Press release

Health Insurance Market to Reach US$ 5.12 Trillion by 2034 at 7.4% CAGR; North America Leads with 40% Share | Key Players UnitedHealth Group, Aetna, Allianz, Cigna

The global Health Insurance market was valued at US$ 2.69 trillion in 2025 and is projected to reach US$ 5.12 trillion by 2034, growing at a CAGR of 7.4% during the forecast period 2025-2034. Market growth is driven by rising healthcare costs, increasing prevalence of chronic diseases, aging populations, and growing awareness of financial protection against medical expenses. Expansion of employer-sponsored insurance, government-backed health coverage programs, and increasing penetration of private health insurance are further supporting market growth. Additionally, digital transformation in insurance services, including online policy distribution, AI-based underwriting, and automated claims processing, is improving accessibility and operational efficiency.The market is witnessing strong momentum from recent investments in insurtech platforms, digital health integration, and data analytics, enabling insurers to offer personalized plans and faster claims settlement. Strategic partnerships between insurers, hospitals, and digital health providers are enhancing value-based care models and customer experience. North America holds the largest market share at approximately 39-40%, supported by high insurance penetration, advanced healthcare infrastructure, and strong public and private insurance systems. Asia-Pacific is the fastest-growing region, driven by rising healthcare expenditure, expanding middle-class population, government initiatives to increase insurance coverage, and rapid adoption of digital insurance platforms, while Europe continues to record steady growth due to universal healthcare frameworks and supplemental private insurance demand.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/health-insurance-market?sai-v

The Health Insurance market refers to the sector of financial services where companies offer policies that cover medical expenses and provide financial protection against health-related costs.

Key Developments

✅ January 2026: In North America, major health insurers such as UnitedHealth Group, Anthem (Elevance Health), Cigna, and Humana expanded digital member engagement platforms and AI-driven claims processing to improve customer experience and operational efficiency amid rising competition and demand for personalized health plans.

✅ January 2026: In Europe, adoption of integrated health insurance solutions grew as insurers like AXA, Allianz, and Bupa enhanced cross-border coverage options and data analytics capabilities to support digital-first insurance products and respond to changing regulatory landscapes.

✅ December 2025: In Asia-Pacific, rising healthcare costs and growing middle-class populations pushed insurers such as Star Health & Allied Insurance, Niva Bupa, Care Health Insurance, and ICICI Lombard to launch innovative wellness and preventive care-linked health insurance plans to increase market penetration.

✅ December 2025: Globally, the integration of AI and machine learning into underwriting and risk scoring systems by firms such as UnitedHealth Group, Cigna, and Anthem improved risk assessment accuracy and streamlined policy issuance, helping reduce claim turnaround times and fraud.

✅ November 2025: In India, increased competition and regulatory encouragement saw Life Insurance Corporation of India (LIC) announce plans to enter the health insurance space through strategic stakes in health insurers such as ManipalCigna, leveraging LIC's distribution network for broader coverage.

✅ October 2025: Worldwide, the rise of digital health platforms and insurtech partnerships, led by companies like Singlife, Oscar Health, and Lemonade, accelerated the shift toward AI-powered advisory and sales channels, improving digital customer acquisition and personalized plan recommendations.

Mergers & Acquisitions

✅ January 2026: Health Care Service Corporation (HCSC) acquired the Medicare Advantage, Medicare Part D, and supplemental benefit businesses from Cigna Group, rebranding the offerings under HealthSpring to expand membership reach and strengthen its portfolio in senior healthcare coverage.

✅ December 2025: Ergo Group fully acquired Next Insurance, entering the U.S. market and gaining foothold in small and medium business health and commercial insurance segments to diversify risk and capitalize on technology-first underwriting models.

✅ 2025: Medi Assist (India) acquired Paramount Health, boosting its managed health insurance services and expanding its role in Third Party Administration (TPA) across the health insurance ecosystem to increase scale and operational efficiency.

Key Players

Aetna Inc. (CVS Health Corporation) | AIA Group Limited | Allianz SE | Aviva Plc | Berkshire Hathaway Inc. | Cigna Corporation | International Medical Group Inc | Prudential Plc | United Health Group Inc | Zurich Insurance Group AG | Others

Key Highlights

United Health Group Inc holds 20% share, driven by its extensive healthcare network, integrated insurance and healthcare services, and strong presence in both commercial and government health plans.

Aetna Inc. (CVS Health Corporation) holds 18% share, supported by its wide range of health insurance products, pharmacy benefits management integration, and strong digital health platform.

Allianz SE holds 15% share, leveraging global insurance operations, diversified life and health insurance portfolio, and robust risk management capabilities.

Cigna Corporation holds 12% share, driven by its comprehensive health insurance offerings, wellness programs, and strong employer-based insurance solutions.

Aviva Plc holds 8% share, focusing on life and health insurance solutions across Europe, supported by strong customer service and digital insurance initiatives.

AIA Group Limited holds 7% share, supported by its leadership in Asia-Pacific insurance markets, strong distribution network, and life and health insurance expertise.

Berkshire Hathaway Inc. holds 6% share, leveraging its diversified insurance operations, strong capital reserves, and strategic acquisitions in the health insurance segment.

Prudential Plc holds 5% share, focusing on life and health insurance solutions with strong presence in Europe and Asia.

International Medical Group Inc holds 4% share, driven by its global health insurance services for expatriates, travel insurance, and international medical coverage.

Zurich Insurance Group AG holds 3% share, contributing through corporate and individual health insurance solutions, global reach, and strong risk assessment capabilities.

Others hold 2-5% share, comprising regional insurers and emerging health coverage providers expanding specialized insurance and wellness solutions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=health-insurance-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

- Rising healthcare costs and increasing out-of-pocket medical expenses driving demand for comprehensive health insurance coverage across populations.

- Growing awareness of preventive care, wellness programs, and financial protection against medical emergencies fueling adoption of health insurance plans.

- Government initiatives and regulatory mandates promoting universal health coverage and mandatory insurance enrollment in several regions.

- Expansion of employer-sponsored health insurance and group plans supporting workforce healthcare benefits and risk mitigation.

- Technological advancements, including digital platforms, telemedicine integration, and AI-driven underwriting, improving policy accessibility, claim processing, and customer experience.

Industry Developments

- Integration of AI, machine learning, and predictive analytics for personalized policy offerings, risk assessment, and fraud detection.

- Shift toward digital health insurance platforms, mobile applications, and online claim processing to enhance customer engagement and operational efficiency.

- Emergence of value-based care insurance models and wellness-linked policies incentivizing preventive healthcare and cost-effective treatment.

- Strategic partnerships between insurers, healthcare providers, and tech companies to expand product portfolios and service reach.

- Introduction of innovative health plans, such as telemedicine coverage, chronic disease management programs, and tailored insurance for niche segments like millennials and seniors.

Regional Insights

North America - 40% share: "Driven by well-established insurance markets, high healthcare expenditure, regulatory frameworks, and widespread employer-sponsored coverage."

Europe - 25% share: "Supported by universal healthcare policies, increasing private insurance adoption, and growing demand for supplemental health plans."

Asia Pacific - 23% share: "Fueled by rising healthcare awareness, expanding middle-class population, government insurance schemes, and digital health adoption."

Latin America - 7% share: "Driven by gradual expansion of private insurance, government initiatives, and increasing healthcare infrastructure."

Middle East & Africa - 5% share: "Supported by emerging insurance markets, growing healthcare access, and rising awareness of health coverage benefits."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/health-insurance-market?sai-v

Key Segments

By Provider

Private providers dominate the market due to their wide range of customizable plans, faster claim settlements, and advanced digital platforms that enhance customer experience. Public providers hold a steady share, supported by government-backed schemes, broader outreach, and affordable premiums, particularly appealing to low- and middle-income groups.

By Coverage

Health insurance represents the largest segment, driven by rising healthcare costs, increasing chronic disease prevalence, and government initiatives promoting universal coverage. Disease-specific insurance is growing steadily, supported by awareness of critical illnesses and the need for financial protection against high-cost treatments like cancer, cardiac care, and organ transplants.

By Plan Type

Family floater health insurance holds a significant share as it provides coverage for multiple members at lower premiums. Individual health insurance is widely adopted among working professionals seeking personal coverage. Critical illness and senior citizens' health insurance are fast-growing segments due to the increasing aging population and rising prevalence of lifestyle-related diseases. Group health insurance is favored by employers to ensure workforce welfare and meet statutory obligations.

By Distribution Channel

Individual agents continue to account for the largest share, leveraging personal relationships and trust to sell policies. Corporate agents and direct marketing are growing rapidly, driven by employer partnerships, digital platforms, and targeted online campaigns. Other channels, including bancassurance and online aggregators, are emerging as convenient, technology-driven alternatives for policy purchase and renewals.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Health Insurance Market to Reach US$ 5.12 Trillion by 2034 at 7.4% CAGR; North America Leads with 40% Share | Key Players UnitedHealth Group, Aetna, Allianz, Cigna here

News-ID: 4368299 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

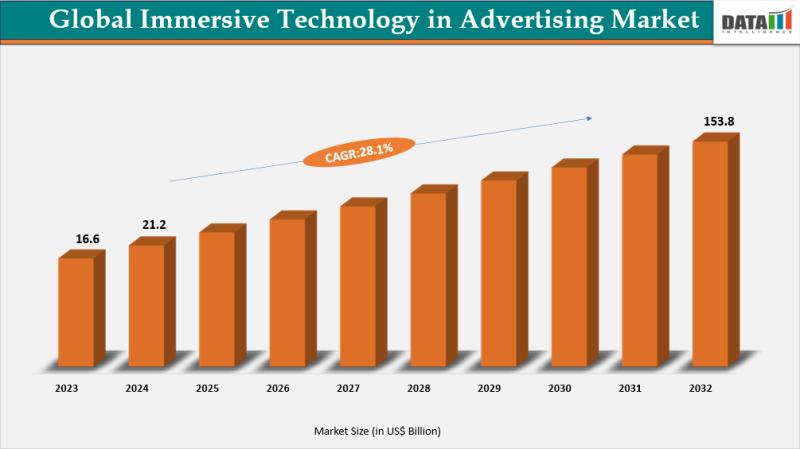

Immersive Technology in Advertising Market Set for Explosive Growth to USD 153.8 …

The Global Immersive Technology in Advertising Market reached USD 16.6 billion in 2023, rising to USD 21.2 billion in 2024 and is expected to reach USD 153.8 billion by 2032, growing at a CAGR of 28.1% from 2025 to 2032.

Market growth is driven by surging demand for interactive consumer experiences, widespread adoption of AR/VR in digital campaigns, and rising smartphone penetration enabling immersive ads. Advancements in metaverse platforms, integration of…

Cancer Registry Software Market to Reach US$ 291.6 Million by 2033 at 12.8% CAGR …

The global Cancer Registry Software market was valued at US$ 98.6 million in 2024 and is expected to reach US$ 291.6 million by 2033, growing at a CAGR of 12.8% during the forecast period 2025-2033. Market growth is driven by the rising global cancer incidence, mandatory cancer reporting requirements, and increasing adoption of digital health IT systems by hospitals, oncology centers, and public health agencies. Cancer registry software enables structured…

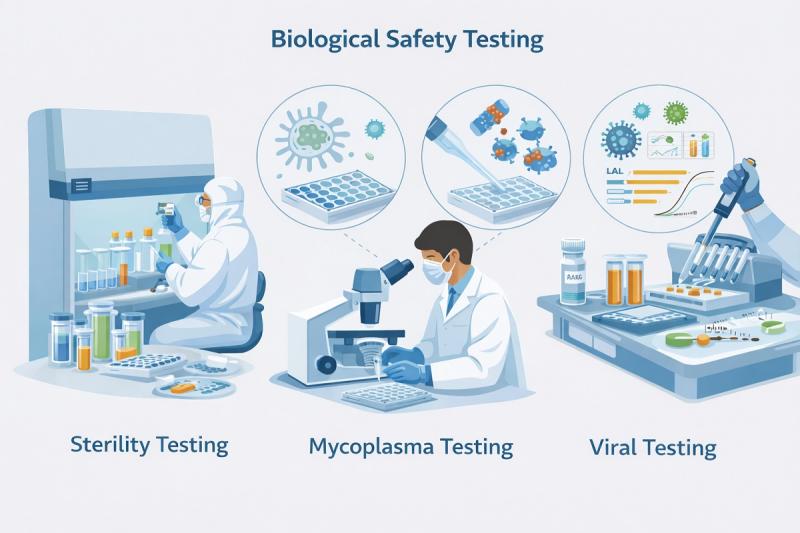

Biological Safety Testing Market to Reach US$ 14.21 Billion by 2032 at 11.8% CAG …

The Biological Safety Testing market reached US$ 5.82 billion in 2024 and is expected to reach US$ 14.21 billion by 2032, growing at a CAGR of 11.8% during the forecast period 2025-2032. Market growth is driven by the increasing production of biologics, vaccines, cell and gene therapies, and biosimilars, along with stringent regulatory requirements to ensure product safety, purity, and quality before commercialization.

Biological safety testing plays a critical role in…

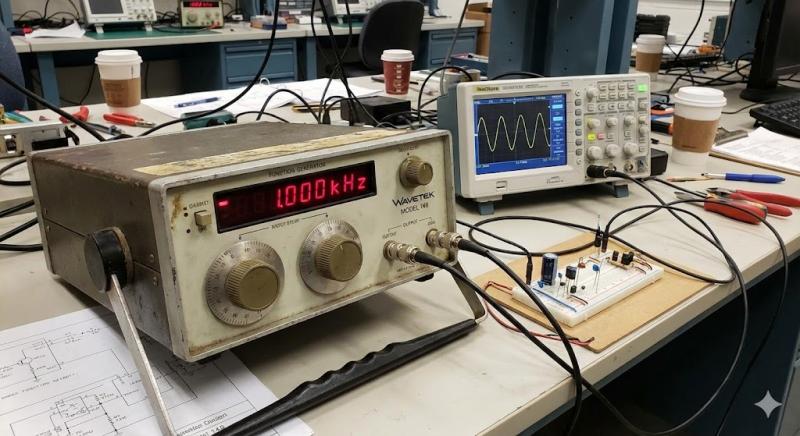

United States Function generator market is set to reach USD 572.43 million by 20 …

Function generator market size stood at USD 1.59 billion in 2019 and is projected to reach USD 3.31 billion by 2032, exhibiting a CAGR of 6.64% during the forecast period. Asia Pacific dominated the global market with a share of 43.4% in 2019. The Function generator market in the U.S. is projected to grow significantly, reaching an estimated value of USD 572.43 million by 2032.

The function generator market is growing…

More Releases for Health

Health Coach Market Positioned for Accelerated Growth with Iora Health, Virta He …

Global health coach market is estimated to be valued at USD 18.83 Bn in 2025 and is expected to reach USD 30.65 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Latest Report on the Health Coach Market 2025-2032, focuses on a comprehensive analysis of the current and future prospects of the Health Coach Market industry. An in-depth analysis of historical trends, future trends,…

Digital Therapeutics Market Research 2025 Leading Key Players - Proteus Digital …

An exclusive Digital Therapeutics Market research report created through broad primary research (inputs from industry experts, companies, and stakeholders) and secondary research, the report aims to present the analysis of Global Digital Therapeutics Market by Type, By Application, By Region - North America, Europe, South America, Asia-Pacific, Middle East and Africa. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment evaluation. Besides, the report…

Digital Therapeutics Market Outlook 2025 : Proteus Digital Health, Omada Health, …

ReportsWeb.com has announced the addition of the “Global Digital Therapeutics Market Size, Status and Forecast 2025” The report focuses on major leading players with information such as company profiles, product picture and specification.

This report studies the global Digital Therapeutics market, analyzes and researches the Digital Therapeutics development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market,…

Digital Therapeutics Market Outlook to 2025 - Propeller Health, CANARY HEALTH, N …

The global digital therapeutics market is segmented on the basis of application, distribution channel, and geography. The application segment includes, respiratory diseases, central nervous system disease, smoking cessation, medication adherence, cardiovascular diseases, musculoskeletal diseases, and other applications. Based on distribution channel, the digital therapeutics market is segmented as, B2B and B2C.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and…

Digital Therapeutics Market Analysis 2018 | Growth by Top Companies: Proteus Dig …

Global Digital Therapeutics Market to 2025

This report "Digital Therapeutics Market Analysis to 2025" provides an in-depth insight of medical device industry covering all important parameters including development trends, challenges, opportunities, key manufacturers and competitive analysis.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and often online health technologies to treat a medical or psychological condition. The treatment relies on behavioral and…

Digital Therapeutics Market Global Outlook to 2025 - Proteus Digital Health, Wel …

“Digital Therapeutics Market" covers a detailed research on the industry with financial analysis of the major players. The report provides key information and detailed study relating to the industry along with the Economic Impact and Regulatory and Market Support. The report examines the industry synopsis, strategic investments, Industry Surveys, Economic Impact, etc.

The market of digital therapeutics market is anticipated to grow with a significant rate in the coming years, owing…