Press release

South Korea Private Equity Market Size, Share, Industry Overview, Trends and Forecast 2033

IMARC Group has recently released a new research study titled "South Korea Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.South Korea Private Equity Market Overview

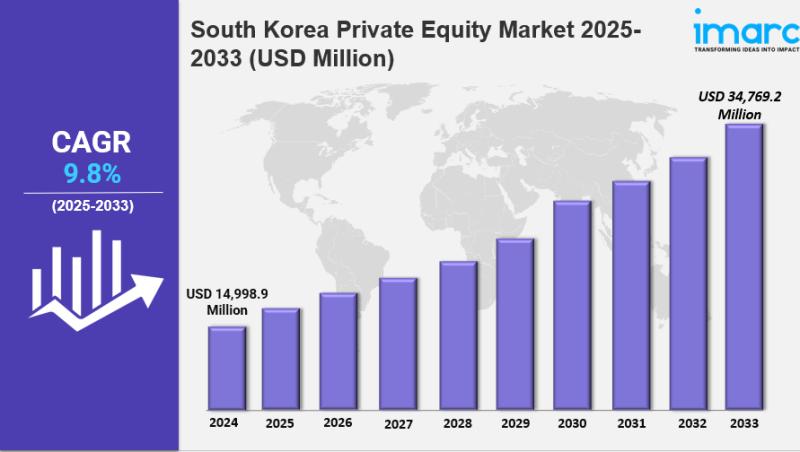

The South Korea Private Equity Market size reached USD 14,998.9 Million in 2024 and is projected to grow to USD 34,769.2 Million by 2033. The market is expected to expand at a CAGR of 9.8% during the forecast period 2025-2033. This growth is primarily driven by companies seeking long-term capital inaccessible through conventional financing channels. The report provides a comprehensive view of the market by fund types and regions, demonstrating significant investor interest, especially in technology and innovation sectors.

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Period: 2025-2033

South Korea Private Equity Market Key Takeaways

• Current Market Size: USD 14,998.9 Million in 2024

• CAGR: 9.8% (2025-2033)

• Forecast Period: 2025-2033

• The increasing number of high-net-worth individuals, institutional investors, and specialized firms is driving market growth.

• South Korean government policies supporting private equity investment with reforms and incentives boost market expansion.

• Technology and innovation sectors like fintech and biotech are major focus areas attracting significant investments.

• Regions like Seoul exhibit growing interest in tech startups and ESG investments, boosting regional private equity activity.

• Challenges include high competition and a rigorous regulatory environment, yet economic growth and technological advances create opportunities.

Sample Request Link: https://www.imarcgroup.com/south-korea-private-equity-market/requestsample

Trends in the South Korea Private Equity Market

Surge in Investment Activity

The South Korea private equity market is witnessing a surge in investment activity as institutional investors increasingly seek higher returns amid low-interest rates. This trend is significantly contributing to the South Korea private equity market size, with funds flowing into various sectors, including technology, healthcare, and consumer goods. Private equity firms are actively raising capital to capitalize on growth opportunities in both established companies and startups. The robust investment climate is fostering competition among firms, leading to innovative deal structures and strategies that enhance overall market dynamics.

Increased Focus on Technology and Innovation

Another notable trend shaping the South Korea private equity market is the increased focus on technology and innovation. As digital transformation accelerates across industries, private equity firms are prioritizing investments in tech-driven companies that demonstrate strong growth potential. This trend is positively impacting the South Korea private equity market share, as technology-focused investments become a significant portion of overall deal activity. By targeting sectors such as fintech, e-commerce, and artificial intelligence, private equity firms are positioning themselves to benefit from the ongoing digital revolution, driving growth in the market.

Expansion of Cross-Border Investments

The expansion of cross-border investments is becoming increasingly prominent in the South Korea private equity market. With globalization and the rise of emerging markets, South Korean private equity firms are looking beyond domestic opportunities to diversify their portfolios. This trend is contributing to the overall South Korea private equity market growth, as firms engage in strategic partnerships and joint ventures with international investors. By accessing foreign markets and leveraging global networks, private equity firms can enhance their investment strategies and capitalize on lucrative opportunities outside South Korea.

Emphasis on ESG Considerations

The emphasis on Environmental, Social, and Governance (ESG) considerations is shaping the South Korea private equity market in significant ways. Investors are increasingly demanding that private equity firms incorporate ESG factors into their investment processes, reflecting a broader shift towards responsible investing. This trend is impacting the South Korea private equity market size, as firms that prioritize ESG criteria attract more capital and enhance their reputations. By focusing on sustainable investments, private equity firms can not only meet investor expectations but also contribute to long-term value creation, further driving growth in the market.

Buy Now- https://www.imarcgroup.com/checkout?id=19179&method=3759

Market Segmentation

• Fund Type:

• Buyout: Involves acquiring controlling interest in companies with stable cash flows; aims at restructuring or growth to boost value. South Korea features many mature firms suitable for buyouts.

• Venture Capital (VCs): Focuses on early-stage companies with high growth potential, offering equity in exchange for investment.

• Real Estate: Encompasses acquisition, development, and management of properties for income generation or capital appreciation. Strong interest exists in commercial spaces driven by business and e-commerce expansion.

• Infrastructure

• Others

• Region:

• Seoul Capital Area: Constitutes the economic and financial core including Seoul, Incheon, and Gyeonggi Province; the most active region for private equity due to business concentration and infrastructure.

• Yeongnam (Southeastern Region): Known for agriculture and industry, with relatively lower private equity interest but opportunities in regional development and manufacturing.

• Honam (Southwestern Region): Gaining private equity attention focusing on agriculture, traditional industries, biotechnology, and tourism.

• Hoseo (Central Region)

• Others

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=19179&flag=C

Regional Insights

The Seoul Capital Area dominates the South Korea private equity market, being the economic and financial hub that includes Seoul, Incheon, and Gyeonggi Province. It is the most active region for private equity investments, driven by a high concentration of businesses, advanced infrastructure, and significant economic output. In contrast, regions such as Yeongnam display lesser activity but hold niche opportunities, particularly in agriculture and regional manufacturing projects.

Recent Developments & News

• August 2024: South Korea's Yellow Umbrella issued a request for proposal for domestic private equity fund managers overseeing funds of at least 200 billion won for eligibility.

• July 2024: Hahn & Co, a South Korean private equity firm founded by a former Morgan Stanley banker, raised $3.4 billion for a new buyout fund.

• March 2024: KKR collaborated with Weave Living to invest in rental housing properties in South Korea.

Key Players

• Yellow Umbrella

• Hahn & Co

• KKR

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release South Korea Private Equity Market Size, Share, Industry Overview, Trends and Forecast 2033 here

News-ID: 4361185 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

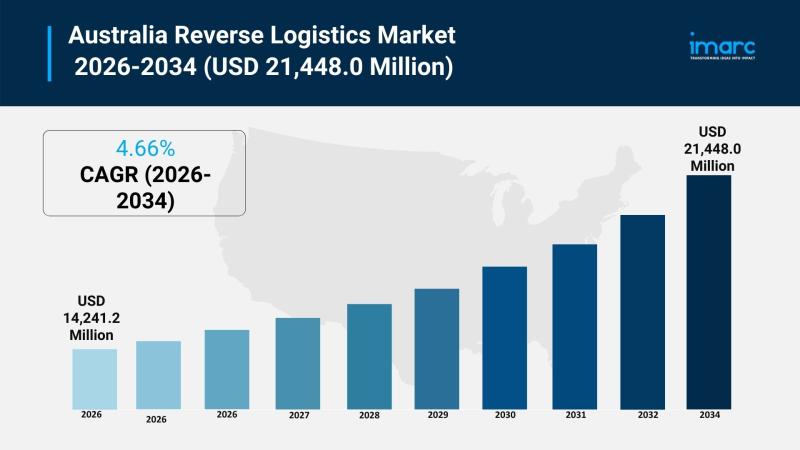

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for South

South Florida's Continuum South Beach Emerges as One of the Most Coveted Propert …

The Continuum South Beach reigns supreme as a highly coveted condominium in South Florida, presenting an array of offerings that ensure an elevated quality of life.

Miami beach, FL - Continuum South Beach [https://www.continuuminsouthbeach.com/] presents a sanctuary of lavishness, featuring opulent apartments and a breathtaking riverfront location in close proximity to the finest attractions of Miami Beach. These extraordinary residences are discreetly nestled within this prestigious condominium, specifically within the Continuum…

Green Cool UK Expand Air Conditioning Services in South Wales and the South West

Cardiff, South Wales - Green Cool UK, the UK's leading air conditioning and refrigeration company, are pleased to announce the extension of their services in South Wales, including Cardiff, Swansea, Newport and into Bristol and the South West. With over 18 years experience in the HVAC industry Green Cool UK supply high performance air conditioning systems and green energy solutions for domestic and commercial customers.

As air conditioning and refrigeration experts…

2024 South Africa International Industrial Exhibition and China (South Africa) I …

Exhibition time: September 19-21, 2024

Exhibition location: Sandton Convention Centre, Johannesburg

Organizer: South Africa Golden Bridge International Exhibition Company

Exhibition introduction

The South African International Industrial Exhibition [https://www.vovt-diesel.com/] and China (South Africa) International Trade Fair is a large-scale international exhibition held to promote Chinese enterprises to explore the African market. Relying on the advantageous resources of the local government, business associations and industry organizations in South Africa, it builds a pragmatic and efficient platform…

Stem Cell Therapy Market | Smith+Nephew (UK), MEDIPOST Co., Ltd. (South Korea), …

Stem Cell Therapy Market in terms of revenue was estimated to be worth $286 million in 2023 and is poised to reach $615 million by 2028, growing at a CAGR of 16.5% from 2023 to 2028 according to a new report by MarketsandMarkets. The global stem cell therapy market is expected to grow at a CAGR of 16.8% during the forecast period. The major factors driving the growth of the…

Global Pajamas Market Report - Japan, Europe, South Korea, Asia and America ( No …

Recently we published the latest report on the Pajamas market. The report on the Pajamas market provides a holistic analysis, of market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 15 vendors.

The report offers an up-to-date analysis regarding the current global market scenario, the latest trends and drivers, and the overall market environment. The Pajamas market analysis includes product segment and geographic landscape.

The…

South Africa Agriculture Market, South Africa Agriculture Industry, South Africa …

The South Africa has a market-oriented agricultural economy, which is much diversified and includes the production of all the key grains (except rice), deciduous, oilseeds, and subtropical fruits, sugar, wine, citrus, and most vegetables. Livestock production includes sheep, cattle, dairy, and a well-developed poultry & egg industry. Value-added activities in the agriculture sector include processing & preserving of fruit and vegetables, crushing of oilseeds, chocolate, slaughtering, processing & preserving of…