Press release

United States Fintech Market is Expected to Grow USD 193.2 Billion by 2034 | At CAGR 13.80%

IMARC Group has recently released a new research study titled United States Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

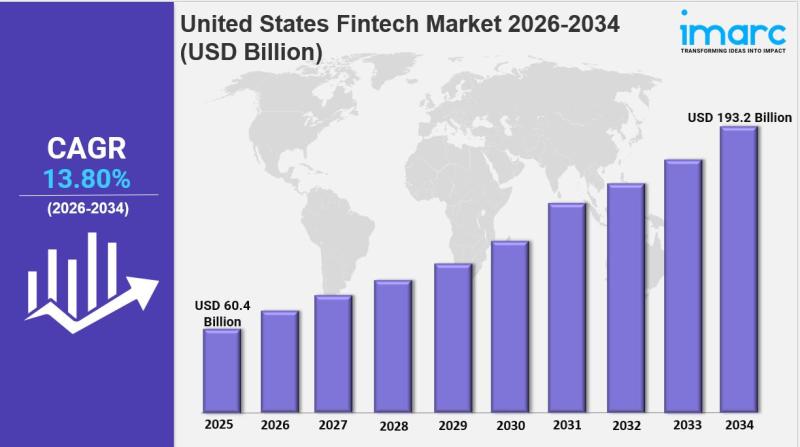

The United States fintech market was valued at USD 60.4 Billion in 2025 and is forecasted to reach USD 193.2 Billion by 2034. The market is projected to grow at a CAGR of 13.80% over the forecast period 2026-2034. Growth is driven by the growing demand for convenient and user-friendly financial services, increasing development of innovative platforms for payments, lending, wealth management, and insurance, and rising emergence of decentralized finance (DeFi).

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

United States Fintech Market Key Takeaways

• Current Market Size: USD 60.4 Billion in 2025

• CAGR: 13.80%

• Forecast Period: 2026-2034

• Accelerated digitalization, penetration of smartphones, and aspirations for smooth financial experiences are driving innovation.

• Favorable regulatory policies and innovations in technologies such as AI and blockchain are prompting financial institutions and technology startups to provide integrated, user-friendly financial services.

• Rising uptake of embedded finance, automation, and decentralized protocols is shaping industry trends.

• Customers are drawn to mobile-first offerings with tailored insights, as fintech platforms mature to bring lending, payments, and investment functionality into integrated, accessible digital ecosystems.

• Growing awareness and increasing access to financial services present considerable opportunities for scalable, inclusive, and technologically enabled financial solutions.

Sample Request Link: https://www.imarcgroup.com/united-states-fintech-market/requestsample

United States Fintech Market Growth Factors

The accelerating digitalization and widespread smartphone adoption are primary drivers of the United States fintech market. Consumers increasingly demand convenient, user-friendly financial services accessible from their mobile devices. This shift has spurred innovation in mobile banking, digital payments, and on-demand financial management tools. Financial institutions and fintech startups are responding by developing integrated platforms that consolidate banking, investing, payments, and budgeting within cohesive digital interfaces. The use of APIs and cloud-based infrastructure enables seamless connectivity and enhanced user experiences, making financial services more accessible across diverse demographics.

Favorable regulatory frameworks and technological advancements in artificial intelligence and blockchain are catalyzing market expansion. Regulatory clarity around digital banking, cryptocurrency, and open banking initiatives encourages both established financial institutions and new entrants to innovate. AI-powered solutions enhance decision-making, fraud detection, and personalized customer service, while blockchain enables secure, transparent, and efficient transactions. These technologies are being integrated into lending platforms, wealth management services, and insurance products, creating new opportunities for fintech providers to differentiate their offerings and capture market share in a competitive landscape.

The emergence of embedded finance and decentralized finance (DeFi) represents a transformative trend in the fintech ecosystem. Embedded finance allows non-financial platforms to offer banking and payment services directly within their applications, expanding the reach of financial products beyond traditional institutions. DeFi leverages blockchain technology to provide peer-to-peer financial services without intermediaries, offering greater transparency and accessibility. As regulatory guidance evolves and institutional participation increases, hybrid models that combine centralized efficiency with decentralized innovation are gaining traction. This evolution supports the development of programmable, inclusive financial architectures that meet diverse consumer and business needs across multiple segments.

United States Fintech Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the United States fintech market report, along with forecasts at country level for 2026-2034. The market has been categorized based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

• On-premises

• Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

• Application Programming Interface

• Artificial Intelligence

• Blockchain

• Robotic Process Automation

• Data Analytics

• Others

A detailed breakup and analysis of the market based on the technology has also been provided in the report. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

Application Insights:

• Payment and Fund Transfer

• Loans

• Insurance and Personal Finance

• Wealth Management

• Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

• Banking

• Insurance

• Securities

• Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

• Northeast

• Midwest

• South

• West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape

The report has also provided a comprehensive analysis of the competitive landscape in the market. Participants in the market consist of a combination of legacy banks, technology providers, and digital-native companies. Fierce competition is centered on service personalization, user acquisition, and innovation, with the players using cloud infrastructure, user interfaces, and data analytics to differentiate their offerings and maintain their market share. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=10452&flag=C

Latest News and Developments

• In January 2025, Trump Media and Technology Group announced that its fintech brand, Truth.Fi, would launch and provide investments in ETFs, SMAs, Bitcoin, and cryptocurrencies. The services will be launched later in 2025 subject to regulatory approval with a $250 million funding support.

• In July 2024, the Miami-based wealthtech start-up Waltz launched a digital platform to facilitate foreign buyers buying US residential property in just 30 days. The platform simplifies LLC setup, online banking, and access to mortgages, and has operations across nine states with an expansion planned in Arizona.

• In April 2024, Ushur released an AI-driven self-service platform to make Know Your Customer (KYC) and paperless enrollment automated, allowing financial institutions to grow compliance, minimize manual effort, and provide secure, omnichannel digital engagement at scale.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Fintech Market is Expected to Grow USD 193.2 Billion by 2034 | At CAGR 13.80% here

News-ID: 4372662 • Views: …

More Releases from IMARC Group

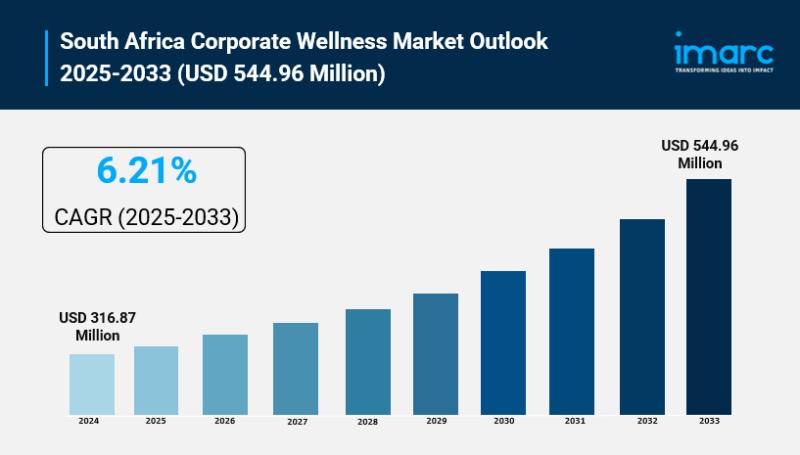

South Africa Corporate Wellness Market Size to Hit USD 544.96 Million by 2033 | …

South Africa Corporate Wellness Market Overview

Market Size in 2024: USD 316.87 Million

Market Size in 2033: USD 544.96 Million

Market Growth Rate 2025-2033: 6.21%

According to IMARC Group's latest research publication, "South Africa Corporate Wellness Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa corporate wellness market size reached USD 316.87 Million in 2024. Looking forward, the market is expected to reach USD 544.96 Million by 2033, exhibiting a…

Saudi Arabia Car Rental and Leasing Market Set to Surge to USD 3.7 Billion by 20 …

Saudi Arabia Car Rental and Leasing Market Overview

Market Size in 2025: USD 2.9 Billion

Market Size in 2034: USD 3.7 Billion

Market Growth Rate 2026-2034: 2.76%

According to IMARC Group's latest research publication, "Saudi Arabia Car Rental and Leasing Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia car rental and leasing market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach…

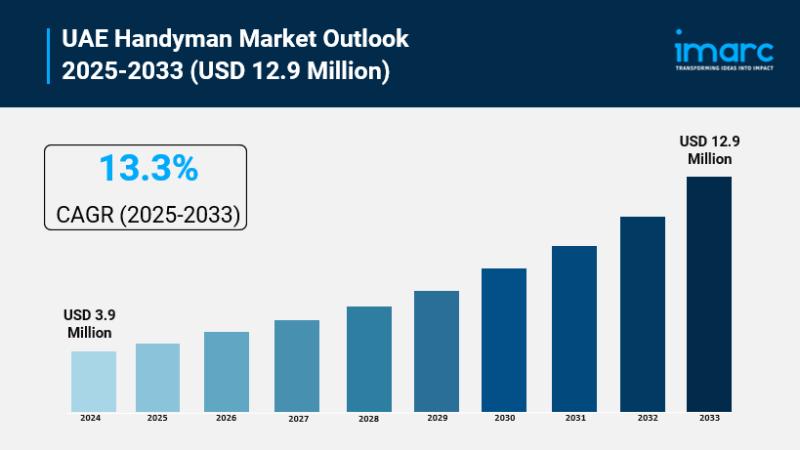

UAE Handyman Market Size is Expected to Reach USD 12.9 Million By 2033 | CAGR: 1 …

UAE Handyman Market Overview

Market Size in 2024: USD 3.9 Million

Market Size in 2033: USD 12.9 Million

Market Growth Rate 2025-2033: 13.3%

According to IMARC Group's latest research publication, "UAE Handyman Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE handyman market size reached USD 3.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 12.9 Million by 2033, exhibiting a growth rate (CAGR) of 13.3%…

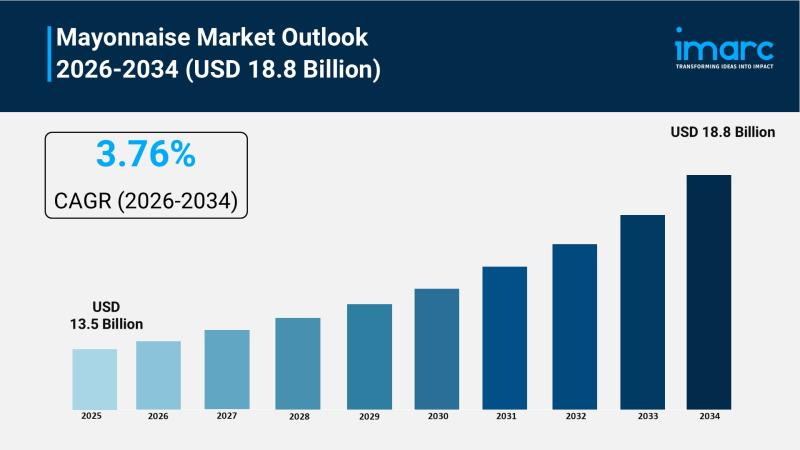

Mayonnaise Market Size to Surpass USD 18.8 Billion by 2034, With a 3.76% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Mayonnaise Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global mayonnaise market size reached USD 13.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 18.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.76% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts.…

More Releases for United

AI Image Recognition Market Will Hit Big Revenues In Future | Google (United Sta …

According to HTF Market Intelligence, the Global AI Image Recognition market to witness a CAGR of 13.42% during the forecast period (2024-2030). The Latest Released AI Image Recognition Market Research assesses the future growth potential of the AI Image Recognition market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify…

Movable Walls Market By Top Key Players- Hufcor (United States), Dormakaba (Swit …

Global Movable Walls Market Report from Advance Market Analytics (AMA) covers market characteristics, size and growth, segmentation, regional breakdowns, competitive landscape, market shares, trends and strategies for this market. The market characteristics section of the report defines and explains the market. The market size section gives the electronic equipment market revenues, covering both the historic growth of the market and forecasting the future. Drivers and restraints looks at the external…

Military Personal Protective Equipment Market 2024 | 3M Ceradyne (United States) …

Military personal protective equipment has become a crucial and standard element of soldier equipment. One of the major factor driving the market is the increasing role of ground troops in different parts of the world such as Iraq, Afghanistan and India among others. The demand for military personal protective equipment is anticipated to be driven by modernization initiatives undertaken by several large defense spenders globally and various internal security threats,…

Internet of Things Market 2021 | Google Inc. (United States), Cisco Systems Inc. …

The Internet of Things refers to the network of physical objects that attribute an IP address for Internet connectivity. Internet of Things is defined as an invisible and intelligent network of things that communicate indirectly or directly with each other. Internets of Things enable communication between the physical objects and other internet-enabled systems and devices. In addition, Internet of Things also makes the life of consumers much more comfortable and…

Logistics Market | Global Growing Industry Key Players - J.B. Hunt Transport Ser …

Market Research Reports Search Engine (MRRSE) has recently updated its massive research catalog by adding a new study, titled “Logistics Market”. The study offers a clear insight about the prevailing trends and innovations happening in the Logistics Market. Readers can further access details about research highlights and executive summary to gain a better idea about this assessment. The market overview covers key industry developments and market opportunity map during the…

Global Logistics Market 2024 | Key Players : J.B. Hunt Transport Services (Unite …

A fresh report has been added to the wide database of Market Research Report Search Engine (MRRSE). The research study is titled “Logistics Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2016 – 2024” which encloses important data about the production, consumption, revenue and market share, merged with information related to the market scope and product overview.

Request for a sample of this research report @ https://www.mrrse.com/sample/2184

Logistics is…