Press release

Neo and Challenger Banks: Global Market Trends and Growth Outlook

Neo and challenger banks are reshaping global banking with digital-first services, rapid growth, and innovative solutions.

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=6247

Why the Market Is Expanding

Neo and challenger banks are designed to operate digitally, often without any physical branches, allowing them to offer convenient, fast, and accessible services. With smartphones present in nearly 85% of households worldwide, more consumers are turning to mobile-first banking. Younger generations, in particular, have embraced digital banking, with nearly 78% of millennials and 67% of Gen Z preferring online apps over traditional bank visits. This shift has created a substantial opportunity for banks that can meet expectations for speed, simplicity, and convenience.

Market Segmentation

The market can be divided by business model, licensing model, services, end-users, and geography. Digital-only banks account for 65-70% of the market, thanks to their lower operational costs and ability to deliver complete banking services online. Operating expenses are generally 60-70% lower than traditional banks, allowing digital banks to provide free accounts, better savings rates, and instant service. These banks also prioritize user experience, offering features such as immediate account access, real-time notifications, fraud alerts, and AI-generated financial insights.

Hybrid banks, which combine digital platforms with physical branches, occupy the remaining market share. They often provide a blend of convenience and traditional banking reliability. Licensing models include fully licensed banks capable of offering the full range of banking services and partnership models, where banks collaborate with existing institutions to provide regulated products.

By service type, payments and money transfers dominate, accounting for 35-40% of revenue. This segment is crucial as it drives both customer engagement and retention. Digital banks process billions of transactions annually, offering instant peer-to-peer transfers, bill splitting, and real-time payments. Other service offerings include savings accounts, loans, investment products, insurance, currency exchange, and additional financial tools.

Retail consumers make up the largest portion of the user base, representing 70-75% of total demand. Small and medium enterprises (SMEs) and larger corporations account for the remainder. Geographically, the Asia-Pacific region is set to experience the fastest growth, with a CAGR of 26.4%, driven by a combination of unbanked populations and mobile-first consumers.

Regional Trends

China leads the Asia-Pacific market with a projected CAGR of 28.3%. Financial services integrated into large digital ecosystems enable users to access banking, payments, and loans directly within popular apps. Government policies promoting digital currencies and financial inclusion further boost adoption. In India, neo banking is projected to grow at a CAGR of 27.8%, supported by initiatives that digitize financial services, streamline customer onboarding, and provide banking access to previously unbanked populations.

In the United States, growth is slightly slower at 19.2% CAGR but remains strong due to venture capital investments, consumer dissatisfaction with traditional banks, and innovative offerings such as early wage access and fee-free accounts. Similar trends are visible in Latin America and Southeast Asia, were digital adoption and favorable regulations support market expansion.

Browse in Depth: https://www.meticulousresearch.com/product/neo-and-challenger-bank-market-6248

Key Drivers

Several factors are driving growth in this market. The demand for digital-first banking solutions is rising, with users seeking convenience, speed, and personalization. Cost efficiency allows digital banks to operate at lower expense ratios and provide free or low-cost products. Regulatory support continues to ease market entry, and technological innovations like AI, cloud computing, and APIs improve service delivery.

Challenges and Restraints

Despite rapid growth, the market faces challenges. Profitability can be difficult to achieve, prompting banks to explore premium offerings, lending products, and other revenue streams. Trust and security remain a concern, addressed through regulatory compliance, deposit insurance, and advanced authentication technologies such as biometrics. Regulatory complexity can slow expansion, although partnerships and compliance automation help mitigate this risk.

Digital Transformation

Neo and challenger banks are at the forefront of digital transformation. Modern technology stacks and microservices enable rapid deployment of features and updates, far outpacing the slower cycles of traditional banks. Emphasis on user-friendly interfaces, personalization, and gamification leads to higher customer satisfaction and engagement. Viral referral programs and social marketing have also lowered customer acquisition costs, supporting faster market penetration.

Competitive Landscape

Competition is intense, with digital-only banks, licensed challengers, and hybrid institutions vying for market share. Differentiation is achieved through superior user experience, innovative product offerings, and geographic expansion. Mergers, acquisitions, and partnerships are increasingly common as banks pursue scale, profitability, and technological advantage. Many institutions are evolving from simple transaction providers into comprehensive financial ecosystems that include payments, savings, lending, investment, insurance, and embedded finance services.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1565

Conclusion

The neo and challenger banking market is poised for remarkable growth over the next decade. Digital-only banks currently dominate, driven by lower costs and enhanced customer experiences, while payments and money transfers remain the largest revenue-generating services. Asia-Pacific is expected to see the fastest expansion, with China and India leading adoption, followed by other emerging markets embracing mobile banking.

Key Questions Answered

What is the projected market size for 2025 and 2035?

What is the expected CAGR for the market between 2025 and 2035?

What are the main differences between digital-only banks and hybrid banks?

How do fully licensed banks differ from partnership-based banking models?

What other banking services are offered by neo and challenger banks aside from payments and money transfers?

Which service segment is growing the fastest, and what is its CAGR?

Why are millennials and Gen Z more likely to use digital banking compared to traditional banks?

How has the pandemic affected consumer behavior toward digital banking?

What is the projected CAGR for China and India from 2025 to 2035?

How have super-app ecosystems influenced the adoption of neo banking in Asia?

Related Reports:

Speech and Voice Recognition Market: https://www.meticulousresearch.com/product/speech-and-voice-recognition-market-5038

E-commerce Market: https://www.meticulousresearch.com/product/e-commerce-market-4644

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Banks: Global Market Trends and Growth Outlook here

News-ID: 4373814 • Views: …

More Releases from Meticulous Research®

Ultrapure Water Market 2025-2035: Trends, Technologies, and Industry Application …

The global ultrapure water market is experiencing rapid growth, driven by the increasing demand for high-purity water across semiconductor manufacturing, pharmaceuticals, and power generation industries. Valued at USD 8.57 billion in 2024, the market is expected to reach USD 9.26 billion in 2025 and expand further to USD 19.03 billion by 2035, representing a compound annual growth rate (CAGR) of 7.6% from 2025 to 2035. This growth reflects the critical…

Europe Pelletized Fertilizer Market: Size, Trends, Segmentation, and Growth Fore …

The Europe pelletized fertilizer market is experiencing steady expansion as agricultural practices across the region become more technology-driven, efficiency-focused, and environmentally regulated. Valued at USD 7.35 billion in 2024, the market is estimated to reach USD 7.85 billion in 2025 and is projected to grow to USD 14.73 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period. This growth reflects the increasing preference…

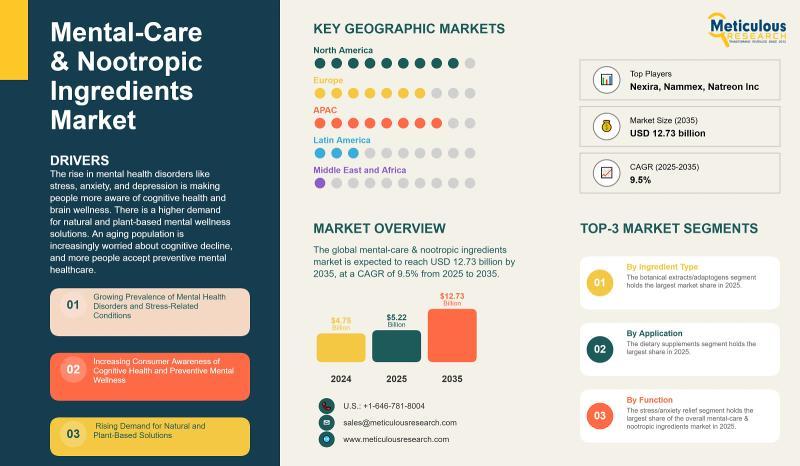

Mental-Care and Nootropic Ingredients Market Outlook 2035: Rising Demand for Bra …

The global mental-care and nootropic ingredients market is gaining significant traction as consumers place greater emphasis on emotional well-being, stress reduction, and enhanced cognitive performance. The market was valued at USD 4.75 billion in 2024 and is expected to grow from USD 5.22 billion in 2025 to USD 12.73 billion by 2035, registering a strong CAGR of 9.5% during the forecast period. This expansion is driven by the increasing prevalence…

Bicycle Security System Market Size, Growth Trends, and Forecast 2025-2035

The global bicycle security system market is witnessing consistent expansion, driven by the rising incidence of bicycle theft, increasing ownership of high-value bicycles, and the growing adoption of e-bikes. In 2024, the market was valued at USD 1.23 billion and is expected to increase from USD 1.31 billion in 2025 to USD 2.32 billion by 2035, registering a robust CAGR of 5.8% over the forecast period. Factors such as the…

More Releases for CAGR

[CAGR of 6.7%] Nanocoatings Market Size, Industry Share, CAGR, Regional Forecast …

The global Nanocoatings Market generated $10.7 billion in 2020, and is projected to reach $20.1 billion by 2030, growing at a CAGR of 6.7% from 2021 to 2030. The report provides an in-depth analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive scenario, and wavering market trends.

Download sample PDF @ https://www.alliedmarketresearch.com/request-sample/2064

According to the report published by Allied Market Research,…

[CAGR of 5.3%] Pigments Market Size, Industry Share, CAGR, Regional Forecast, 20 …

A recent report by Allied Market Research provides a detailed analysis of the pigments market, highlighting its robust growth. The industry was valued at $27.2 billion in 2022 and is projected to surge to $45.4 billion by 2032, exhibiting an impressive CAGR of 5.3% from 2023 to 2032.

This research report identifies the growth drivers behind the market's expansion and delves into the market dynamics using advanced analytical frameworks…

Enzymes Market Expansion CAGR of 4.9% CAGR Anticipated 2025-2034

The Enzymes Market report is an in-depth examination of the global Enzymes Market's general consumption structure, development trends, sales techniques, and top nations' sales. The research looks at well-known providers in the global Enzymes Market industry, as well as market segmentation, competition, and the macroeconomic climate. A complete Enzymes Market analysis takes into account a number of aspects, including a country's population and business cycles, as well as market-specific microeconomic…

Waterproofing Membranes Market is Projected Grow at CAGR of 8% CAGR by 2033

The waterproofing membranes market is anticipated to witness a Compound Annual Growth Rate (CAGR) of 8.0% over the forecast period. By 2023, the estimated market value for waterproofing membranes is substantial, reaching US$ 31.5 billion.

These waterproofing materials comprise thin, impermeable membranes designed to collaborate with asphalt, providing a protective shield for the structural integrity of buildings. The asphalt component in these membranes acts as a safeguard, preserving the underlying membrane…

Electric Bed Market CAGR, Size, Share Grow USD 2,063 Million by 2030 CAGR 13.70%

Global electric bed market size is expected to be worth roughly USD 2,063 million by 2030, growing at a CAGR of more than 13.7% during the projected timeframe of 2022-2030, according to Ameco Research

A significant portion of the population over the age of 60, who often have reduced immunity levels and are more susceptible to neurological disorders, cardiac issues, tumors, and spinal cord compression, is anticipated to have a substantial…

Pediatric Radiology Market Size will Grow at CAGR 7.7% CAGR during 2017-2026

Pediatric Radiology Market:Overview

The pediatric radiology market is likely to register robust growth in the near future. Chronic illnesses among children including neurological disorders such as ADHD are on the rise. According to the US labor bureau, the demand for pediatrician is expected to grow by 24% on average by 2020. This is the highest average growth among all professionals in the United States.

Despite challenges such as training for new…