Press release

Base Oil Prices in Q4 2025: Latest Index, History & Forecast Report

The Base Oil Price Index remains a critical benchmark for tracking global Base Oil Prices across automotive, industrial, and lubricant manufacturing sectors. In recent quarters, Base Oil Prices have shown calculated fluctuations driven by crude oil costs, refinery output adjustments, and shifting trade flows. This Base Oil Price Trend Analysis highlights the latest movements, Base Oil price index data, Base Oil price history, and Base Oil future price outlook to help buyers, traders, and procurement teams make informed decisions.Base Oil Current Price Movements

According to the latest updates available on IMARC Group's Base Oil pricing intelligence platform, Base Oil Prices have experienced region-specific volatility across Asia, Europe, and North America. In Asia, price corrections were observed due to stable refinery operations and balanced downstream lubricant demand. Meanwhile, Europe recorded slight upward revisions in the price of Base Oil amid energy cost fluctuations and controlled inventories.

In North America, Base Oil Prices remained moderately firm, supported by steady demand from automotive and industrial lubricant manufacturers. Export inquiries and freight adjustments have also influenced the Base Oil price today across key ports. Procurement teams continue monitoring refinery run rates and feedstock costs to assess short-term price direction.

Base Oil Prices Outlook - Q4 2025

The latest Q4 2025 assessments indicate the following benchmark levels:

• China: USD 941/MT

• USA: USD 1,865/MT

• Germany: USD 1,280/MT

• Saudi Arabia: USD 1,417/MT

• UAE: USD 1,438/MT

These figures highlight notable regional disparities in Base Oil Prices, with North America reflecting higher pricing due to production economics and demand strength, while Asia maintains comparatively competitive levels. Middle Eastern markets continue to influence global trade flows, impacting the overall Base Oil price index and near-term pricing strategies.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/base-oil-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Base Oil Price Snapshot (2026):

As of early 2026, Base Oil Prices reflect a cautiously stable environment with periodic upward pressure. The Base Oil price index indicates balanced supply-demand fundamentals compared to the volatility witnessed in previous years.

Key snapshot highlights include

• Stable Group I and Group II Base Oil Prices in Asia

• Marginal increase in European Base Oil price today due to utility costs

• Consistent buying activity from lubricant blenders

• Controlled inventories supporting near-term Base Oil future price stability

This Base Oil Price Trend Analysis suggests that while sharp spikes are unlikely, gradual adjustments may continue depending on crude oil movements and refinery margins.

Base Oil Price Trend Analysis:

The broader Base Oil price trend over the past 12 months has reflected synchronized movements with crude oil benchmarks. When upstream feedstock costs increased, the price of Base Oil followed with short-term upward adjustments. Conversely, improved refinery throughput and normalized shipping routes supported moderate corrections.

The Base Oil price history shows that seasonal lubricant demand cycles-especially during peak automotive maintenance periods-have contributed to temporary price increases. Additionally, regional export restrictions and logistics disruptions have occasionally tightened supply chains.

Overall, Base Oil Prices have demonstrated resilience, maintaining a structured range despite macroeconomic uncertainties.

Base Oil Price Chart & Index - What It Suggests:

The Base Oil price chart and Base Oil price index provide measurable insights into price direction, volatility range, and procurement timing. Current Base Oil price chart trends suggest consolidation, indicating neither aggressive buying pressure nor oversupply conditions.

The Base Oil price index highlights:

• Stabilization across major export hubs

• Reduced month-on-month volatility

• Improved alignment between crude and downstream Base Oil Prices

For procurement managers, analyzing the Base Oil price chart helps identify optimal purchase windows, especially when short-term corrections occur within a broader stable trend.

Base Oil Price Historical Analysis Data:

An assessment of Base Oil price history over the last five years reveals cyclical patterns influenced by

• Crude oil price cycles

• Refinery shutdowns and maintenance schedules

• Global lubricant demand recovery phases

• Shipping and container cost variations

During supply-constrained phases, Base Oil Prices witnessed accelerated growth. However, recovery in refinery output typically led to normalization. This historical pattern indicates that Base Oil price today levels are more structurally balanced compared to extreme volatility seen during global disruptions.

Long-term Base Oil price history data supports strategic procurement planning rather than reactive buying decisions.

Factors Driving Recent Base Oil Price Trend Increases:

Recent increases in Base Oil Prices can be attributed to several core factors

1. Rising crude oil benchmarks influencing feedstock costs

2. Adjustments in refinery operating rates

3. Steady automotive and industrial lubricant demand

4. Export logistics and freight cost revisions

5. Energy and compliance-related production expenses

Each of these drivers directly impacts the Base Oil price index, leading to gradual shifts in the price of Base Oil across regions. Understanding these drivers helps anticipate Base Oil future price movements with greater accuracy.

Base Oil Price Forecast - Next 12 Months:

The Base Oil future price outlook for the next 12 months indicates a moderately stable trajectory with selective upward pressure. If crude oil benchmarks remain firm, Base Oil Prices may experience controlled increases. However, expanded refinery capacity and steady supply chains could prevent sharp spikes.

Forecast indicators suggest

• Balanced global demand growth

• Limited risk of severe supply disruptions

• Stable Base Oil price today levels transitioning into incremental adjustments

Overall, this Base Oil Price Trend Analysis projects measured movement rather than extreme volatility in 2026.

Regional Price Differences for Base Oil:

Regional variations in Base Oil Prices continue to reflect localized demand patterns and production costs.

• Asia: Competitive pricing due to strong refinery presence

• Europe: Slightly elevated Base Oil price today due to energy expenses

• North America: Stable pricing supported by domestic production

• Middle East: Export-driven pricing strategy influencing global Base Oil price index

These regional differences influence global trade flows and arbitrage opportunities within the Base Oil market.

Current & Near-Term Prices (Late 2025 - Early 2026):

During late 2025 and early 2026, Base Oil Prices maintained steady momentum. Short-term movements were influenced by feedstock alignment and year-end inventory adjustments. Buyers remain cautious but active, preventing oversupply scenarios.

Near-term Base Oil price trend indicators suggest consolidation with minor upward corrections, especially if refinery maintenance schedules tighten supply temporarily.

Summary - Key Points:

• The Base Oil Price Index indicates structured stability in 2026

• Base Oil Prices reflect balanced supply-demand fundamentals

• Historical trends show cyclical yet controlled volatility

• Forecast suggests moderate and sustainable price movement

• Regional dynamics continue shaping global Base Oil price trend

For comprehensive price intelligence, verified data, and forecast charts, industry participants rely on structured pricing platforms such as IMARC Group's Base Oil pricing report, which delivers updated Base Oil price chart, index, historical data, and forecast insights.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=22299&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help:

The latest IMARC Group study, Base Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Base Oil price trend, offering key insights into global Base Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Base Oil demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Base Oil Prices in Q4 2025: Latest Index, History & Forecast Report here

News-ID: 4388243 • Views: …

More Releases from IMARC Group

Steel Wire Rod Prices 2026 Outlook: Key Factors Influencing Global Rates

Northeast Asia Steel Wire Rod Prices Movement January 2026:

In Northeast Asia, steel wire rod prices reached USD 0.5 per kg in January 2026, marking an 8.7% increase compared to the previous month. The upward movement was driven by improved construction activity and restocking demand after year-end inventory corrections. Higher raw material costs and firm domestic steel production levels also supported the positive price trend across the region.

Get the Real-Time Prices…

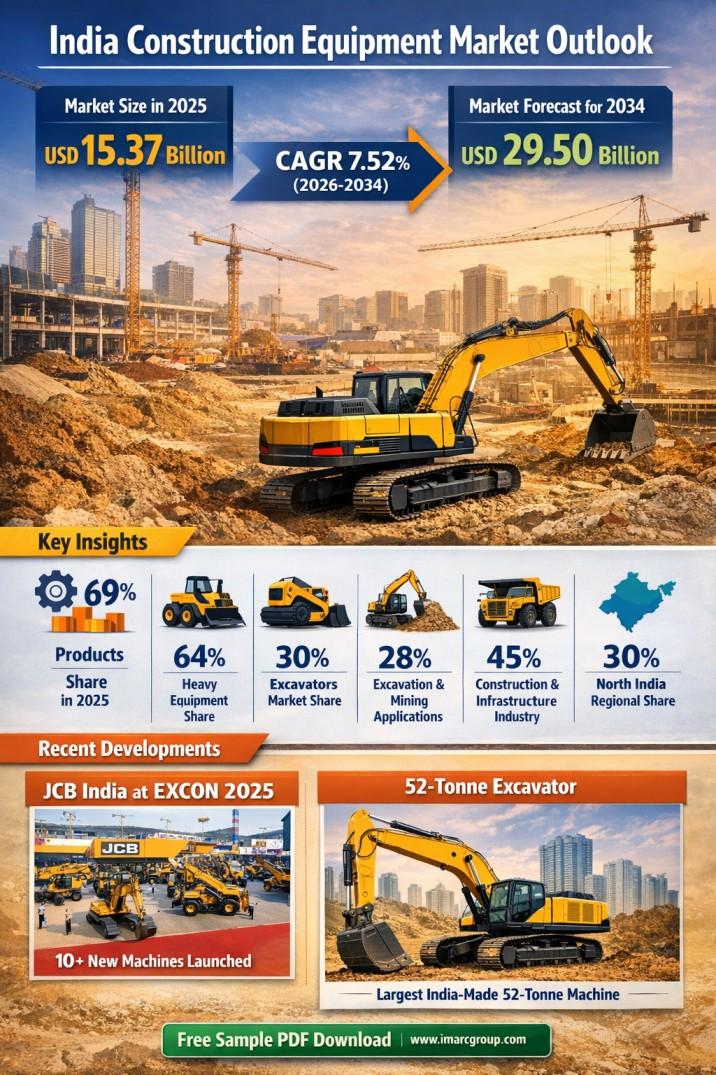

India Construction Equipment Market to Reach USD 29.50 Billion by 2034 | Exapand …

India Construction Equipment Market Overview

According to IMARC Group's report titled "India Construction Equipment Market Size, Share, Trends and Forecast by Solution Type, Equipment Type, Type, Application, Industry, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India construction equipment market size was valued at USD 15.37 Billion in 2025 and is projected to reach USD 29.50 Billion by 2034,…

Hot Rolled Coil Prices 2026: Global Market Outlook, Regional Trends, and Industr …

Northeast Asia Hot Rolled Coil Prices Movement January 2026:

In January 2026, hot rolled coil prices in Northeast Asia rose to USD 0.48/KG, marking a 4.3% increase from the previous month. Strong demand from construction, automotive, and infrastructure sectors supported the upward movement. Higher raw material costs, particularly iron ore and coking coal, along with firm mill operating rates, contributed to tighter supply conditions and improved pricing momentum.

Get the Real-Time Prices…

Mixed Reality Market Size & Forecast 2025-2033 | Growth, Share & Trends Analysis

The global mixed reality market was valued at USD 2,162.38 Million in 2024 and is projected to reach USD 27,530.12 Million by 2033, growing at a CAGR of 31.03% during the forecast period 2025-2033. Continuous hardware innovations like advanced headsets and sensors, alongside software developments incorporating AI and cloud computing, are expanding MR applications across industries. North America leads with over 37.6% market share in 2024 due to technological advancements…

More Releases for Base

Base Station Analyzer Market Report 2024 - Base Station Analyzer Market Trends A …

"The Business Research Company recently released a comprehensive report on the Global Base Station Analyzer Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Base Station Analyzer Market Report 2024 - Base Station Analyzer Market Demand A …

"The Business Research Company recently released a comprehensive report on the Global Base Station Analyzer Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Base Station Analyzer Market Report 2024 - Base Station Analyzer Market Demand A …

"The Business Research Company recently released a comprehensive report on the Global Base Station Analyzer Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Base Editing Market

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Base Editing Market - (by Product (Platform, Reagents & Kits, Plasmids, Base Editing Libraries), Service (gRNA Design, Cell Line Engineering), Type, Targeted base (Cytosine, Adenine), Application, End-User, Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Base Editing Market is valued at US$ 273.1 Mn in…

Base Oil Market

The Global Base Oil Market size valued to USD 36.55 billion in 2019 is predicted to garner USD 41.65 billion by 2030, with a CAGR of 1.1% from 2020-2030.

The Global Base Oil Market held a volumetric turn-over of 41,907.3 kilotons in 2019 that is expected to level-up to 48,879.3 kilotons by 2030, witnessing a CAGR of 1.3% from 2020-2030.

Request sample copy of this report at: https://www.nextmsc.com/base-oil-market/request-sample

Market Dynamics and Trends

The…

Base Oil Market Base Oil Market Size, Sales, Share and Forecasts by 2030

Base Oil Market: Introduction

The global base oil market was valued at ~US$ 34 Bn in 2019 and is anticipated to expand at a CAGR of ~2% during the forecast period. Among grades, the Group I segment accounted for a major share of the global base oil market in 2019. However, the demand for Group I base oil is likely to decline during the forecast period, owing to their replacement by…