Press release

Debt Settlement Firm One Payment Plan Offers Financial Literacy Guidance and Connects Clients with Qualified Debt Relief Partners

One Payment Plan offers consumers a clear path toward financial stability by explaining options and matching individuals with qualified debt management partners.Image: https://www.globalnewslines.com/uploads/2026/01/5be32e1c9ff695525c68c7e6118db6a5.jpg

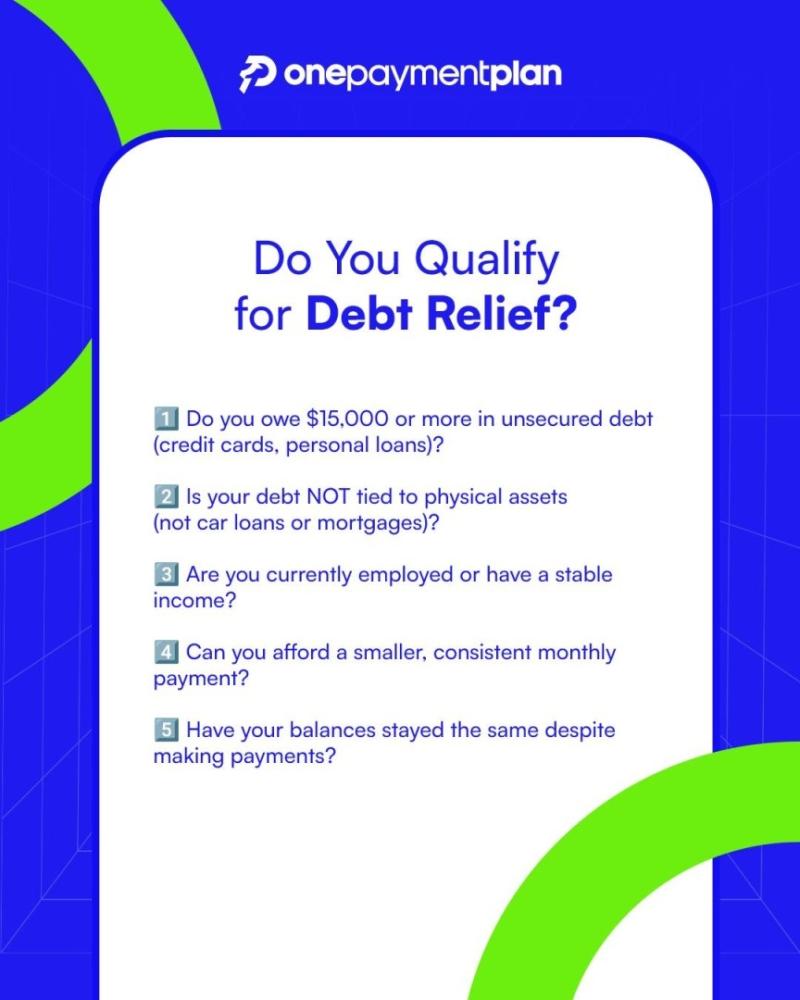

As household debt in the United States continues to climb, more consumers are actively searching for legitimate, trustworthy help. One Payment Plan [https://www.onepaymentplan.com/] is a financial services comparison platform designed to bring clarity to the complex debt relief landscape by helping individuals understand their options and connect with vetted debt relief partners nationwide.

For many consumers, the most challenging aspect of seeking help is determining whom to trust. The debt relief industry comprises both reputable providers and unscrupulous actors, and misinformation is prevalent. One Payment Plan was explicitly created to solve that problem - offering a structured way for users to explore programs, compare options, and avoid providers that fail to meet transparency and compliance standards.

"One Payment Plan exists because consumers deserve better than pressure, confusion, and misleading marketing," said CEO Elias Ervill. "Our focus is on education first. When people understand their options, they can make better decisions. From there, we connect them with partners who are committed to ethical practices and long-term outcomes."

Through its platform, One Payment Plan [https://www.onepaymentplan.com/] enables individuals to evaluate potential solutions based on their unique financial situation, taking into account factors such as debt amount, income, and personal goals. Depending on the partner and program selected, consumers may explore options such as debt settlement programs, debt management plans, or consolidation alternatives designed to simplify payments and provide a more straightforward path forward.

Many users come to One Payment Plan after struggling to keep up with multiple monthly payments across credit cards, medical bills, and personal loans. The platform is designed to make that process easier by helping consumers compare reputable providers in one place rather than navigating the market alone.

Education remains a central component of the company's approach. One Payment Plan encourages users to thoroughly understand the program's terms, timelines, and expectations before proceeding with any third-party service. The company's support team assists consumers throughout the exploration process, helping them navigate questions and next steps.

"One of the most common things we hear is relief - not because someone has signed up yet, but because they finally understand their options," Ervill said. "That clarity alone can be incredibly powerful for people who have felt stuck for years."

One Payment Plan [https://www.onepaymentplan.com/] primarily serves individuals with unsecured debt such as credit cards, medical debt, and personal loans. Its platform is designed to support consumers at different stages - whether they are researching early or actively seeking structured solutions.

By helping consumers identify reputable partners and avoid questionable offers, One Payment Plan aims to raise standards across the debt relief industry and provide Americans with a safer, clearer way to pursue financial stability.

To learn more, visit the official One Payment Plan website to explore available options, access educational resources, or connect with the support team. Consumers can also subscribe to the company's newsletter and follow One Payment Plan on Facebook [https://www.facebook.com/onepaymentplanusa] and Instagram [https://www.instagram.com/onepaymentplan/] for ongoing financial education and industry insights.

Image: https://www.globalnewslines.com/uploads/2026/01/f9024474674a88d03c127dbcaa405318.jpg

Media Contact

Company Name: One Payment Plan

Contact Person: Elias Ervill

Email: Send Email [http://www.universalpressrelease.com/?pr=debt-settlement-firm-one-payment-plan-offers-financial-literacy-guidance-and-connects-clients-with-qualified-debt-relief-partners]

Country: United States

Website: https://www.onepaymentplan.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Settlement Firm One Payment Plan Offers Financial Literacy Guidance and Connects Clients with Qualified Debt Relief Partners here

News-ID: 4362538 • Views: …

More Releases from Getnews

BE IN THE CLOUD Unveils Revolutionary Microsoft 365 Backup Solution

BE IN THE CLOUD, a cloud backup provider trusted by more than 10,000 businesses in over 25 countries, has today launched a new backup solution for Microsoft 365. The service is designed to help businesses protect their data without the high costs and complexity that usually come with Microsoft 365 backups.

Image: https://www.globalnewslines.com/uploads/2026/01/b6721233d5b97b023484f8e20f7b9d26.jpg

Many companies now rely on Microsoft 365 every day for email, files and team collaboration. However, data loss can…

Quantum Subsidiary ALA Prestamos Precision-Engineers Liquidity Solutions for Mex …

In the evolving financial landscape of Mexico, ALA Prestamos, a flagship product of the SOFOM ENR institution Quantum, is setting a new benchmark by precision-targeting the liquidity needs of the country's vast working class. The platform is specifically designed to address "short-term, small-amount, and high-frequency" capital requirements that traditional banking sectors often overlook.

Image: https://www.globalnewslines.com/uploads/2026/01/d30289f1c94dd9b9c1d1b2e3348fbf27.jpg

The pain points for these users are distinct: urgent financial gaps a week before payday, sudden household…

Digitrix Media Partners with AI Server Platform Developers to Deliver Industry-S …

Image: https://www.globalnewslines.com/uploads/2026/01/1769127585.jpg

Digitrix Media partners with Apex Neural Systems to deliver industry-specific agentic AI solutions

Digitrix Media partners with Apex Neural Systems to deliver industry-specific agentic AI solutions powered by Nvidia technology. The collaboration targets real estate, healthcare, HVAC, and fitness sectors with no-code automation that translates plain English commands into functional AI tools. The partnership leverages Nvidia GPU infrastructure to enable businesses to deploy professional-grade AI solutions in minutes without technical…

William Pardue Releases Gripping Memoir Wolf Creek A True Life Drama of Redempti …

Image: https://www.globalnewslines.com/uploads/2026/01/1769190107.jpg

Discover the Battle Between Trust and Violence in a Remote East Texas Camp

Author William Pardue unveils his new book Wolf Creek [https://www.amazon.com/Wolf-Creek-Based-True-Story/dp/B0BP97K13Y/ref=], a memoir chronicling a year of intense survival and transformation set in the remote East Texas woods in 1971. This compelling narrative is not just about a group of troubled boys sent to the wilderness as a last-ditch effort for rehabilitation; it's a gripping tale of emotional…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…