Press release

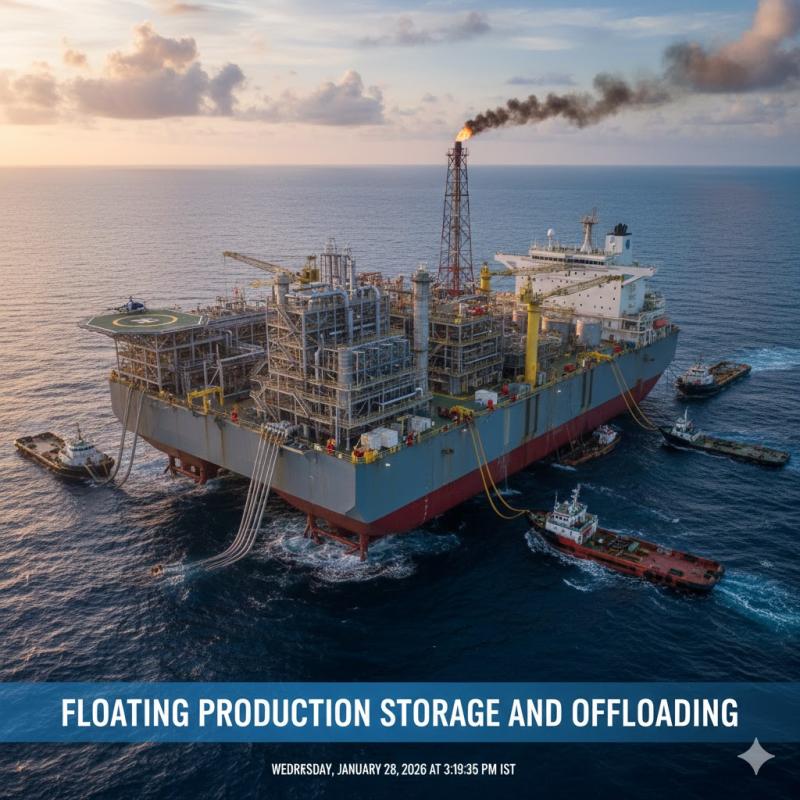

FPSO (Floating Production Storage and Offloading) Market to Reach USD 23.5B by 2031 | CAGR 6.5% | North America Leads with 32% Share | Key Players: BP Plc, Aker Solutions AS, Shell Global, Bluewater Energy Services B.V.,

Leander, Texas and Tokyo, Japan - Jan.28.2026The Global FPSO Market reached USD 14.2 billion in 2022 and is expected to reach USD 23.5 billion by 2031, growing with a CAGR of 6.5% during the forecast period 2024-2031.

The FPSO (Floating Production Storage and Offloading) market is expanding as offshore oil and gas operators seek flexible and cost-effective solutions for deepwater and ultra-deepwater developments. Advancements in vessel design, digital monitoring, and subsea integration are improving operational efficiency and safety. Rising offshore exploration activities and investments in complex offshore fields are driving strong market growth.

Download your exclusive sample report today: (corporate email gets priority access):https://www.datamintelligence.com/download-sample/fpso-market?praveen

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

FPSO : Competitive Intelligence

BP Plc, Aker Solutions AS, Shell Global, Bluewater Energy Services B.V., Bumi Armada Berhad, BW Offshore, Chevron, ExxonMobil Corporation, MODEC, Inc., and Petrobras

The global FPSO (Floating Production Storage and Offloading) market is driven by increasing offshore exploration and production activity, particularly in deepwater and ultra-deepwater fields where FPSOs provide flexible and cost-effective production solutions. Leading energy companies and engineering specialists including BP Plc, Aker Solutions AS, Shell Global, Bluewater Energy Services B.V., Bumi Armada Berhad, BW Offshore, Chevron, ExxonMobil Corporation, MODEC, Inc., and Petrobras shape the competitive environment through large-scale project developments, long-term leasing contracts, and advanced offshore engineering capabilities. These players focus on maximizing field recovery, reducing development timelines, and optimizing lifecycle costs, making FPSOs a critical asset class for offshore oil and gas production in regions such as Brazil, West Africa, the North Sea, and Southeast Asia.

Competitive differentiation is increasingly driven by digitalization, standardization, and sustainability-focused design. MODEC, BW Offshore, Bumi Armada Berhad, and Bluewater Energy Services B.V. are recognized for their expertise in FPSO leasing, conversion, and operations, while Aker Solutions AS contributes advanced subsea and topside engineering solutions that enhance project efficiency and safety. Supermajors such as BP Plc, Shell Global, Chevron, ExxonMobil Corporation, and Petrobras leverage strong balance sheets, global project portfolios, and deep technical expertise to sanction and operate large, complex FPSO developments. Together, these companies are shaping the future of the FPSO market through innovations in carbon reduction technologies, digital asset management, and modular FPSO designs, supporting the long-term viability of offshore production in an evolving energy transition landscape.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/fpso-market?praveen

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

United States: Recent Industry Developments

✅ In January 2026, ExxonMobil and SBM Offshore expanded FPSO engineering partnerships for deepwater projects in the Gulf of Mexico. The collaboration improves project execution. It enhances production efficiency.

✅ In November 2025, Chevron invested $750 million in FPSO-compatible subsea infrastructure upgrades. The investment supports ultra-deepwater developments. It improves long-term field economics.

✅ In September 2025, Modec secured new FPSO charter contracts for U.S.-linked offshore projects. The agreements strengthen production capacity. They support offshore energy security.

✅ In July 2025, Baker Hughes introduced advanced digital monitoring systems for FPSO asset management. The technology improves operational reliability. It reduces downtime and maintenance costs.

Japan: Recent Industry Developments

✅ In January 2026, Mitsubishi Heavy Industries and Modec expanded FPSO topside module fabrication capacity. The expansion supports global offshore demand. It strengthens project delivery timelines.

✅ In October 2025, NYK Line invested in FPSO fleet logistics and offshore support vessel integration. The investment improves operational efficiency. It enhances offshore supply chain resilience.

✅ In August 2025, Sumitomo Corporation entered new FPSO leasing and financing agreements for international offshore oil and gas projects. The deals improve project bankability. They support global energy development.

✅ In June 2025, JGC Corporation advanced modular FPSO design platforms for faster offshore deployment. The designs reduce construction time. They improve capital efficiency for operators.

Segment Covered in the FPSO Market

By Type

The FPSO market is segmented into Converted FPSOs 65% and New-Build FPSOs 35%. Converted FPSOs dominate the market due to lower capital expenditure, shorter project timelines, and the ability to repurpose aging oil tankers for offshore production. These advantages make conversions particularly attractive for marginal fields and brownfield developments. New-build FPSOs, while representing a smaller share, are gaining momentum for large, long-life deepwater projects where higher processing capacity, enhanced safety systems, and customized topside designs are required to support complex reservoir conditions.

By Carrier Type

Based on carrier type, the market is classified into Oil FPSOs 70% and Gas & Condensate FPSOs 30%. Oil FPSOs lead the market as they are widely deployed in offshore crude oil production, storage, and offloading operations. Their dominance is supported by continued offshore oil investments in regions such as Brazil, West Africa, and Southeast Asia. Gas and condensate FPSOs are experiencing steady growth, driven by rising offshore gas developments, increasing demand for cleaner-burning fuels, and the need for offshore processing solutions in remote gas fields where pipeline infrastructure is limited.

By Water Depth

By water depth, the market is segmented into Shallow Water 15%, Deepwater 45%, and Ultra-Deepwater 40%. Deepwater FPSOs represent the largest segment due to strong project activity in depths ranging from 1,000 to 3,000 meters, particularly in Brazil and the Gulf of Mexico. Ultra-deepwater FPSOs are growing rapidly as operators push into more challenging environments to access large offshore reserves. Shallow water FPSOs account for a smaller share, as fixed platforms are often more economical in these regions, though FPSOs remain relevant for redeveloped and marginal fields.

By Hull Type

Based on hull type, the market is divided into Single Hull 30% and Double Hull 70%. Double-hull FPSOs dominate due to stricter environmental regulations, enhanced spill protection, and improved safety standards. The double-hull design reduces the risk of oil leakage in the event of grounding or collision, making it the preferred choice for new-build and many converted FPSOs. Single-hull FPSOs are gradually declining as regulatory pressure increases and operators prioritize environmental compliance and long-term operational safety.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=fpso-market?praveen

Regional Analysis

North America - 32% Share

North America holds the largest share at around 32%, driven by extensive offshore oil and gas activities in the Gulf of Mexico and U.S. offshore fields. High investment in deepwater exploration, advanced engineering capabilities, and strong regulatory support for offshore production contribute to robust FPSO deployment. Major oil companies are increasingly adopting FPSOs to optimize production, storage, and export efficiency.

Europe - 20% Share

Europe accounts for approximately 20% share, supported by mature offshore markets in the North Sea, particularly in the U.K. and Norway. FPSOs are increasingly utilized to extend the life of existing fields and manage remote deepwater assets. Strong technological expertise, stringent safety standards, and a focus on environmentally responsible operations further boost adoption.

Asia Pacific - 28% Share

Asia Pacific represents roughly 28% share, fueled by rapid offshore exploration and production in regions such as Brazil (part of South America's influence but Asia-Pacific tech adoption in shipyards), China, Malaysia, and Australia. Growing energy demand, coupled with investments in deepwater oilfields, drives FPSO deployment. Local shipbuilding capabilities and partnerships with international operators are also strengthening market growth.

Latin America - 15% Share

Latin America contributes about 15% share, primarily led by Brazil's offshore pre-salt fields. FPSOs are a key solution for deepwater oil extraction, storage, and export in remote offshore locations. Strategic government support and long-term production contracts with oil majors drive regional adoption, although economic fluctuations can impact investment pace.

Middle East & Africa - 5% Share

Middle East & Africa captures approximately 5% share, driven by offshore exploration in Nigeria, Angola, and UAE waters. Increasing focus on deepwater production and offshore storage solutions supports FPSO demand. However, slower infrastructure development, political risks, and limited shipyard capabilities in some regions constrain market expansion.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?praveen

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FPSO (Floating Production Storage and Offloading) Market to Reach USD 23.5B by 2031 | CAGR 6.5% | North America Leads with 32% Share | Key Players: BP Plc, Aker Solutions AS, Shell Global, Bluewater Energy Services B.V., here

News-ID: 4366635 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Solid Oxide Fuel Cell Market | 30.0% CAGR; North America Leads wit …

Market Overview

The global Solid Oxide Fuel Cell (SOFC) market is projected to grow at an impressive CAGR of 30.0% during the forecast period (2025-2032). The market growth is being driven by the rising global demand for clean, efficient, and decentralized power generation systems, alongside the increasing emphasis on carbon reduction and renewable energy integration.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/solid-oxide-fuel-cell-market?Juli

(Single User Report:…

United States Foley Catheter Market 2031 | Growth Drivers, Key Players & Investm …

Market Size and Growth

The Global Foley Catheter Market reached US$ 1.67 billion in 2023 and is expected to reach US$ 2.59 billion by 2031, growing at a CAGR of 5.7% during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/foley-catheter-market?sb

Key Development:

United States: Recent Industry Developments

✅ In January 2026, Jabil opened an Advanced Catheter Development Lab in Florida, focused on accelerating…

Ovarian Cancer Market to Reach US$ 8.2B by 2031 | CAGR 23.7% | North America Lea …

Leander, Texas and Tokyo, Japan - Jan.28.2026

Global Ovarian Cancer Market reached US$ 1.8 billion in 2022 and is expected to reach US$ 8.2 billion by 2031 growing with a CAGR of 23.7% during the forecast period 2024-2031.

Ovarian cancer remains a major global health concern as late-stage diagnosis and high recurrence rates continue to challenge patient outcomes. Advances in early detection methods, targeted therapies, and personalized treatment approaches are improving…

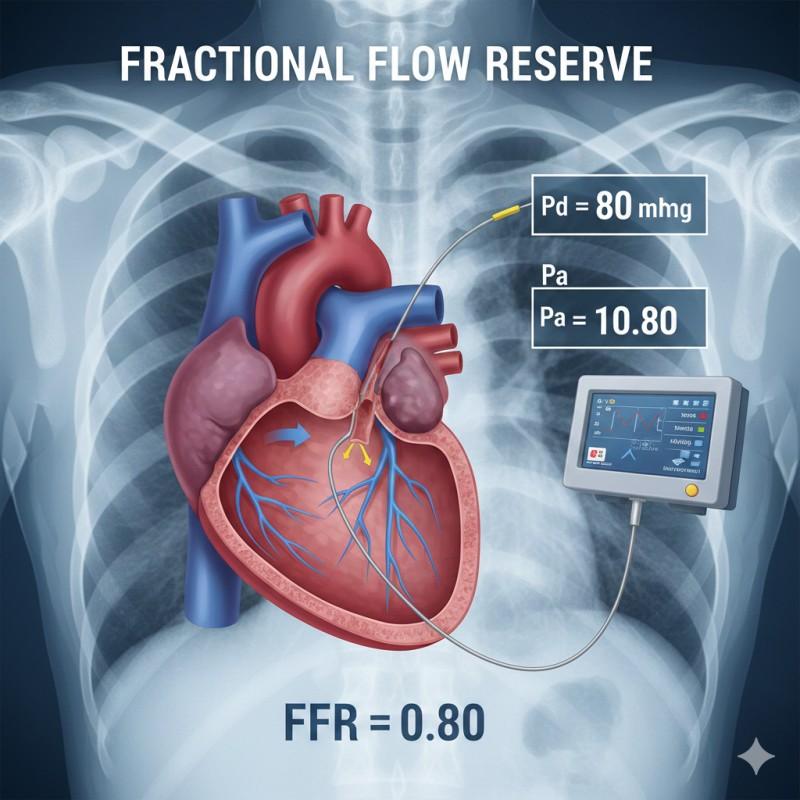

United States Fractional Flow Reserve Market 2031 | Growth Drivers, Key Players …

Market Size and Growth

The Global Fractional Flow Reserve Market reached US$ 881.35 million in 2023 and is expected to reach US$ 2,047.68 million by 2031, growing at a CAGR of 11.27% during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/fractional-flow-reserve-market?sb

Key Development:

United States: Recent Industry Developments

✅ In December 2025, Royal Philips agreed to acquire SpectraWAVE Inc., integrating the X1-FFR AI-enabled…

More Releases for FPSO

Global FPSO Industry Outlook to 2026 - Brazil Continues to Lead Global Upcoming …

A total of 55 planned and announced floating production, storage, and offloading units (FPSOs) are expected to start operations during the outlook period 2021-2026. South America leads globally with 25 planned and announced FPSOs, followed by Africa, Asia, and Europe. Among countries, Brazil continues to lead with 21 FPSOs to be deployed by 2026, followed by the UK with four. Among operators globally, Petroleo Brasileiro SA, Modec Inc and SBM…

Global FPSO Industry Outlook - Announced FPSO Additions by Key Operators, Scope, …

Market Research Hub (MRH) has actively included a new research study titled Q1 2019 Global FPSO Industry Outlook - Australia Leads FPSO Deployments in Asia-Pacific to its wide online repository. The concerned market is discoursed based on a variety of market influential factors such as drivers, opportunities and restraints. This study tends to inform the readers about the current as well as future market scenarios extending up to the period…

FPSO Market | Key Players - MODEC, Inc., SBM Offshore N.V., BW Offshore, Bluewat …

As per the current market trends and the promising nature of the “Global FPSO Market” market, it can be estimated that the future holds positive outcomes. In order to provide a deep insight about the concerned market, Market Research Reports Search Engine would be publishing a resourceful analysis that will enclose knowledge about the regional market size, revenue and opportunity status. Readers will be offered the privilege to decode various…

Global FPSO Market: Redeployed FPSO Systems Score High in Demand, Says TMR

According to Transparency Market Research, the competitive landscape in the global floating, production, storage, and offloading vessels is expected to grow stronger over the coming years. Mergers and acquisitions are among the more common consolidation strategies being carried out in the market. The market was led in 2015 by players such as Bumi Armada Berhad, Bluewater Energy Services B.V., and BW Offshore.

The TMR research report reveals that the global FPSO…

Q1 2017 Global FPSO Industry Outlook: Surge in Planned FPSO Delays

ReportsWorldwide has announced the addition of a new report title "Q1 2017 Global FPSO Industry Outlook: Surge in Planned FPSO Delays" to its growing collection of premium market research reports.

About 54 FPSOs are expected to start operations globally over the next four years. South America will continue to lead globally with planned deployment of around 23 FPSOs, followed by Africa and Europe by 2021. Among countries Brazil continues to be…

New Study Reveals Global FPSO Industry Outlook: Surge in Planned FPSO Delays Q1 …

Researchmoz added Most up-to-date research on "Q1 2017 Global FPSO Industry Outlook: Surge in Planned FPSO Delays" to its huge collection of research reports.

About 54 FPSOs are expected to start operations globally over the next four years. South America will continue to lead globally with planned deployment of around 23 FPSOs, followed by Africa and Europe by 2021. Among countries Brazil continues to be the leader, followed by the UK…