Press release

Urea Phosphate Manufacturing Plant Cost 2026: Business Plan, Setup Requirements & ROI Insights

The global urea phosphate manufacturing industry is witnessing robust growth driven by the rapidly expanding agriculture sector and increasing demand for high-efficiency fertilizers. At the heart of this expansion lies a critical specialty fertilizer-urea phosphate. As agricultural regions transition toward precision irrigation systems and controlled nutrient delivery methods, establishing a urea phosphate manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and agro-chemical investors seeking to capitalize on this growing and essential market.IMARC Group's report, "Urea Phosphate Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The urea phosphate manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/urea-phosphate-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global urea phosphate market demonstrates strong growth trajectory, valued at USD 598.2 Million in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 985.2 Million by 2034, exhibiting a robust CAGR of 5.7% from 2026-2034. This sustained expansion is driven by rapidly expanding agriculture sector, increasing demand for high-efficiency fertilizers, rising adoption of fertigation systems, and expanding food production requirements across developing economies.

Urea phosphate is a water-soluble, acidic nitrogen-phosphorus fertilizer produced by reacting urea with phosphoric acid. It appears as a white crystalline compound with high purity and rapid dissolution properties. Urea phosphate contains both nitrogen (N) and phosphorus (P), making it an efficient dual-nutrient fertilizer used primarily in drip irrigation and fertigation systems. Due to its strong acidifying nature, it helps lower irrigation water pH and prevents mineral precipitation in micro-irrigation lines. Its high solubility, non-hygroscopic structure, and compatibility with other soluble fertilizers make it a preferred option in precision agriculture and horticultural nutrient supply.

The urea phosphate market is witnessing robust demand due to the rising need for high-efficiency fertilizers that support precision irrigation systems. Agricultural regions increasingly transitioning toward controlled nutrient delivery-particularly in horticulture, greenhouse farming, and hydroponics-are driving large-scale adoption. According to the Economic Survey 2024-25, agriculture and allied sectors contribute nearly 16% to India's GDP and supports over 46% of the population. Government-led agricultural modernization programs, subsidies for micro-irrigation systems, and soil fertility enhancement initiatives further strengthen market prospects.

Plant Capacity and Production Scale

The proposed urea phosphate manufacturing facility is designed with an annual production capacity ranging between 30,000-60,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from agriculture and horticulture to water treatment, industrial cleaning, and flame-retardant applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The urea phosphate manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 20-30%

• Net Profit Margins: 10-15%

These margins are supported by stable demand across agricultural and industrial sectors, value-added specialty fertilizer positioning, and the critical nature of urea phosphate in precision farming applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established chemical manufacturers looking to diversify their product portfolio in the specialty fertilizers sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a urea phosphate manufacturing plant is primarily driven by:

• Raw Materials: 70-75% of total OpEx

• Utilities: 4-6% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with phosphoric acid and urea being the primary input materials. Establishing long-term contracts with reliable phosphoric acid and urea suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that phosphoric acid price fluctuations represent the most significant cost factor in urea phosphate manufacturing.

Capital Investment Requirements

Setting up a urea phosphate manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to phosphoric acid and urea suppliers. Proximity to target agricultural markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Controlled reaction vessels for acid-urea chemical synthesis under regulated temperature

• Cooling systems for promoting crystallization of urea phosphate from reaction slurry

• Filtration systems for solid-liquid separation of crystals from mother liquor

• Drying equipment for moisture control and achieving final product specifications

• Milling and sieving machinery for uniform particle size distribution

• Packaging lines for filling moisture-resistant bags for storage and transport

• Quality control laboratory equipment for nutrient content and purity testing

• Effluent treatment systems for managing acidic effluents and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, reaction zone, crystallization unit, filtration section, drying unit, milling and sieving area, quality control laboratory, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=10315&method=2175

Major Applications and Market Segments

Urea phosphate products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Agriculture: Primary use as a dual-nutrient nitrogen-phosphorus fertilizer in drip irrigation and fertigation systems, particularly valuable in precision agriculture, horticulture, greenhouse farming, and hydroponic applications where controlled nutrient delivery is essential.

Horticulture: Specialized applications in fruit orchards, vegetable cultivation, and ornamental plant production where precise nutrient management and pH control are critical for optimal crop quality and yield.

Water Treatment: Utilized for pH adjustment and prevention of mineral precipitation in irrigation water systems, helping maintain micro-irrigation equipment efficiency and preventing emitter clogging.

Industrial Cleaning: Applications in metal cleaning agents and detergent formulations where acidic properties and dual-nutrient composition provide functional benefits.

Flame Retardants: Specialized industrial applications in fire-resistant materials where urea phosphate's chemical properties contribute to flame suppression.

End-use industries include agriculture, horticulture, water treatment, industrial cleaning, and flame-retardant applications, all of which contribute to sustained market demand.

Why Invest in Urea Phosphate Manufacturing?

Several compelling factors make urea phosphate manufacturing an attractive investment opportunity:

Essential Specialty Fertilizer Segment: Urea phosphate serves as a critical specialty fertilizer supporting precision agriculture, fertigation systems, and controlled nutrient delivery, making it indispensable for modern farming operations focused on efficiency and yield optimization.

Rising Precision Agriculture Adoption: Agricultural regions increasingly transitioning toward controlled nutrient delivery-particularly in horticulture, greenhouse farming, and hydroponics-are driving large-scale adoption of specialty fertilizers like urea phosphate.

Dual-Nutrient Efficiency: The product's ability to provide both nitrogen and phosphorus in a single application, combined with its pH-adjusting properties, offers significant agronomic advantages and positions it favorably against conventional fertilizers.

Water Scarcity Solutions: The product's effectiveness in preventing emitter clogging in drip irrigation lines and enhancing nutrient absorption positions it as a preferred fertilizer in water-scarce regions, especially across South Asia, the Middle East, and Mediterranean countries.

Government Support: Government-led agricultural modernization programs, subsidies for micro-irrigation systems, and soil fertility enhancement initiatives further strengthen market prospects and support industry growth.

Import Substitution Opportunities: Emerging economies such as India, China, Brazil, and Turkey are expanding local manufacturing as part of their strategy to reduce dependence on imported specialty fertilizers, creating opportunities for domestic producers.

Food Security Alignment: The food security agenda and increasing demand for fruits, vegetables, and cash crops are expected to enhance long-term growth opportunities for high-efficiency fertilizers.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=10315&flag=C

Manufacturing Process Excellence

The urea phosphate manufacturing process involves several precision-controlled stages:

• Raw Material Charging: Urea and phosphoric acid are measured and fed into a controlled reaction vessel

• Acid-Urea Reaction: A chemical reaction occurs between urea and phosphoric acid under controlled temperature to form urea phosphate slurry

• Crystallization: The reaction mixture is cooled to promote formation of urea phosphate crystals

• Filtration: Crystals are separated from the mother liquor via filtration systems

• Drying: Filtered crystals are dried to obtain the final moisture-controlled product

• Milling and Sieving: Dried material is milled and sieved to achieve uniform particle size distribution

• Packaging: Product is filled into moisture-resistant bags for storage and transport

Industry Leadership

The global urea phosphate industry is led by established chemical manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Prayon

• EuroChem Group

• Taurus Chemicals

• Haifa Group

• Lianyungang Mupro Fiine Chemical

These companies serve diverse end-use sectors including agriculture, horticulture, water treatment, industrial cleaning, and flame-retardant applications, demonstrating the broad market applicability of urea phosphate products.

Recent Industry Developments

June 2024: Paradeep Phosphates Ltd launched India's first biogenic Nano Urea and Nano DAP under the 'Jai Kisaan Navratna Nano Shakti' brand. These products are designed to increase nutrient use efficiency to over 90%, compared to traditional urea, by using nanotechnology for better absorption and controlled nutrient release, as well as reducing environmental impact.

Browse Related Reports:

• Recycled Polyethylene Terephthalate (RPET) Production Plant Cost: https://industrytoday.co.uk/chemicals/recycled-polyethylene-terephthalate-rpet-production-cost-report-2025-plant-setup-and-profitability-insights

• Smart Watch Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/smart-watch-manufacturing-plant-report-2025-setup-cost-machinery-requirement-and-profit-analysis

• Detergent Powder Manufacturing Plant: https://industrytoday.co.uk/manufacturing/detergent-powder-manufacturing-plant-setup-cost-2025-industry-trends-machinery-and-profit-analysis

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Urea Phosphate Manufacturing Plant Cost 2026: Business Plan, Setup Requirements & ROI Insights here

News-ID: 4373079 • Views: …

More Releases from IMARC Group

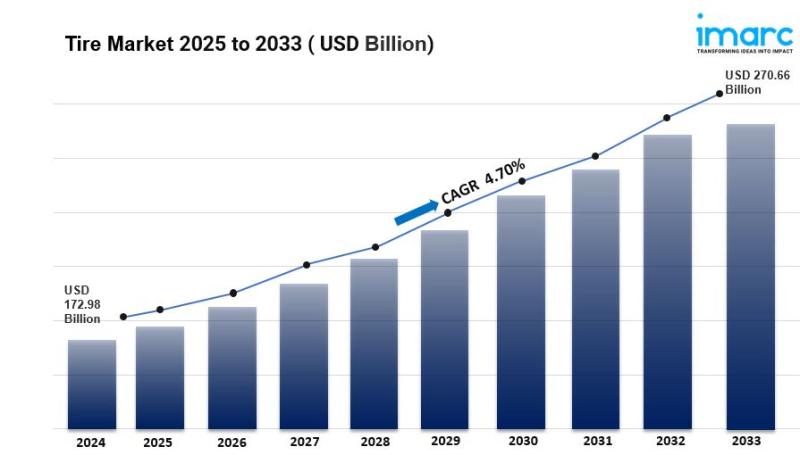

Tire Market Size to Surpass USD 270.66 Billion by 2033 | At CAGR 4.70%

IMARC Group, a leading market research company, has recently released a report titled "Tire Market Size, Share, Trends and Forecast by Design, End-Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the tire market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

The global tire market…

Establish a Magnet Manufacturing Plant: Investment Cost, Production Process & RO …

Magnets are essential functional materials that generate magnetic fields and are widely used in electric motors, generators, transformers, consumer electronics, medical devices, automotive systems, renewable energy equipment, and industrial machinery. Depending on composition and application, magnets are classified into permanent magnets (ferrite, neodymium, samarium cobalt, alnico) and electromagnetic components. With rapid electrification, automation, and renewable energy expansion, magnets have become critical components across modern industries.

Growing demand from electric vehicles (EVs),…

Global Prawn Market Size, Share, Forecast & Species-Wise Analysis Report 2025-20 …

The global prawn market is on a steady growth trajectory, valued at 8.6 million tons in 2024, with projections to reach 11.1 million tons by 2033, growing at a CAGR of 2.76%. This expansion is fueled by rising global seafood demand, increasing health-conscious eating habits, and the integration of prawns into diverse cuisines worldwide. Technological innovations in sustainable aquaculture, supportive international trade policies, and the rising use of prawns in…

Global Rice Noodles Market Size, Share, Forecast & Industry Analysis Report 2025 …

The global Rice Noodles Market reached a valuation of USD 6.0 Billion in 2024 and is projected to soar to USD 17.4 Billion by 2033, growing at an impressive CAGR of 11.7%. This dynamic expansion is fueled by the rising global appetite for Asian cuisine, increased availability of gluten-free and healthy noodle alternatives, and the convenience offered by instant and ready-to-cook variants. With consumers increasingly prioritizing both taste and wellness,…

More Releases for Urea

Urea Formaldehyde Market Size Report 2025

"Global Urea Formaldehyde Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Urea Formaldehyde market, including Urea Formaldehyde market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings, product types and applications. This report…

Global Marine Urea Solution Market Size by Application, Type, and Geography: For …

According to Market Research Intellect, the global Marine Urea Solution market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The market for marine urea solutions is expanding significantly due to stricter environmental rules that aim to lower…

Urea market: Market Indicators Showing Positive Outlook

The new report published by The Business Research Company, titled Urea Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the urea market size has grown steadily in recent years. It will grow from $47.64 billion in 2023…

Granular Urea Market: Cultivating Growth and Fertility with Premium Granular Ure …

The Worldwide "Granular Urea Market" 2023 Research Report presents a professional and complete analysis of the Global Granular Urea Market in the current situation. This report includes development plans and policies along with Granular Urea manufacturing processes and price structures. the reports 2023 research report offers an analytical view of the industry by studying different factors like Granular Urea Market growth, consumption volume, Size, revenue, share, trends, and Granular Urea…

Urea Market: Asia-Pacific to Lead Urea Market Growth with Rapid Industrializatio …

[100+ Pages Report] | Global "Urea Market" research report provides Innovative Insights on the Strategies adopted by Major Global in the worldwide industry. This valuable information offers businesses and investors a clear understanding of the market's Competitive Landscape, Growth Potential, and Impending Opportunities. The modern report highlights Latest Mergers, Achievements, Revenue Offshoring, R & D, Development Plans, Progression Growth, and Collaborations.

The global urea market size was valued at USD 107.28…

Polymer Sulphur Coated Urea Accounts for Over 90% of the Sales of Global Sulphur …

The impact of the COVID-19 outbreak has compelled several manufacturers and industries to rethink their operations to gradually recover from the losses incurred for years to come. The organic chemicals industry suffered a huge setback due to halted production and a limited supply of raw materials.

The report offers actionable and valuable market insights of Polymer Sulphur Coated Urea. The latest report by Fact.MR provides details on the present scenario of the…