Press release

Rare Earth Magnet Manufacturing Plant DPR 2026: CapEx/OpEx Analysis, Process Flow & Market Outlook

The global rare earth magnet manufacturing industry is experiencing unprecedented growth driven by the electrification revolution, renewable energy expansion, and the accelerating transition toward advanced technologies. At the heart of this transformation lies a critical component of rare earth magnets. As industries worldwide pivot toward electric vehicles, wind turbines, and high-performance electronics, establishing a rare earth magnet manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and technology investors seeking to capitalize on this indispensable and rapidly growing market.Market Overview and Growth Potential

The global rare earth magnet market demonstrates an exceptional growth trajectory, valued at USD 20.47 Billion in 2025. According to comprehensive market analysis, the market is projected to reach USD 31.76 Billion by 2034, exhibiting a robust CAGR of 5.0% from 2026-2034. This sustained expansion is driven by accelerating electric vehicle adoption, renewable energy infrastructure development, growing demand for miniaturized electronics, expanding industrial automation, and increasing defense and aerospace applications across developed and emerging economies.

Rare earth magnets are permanent magnets manufactured from alloys containing rare earth elements such as neodymium, samarium, dysprosium, and praseodymium.

These magnets-primarily neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo)-exhibit exceptionally high magnetic strength, superior temperature stability, and excellent coercivity. Rare earth magnets are critical components in electric vehicle motors, wind turbine generators, hard disk drives, magnetic resonance imaging (MRI) machines, industrial motors, consumer electronics, and defense systems. Their unmatched magnetic properties enable miniaturization, energy efficiency improvements, and performance enhancements across diverse high-technology applications.

The rare earth magnet market is witnessing robust demand due to the global energy transition and electrification megatrends. Electric vehicle production is scaling exponentially, with each EV requiring 1-3 kg of rare earth magnets for traction motors and auxiliary systems. Wind energy installations demand large quantities of high-performance magnets for direct-drive generators. According to the International Energy Agency, global EV sales reached 14 million units in 2023 and are projected to exceed 40 million annually by 2030. Government mandates for carbon neutrality, clean energy incentives, and electrification policies across North America, Europe, and Asia-Pacific further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/rare-earth-magnet-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed rare earth magnet manufacturing facility is designed with an annual production capacity ranging between 500-2,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from electric vehicles and renewable energy to consumer electronics, industrial automation, medical devices, and defense applications-ensuring steady demand and consistent revenue streams across multiple high-growth industry verticals.

Financial Viability and Profitability Analysis

The rare earth magnet manufacturing business demonstrates exceptional profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 35-45%

Net Profit Margins: 15-20%

These margins are supported by sustained demand across electrification and renewable energy sectors, high-value specialty material positioning, strategic importance in critical technology supply chains, and the essential nature of rare earth magnets in next-generation applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established materials manufacturers looking to diversify their product portfolio in the advanced materials sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a rare earth magnet manufacturing plant is primarily driven by:

Raw Materials: 60-70% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, quality control, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with rare earth oxides (neodymium oxide, praseodymium oxide, dysprosium oxide), iron, and boron being the primary input materials. Establishing long-term supply agreements with reliable rare earth element suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that rare earth oxide price fluctuations represent the most significant cost factor in magnet manufacturing.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=7303&flag=C

Capital Investment Requirements

Setting up a rare earth magnet manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to rare earth element suppliers and target industries such as automotive clusters and electronics manufacturing hubs. The site must have robust infrastructure, including reliable power supply, water resources, waste management systems, and specialized environmental controls. Compliance with environmental regulations governing rare earth processing and magnetic material handling must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

Melting furnaces for alloy preparation through vacuum induction melting or strip casting

Hydrogen decrepitation equipment for controlled fracture of alloy ingots

Jet milling systems for producing fine magnetic powder with controlled particle size

Magnetic field alignment presses for orienting powder particles during compaction

Sintering furnaces with controlled atmosphere for densification and grain growth

Heat treatment systems for optimizing magnetic properties and coercivity

Machining and grinding equipment for dimensional accuracy and surface finishing

Magnetizing equipment for saturating magnets to full magnetic potential

Coating and plating systems for corrosion protection (nickel, zinc, epoxy)

Quality control instrumentation for magnetic property testing and dimensional verification

Environmental control systems for managing hydrogen gas and rare earth dust

Civil Works: Building construction, cleanroom facilities, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize contamination risks throughout the production process. The layout should be optimized with separate zones for raw material storage, melting and casting area, powder processing section, pressing and alignment zone, sintering furnaces, heat treatment area, machining and finishing section, coating facility, magnetization and testing laboratory, finished goods warehouse, utility block, environmental compliance area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, technology licensing fees, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Rare earth magnet products find extensive applications across diverse high-technology market segments, demonstrating their versatility and critical importance:

Electric Vehicles: Primary application in traction motors, power steering systems, and auxiliary motor components where high power density and energy efficiency are essential for extended driving range and performance.

Renewable Energy: Critical components in wind turbine generators, particularly direct-drive systems that eliminate gearboxes and improve reliability, as well as emerging applications in wave and tidal energy systems.

Consumer Electronics: Essential components in smartphones, laptops, tablets, headphones, speakers, hard disk drives, and wearable devices where miniaturization and performance optimization drive continuous demand.

Industrial Automation: Applications in servo motors, industrial robots, magnetic separators, magnetic bearings, and precision positioning systems where high torque density and reliability are paramount.

Medical Devices: Specialized applications in MRI machines, surgical instruments, drug delivery systems, and diagnostic equipment where magnetic precision and biocompatibility are critical.

Defense and Aerospace: Strategic applications in guided missile systems, radar equipment, satellite systems, and advanced weaponry where performance under extreme conditions is essential.

End-use industries include automotive, renewable energy, electronics, industrial machinery, healthcare, defense, and aerospace, all of which contribute to sustained market demand.

Why Invest in Rare Earth Magnet Manufacturing?

Several compelling factors make rare earth magnet manufacturing an attractive investment opportunity:

Electrification Megatrend: The global transition toward electric mobility and renewable energy creates unprecedented demand for high-performance magnets, positioning rare earth magnet manufacturing at the center of the energy transition.

Technology Indispensability: Rare earth magnets are irreplaceable in critical applications due to their unique magnetic properties, creating sustained demand that cannot be easily substituted by alternative materials.

Supply Chain Security: Growing concerns about supply chain concentration and geopolitical dependencies are driving countries and corporations to invest in domestic rare earth magnet manufacturing capacity, creating opportunities for new entrants.

Premium Value Positioning: High-performance rare earth magnets command premium pricing due to their critical functionality and limited substitutability, supporting attractive profit margins.

Government Support: Strategic material designations, clean energy incentives, defense procurement priorities, and domestic manufacturing subsidies provide substantial policy support for rare earth magnet production.

Innovation Pipeline: Continuous technological advancement in magnet formulations, recycling technologies, and application development ensures long-term growth opportunities beyond current market projections.

Circular Economy Opportunities: Growing emphasis on magnet recycling from end-of-life electronics and vehicles creates additional revenue streams and reduces raw material dependency.

Manufacturing Process Excellence

The rare earth magnet manufacturing process involves several precision-controlled stages:

Alloy Preparation: Rare earth elements, iron, and boron are melted together using vacuum induction melting or strip casting to form homogeneous alloy

Hydrogen Decrepitation: Alloy ingots are exposed to hydrogen gas causing controlled fracture into smaller particles

Jet Milling: Hydrogen-decrepitated material is milled into fine powder with particle sizes typically 3-7 microns

Magnetic Alignment and Pressing: Powder is compacted in a magnetic field to align particles and achieve maximum magnetic orientation

Sintering: Compacted material is sintered at high temperature in controlled atmosphere to achieve densification and grain growth

Heat Treatment: Magnets undergo precise heat treatment to optimize magnetic properties and coercivity

Machining and Grinding: Sintered magnets are machined to final dimensions and surface specifications

Surface Treatment: Magnets receive protective coatings (nickel, zinc, epoxy) for corrosion resistance

Magnetization: Finished magnets are exposed to strong magnetic fields to achieve saturation magnetization

Quality Testing and Packaging: Magnets undergo magnetic property verification before packaging for shipment

Industry Leadership

The global rare earth magnet industry is led by established materials manufacturers with extensive production capabilities and diverse application portfolios.

Key industry players include:

Hitachi Metals

China Northern Rare Earth Group High-Tech Co.

TDK Corporation

Shin-Etsu Chemical Co., Ltd.

Samsung SDI Co.

These companies serve diverse end-use sectors including automotive, renewable energy, electronics, industrial automation, medical devices, and defense applications, demonstrating the broad market applicability of rare earth magnet products.

Buy Now:

https://www.imarcgroup.com/checkout?id=7303&method=2175

Recent Industry Developments

November 2025: The Union Cabinet sanctioned the Scheme to Promote Manufacturing of Sintered Rare Earth Permanent Magnets, committing a financial outlay of ₹7,280 crore. This landmark initiative is designed to build 6,000 metric tons per annum (MTPA) of integrated rare earth permanent magnet manufacturing capacity in India, strengthening domestic supply chains and reducing import dependence.

January 2025: MP Materials achieved a major milestone in revitalizing the U.S. rare earth magnet supply chain. Its flagship Independence facility in Fort Worth, Texas, began commercial-scale production of neodymium-praseodymium (NdPr) metal, along with trial production of automotive-grade sintered neodymium-iron-boron (NdFeB) magnets, marking a significant step toward localized magnet manufacturing in the United States.

Conclusion

The rare earth magnet manufacturing sector presents a strategically positioned investment opportunity at the intersection of electrification, renewable energy, and advanced technology manufacturing. With favorable profit margins ranging from 35-45% gross profit and 15-20% net profit, strong market drivers including accelerating EV adoption, expanding renewable energy infrastructure, growing electronics miniaturization, rising industrial automation, and supportive government policies promoting supply chain security and clean energy transition, establishing a rare earth magnet manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of technological indispensability, premium value positioning, strategic importance in critical supply chains, expanding application diversity, and circular economy opportunities creates an attractive value proposition for serious materials investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding client business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rare Earth Magnet Manufacturing Plant DPR 2026: CapEx/OpEx Analysis, Process Flow & Market Outlook here

News-ID: 4373388 • Views: …

More Releases from IMARC Group

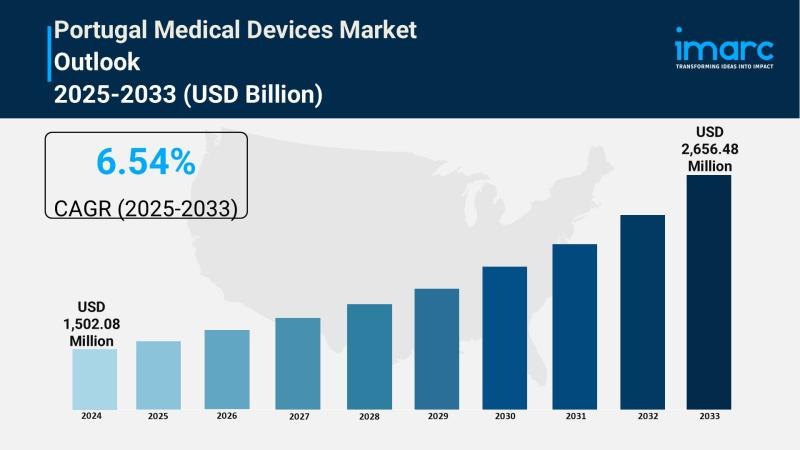

Portugal Medical Devices Market to Expand Rapidly Projected to Reach USD 2,656.4 …

Market Overview

The Portugal Medical Devices Market size reached USD 1,502.08 Million in 2024 and is projected to reach USD 2,656.48 Million by 2033, growing at a CAGR of 6.54% during 2025-2033. Growth is driven by digital health adoption, an aging population, and increased government investment. Integration of electronic health records, telemedicine platforms, and connected devices improves efficiency and outcomes. Rising age-related conditions boost demand for diagnostic imaging, surgical, cardiovascular, and…

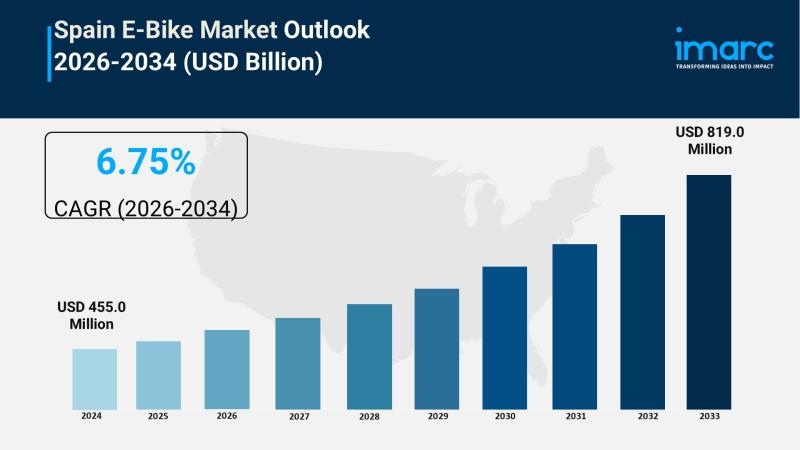

Spain E-Bike Industry Set for Rapid Growth Projected to Hit USD 819 Million by 2 …

Market Overview

The Spain E-Bike market size reached USD 455.0 Million in 2025 and is projected to grow to USD 819.0 Million by 2034, exhibiting a CAGR of 6.75% during 2026-2034. This expansion is driven by rising consumer preference for eco-friendly transport, government incentives, technological advances, increased urbanization, and sustainability focus. The market includes segments such as mode, motor type, battery type, class, design, and application.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period:…

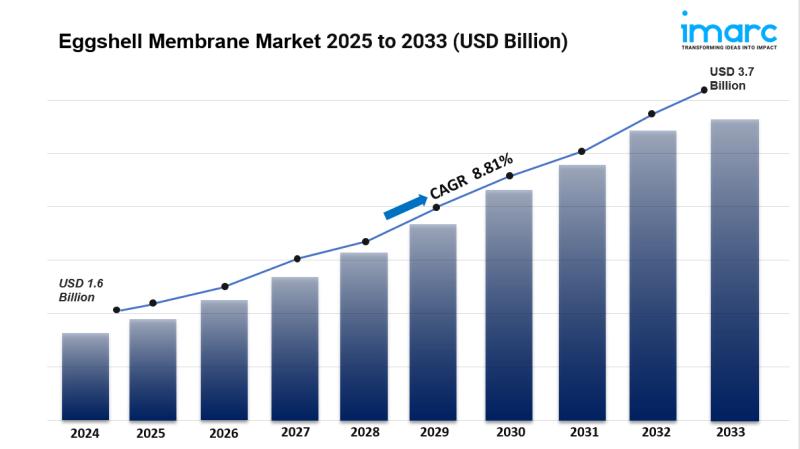

Eggshell Membrane Market Size, Growth Key Players, Latest Insights and Forecast …

IMARC Group has recently released a new research study titled "Eggshell Membrane Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Eggshell Membrane Market Size:

The global eggshell membrane market size reached USD 1.6 Billion in 2024. It is projected to grow to USD 3.7…

Polyurethane Elastomers Manufacturing Plant Project Report 2026: Setup Guide, Ma …

The global materials science landscape is experiencing a transformative shift driven by increasing demand for high-performance polymers across critical industries including automotive, construction, sports equipment, and industrial machinery. At the forefront of this evolution stands polyurethane elastomers manufacturing-a specialized segment producing advanced materials that combine rubber-like elasticity with exceptional durability and customizable properties. As industries worldwide prioritize long-lasting, durable solutions that deliver superior performance in demanding applications, establishing a polyurethane…

More Releases for Magnet

Luci Magnet Welcomes Korean Delegation for Magnet Technology Collaboration

On September 2, 2024, Shandong Luci Industrial Technology Co., Ltd. (Luci Magnet [https://www.lucimagnets.com/]) warmly welcomed a delegation of clients from South Korea. This visit aimed to deepen cooperation between the two countries in the field of magnetic technology and propel technological innovation and market expansion.

At the welcoming ceremony, Mr. Zhang Wei, Chairman of Luci Magnet, first extended a warm welcome to the Korean delegation. He recounted the company's achievements in…

NdFeB Market Size, Share & Analysis 2025 | Neodymium Magnet, Rare-Earth Magnet I …

Global NdFeB (Neodymium Iron Boron) Magnets Market reached US$ 14.0 billion in 2022 and is expected to reach US$ 23.7 billion by 2031, growing with a CAGR of 6.9% during the forecast period 2024-2031.

NdFeB Magnets Market Industry Outlook - Strategic Insights for 2025

NdFeB Magnets Market is witnessing transformative growth in 2025, driven by evolving consumer demand, technology disruption, and sustainability trends. The newly released market research report by DataM Intelligence…

Global Magnet Assemblies & Magnet Market Size by Application, Type, and Geograph …

USA, New Jersey- According to Market Research Intellect, the global Magnet Assemblies & Magnet market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The magnet assemblies and magnet market is experiencing steady growth due to rising demand across industries such as automotive, electronics, renewable energy, and…

Why is QCM Shuttering Magnet the best choice for precast concrete magnet?

What are the advantages of QCM Shuttering Magnet?

.Magnet

Magnet is the core raw material of shuttering magnet, for precast magnet its main two properties are crucial.

1, the residual magnetism Br: the magnetization of ferromagnetic materials to remove the magnetic field, the magnetization of the magnetized ferromagnet on the remaining magnetization strength, which directly affects the shuttering magnet [https://www.pcshutteringmagnet.com/precast-concrete-magnets/] suction, the higher the magnet performance Br the greater.

2, endowed coercivity Hcj: endowed…

Why are permanent magnet motors permanent magnet motors more efficient?

The permanent magnet synchronous motor [https://www.cndfdmotor.com/ty2-series-high-efficiency-permanent-magnet-synchronous-motor/] is mainly composed of a stator, a rotor and a housing. Like ordinary AC motors, the stator core is a laminated structure to reduce iron loss due to eddy current and hysteresis effects during motor operation; the winding is usually a three-phase symmetrical structure, but the parameter selection is quite different. The rotor part has various forms, including permanent magnet rotors with starting squirrel…

Magnet Wire Market Report 2024 - Magnet Wire Market Trends, Share, And Forecast

"The Business Research Company recently released a comprehensive report on the Global Magnet Wire Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…