Press release

New Jersey Trust Attorney Christine Matus Explains How Qualified Personal Residence Trusts Reduce Estate Taxes

TOMS RIVER, NJ - Homeowners seeking to transfer valuable residences to family members while minimizing estate taxes face complex decisions about timing and structure. New Jersey trust attorney Christine Matus of The Matus Law Group (https://matuslaw.com/what-is-a-qualified-personal-residence-trust/) explains how Qualified Personal Residence Trusts allow homeowners to transfer properties at reduced tax costs while continuing to live in them for a specified term.According to New Jersey trust attorney Christine Matus, a Qualified Personal Residence Trust works by freezing a home's value for gift tax purposes at the time of transfer. The homeowner transfers the residence into an irrevocable trust and retains the right to live there rent-free for a specific term of years. Because only the future interest in the property is being transferred, not the immediate right to possess it, the taxable gift value is significantly lower than the home's full fair market value.

New Jersey trust attorney Christine Matus emphasizes that the IRS calculates the gift value using complex formulas that consider the home's current value, the length of the trust term, the homeowner's age, and current interest rates, called Section 7520 rates. A longer trust term and a younger age at transfer result in a smaller taxable gift because the homeowner retains the right to live there for more years. When the trust term expires, the home passes to beneficiaries outside the taxable estate, meaning the estate avoids taxation on any appreciation that occurred after the property was transferred.

The IRS limits QPRTs to personal residences only. A primary home qualifies, meaning the house where the homeowner lives most of the year. One vacation home or second residence can also be placed in a QPRT, but investment properties or rental real estate do not qualify. Homeowners can only have two QPRTs at any time-one for a primary residence and one for a vacation home. The property must include a dwelling that is actually used as a residence.

Many Ocean County residents use QPRTs for shore properties in communities like Point Pleasant Beach, Seaside Heights, Lavallette, and Long Beach Island that have appreciated significantly over the years. "Waterfront homes along Barnegat Bay and beachfront properties have seen particularly strong appreciation, making them ideal candidates for QPRTs that freeze value at current prices while passing future growth to children tax-free," notes Matus.

A QPRT makes sense when an estate will exceed the federal estate tax exemption and the homeowner owns a valuable home to keep in the family. Under current federal law, the federal estate and gift tax exemption is $13.99 million per person for 2025 and is scheduled to increase to $15 million per person in 2026. Estates above those amounts may be subject to federal estate tax at rates up to 40 percent.

Attorney Matus points out that homeowners should be relatively young and healthy when establishing a QPRT. Most estate planners recommend this strategy for homeowners in their 50s or early 60s with life expectancies well beyond the proposed trust term. This strategy works best when the homeowner plans to live in the home long-term and has sufficient assets outside the residence to support themselves.

The tax advantages of a QPRT make it one of the most powerful estate planning tools for transferring valuable residences. When a homeowner transfers property into a QPRT, a taxable gift equal to the home's fair market value minus the value of the retained interest is made. For example, a 60-year-old transferring a $1 million home into a 15-year QPRT might make a taxable gift of only $400,000 to $500,000, depending on interest rates. This allows substantial value to be transferred while using less of the lifetime gift tax exemption.

"After the trust term ends, homeowners must either move out, pay fair market rent to continue living there, or structure another arrangement that complies with IRS rules to preserve the estate tax benefits," adds Matus.

The biggest risk with a QPRT is dying before the trust term ends. If the homeowner does not survive the full trust term, the residence is included in the gross estate at its date-of-death value, as if the trust had never been created. The estate tax benefit is lost entirely, and the gift tax exemption used when funding the trust is wasted. For this reason, homeowners should be in good health when creating a QPRT and choose a term that gives a high probability of survival.

Setting up a QPRT involves choosing an appropriate trust term, drafting an IRS-compliant trust agreement, executing and recording a deed in Ocean County, updating insurance, and filing a federal gift tax return. The trust agreement must comply with strict IRS requirements under Section 2702 of the Internal Revenue Code to qualify for favorable tax treatment.

About The Matus Law Group:

The Matus Law Group is a Toms River-based law firm focused on trust and estate planning for families throughout Ocean County and New Jersey. Led by attorney Christine Matus, the firm assists clients in creating customized trusts and estate plans that safeguard loved ones and preserve wealth for future generations. For consultations, call (732) 281-0060.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=wtaofda3Wsg

GMB: https://www.google.com/maps?cid=6876392708092026946

Email and website

Email: admin@matuslaw.com

Website: https://matuslaw.com/

Media Contact

Company Name: Matus Law Group

Contact Person: Christine Matus

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-trust-attorney-christine-matus-explains-how-qualified-personal-residence-trusts-reduce-estate-taxes]

Phone: (732) 281-0060

Address:81 E Water St #2C

City: Toms River

State: New Jersey 08753

Country: United States

Website: https://matuslaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Trust Attorney Christine Matus Explains How Qualified Personal Residence Trusts Reduce Estate Taxes here

News-ID: 4354470 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

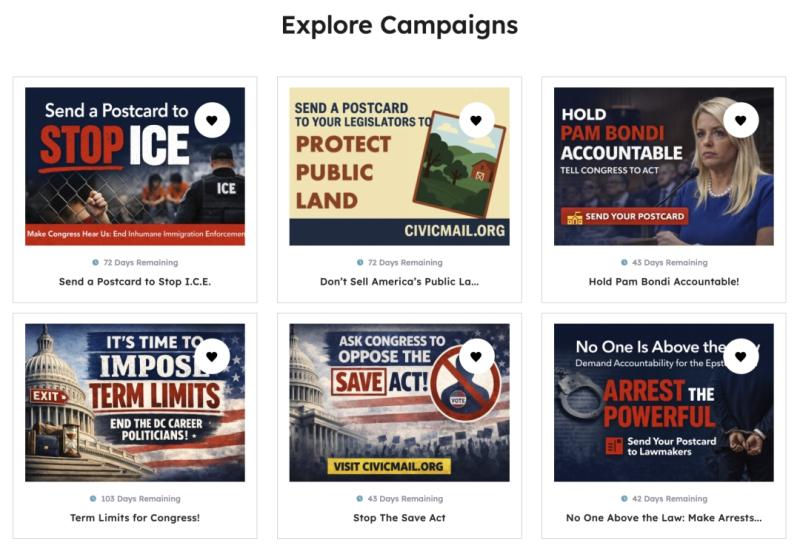

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Matus

New Jersey Probate Lawyer Christine Matus Explains How to Avoid Probate

Christine Matus (https://matuslaw.com/how-to-avoid-probate-in-new-jersey/), a seasoned New Jersey probate lawyer, offers valuable insights into navigating estate planning without the complications of probate. In her latest publication, "How to Avoid Probate in New Jersey," Matus outlines the legal mechanisms that help individuals sidestep the formal court process and ease the burden on surviving family members. The Matus Law Group, known for its legal services throughout New Jersey, provides guidance on avoiding lengthy…

New Jersey Medicaid Trust Attorney Christine Matus Explains Qualified Income Tru …

Navigating the strict financial requirements of Medicaid in New Jersey can be a significant barrier for many families seeking long-term care. New Jersey Medicaid trust attorney Christine Matus (https://matuslaw.com/understanding-qualified-income-trusts-in-new-jersey/) provides essential insights into how Qualified Income Trusts (QITs) serve as a crucial financial tool for individuals who exceed Medicaid income limits. Without compromising access to care or exhausting savings, these trusts offer a way to meet eligibility criteria while maintaining…

New Jersey Medicaid Trust Lawyer Christine Matus of The Matus Law Group Helps Fa …

Navigating Medicaid eligibility in New Jersey can be a complex process for individuals and families seeking healthcare assistance. A New Jersey Medicaid trust lawyer plays a crucial role in helping clients understand income and asset limits while preserving financial security. Christine Matus (https://matuslaw.com/new-jersey-medicaid-eligibility/) of The Matus Law Group provides guidance on Medicaid rules and planning strategies, ensuring that clients can access necessary medical care without jeopardizing their assets.

Medicaid, also known…

New Jersey Guardianship Attorney Christine Matus Explains Legal Considerations f …

New Jersey guardianship attorney [https://matuslaw.com/guardianship-attorney/] Christine Matus recently discussed the legal aspects of guardianship, providing insight into the responsibilities and challenges involved in the process. Guardianship is an essential legal arrangement for individuals who cannot make decisions for themselves due to age, disability, or other circumstances. With years of experience in this field, Christine Matus of The Matus Law Group has assisted families in navigating guardianship laws in New Jersey.

A…

New Jersey Estate Planning Attorney Christine Matus Discusses Estate Planning St …

New Jersey estate planning attorney [https://matuslaw.com/ocean-county-nj/] Christine Matus has shared valuable insights on estate planning strategies, emphasizing the importance of preparing for the future. As a legal professional with The Matus Law Group, Christine Matus highlights key aspects of estate planning that individuals and families should consider to protect their assets and loved ones. The discussion includes strategies for creating wills, trusts, and other essential estate planning documents.

The New Jersey…

New Jersey Wills Attorney Christine Matus Helps Families Secure Their Legacy

Planning for the future is a critical step in protecting assets and ensuring that loved ones are cared for according to an individual's wishes. Without a legally valid will, the distribution of assets is left to the courts, which may not align with personal preferences. New Jersey wills attorney Christine Matus (https://matuslaw.com/wills-attorney/) understands the importance of estate planning and works to help individuals and families create legally sound wills that…