Press release

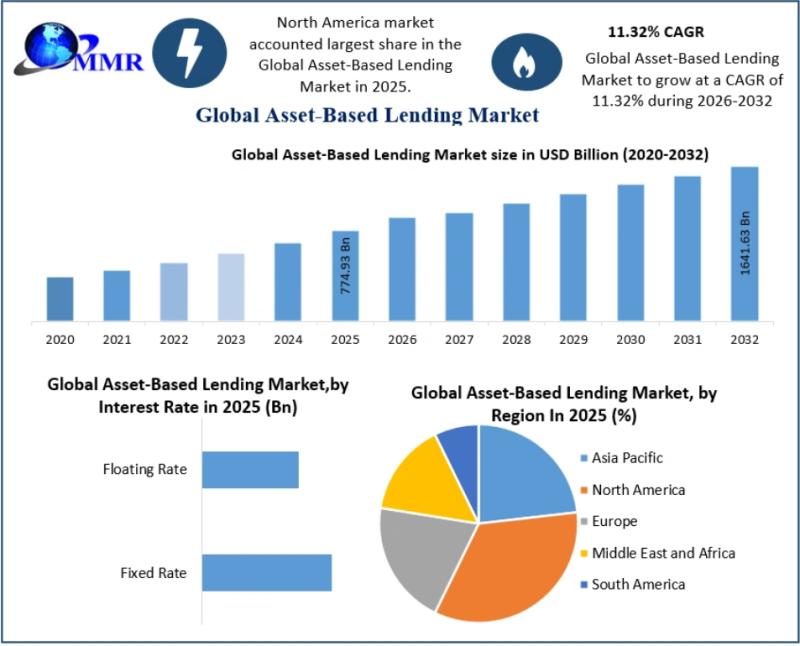

Asset-Based Lending Market Revenue Analysis: From USD 774.93 Bn to USD 1.64 Trillion by 2032

Asset-Based Lending Market - Overview, Trends & Forecast (2025-2032)Market Overview

The global Asset-Based Lending (ABL) Market is witnessing steady expansion driven by rising demand for flexible financing solutions among enterprises and SMEs. The market was valued at USD 774.93 Billion in 2025 and is projected to reach USD 1,641.63 Billion by 2032, registering a CAGR of 11.32% during the forecast period.

Asset-Based Lending is a financing mechanism in which borrowers secure loans by pledging tangible or financial assets as collateral. Unlike conventional lending models that primarily evaluate borrower creditworthiness, ABL focuses on the quality, liquidity, and marketability of pledged assets, including accounts receivable, inventory, equipment, real estate, and other fixed assets. Loan values are determined through advance rates, typically ranging from 50% to 80% of the appraised asset value.

ABL enables businesses to unlock working capital from their balance sheets and deploy funds for growth initiatives, acquisitions, working capital management, and debt restructuring. The market size estimation is based on a bottom-up approach supported by extensive primary and secondary data collection.

Unlock Insights: Request a Free Sample of Our Latest Report Now @https://www.maximizemarketresearch.com/request-sample/189641/

Market Dynamics

Increased Liquidity as the Primary Advantage

Asset-based finance significantly enhances business liquidity by converting illiquid assets into immediate working capital. This financing model is particularly beneficial for:

• High-growth companies

• Seasonal businesses

• Firms facing short-term cash flow constraints

• Enterprises undergoing restructuring or transition

ABL offers predictable cash flows and stable financing structures, making it an attractive alternative for non-investment-grade companies that may not qualify for traditional cash-flow-based loans.

The introduction of innovative ABL products further strengthens market growth. For instance, Metro Bank (UK) launched a new asset-based lending product enabling businesses to secure credit of £2 million or more using diverse collateral such as inventory, machinery, property, and receivables.

Easier Qualification Criteria Expands Market Accessibility

Asset-based lending offers a more flexible approval process compared to traditional bank financing, which often requires:

• Long profitability track records

• Strong financial controls

• Stringent covenant compliance

In contrast, ABL primarily evaluates collateral quality, with accounts receivable serving as the most preferred asset class due to their high liquidity. Lenders typically fund invoices with payment cycles of up to 70 days, enabling faster qualification even for younger or financially constrained firms.

The inclusion of inventory and equipment financing further broadens access to funding, positioning ABL as a critical financing tool for SMEs and asset-intensive businesses.

Asset-Based Lending vs. Traditional Bank Lending

Asset-based lending determines borrowing capacity primarily from the value of eligible assets such as receivables, inventory, or equipment, allowing companies with strong balance sheets but volatile cash flows to access funding. In contrast, traditional bank lending relies more heavily on leverage levels and the stability of operating cash flows, favoring borrowers with predictable earnings and strong credit profiles.

From a structural perspective, asset-based facilities are typically revolver-dominated with maturities ranging between three and five years, providing flexible working capital support. Traditional bank loans, on the other hand, may be structured either as revolving credit lines or term loans, depending on the borrower's needs and creditworthiness.

Monitoring practices also differ significantly. Asset-based lenders closely track collateral performance through regular borrowing base reports and periodic audits to ensure asset coverage remains adequate. Traditional lenders focus more on financial statement reviews and covenant compliance to assess ongoing credit risk.

Covenant frameworks further distinguish the two approaches. Asset-based lending usually features more flexible covenants that are centered on asset quality and availability. Traditional bank lending commonly includes multiple restrictive financial covenants tied to leverage ratios, interest coverage, and liquidity metrics, which can limit borrower flexibility but provide lenders with stronger control mechanisms.

Key Market Drivers

Access to Large-Scale Financing for SMEs

Asset-based lending provides small business owners and startups with access to substantial funding by leveraging assets rather than relying solely on credit history. This:

• Reduces startup financial risk

• Consolidates financing into a single loan

• Simplifies capital access

• Encourages entrepreneurship

ABL is especially valuable for businesses lacking access to equity or traditional debt markets.

Unlocking Capital for SME Growth

SMEs account for nearly 90% of businesses and over 50% of global employment, yet face significant financing gaps:

• 65 million MSMEs lack adequate financing

• Global financing gap: USD 5.2 trillion annually

• Highest gaps in East Asia & Pacific, Latin America, and MENA

ABL plays a crucial role in bridging this gap by providing collateral-driven financing models, thereby supporting job creation, industrial expansion, and economic development.

Market Landscape & Trends

The ABL industry is evolving through:

• Expansion of collateral scope beyond receivables

• Integration of fixed assets, inventory, machinery, and property

• Adoption of digital lending platforms and automation tools

• Enhanced collateral valuation and compliance systems

Get access to the full description of the report @https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

Market Segmentation

By Type

• Receivables Financing (Dominant segment in 2025)

• Inventory Financing

• Equipment Financing

• Others

Receivables financing leads due to its high liquidity, predictable repayment, and widespread SME adoption.

By Interest Rate

• Fixed Rate

• Floating Rate

By End User

• Small & Medium Enterprises (Largest share)

• Large Enterprises

SMEs dominate due to limited access to traditional credit and higher reliance on alternative financing channels.

Regional Insights

North America - Market Leader

North America accounted for 37.8% of global market share in 2025 and is projected to grow at a CAGR of 10.12% through 2032.

Key growth factors include:

• Mature financial infrastructure

• Favorable regulatory frameworks

• Presence of specialized ABL lenders

• Advanced digital lending ecosystems

The region benefits from strong collateral management systems, technology-enabled underwriting, and diversified industry adoption.

Key Players

Leading participants in the Asset-Based Lending Market include:

• Lloyds Bank

• Barclays Bank PLC

• JPMorgan Chase & Co.

• Wells Fargo

• HSBC Holdings plc

• Goldman Sachs Group, Inc.

• Truist Financial Corporation

• Santander Bank

• Fifth Third Bank

• White Oak Financial

• SLR Credit Solutions

• Porter Capital

Get a sample of the report@https://www.maximizemarketresearch.com/request-sample/189641/

Report Scope & Coverage

This report analyzes the market using 2025 as the base year, providing a forward-looking assessment for the period from 2026 to 2032. In 2025, the market was valued at USD 774.93 billion, reflecting a strong foundation for future expansion. Over the forecast period, the market is projected to grow at a compound annual growth rate (CAGR) of 11.32%, driven by rising demand, technological advancements, and expanding applications across industries. By 2032, the market size is expected to reach approximately USD 1,641.63 billion, indicating robust and sustained growth throughout the forecast timeline.

Frequently Asked Questions (FAQs)

1. What is Asset-Based Lending?

Asset-Based Lending is a financing method where loans are secured using business assets such as receivables, inventory, equipment, or real estate.

2. Who are the primary users of ABL?

SMEs are the largest users, followed by asset-intensive large enterprises.

3. Which region dominates the market?

North America leads due to advanced financial infrastructure and strong lender presence.

4. What are the main growth drivers?

Liquidity enhancement, SME financing needs, flexible qualification criteria, and digital lending adoption.

Related Market Research Reports

Core Banking Software Market https://www.maximizemarketresearch.com/market-report/core-banking-software-market/148072/

Most Performing Reports

Global Ship Repair and Maintenance Services Market https://www.maximizemarketresearch.com/market-report/global-ship-repair-and-maintenance-services-market/104905/

Tires Market https://www.maximizemarketresearch.com/market-report/global-tires-market/112589/

Freight Forwarding Market https://www.maximizemarketresearch.com/market-report/freight-forwarding-market/148362/

Global OKR Software Market https://www.maximizemarketresearch.com/market-report/global-okr-software-market/30267/

Connect with us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Revenue Analysis: From USD 774.93 Bn to USD 1.64 Trillion by 2032 here

News-ID: 4358095 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Headwear Market to Reach US$ 34.97 Billion by 2032

Headwear Market was valued at US$ 22.84 billion in 2024 and is expected to reach US$ 34.97 billion by 2032, expanding at a compound annual growth rate (CAGR) of 5.47% during the forecast period.

The market growth is driven by increasing fashion consciousness, rising sports participation, growing demand for branded and designer headwear, and expanding e-commerce penetration worldwide. Additionally, changing lifestyle trends and the growing influence of social media and celebrity…

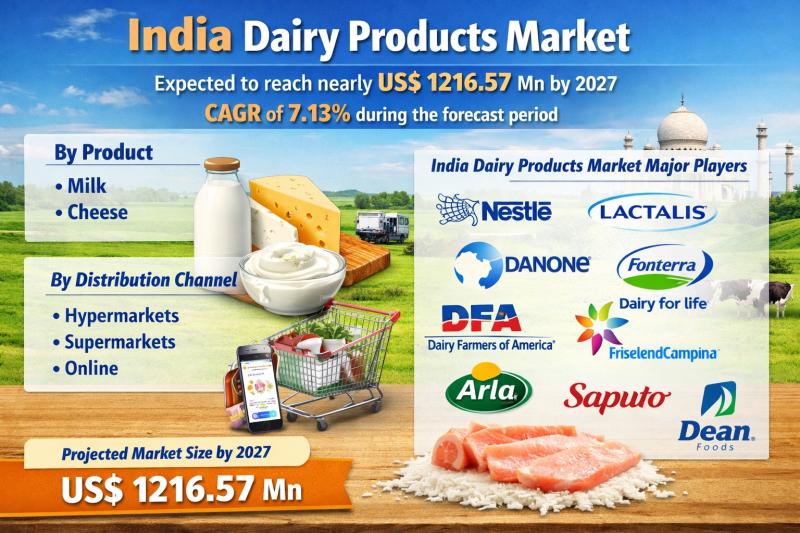

India Dairy Products Market to Reach US$ 1216.57 Mn by 2027, Expanding at a CAGR …

India Dairy Products Market size is expected to reach nearly US$ 1216.57 Mn by 2027, expanding at a CAGR of 7.13% during the forecast period. The market growth is driven by increasing dairy consumption, rising health awareness, expansion of organized retail, and growing demand for value-added dairy products across urban and semi-urban regions.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/india-dairy-products-market/92594/

Key Market Highlights

Market Size & CAGR:

The India Dairy Products…

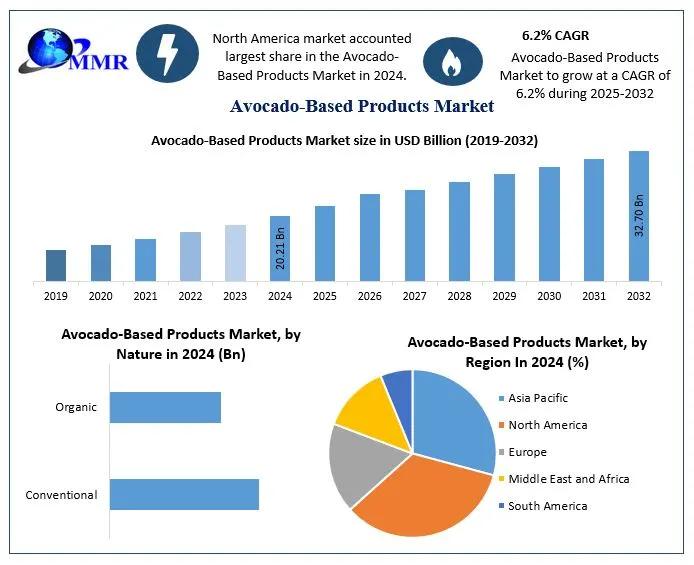

Avocado-Based Products Market Set for Strong Growth Through 2032 Driven by Healt …

The global Avocado-Based Products Market is projected to reach a market value of USD 32.70 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2032, according to a new research report.

Avocado-Based Products Market Overview:

The global Avocado-Based Products Market is experiencing significant traction as consumers increasingly embrace nutrient-rich and plant-based options. With avocados recognized for their natural healthy fats, vitamins, and fiber, demand across…

Waste Paper Recycling Market to Reach USD 63.32 Billion by 2030, Growing at a CA …

Waste Paper Recycling Market reached a value of USD 45.60 Bn. in 2023. The global market is expected to grow at a CAGR of 4.8% during the forecast period, reaching nearly USD 63.32 Bn. by 2030. The market growth is driven by increasing environmental awareness, rising demand for sustainable packaging solutions, and stringent government regulations promoting recycling and waste reduction practices.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/global-waste-paper-recycling-market/84320/

Key…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…