Press release

Global Instant Payment Market Poised for Explosive Growth to USD 286.9 Billion by 2033, Anchored by Asia Pacific's 43.5% Dominance | DataM Intelligence

The Instant Payments Market reached USD 23.1 billion in 2023 and is expected to reach USD 286.9 billion by 2033, growing at a robust CAGR of 28.2% during the forecast period 2024-2033.Market growth is driven by surging e-commerce transactions, rising demand for real-time payment solutions, and expanding adoption of digital wallets globally. Regulatory mandates for faster payments, technological advancements in blockchain and APIs, and increasing P2B (person-to-business) volumes particularly in emerging markets are further accelerating expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/instant-payment-market?ram

United States: Key Industry Developments

✅ December 2025: The Federal Reserve expanded FedNow's interoperability with private payment networks, enabling 24/7 cross-border instant transfers for small businesses and boosting transaction volumes by 25% in Q4.

✅ October 2025: Visa launched Visa Direct Instant Payments 2.0, integrating AI-driven fraud detection and supporting payouts to digital wallets in under 5 seconds for e-commerce refunds.

✅ September 2025: JPMorgan Chase rolled out its RTP network enhancements, allowing real-time B2B payments with embedded smart contracts for automated invoicing in the manufacturing sector.

Asia Pacific / Japan: Key Industry Developments

✅ November 2025: Japan's Zengin-Net upgraded to full instant payment capabilities via the J-FPS system, processing over 1 million daily transactions with QR code standardization for retail use.

✅ October 2025: Singapore's PayNow linked with Australia's New Payments Platform for cross-border instant remittances, reducing costs by 40% and targeting migrant workers.

✅ September 2025: India's UPI achieved 15 billion monthly instant payment transactions, with RBI mandating bank adoption for all P2P and P2M use cases nationwide.

Key Mergers and Acquisitions(2025 - 26):

✅ Global Payments expanded its payments processing dominance through the acquisition of Worldpay's merchant acquiring business for approximately $24 billion in April 2025.

✅ Shift4 bolstered its global payments capabilities by acquiring Swiss paytech Global Blue in a $2.5 billion deal during 2025.

✅ Fifth Third strengthened its banking footprint with the $10.9 billion acquisition of Comerica Bank in 2025.

Market Segmentation Analysis:

-By Nature of Payment: P2P Leads with High Transaction Volumes

Person-to-Person (P2P) payments dominate at 45% market share in 2025, driven by peer remittances, bill splitting, and social transfers via apps like Venmo and UPI. Person-to-Business (P2B) holds 25%, enabling quick consumer purchases and utility payments. Business-to-Person (B2P) captures 20% for salary disbursals and refunds, while Others (e.g., B2B micropayments) take 10%.

-By Services: Solutions Command Core Infrastructure

Solutions lead at 60%, providing payment platforms, gateways, and software for seamless processing. Services follow at 40%, offering integration, consulting, and maintenance support.

-By Deployment Mode: Cloud Drives Scalability

Cloud deployment holds 55% share, favored for flexibility, cost savings, and rapid scaling in digital ecosystems. On-Premises accounts for 45%, preferred by regulated sectors for data control and security.

-By Enterprise Size: Large Enterprises Dominate Investments

Large enterprises claim 70%, leveraging high-volume transactions and advanced tech in BFSI giants. SMEs take 30%, adopting affordable cloud solutions for digital payments.

-By End-User: BFSI Retains Top Position

BFSI leads at 40% share, powering real-time settlements and fraud reduction. Retail and e-commerce follow at 25% for instant checkouts. IT and Telecom (15%), Government (10%), Energy and Utilities (5%), and Others (5%) support niche transactional needs.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=instant-payment-market?ram

Growth Drivers:

-Technological advancements in digital infrastructure and real-time processing systems.

-Rising consumer and business demand for faster, seamless transactions, especially in retail and e-commerce.

-Government initiatives and regulatory support promoting cashless economies and interoperability.

-Surge in smartphone penetration and 5G rollout enabling ubiquitous access.

-Shift toward business-to-business applications for improved cash flow and supply chain efficiency.

Regional Insights:

-Asia Pacific holds the largest share of the global instant payment market (43.5% of revenue) due to rapid digital transformation, high mobile payment volumes, and government initiatives for financial inclusion. China, India, and Japan dominate regional demand with expanding digital infrastructure and smartphone penetration.

-North America accounts for around 25% of the global market, driven by advanced technological infrastructure and regulatory support like FedNow in the US. The United States leads with strong adoption among banks and fintechs, while Canada contributes through secure transaction preferences.

-Europe represents approximately 20% of the market, bolstered by unified regulations such as PSD2 and growing interoperability. Key markets like Germany, France, and the UK drive growth with high instant payment volumes and innovation in cross-border systems.

-Latin America holds about 7% global share but exhibits strong growth potential, particularly in Brazil and Mexico, fueled by increasing access to real-time systems and e-commerce expansion.

-The Middle East & Africa accounts for the remaining roughly 4.5%, with emerging adoption in South Africa, Saudi Arabia, and UAE supported by investments in digital payment rails.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/instant-payment-market?ram

Key Players:

ACI Worldwide | FIS | Fiserv | Mastercard | Worldline | PayPal | Visa | Ant Financial | Intelligent Payments | Temenos

Key Highlights (Top 5 Key Players) for Instant Payment Market:

-ACI Worldwide supports 18 real-time domestic schemes globally, processing 50% of the U.K.'s Faster Payments and 75% of Hungary's AFR transactions through its Enterprise Payments Platform.

-FIS provides comprehensive real-time payment solutions, including processing infrastructure for major schemes and enabling instant account-to-account transfers across P2P, P2B, and B2P transactions.

-Fiserv delivers instant payment processing and gateway services, focusing on fraud management and high-volume real-time settlement for retail, e-commerce, and BFSI sectors.

-Mastercard advances instant payments via its global network, supporting multi-currency transactions and partnerships for schemes like FedNow and RTP to drive merchant adoption.

-Visa powers real-time payments infrastructure worldwide, integrating with RTP Network and FedNow for immediate funds availability in B2B, B2C, and retail use cases.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Instant Payment Market Poised for Explosive Growth to USD 286.9 Billion by 2033, Anchored by Asia Pacific's 43.5% Dominance | DataM Intelligence here

News-ID: 4355611 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Pharmaceuticals Market to Reach USD 2.5 Trillion by 2033 at 5.8% CAGR | North Am …

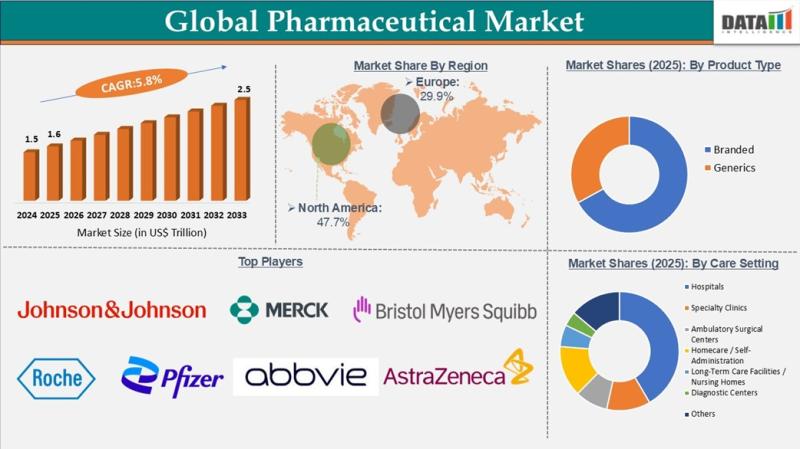

The Pharmaceuticals Market reached USD 1.5 trillion in 2024, rising to USD 1.6 trillion in 2025, and is projected to reach USD 2.5 trillion by 2033, expanding at a CAGR of 5.8% during the forecast period from 2026 to 2033. Steady market growth is being driven by global population aging, increasing prevalence of chronic and lifestyle related diseases, and rising demand for advanced therapeutics across hospitals, specialty clinics, and homecare…

Hospital Robotics (Logistics and Pharmacy) Market to Reach USD 14.77 Billion by …

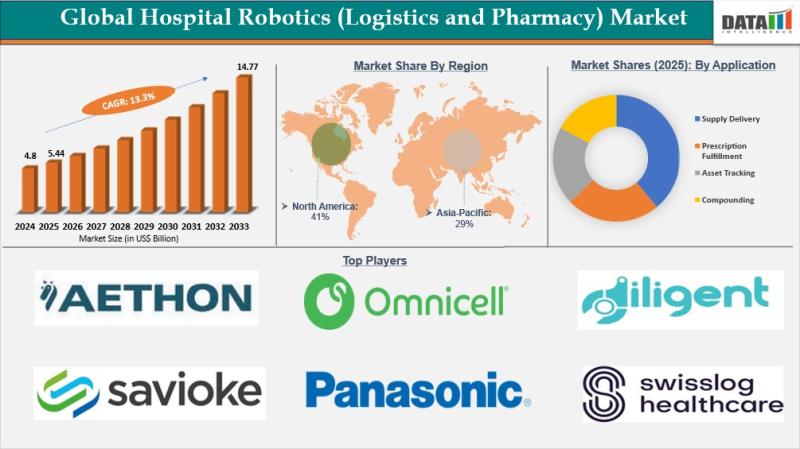

The Hospital Robotics (Logistics and Pharmacy) Market reached USD 4.8 billion in 2024, rising to USD 5.44 billion in 2025, and is projected to reach USD 14.77 billion by 2033, expanding at a CAGR of 13.3% during the forecast period from 2026 to 2033. Market growth is driven by increasing hospital workload, rising complexity of medication management, and persistent shortages of skilled healthcare personnel. Population aging and the growing prevalence…

Inactivated Vaccines Market Forecast for Expansion to US$34.26 Billion by 2033, …

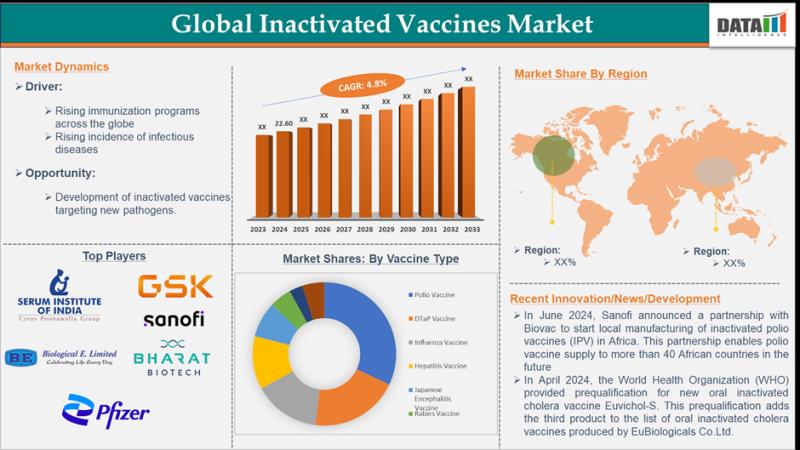

The Global Inactivated Vaccines Market reached US$22.60 billion in 2024 and is expected to reach US$34.26 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024-2032.The inactivated vaccines market is growing due to rising immunization programs, increasing prevalence of infectious diseases, expanding pediatric and adult vaccination coverage, government funding initiatives, and advancements in vaccine manufacturing technologies. Strong safety profiles and global pandemic preparedness efforts further support…

Interventional Radiology Market to Reach USD 42.82 Billion by 2033 at 8.5% CAGR …

The Interventional Radiology Market was valued at USD 22.13 billion in 2024 and is projected to reach USD 42.82 billion by 2033, expanding at a CAGR of 8.5% during the forecast period from 2025 to 2033. This strong growth is driven by increasing clinical adoption of minimally invasive procedures, rising prevalence of chronic diseases such as cardiovascular and oncologic conditions, and growing demand for image-guided diagnostic and therapeutic interventions that…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…