally tea-drinking markets with domestic coffee uptake growing from 84,000 tons (2012) to 91,000 tons (2023) in India alone.

✓ Opportunities for Product Innovation: Flavored variants, decaffeinated options, specialty single-origin instant coffee, and organic/Fair Trade certified products cater to diverse consumer tastes supporting premiumization strategies.

✓ Strong Export Potential: High demand exists in emerging and developing markets worldwide where instant coffee represents majority of coffee consumption, offering substantial international growth opportunities.

✓ Scalable Production Model: Facilities can be easily expanded through modular capacity addition, with spray drying technology particularly amenable to incremental scaling meeting increasing market demand.

✓ Attractive Margins: Premium instant coffee commands favorable profitability (Gross: 35-45%, Net: 15-25%) significantly exceeding commodity agricultural products through value-added processing and brand development.

✓ Retail and E-commerce Growth: Expanding organized retail infrastructure and e-commerce penetration improving product accessibility across urban and semi-urban markets, overcoming traditional distribution barriers.

✓ Multiple Revenue Streams: Diversified customer base across retail consumers, foodservice operators, vending services, industrial users, and export markets reducing dependence on single channel.

✓ Brand Development Opportunities: Instant coffee markets reward brand building with consumer loyalty supporting premium pricing and sustainable competitive advantages.

Industry Leadership

The global instant coffee powder manufacturing industry features several established leaders with extensive production capacities:

Leading Instant Coffee Powder Manufacturers:

• Iguacu

• Olam International

• Cacique

• Cocam

• Realcafe

• Nestlé S.A.

• JDE Peet's

• Starbucks Corporation

These major manufacturers operate large-scale facilities serving end-use sectors including beverage manufacturing, food processing, HoReCa operations, vending services, and retail distribution across global markets. Their market presence demonstrates the scalability and profitability potential of professional instant coffee production operations supporting diverse product portfolios and international distribution networks.

Buy Now: https://www.imarcgroup.com/checkout?id=10302&method=2175

Latest Industry Developments

The instant coffee sector continues to experience product innovation and market expansion:

• December 2025: Koffelo launched NOC, India's fastest cold brew shot, delivering café-style coffee in 5 seconds with 2.4X natural caffeine, low acidity, and no added sugar. Made from Brazilian and Ethiopian Arabica beans, it complements Koffelo's portfolio including cold brew signature instant powder and instant specialty coffee, offering convenient, premium coffee experiences.

• September 2025: Mexico's Food for Well-Being program launched "Wellness Coffee," a pure instant coffee powder sourced from Oaxaca, Puebla, Veracruz, and Guerrero. Free of additives and predominantly Arabica, it caters to 84% of Mexican families who prefer instant coffee.

These developments underscore industry trends toward premium product positioning with specialty bean sourcing (Brazilian and Ethiopian Arabica), functionality enhancement offering 2.4X natural caffeine supporting energy-focused positioning, speed and convenience innovation delivering café-style coffee in 5 seconds, purity focus with additive-free formulations appealing to health-conscious consumers, and government support recognizing instant coffee's accessibility serving 84% of Mexican families, demonstrating product's democratic reach across socioeconomic segments.

Conclusion

The instant coffee powder manufacturing sector presents an exceptionally compelling investment opportunity characterized by strong market fundamentals driven by lifestyle convenience trends, urbanization acceleration, coffee culture expansion, and attractive profitability potential supported by value-added transformation of agricultural commodities into premium convenience products.

For entrepreneurs and businesses seeking to participate in the essential food processing infrastructure supporting modern beverage consumption, lifestyle convenience, and coffee culture globalization, instant coffee powder manufacturing offers a proven pathway to creating substantial value while contributing to consumer convenience, agricultural value addition, and coffee culture democratization. The sector's robust fundamentals, supported by lifestyle megatrends, proven processing technologies, diverse application opportunities spanning retail to foodservice to industrial markets, and continuous innovation in product development and quality enhancement, ensure continued market relevance and attractive opportunities for well-planned and professionally executed manufacturing ventures delivering consistent quality, sensory excellence, and brand differentiation across diverse market applications and geographic regions.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Instant Coffee Powder Manufacturing Plant Cost 2026: Raw Materials Requirement and Profit Margin here

News-ID: 4374955 • Views: …

More Releases from IMARC Group

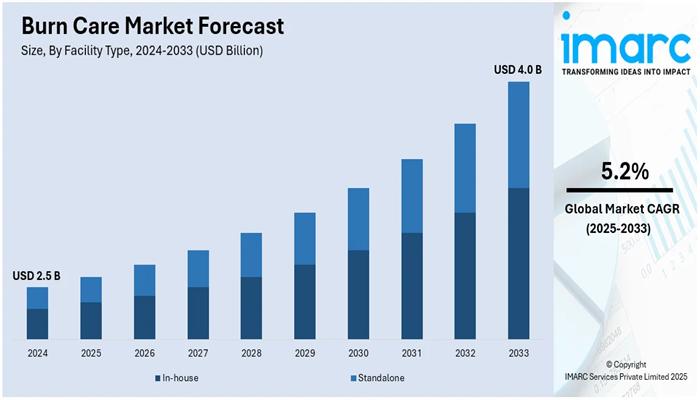

Global Burn Care Market Report by Facility Type, Treatment Type, Burn Severity, …

Market Overview

The global Burn Care Market was valued at USD 2.5 Billion in 2024 and is projected to reach USD 4.0 Billion by 2033, growing at a CAGR of 5.2% between 2025 and 2033.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Market Key Takeaways

• Current Market Size: USD 2.5 Billion (2024)

• CAGR: 5.2% (2025-2033)

• Forecast Period: 2025-2033

• The market is driven by increasing prevalence of burn injuries globally.

• Rising awareness and demand for advanced…

Plant Based Protein Market Size to Surpass USD 29.9 Billion by 2033, Driven by t …

Market Overview

The global Plant Based Protein Market was valued at USD 16.9 Billion in 2024. The market is projected to reach USD 29.9 Billion by 2033, growing at a CAGR of 6.55% during the forecast period from 2025 to 2033. The rise in sustainable food sources and the increasing inclusion of plant-based proteins in hotel and restaurant menus are driving market growth globally.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period:…

Global Organic Food Market to Grow at a CAGR of 10.42% during 2025-2033, Driven …

Market Overview

The global organic food market was valued at USD 230.1 Billion in 2024 and is projected to reach USD 587.0 Billion by 2033, growing at a CAGR of 10.42% during the forecast period of 2025-2033.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Period: 2025-2033

Market Key Takeaways

• Current Market Size: USD 230.1 Billion in 2024

• CAGR: 10.42%

• Forecast Period: 2025-2033

• North America dominates driven by health consciousness and mainstream retail adoption.

• Organic fruits and vegetables…

Transformer Oil Manufacturing Plant Setup - 2026, Market Trends, Machinery, Busi …

The global energy infrastructure underpinning modern civilization depends fundamentally on electrical power transmission and distribution systems that span thousands of kilometres, connecting generation facilities to billions of end consumers across industrial, commercial, and residential sectors worldwide. At the heart of these critical networks lies transformer technology-massive electrical equipment that steps voltage up or down efficiently across substations, and within every transformer operates an indispensable consumable: transformer oil. This extremely pure…

More Releases for Coffee

Cafe Chain Market Is Booming Worldwide | Costa Coffee, Starbucks, Ediya Coffee, …

Latest Study on Industrial Growth of Worldwide Cafe Chain Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Worldwide Cafe Chain market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Coffee Grounds Market 2021 Witnessing Enormous Growth | Folgers Coffee, Hills Br …

Global Coffee Grounds Market – Scope of the Report

“Coffee Grounds Market research report delivers a comprehensive study on production capacity, consumption, import and export for all major regions across the world. Report provides is a professional inclusive study on the current state for the market. Analysis and discussion of important industry like market trends, size, share, growth estimates are mentioned in the report.”

Coffee refers to a brewed drink that is…

Coffee Beans Market Forecast to 2027 - Kicking Horse Whole Beans, IllycaffS.p.A …

The coffee Beans market was valued at US$ 25,591.7 million in 2018 and is projected to reach US$ 41,962.4 million by 2027; it is expected to grow at a CAGR of 5.6% from 2019 to 2027.

Coffee beans are the seeds produced by coffee plants, which are a rich source of coffee. The coffee beans are not exactly beans, but they are called coffee beans as they resemble true beans in…

Coffee Market: Getting Back To Growth | Ultimate Coffee Company, Unar Coffee Com …

A new business intelligence report released by HTF MI with title "Global Coffee Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread)" is designed covering micro level of analysis by manufacturers and key business segments. The Global Coffee Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived…

Organic Coffee Market is Booming Worldwide |ALLEGRO COFFEE, ARAKU COFFEE

The proposed Organic Coffee Market report will encompass all the qualitative & quantitative aspects including the market size, market estimates, growth rates & forecasts & hence will give you a holistic view of the market. The study also includes detailed analysis of market drivers, restraints, technological advancements & competitive landscape along with various micro & macro factors influencing the market dynamics.

The Organic Coffee Market sample report includes an exclusive analysis…

Global Drip Coffee Market 2019 | Forecast by Type - Ice Drip Coffee, Instant Cof …

QY Market Study offers an Seven-year forecast for the worldwide Drip Coffee Market between 2019 and 2026. During a recently published report by QY Market Study, the global Drip Coffee market is predicted to register a CAGR of cardinal throughout the forecast period. The first objective of the report is to supply insights on the advancements and chance within the Drip Coffee market. The study demonstrates market dynamics that ar…