Press release

Commercial loan software market grows as cloud, AI automation transform lending globally!

The global commercial loan software (CLS) market was valued at USD 6.13 billion in 2024 and is projected to grow from USD 6.71 billion in 2025 to USD 15.88 billion by 2035, registering a CAGR of 9.1% during the forecast period. This growth reflects a strategic shift across financial institutions toward digitized, automated, and cloud-based lending platforms that enhance operational efficiency, compliance, and customer experience.Commercial loan software solutions are increasingly adopted to streamline loan origination, underwriting, risk assessment, servicing, and regulatory compliance. In 2024, more than 68% of mid-sized banks in North America transitioned to digital loan processing systems, citing reduced turnaround times and improved regulatory alignment. The growing adoption of embedded finance, API-driven integrations, and AI-powered credit scoring is further reshaping commercial lending workflows globally.

Commercial Loan Software Market - Competitive Scenario and Insights

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=6262

The commercial loan software market features a competitive landscape led by established technology providers and emerging fintech innovators. Key players such as FIS, Finastra, nCino, and Temenos dominate the market by offering modular, cloud-native platforms tailored to commercial lending operations. nCino continues to gain traction among regional banks through its AI-based credit decisioning tools, while Finastra is expanding the global footprint of its Fusion Loan IQ platform. Emerging vendors like Lendisoft and CloudBnq focus on niche segments such as SME and community bank lending. Competitive differentiation increasingly depends on user experience, AI capabilities, regulatory compliance features, and seamless system integration.

Recent Developments

In August 2025, HyperVerge launched an AI-driven loan origination system focused on advanced fraud detection and real-time analytics, improving underwriting speed and accuracy. Also in August 2025, M2P Fintech introduced Finflux, a configurable AI-powered loan origination platform designed for microfinance, retail, and SME lending, offering extensive third-party integrations and automated decision-making.

Key Market Drivers

Financial institutions are increasingly automating loan workflows to reduce costs, improve compliance, and accelerate approvals. In 2024, over 70% of banks with assets exceeding USD 10 billion automated core loan processes, supported by regulatory encouragement from bodies such as the OCC and FDIC. Digital SME lending surged in 2024, particularly in Asia-Pacific, with loan applications rising by nearly 28%. This trend is driving demand for flexible repayment models, digital onboarding, and advanced SME-focused credit scoring tools. Additionally, AI-driven credit assessment and fraud detection are significantly improving loan performance. Banks using AI-based systems reported nearly 20% lower default rates and 25% improvement in loan origination efficiency, reinforcing AI as a core capability in modern lending software.

Browse in Depth: https://www.meticulousresearch.com/product/commercial-loan-software-market-6262

Regional Analysis

North America holds the largest revenue share in 2025, driven by aggressive cloud migration, strong regulatory clarity, and widespread AI adoption. Over 60% of U.S. banks adopted cloud-based lending platforms in 2024, supported by fintech partnerships and regulatory guidance. Asia-Pacific is projected to grow at a 10.9% CAGR through 2035, fueled by fintech innovation, mobile-first lending platforms, and rapid SME growth in countries such as India, China, and Southeast Asia. China's CLS market is expanding rapidly due to government-backed digital finance initiatives, while Germany's market growth is driven by EU compliance mandates, SME financing demand, and ESG-focused lending platforms.

Segmental Insights

Loan Origination Software leads the market with approximately 30% share in 2025, driven by AI-driven credit decisioning and digital onboarding. The Solutions Segment dominates with over 70% revenue share, as institutions prioritize end-to-end platforms covering origination, risk management, servicing, and compliance.

Commercial Loan Software Market - Report Highlights

The market size in 2025 stands at USD 6.71 billion and is forecast to reach USD 15.88 billion by 2035, growing at a CAGR of 9.1% from 2025 to 2035. Key companies operating in this market include nCino, Finastra, Temenos, FIS, Oracle, Newgen Software, ICE Mortgage Technology, M2P Fintech, HyperVerge, Q2 Holdings, and others.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1579

Related Reports:

Battery Passport Software Market: https://www.meticulousresearch.com/product/battery-passport-software-market-6257

Self Storage Software Market: https://www.meticulousresearch.com/product/self-storage-software-market-6241

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial loan software market grows as cloud, AI automation transform lending globally! here

News-ID: 4372417 • Views: …

More Releases from Meticulous Research®

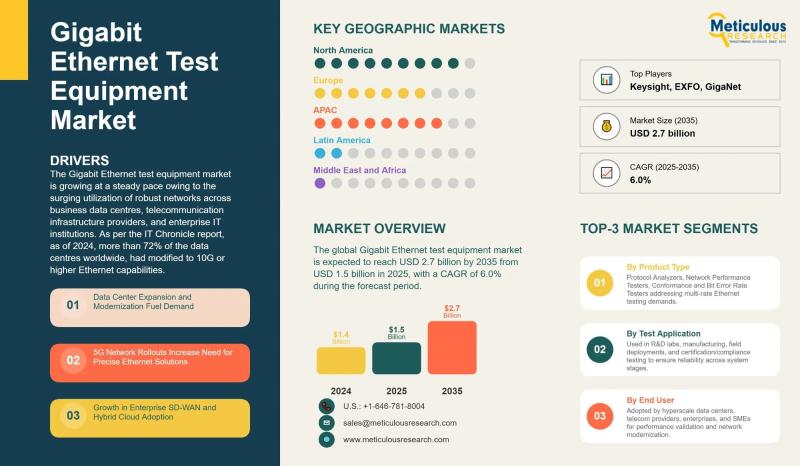

Gigabit Ethernet Test Equipment Market to Reach USD 2.7 Billion by 2035

The global Gigabit Ethernet test equipment market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.7 billion by 2035, growing from USD 1.5 billion in 2025 at a CAGR of 6.0% during the forecast period. The market is witnessing steady growth due to the rising adoption of high-speed Ethernet networks across hyperscale data centers, telecom infrastructure, and enterprise IT environments.

The increasing shift toward 10G,…

Marine & Aviation EV Charging Hubs Market to Reach USD 8.5 Billion by 2035

The global marine & aviation EV charging hubs market was valued at USD 1.2 billion in 2024 and is projected to grow from USD 1.6 billion in 2025 to USD 8.5 billion by 2035, expanding at a CAGR of 18.5% during the forecast period.

This strong growth reflects a structural shift across the maritime and aviation industries toward electrification and decarbonization, supported by tightening environmental regulations, government-backed incentives, and rapid advancements…

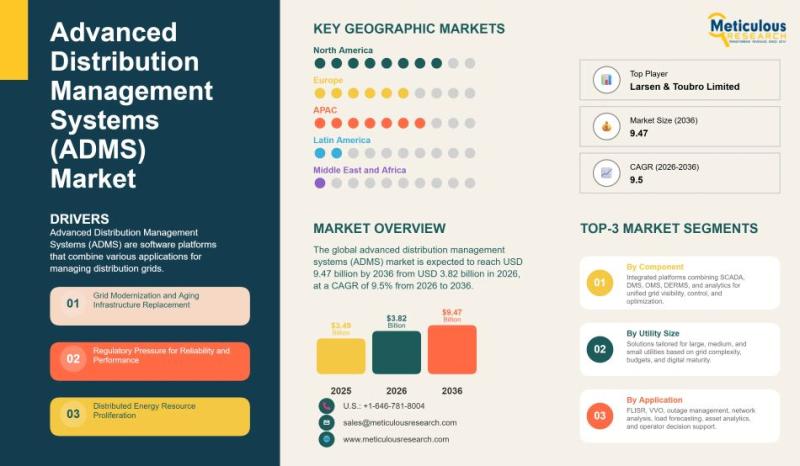

Global Advanced Distribution Management Systems (ADMS) Market Outlook 2026-2036

The Advanced Distribution Management Systems (ADMS) market is on track for remarkable growth over the next decade. Experts expect it to increase from about USD 3.8 billion in 2026 to nearly USD 9.5 billion by 2036, reflecting steady annual growth. ADMS has become a critical tool for utilities, helping them navigate the challenges of modern electricity grids, which are far more complex than the traditional, one-way power networks of the…

Global Space-Based Synthetic Aperture Radar (SAR) Data & Services Market Forecas …

The global space-based Synthetic Aperture Radar (SAR) data and services market is poised for significant growth over the next decade, driven by increasing demand for high-resolution, all-weather Earth observation capabilities. In 2025, the market was valued at approximately USD 27.8 billion, and it is projected to reach USD 29.9 billion in 2026. By 2036, it is expected to expand further to USD 76.2 billion, reflecting a robust compound annual growth…

More Releases for SME

SME Insurance - Market Size | Valuates Reports

SME Insurance - Market Size | Valuates Reports

The global market for SME Insurance was estimated to be worth US$ 18010 million in 2023 and is forecast to a readjusted size of US$ 24100 million by 2030 with a CAGR of 4.2% during the forecast period 2024-2030

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-3D7510/China_SME_Insurance_Market_Report_Forecast_2021_2027

Report Scope

This report aims to provide a comprehensive presentation of the global market for SME Insurance, focusing on the total sales revenue, key…

SME Force Automation Market Investment Analysis

The SME force automation market is expected to witness market growth at a rate of 15.20% in the forecast period of 2021 to 2028. Data Bridge Market Research report on SME force automation market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rising adoption of cloud sales force automation (SFA) software is escalating…

UK SME Insurance Market Report- Competitor Dynamics | Insurers can challenge the …

The research study contains an in detail descriptive overview and analysis of the UK SME Insurance Market, a summary of the UK SME Insurance Market shares constituted by each component, the annual growth of each sector, and the revenue potential of the section. In addition, UK SME Insurance Market production and consumption data are used to determine the geographical features.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4430784

AXA and…

INDIA: Big March for SME

In keeping with recent and ongoing changes in the business landscape, business is focusing on mobility rather than stability, and the service business has evolved accordingly. Globalization is the buzzword as geographic boundaries cease to exist. Business is competing for opportunities in an international arena. Because the world is connected in a single unit, any crisis in one part of the world has repercussions in other parts, too.

Small and medium-sized…

IndiaMART.com Pushes for Cohesive SME Ecosystem through SME Learning Series

Partners with Smallenterpriseindia.com for the Series

Series aims to bring clear understanding of Finance, HR, IT, Communication, Marketing & other business verticals to SMEs

Roadshows in Delhi, Ghaziabad, Gurgaon, Bangalore & Vadodara receive huge response

New Delhi, 28th May, 2011: Small and Medium Enterprises (SMEs) have been playing a vital role in growth and development of Indian economy. They are credited with generating million of job opportunities every year along with contributing a…

IndiaMART.com Plans Massive SME Awareness Campaign

To be launched in 2-3 weeks, campaign's theme centers on boosting awareness amongst SMEs on the need to go online

- Educate buyers & suppliers on how they can leverage Internet for 24X7 global presence, cost-effective marketing & B2B matchmaking

- Highlight catalyzing role of B2B e-marketplaces like IndiaMART.com in growth of SMEs

- Nation-wide drive to be launched across newspapers, magazines, online, radio, electronic & outdoor media

New Delhi,…