Press release

United States Solid Oxide Fuel Cell Market | 30.0% CAGR; North America Leads with 38% Share, Key Players: Bloom Energy, Mitsubishi Heavy Industries, Ceres Power, Aisin Seiki

Market OverviewThe global Solid Oxide Fuel Cell (SOFC) market is projected to grow at an impressive CAGR of 30.0% during the forecast period (2025-2032). The market growth is being driven by the rising global demand for clean, efficient, and decentralized power generation systems, alongside the increasing emphasis on carbon reduction and renewable energy integration.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/solid-oxide-fuel-cell-market?Juli

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

North America is expected to hold a significant share of the SOFC market, supported by strong regulatory frameworks, government incentives, and major private-sector investments in clean energy. The United States and Canada are leading the adoption of SOFC technology due to growing environmental awareness and the need for energy diversification. For instance, in 2019, the State of California launched the Self-Generation Incentive Program (SGIP) with a budget of US$ 566 million to promote electricity generation through fuel cell technologies. This initiative has accelerated commercial and residential SOFC installations across the region.

In Asia-Pacific, Japan is one of the largest consumers of solid oxide fuel cells, driven by strong government initiatives like the Ene-Farm Program, which focuses on deploying SOFC systems for micro-combined heat and power (micro-CHP) applications. Under this initiative, Japan aims to install 1.4 million SOFC units by 2020 and expand to 5.3 million units by 2030, contributing to significant energy efficiency and household energy independence.

Europe is also emerging as a promising region due to stringent carbon neutrality targets and the European Green Deal, which encourages clean hydrogen and fuel cell technologies in both stationary and transport applications.

Key industry players such as Bloom Energy, Aisin Seiki Co., Ltd., and Mitsubishi Heavy Industries, Ltd. are leading innovation in the SOFC market by developing scalable, high-efficiency fuel cell systems for distributed power generation, backup energy, and industrial applications. The increasing adoption of hydrogen-based and renewable-powered SOFCs in commercial, residential, and defense sectors is set to redefine global energy infrastructure, positioning solid oxide fuel cells as a cornerstone of next-generation clean power technology.

Recent Developments:

✅ January 2026 - United States: Bloom Energy announced the commissioning of a 10 MW solid oxide fuel cell microgrid in California to provide carbon-free power to a major data center, marking one of the largest SOFC-based installations in North America.

✅ November 2025 - Japan: Aisin Corporation and Panasonic Holdings expanded their partnership under Japan's Ene-Farm program, introducing a next-generation residential SOFC system with 10% higher electrical efficiency and 15% reduced installation cost.

✅ September 2025 - South Korea: POSCO Energy launched a commercial-scale 5 MW SOFC power generation unit in Incheon, supporting the country's transition toward distributed, hydrogen-powered energy systems.

✅ July 2025 - Germany: Siemens Energy completed successful trials of a hybrid SOFC system integrated with green hydrogen production for industrial power and heating applications, improving combined efficiency above 70%.

✅ May 2025 - United Kingdom: Ceres Power Holdings plc signed a multi-year licensing agreement with a leading automotive OEM to develop solid oxide fuel cells for electric vehicle range extenders and stationary backup power.

✅ March 2025 - China: The Chinese Academy of Sciences and SinoHyKey Hydrogen Energy Co. co-developed a high-temperature SOFC stack optimized for hydrogen-ammonia fuel blends, aimed at large-scale industrial energy storage.

Mergers & Acquisitions:

✅ December 2025 - Global: Bloom Energy and Samsung Heavy Industries expanded their collaboration to deploy marine SOFC systems for next-generation cargo and passenger vessels, reducing onboard emissions.

✅ October 2025 - Europe: Ceres Power entered a joint venture with Bosch to establish a pilot manufacturing facility in Germany for high-efficiency SOFC stacks aimed at industrial decarbonization.

✅ August 2025 - Japan: Mitsubishi Heavy Industries (MHI) acquired a minority stake in a local SOFC startup to accelerate commercialization of ammonia-fueled SOFC systems for distributed generation.

✅ June 2025 - United States: Cummins Inc. entered a strategic partnership with Bloom Energy to co-develop modular SOFC systems for data centers and commercial buildings, enabling clean backup and off-grid power solutions.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=solid-oxide-fuel-cell-market?Juli

Key Players:

Mitsubishi Heavy Industries, Ltd. | Ceres Power Holdings plc | Atrex Energy, Inc. | Watt Fuel Cell Corporation | Aisin Seiki Co., Ltd. | Ensol Systems Inc. | ZTEK Corporation, Inc. | Nexceris | KERAFOL Keramische Folien GmbH

Key Highlights:

• Mitsubishi Heavy Industries, Ltd. (MHI) - Holds an estimated 15% market share, leading in large-scale industrial and commercial SOFC installations. MHI's focus lies in ammonia- and hydrogen-fueled fuel cell systems, emphasizing clean distributed power generation and grid resilience across Asia and Europe.

• Ceres Power Holdings plc - Holds around 13%, specializing in SteelCell® technology, a cost-efficient SOFC platform licensed globally for both stationary and automotive applications. The company's strategic partnerships with Bosch, Weichai, and Doosan strengthen its global footprint.

• Atrex Energy, Inc. - Accounts for 9%, focusing on compact, low-maintenance SOFC systems for remote and portable power generation. Its modular systems serve defense, aerospace, and off-grid industrial markets.

• Watt Fuel Cell Corporation - Holds approximately 8%, manufacturing lightweight, hybrid SOFC systems for residential and small commercial use. The company's hybrid propane-electric designs provide reliable microgrid power solutions.

• Aisin Seiki Co., Ltd. - Holds 12%, a key player in Japan's Ene-Farm residential fuel cell program, producing micro-combined heat and power (micro-CHP) SOFC units for household energy efficiency.

• Ensol Systems Inc. - Holds 7%, offering off-grid and remote SOFC power solutions for telecommunications, mining, and industrial monitoring applications, particularly in North America and remote Arctic regions.

• ZTEK Corporation, Inc. - Holds 6%, developing high-efficiency solid oxide fuel cell stacks and power modules for industrial, defense, and renewable hybrid systems. The company is noted for its advancements in tubular SOFC architecture.

• Nexceris - Holds 10%, recognized for its InnovateSOFC platform and fuel cell components, including anode-supported cells and stack materials. Nexceris supplies core technology for global R&D, defense, and hydrogen projects.

• KERAFOL Keramische Folien GmbH - Holds 5%, specializing in ceramic membranes and electrolyte films used in SOFC stack manufacturing. Its materials are integral to improving thermal stability and overall system efficiency.

Market Segmentation:

By Type:

Planar SOFCs dominate the market with an estimated 70% share, owing to their simpler design, high power density, and scalability for stationary power applications. Planar systems are preferred for large installations, including industrial and data center energy systems, due to their efficient heat management and lower cost of manufacturing at scale.

Tubular SOFCs account for about 30%, offering superior thermal stability and mechanical strength, making them ideal for long-term, continuous operations in distributed generation and transportation applications. They are particularly used in hybrid systems integrating gas turbines and fuel cells for enhanced overall efficiency.

By Technology:

High-Temperature Solid Oxide Fuel Cells (SOFCs above 800°C) hold approximately 60% share, driven by their ability to operate directly on multiple fuels such as hydrogen, methane, and biogas without requiring external reformers. These systems are widely adopted for industrial and power generation purposes due to their high electrical efficiency and fuel flexibility.

Intermediate Temperature Solid Oxide Fuel Cells (IT-SOFCs, 500°C-800°C) account for 40%, offering longer lifespans and faster startup times while reducing material degradation. These systems are increasingly used in residential and commercial micro-CHP applications and portable energy solutions due to lower thermal stress and cost-effective stack components.

By Electrolyte Type:

Solid Ceramic Electrolytes lead with 65% share, as materials like yttria-stabilized zirconia (YSZ) and gadolinium-doped ceria (GDC) provide excellent ionic conductivity and high-temperature stability. They are the preferred choice for both planar and tubular SOFC architectures.

Polymer Electrolytes account for 25%, offering improved flexibility, lightweight design, and easier integration into portable and small-scale fuel cells, although they face temperature limitations.

By Capacity:

Less than 20 mAh holds 20% share, representing small-scale, portable SOFC systems used in consumer electronics, sensors, and micro-power devices.

20-500 mAh represents 40%, widely used in residential and commercial micro-CHP systems for efficient on-site power generation and combined heating.

More than 500 mAh leads with 40%, covering large stationary systems and grid-support applications in industrial, utility, and data center setups that demand continuous high-power output and extended operational life.

By Fuel:

Hydrogen dominates with 35% share, benefiting from global clean hydrogen initiatives and its compatibility with both high- and intermediate-temperature SOFC systems.

Methane holds 20%, utilized in natural gas-based SOFC systems for distributed and backup power applications.

Biogas represents 15%, offering a renewable and low-carbon alternative for small-scale and off-grid energy generation, particularly in agricultural and waste management sectors.

Ethanol and Methanol together account for 20%, driven by their use in portable and residential SOFC systems due to easier fuel storage and handling.

Propane and Others make up 10%, serving as backup or hybrid fuel sources in commercial and military field applications.

By Application:

Stationary Applications dominate with 65% share, as SOFC systems are increasingly deployed in distributed power generation, data centers, and combined heat and power (CHP) systems. Their high efficiency and low emissions make them ideal for replacing conventional grid-dependent systems.

Transportation accounts for 25%, growing rapidly with R&D investments in SOFC-powered electric vehicles, ships, and auxiliary power units (APUs) that leverage hydrogen and ammonia fuels.

Portable Applications represent 10%, driven by compact SOFC systems for defense, remote communication sites, and off-grid industrial use.

By End User:

Power Generation leads with 30% share, driven by the increasing integration of SOFC systems for decentralized, continuous, and backup energy production.

Residential and Commercial applications hold 25%, fueled by adoption of micro-CHP systems that provide both electricity and heat for homes and small businesses, particularly in Japan and Europe.

Military represents 10%, leveraging SOFCs for quiet, efficient, and portable energy sources in field operations.

Retail and Data Centers account for 20%, where reliable and emission-free power is critical for continuous operations and sustainability goals.

Combined Heat and Power (CHP) contributes 15%, combining thermal and electrical efficiency to optimize energy usage in industrial and commercial environments.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/solid-oxide-fuel-cell-market?Juli

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Regional Insights:

North America dominates the global solid oxide fuel cell market with an estimated 38% share, led by rapid technological adoption, strong government incentives, and large-scale private investments in clean energy. The United States is the key market, driven by growing demand for distributed power generation, data center backup systems, and hydrogen-based energy solutions. Government initiatives like the Self-Generation Incentive Program (SGIP) in California and the Hydrogen Energy Earthshot initiative have accelerated the deployment of SOFC systems. Leading players such as Bloom Energy and Atrex Energy are expanding their installations across commercial and industrial sectors, with increasing interest in decarbonized microgrids and hybrid fuel cell systems. Canada is also investing heavily in clean hydrogen and solid oxide fuel cell R&D for remote power and off-grid applications, further strengthening North America's market presence.

Europe holds around 28% of the market, propelled by the region's strong commitment to carbon neutrality, renewable integration, and clean hydrogen utilization under the European Green Deal. Countries like Germany, the United Kingdom, and Italy are leading adopters of SOFCs for industrial, residential, and combined heat and power (CHP) applications. Supportive funding programs such as Horizon Europe and Fuel Cells and Hydrogen Joint Undertaking (FCH JU) are boosting innovation and commercialization of SOFC systems across the continent. European companies, including Ceres Power and Siemens Energy, are spearheading collaborations with major OEMs to expand SOFC production for both stationary and mobility applications.

Asia-Pacific accounts for approximately 26%, with Japan, South Korea, and China being the primary markets. Japan remains a global leader in residential SOFC deployment through the Ene-Farm program, which has already installed over 400,000 units for micro-CHP use. The country's focus on hydrogen infrastructure and smart homes continues to drive steady growth. South Korea is rapidly advancing commercial-scale SOFC power plants with investments from companies like POSCO Energy and Doosan Fuel Cell, while China is intensifying R&D efforts to integrate SOFC systems into its new energy vehicle (NEV) and industrial decarbonization strategies.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Solid Oxide Fuel Cell Market | 30.0% CAGR; North America Leads with 38% Share, Key Players: Bloom Energy, Mitsubishi Heavy Industries, Ceres Power, Aisin Seiki here

News-ID: 4366588 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Regenerative Agriculture Market to Reach USD 48.14 Billion by 2032 | Cover Cropp …

The Global Regenerative Agriculture Market USD 12,634.54 million in 2024 and is projected to witness lucrative growth by reaching up to USD 48,139.24 million by 2032. The market is growing at a CAGR of 18.20% during the forecast period 2025-2032.

The Regenerative Agriculture Market is rapidly gaining traction as farmers, agribusinesses, and policymakers focus on sustainable practices that restore soil health, enhance biodiversity, and mitigate climate change. Driven by increasing consumer…

United States Neonatal Intensive Care Unit Market 2026 | Growth Drivers, Trends …

Market Size and Growth

Neonatal intensive care unit market is estimated to reach at a CAGR of 4.19% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/neonatal-intensive-care-unit-market?sb

Key Development:

United States: Recent Industry Developments

✅ In February 2026, VirtuAlly became one of the first in the nation to integrate experienced virtual registered nurses into a Level IV Neonatal Intensive Care Unit care team,…

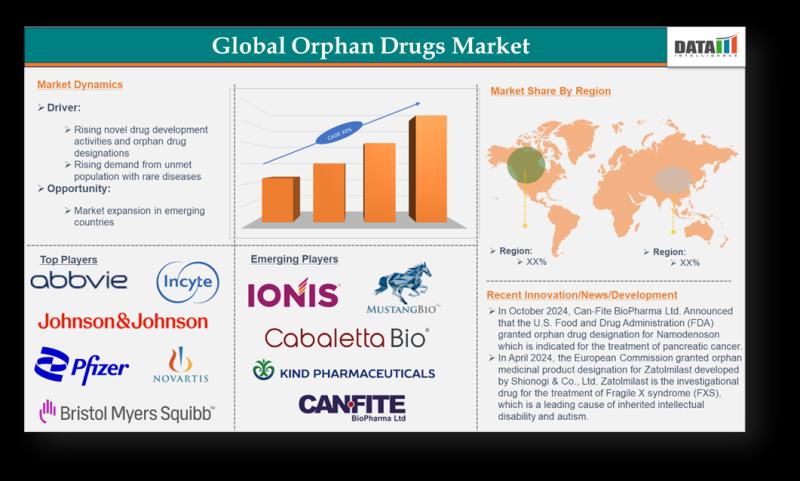

Orphan Drugs Market to Surge Beyond USD 350 Billion by 2033 | Biologics, Gene & …

The Global Orphan Drugs Market reached US$ 223.76billion in 2023 and is expected to reach US$ 486.51 billion by 2032, growing at a CAGR of 9.1% during the forecast period 2024-2032.

The Orphan Drugs Market is witnessing rapid growth as pharmaceutical companies and healthcare systems focus on developing treatments for rare and life-threatening diseases that affect small patient populations. Driven by increasing regulatory support, such as orphan drug designations, tax incentives,…

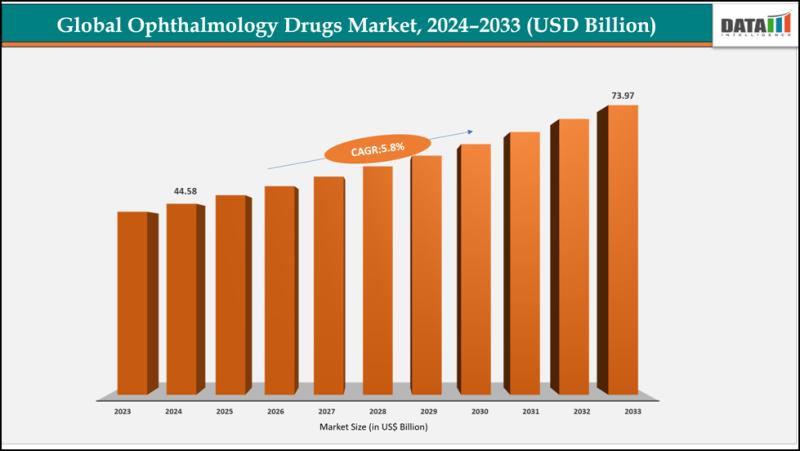

Ophthalmology Drugs Market to Reach USD 73.97 Billion by 2033 | Biologics, Anti- …

The global ophthalmology drugs market reached US$ 42.30 Billion with a rise of US$ 44.58 Billion in 2024 and is expected to reach US$ 73.97 Billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033.

The Ophthalmology Drugs Market is experiencing steady expansion driven by the rising prevalence of vision-related disorders such as glaucoma, dry eye syndrome, retinal diseases, and age-related macular degeneration. Increasing screen exposure, aging…

More Releases for SOFC

Global SOFC and SOEC Market Research Report 2023-2029

The global SOFC and SOEC market was valued at US$ 1,289.69 million in 2022 and is anticipated to reach US$ 7,657.82 million by 2029, witnessing a CAGR of 29.56% during the forecast period 2023-2029. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

North American market for SOFC and SOEC is estimated to increase from $ 813.94 million in 2022 to reach $ 5,164.85 million by…

SOFC Market Key Vendors, Segment, Growth Opportunities

solid oxide fuel cell market size was estimated at USD 1.7 billion in 2021 and is foreseen to touch USD 14.8 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 27.18% over the forecast period 2022 to 2030.

A negative electrode (an anode) and a positive electrode (a cathode) sandwiched over an electrolyte engage in an electrochemical reaction to produce an electric current, which is common…

Solid Oxide Fuel Cell (SOFC) Market 2022 | Detailed Report

The Solid Oxide Fuel Cell (SOFC) research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market's key players. Furthermore, the report offers insightful market data and information about…

SOFC Market 2022 | Detailed Report

The SOFC report compiles the market information depending upon market development and growth factors, optimizing the growth path. In addition, it highlights the strategies and market share of the leading vendors in the particular market. The report follows a robust research methodology model that helps to make informed decisions. It obtains both qualitative and quantitative market information supported by primary research.

The SOFC research report recognizes and gets fundamental and various…

SOFC and SOEC Market 2022 | Detailed Report

The research reports on “SOFC and SOEC Market” report gives detailed overview of factors that affect global business scope. SOFC and SOEC Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. An exclusive data offered in this report is collected by research and industry experts team.

Download FREE Sample Report @…

SOFC and SOEC Market 2021 | Detailed Report

According to Market Study Report, SOFC and SOEC Market provides a comprehensive analysis of the SOFC and SOEC Market segments, including their dynamics, size, growth, regulatory requirements, competitive landscape, and emerging opportunities of global industry. An exclusive data offered in this report is collected by research and industry experts team.

Get Free Sample PDF (including full TOC, Tables and Figures) of SOFC and SOEC Market @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4672429

The report provides a…