Press release

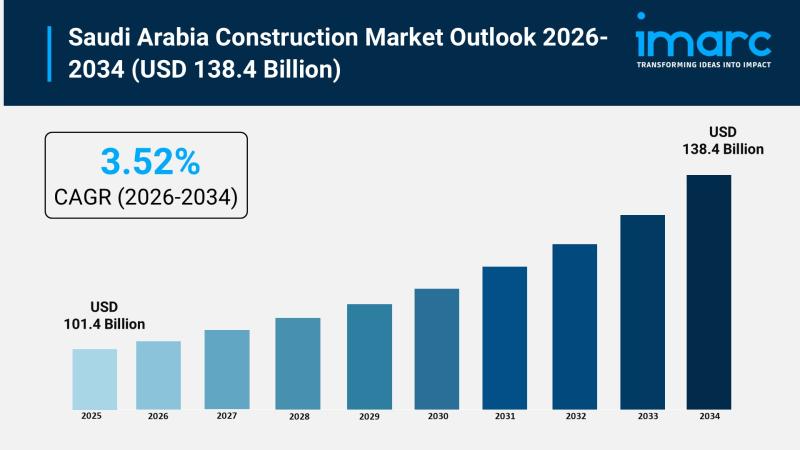

Saudi Arabia Construction Market Size to Worth USD 138.4 Billion by 2034 | With a 3.52% CAGR

Saudi Arabia Construction Market OverviewMarket Size in 2025: USD 101.4 Billion

Market Size in 2034: USD 138.4 Billion

Market Growth Rate 2026-2034: 3.52%

According to IMARC Group's latest research publication, "Saudi Arabia Construction Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia construction market size was valued at USD 101.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 138.4 Billion by 2034, exhibiting a CAGR of 3.52% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Construction Market

● AI-powered project management systems optimize scheduling and resource allocation, reducing project delays by up to 20% and improving overall construction efficiency across Saudi Arabia's mega-projects.

● Machine learning algorithms analyze historical project data to predict potential delays and cost overruns, enabling proactive decision-making and reducing budget deviations by 15-25% in construction projects.

● Computer vision and real-time monitoring systems detect safety hazards and non-compliance with safety protocols on construction sites, significantly reducing workplace accidents and improving worker safety standards.

● AI-driven Building Information Modeling (BIM) enhances coordination between architects, engineers, and contractors by automating clash detection and preventing costly rework, improving project collaboration efficiency by up to 30%.

● Autonomous construction robotics and AI-powered equipment perform repetitive tasks such as bricklaying, concrete pouring, and site preparation, accelerating construction timelines while addressing labor shortages across the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-construction-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Construction Industry

Saudi Arabia's Vision 2030 is fundamentally transforming the construction industry by driving unprecedented investment in mega-projects, infrastructure development, and economic diversification beyond oil dependence. The initiative positions construction as a cornerstone of national transformation, with the Public Investment Fund (PIF) financing landmark projects like NEOM, Qiddiya, The Red Sea Project, and The Line, creating massive demand for residential, commercial, industrial, and infrastructure construction activities. Government-backed programs through the National Industrial Development and Logistics Program are establishing Saudi Arabia as a regional construction hub, attracting global contractors and fostering partnerships between local companies and international engineering firms. Vision 2030's housing initiatives, including public-private partnerships and affordable housing programs, are addressing the Kingdom's housing gap while stimulating residential construction growth. The focus on tourism and entertainment infrastructure, exemplified by projects like Sindalah island and Amaala luxury resort, is creating new construction opportunities in hospitality, leisure, and cultural facilities. Additionally, Vision 2030's emphasis on sustainability and green building practices is driving adoption of advanced construction technologies, modular construction methods, and eco-friendly materials. Major infrastructure investments in transportation networks, including the Riyadh Metro, Saudi Landbridge Railway, and airport expansions, are enhancing connectivity and supporting economic growth. Ultimately, Vision 2030 positions the construction sector as essential to Saudi Arabia's economic transformation, creating sustained demand for building projects and establishing the Kingdom as a leader in modern, sustainable construction practices.

Saudi Arabia Construction Market Trends & Drivers:

Saudi Arabia's construction market is experiencing robust growth, driven by the government's ambitious Vision 2030 mega-projects that are reshaping the Kingdom's economic landscape. Major developments such as NEOM, Qiddiya, The Red Sea Project, and the newly opened Sindalah luxury island destination are creating unprecedented demand for construction activities across multiple sectors. In 2024, significant progress was achieved on high-profile projects, including the launch of Amaala's first phase with eco-friendly luxury resorts and the announcement of The Mukaab, a unique 400-meter cube-shaped in Riyadh set to become the world's largest building upon completion. These mega-projects are not only transforming Saudi Arabia's skyline but also generating substantial opportunities for global and local contractors, with the Public Investment Fund (PIF) serving as the primary financing mechanism for these massive undertakings.

The housing sector is experiencing significant expansion driven by rapid population growth and urbanization. According to United Nations projections, Saudi Arabia's population reached 37.5 million in 2024 with a growth rate of 1.43%, creating sustained demand for both affordable and luxury residential developments. The Ministry of Municipal and Rural Affairs and Housing is implementing comprehensive policies to enhance housing supply through public-private partnerships, with major projects delivered in Riyadh and Jeddah. In 2024, Riyadh's residential market expanded to 1.5 million units following the delivery of 16,200 units in the first half of the year, demonstrating the scale of residential construction activity. Government initiatives are focused on developing integrated communities with modern amenities, addressing both the needs of the growing middle class for affordable housing and the demand from affluent segments for luxury properties.

Infrastructure development is a critical driver of construction market growth, with massive investments in transportation networks, logistics hubs, and energy facilities. The $7 billion Saudi Landbridge Railway project, announced in November 2023 and implemented in 2024, exemplifies the scale of infrastructure investments transforming the Kingdom's connectivity. The Riyadh Metro system, expansion of King Abdulaziz International Airport, and development of modern highways and bridges are enhancing mobility within cities and regions while supporting economic diversification goals. In September 2024, the Avenues-Khobar mall in the Eastern Province, a 7.3 billion Saudi Riyals ($1.947 billion) project featuring a mall and mixed-use towers, achieved 5.25% completion, demonstrating continued investment in commercial infrastructure. The adoption of advanced construction technologies, including modular construction, 3D printing, and Building Information Modeling (BIM), is accelerating project timelines and improving efficiency. Government reforms introduced in February 2025, including infrastructure-guaranteed financing and surety bonds, are further supporting contractors and facilitating construction project execution across the Kingdom.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16893&flag=E

Saudi Arabia Construction Industry Segmentation:

The report has segmented the market into the following categories:

Sector Insights:

● Residential

● Commercial

● Industrial

● Infrastructure (Transportation)

● Energy and Utilities Construction

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

● AFRAS

● AL Jazirah Engineers & Consultants

● Al Latifa Trading and Contracting

● Bechtel Corporation

● Fluor Corporation

● Gilbane Inc.

● Jacobs

● Tekfen Construction

Recent News and Developments in Saudi Arabia Construction Market

● February 2025: Saudi Arabia introduced infrastructure-guaranteed financing and surety bonds to assist contractors in the construction sector. These surety bonds operate similarly to insurance, offering guarantees to contractors that protect clients from project-related issues, with insurance companies intervening to compensate for losses when necessary.

● October 2024: Saudi Arabia announced plans to build The Mukaab, a unique 400-meter cube-shaped in Riyadh. The structure is set to become the world's largest building upon completion, demonstrating the Kingdom's ambition to create iconic architectural landmarks as part of Vision 2030 initiatives.

● September 2024: Construction of Phase 1 of the Avenues-Khobar mall in Saudi Arabia's Eastern Province, valued at 7.3 billion Saudi Riyals ($1.947 billion), achieved a completion rate of 5.25%. The project features a mall and two mixed-use towers, covering a total area of 198,000 square meters with a gross leasable area of 167,000 square meters.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Construction Market Size to Worth USD 138.4 Billion by 2034 | With a 3.52% CAGR here

News-ID: 4357861 • Views: …

More Releases from IMARC Group

Ethylene Oxide Prices January 2026 | Latest Price Index, Market Analysis & Forec …

Northeast Asia Ethylene Oxide Prices Movement January 2026:

Northeast Asia ethylene oxide prices in January 2026 were recorded at USD 0.9/kg, rising by 2.3% due to improved downstream chemical and surfactant demand. The ethylene oxide price trend remained positive, while the ethylene oxide price index strengthened slightly. The ethylene oxide price chart reflected upward momentum. The ethylene oxide price forecast indicates stable-to-firm pricing if demand remains steady.

Get the Real-Time Prices Analysis:…

Cocoa Butter Price Index Report - Historical Trends, Supply-Demand Analysis & Fo …

North America Cocoa Butter Prices Movement 2025:

Cocoa Butter Prices in USA:

USA cocoa butter prices in Q4 2025 averaged USD 9,835/MT, supported by strong confectionery and food processing demand. The cocoa butter price trend remained firm amid tight global cocoa supply. The cocoa butter price index showed sustained strength, while the cocoa butter price chart reflected elevated levels. The cocoa butter price forecast indicates continued firmness driven by supply constraints.

Get the…

Base Oil Prices in Q4 2025: Latest Index, History & Forecast Report

The Base Oil Price Index remains a critical benchmark for tracking global Base Oil Prices across automotive, industrial, and lubricant manufacturing sectors. In recent quarters, Base Oil Prices have shown calculated fluctuations driven by crude oil costs, refinery output adjustments, and shifting trade flows. This Base Oil Price Trend Analysis highlights the latest movements, Base Oil price index data, Base Oil price history, and Base Oil future price outlook to…

Steel Wire Rod Prices 2026 Outlook: Key Factors Influencing Global Rates

Northeast Asia Steel Wire Rod Prices Movement January 2026:

In Northeast Asia, steel wire rod prices reached USD 0.5 per kg in January 2026, marking an 8.7% increase compared to the previous month. The upward movement was driven by improved construction activity and restocking demand after year-end inventory corrections. Higher raw material costs and firm domestic steel production levels also supported the positive price trend across the region.

Get the Real-Time Prices…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…