Press release

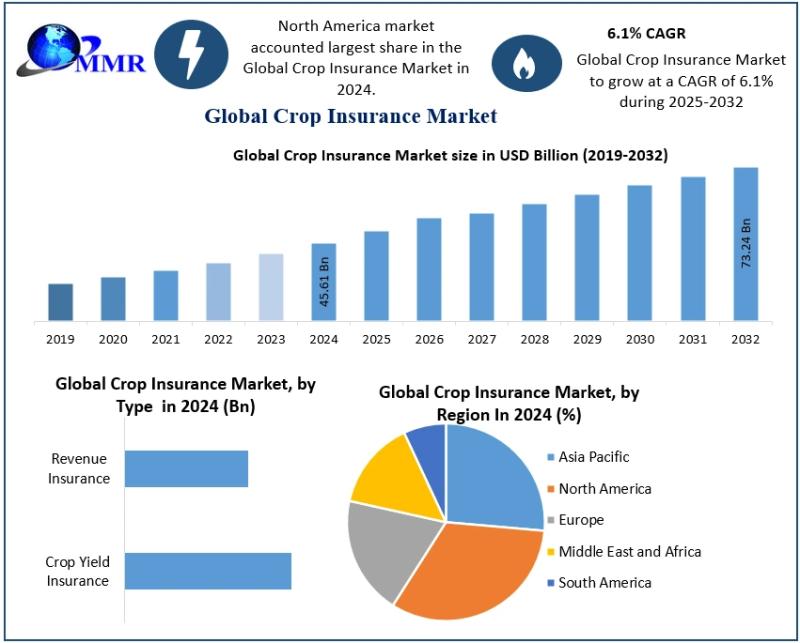

Crop Insurance Market to Reach USD 73.24 Billion by 2032 | Growth Driven by Tech, Climate Risks & Government Support

According to Maximize Market Research, the global Crop Insurance Market size was valued at USD 45.61 Billion in 2024 and is projected to grow at a CAGR of 6.1% to reach USD 73.24 Billion by 2032.Market Overview

The Crop Insurance Market has become a critical risk mitigation tool for global agriculture, protecting farmers and agribusinesses from unpredictable weather shocks, price drops, pests, and yield losses. With rising extreme weather events and the increasing adoption of digital technologies, demand for crop insurance products - such as multi-peril crop insurance (MPCI) and weather-indexed solutions - is expanding rapidly. Government subsidies and public-private partnerships are further accelerating uptake, especially in emerging economies where agricultural productivity underpins rural livelihoods and food security.

Unlock Insights: Request a Free Sample of Our Latest Report Now @ https://www.maximizemarketresearch.com/request-sample/148613/

Market Size Outlook

Base Year (2024) Market Value USD 45.61 Billion

Forecast Period 2025-2032

Projected Market Value (2032) USD 73.24 Billion

Forecast CAGR (2025-2032) 6.1%

Market Segmentation

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

Access Premium Market Insights - Limited-Time 30% Off https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

Market Key Growth Drivers

Climate Change & Weather Volatility: The rising frequency of floods, droughts, storms, and other extreme events is compelling farmers to adopt insurance solutions to protect revenues and assets.

Technology Integration: Digital adoption - including satellite imagery, AI risk modeling, drones, and remote sensing - is improving accuracy in underwriting and speeding up claim settlements.

Government Support & Subsidies: Incentive programs and subsidies from governments in key markets like the U.S., India, and China are making insurance affordable and accessible for smallholders.

Rising Awareness of Risk Management: As farmers face unpredictable market prices and yields, insurance becomes a key strategic tool in financial planning for modern agriculture.

Expansion of Parametric & Index-Based Products: These solutions reduce claim processing time by linking payouts to weather indices rather than traditional loss assessments.

Market Challenges

High Premium Costs: Premium affordability remains a barrier for small and marginal farmers, particularly in developing regions.

Complex Claim Processes: Policyholders often face bureaucratic documentation requirements and delays in payout settlements.

Limited Awareness & Accessibility: Many farmers lack understanding of insurance benefits or struggle to access digital platforms in remote areas.

Regulatory Hurdles: Varied compliance requirements across regions slow down product standardization and market adoption.

Recent Developments

Insurers are increasingly integrating AI and remote sensing technologies to automate risk assessment and fraud detection.

Growth in parametric insurance offerings that expedite payouts based on weather data.

Government-backed initiatives in several nations to boost enrollment, especially in rural farming communities.

Strategic partnerships between insurers and agri-tech providers to deliver mobile-enabled crop insurance platforms.

Need More Information? Inquire About additional details here @ https://www.maximizemarketresearch.com/request-sample/148613/

Emerging Opportunities

Microinsurance Products: Tailored, cost-effective products for smallholder farmers will expand market reach.

Blockchain & IoT: Enhanced transparency and secure claim verification can increase trust in insurance systems.

Mobile Platforms: Rural adoption is accelerating as mobile enrollment and claims simplify access.

Public-Private Partnerships (PPPs): Collaboration between governments and insurers to subsidize risk and expand coverage.

Market Key Players:

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

Frequently Asked Questions (FAQs)

1. What was the global Crop Insurance Market size in 2024?

The global market was valued at approximately USD 45.61 Billion in 2024.

2. What growth rate is expected for the market through 2032?

It is expected to grow at a CAGR of about 6.1% from 2025 to 2032.

3. Which product types dominate the market?

Multi-peril crop insurance (MPCI) accounts for the largest share due to wide coverage and government backing.

4. Which region leads the crop insurance market?

North America currently leads due to developed agricultural insurance frameworks, while Asia-Pacific is the fastest-growing region.

5. What are the key drivers of crop insurance adoption?

Climate change risk, digital technology integration, and government subsidies are primary growth drivers.

6. How are digital technologies influencing the market?

Technologies like AI, satellite data, and drones are improving risk assessment and claims efficiency.

Related Reports:

Insurance Advertising Market https://www.maximizemarketresearch.com/market-report/insurance-advertising-market/147736/

Critical Illness Insurance Market https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

Takaful Insurance Market https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Most performing reports:

Cinnamon Market https://www.maximizemarketresearch.com/market-report/global-cinnamon-market/116902/

Agriculture Packaging Market https://www.maximizemarketresearch.com/market-report/global-agriculture-packaging-market/99567/

Premium Finance Market https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

India Gold Loan Market https://www.maximizemarketresearch.com/market-report/india-gold-loan-market/213911/

Connect With Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Analytics Partner

https://www.mmrstatistics.com/

MMRStatistics is an advanced market intelligence platform delivering data-driven insights, forecasts, and industry trends across global markets. Powered by differentiated research modules-covering market sizing, competitive analysis, and future outlooks-it helps businesses decode complex industries with clarity. Unlike traditional market research firms, MMRStatistics blends primary research, secondary data, and analytical frameworks into actionable intelligence. Flexible subscription plans provide scalable access, from snapshot insights to enterprise-grade market reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market to Reach USD 73.24 Billion by 2032 | Growth Driven by Tech, Climate Risks & Government Support here

News-ID: 4352785 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

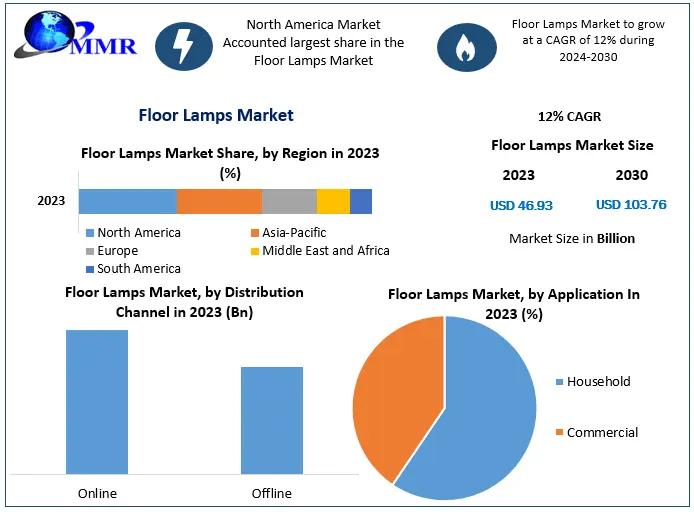

Floor Lamps Market Set to Surge, Reaching USD 103.76 Billion by 2030: Driven by …

The Floor Lamps Market is witnessing unprecedented growth, driven by increasing consumer interest in home décor, rising urbanization, and a growing focus on energy-efficient lighting solutions. The market size of floor lamps was valued at US$ 46.93 Billion in 2023, and it is projected to grow at a CAGR of 12% from 2024 to 2030, reaching nearly US$ 103.76 Billion by 2030.

Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/146940/…

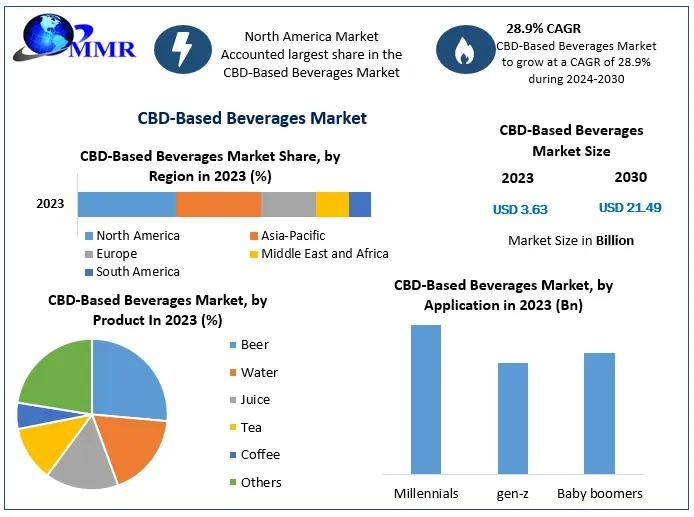

Hemp-Based Beverages Market Growth, Trends, and Forecast 2025-2032

Hemp-Based-Based Beverages Market: Growth, Dynamics, and Future Outlook

The Hemp-Based-Based Beverages Market size was valued at USD 5.12 Billion in 2024, and the total Hemp-Based-Based Beverages revenue is expected to grow at a CAGR of 7.4% from 2025 to 2032, reaching nearly USD 9.24 Billion by 2032.

Market Overview

The Hemp-Based-Based Beverages Market is emerging as a dynamic segment within the global functional beverages industry. Rising consumer awareness about wellness, natural remedies, and…

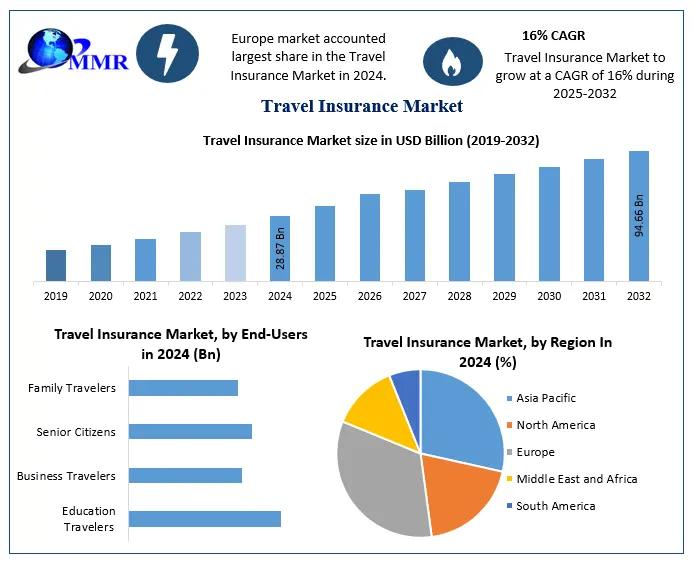

Travel Insurance Market to Reach USD 94.66 Billion by 2032, Driven by Post-Pande …

The Travel Insurance Market is witnessing significant growth, with a market size valued at USD 28.87 billion in 2024 and expected to reach USD 94.66 billion by 2032, growing at a robust CAGR of 16% during the forecast period from 2025 to 2032. The increasing need for protection against travel-related uncertainties, coupled with the resurgence of tourism post-COVID-19, is propelling the growth of the global travel insurance market.

Get a sneak…

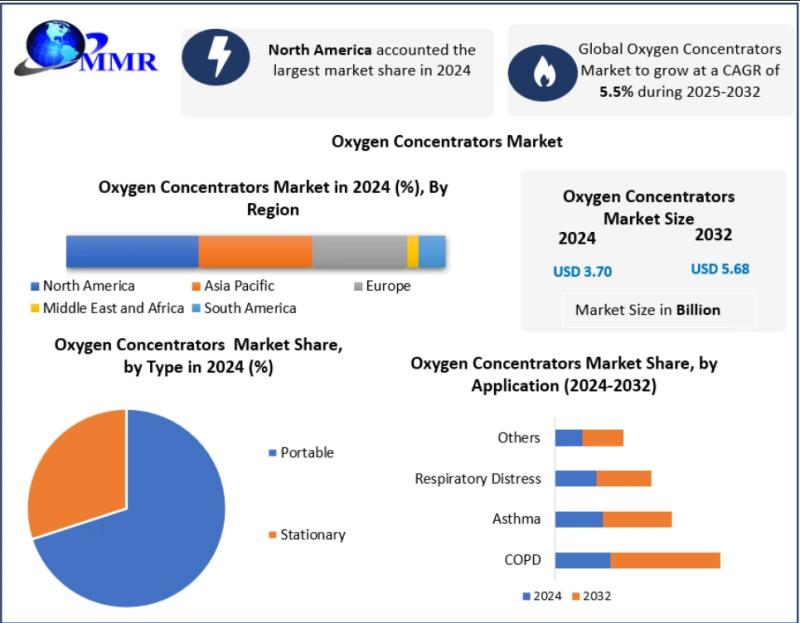

Oxygen Concentrators Market: Adoption of Energy-Efficient and Low-Noise Devices …

Oxygen Concentrators Market Overview

The Global Oxygen Concentrators Market is witnessing steady growth as demand for respiratory care solutions rises due to the increasing prevalence of chronic respiratory diseases such as COPD, asthma, and respiratory distress, particularly among aging populations. Oxygen concentrators are medical devices that extract oxygen from ambient air, removing nitrogen, and deliver concentrated oxygen through nasal cannula or masks. Portable models allow continuous oxygen therapy without the need…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…