Press release

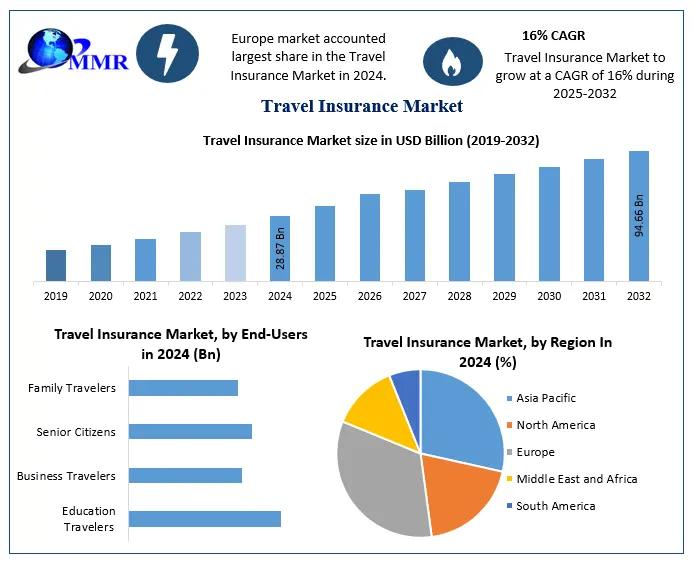

Travel Insurance Market to Reach USD 94.66 Billion by 2032, Driven by Post-Pandemic Tourism Boom and Digitalization

The Travel Insurance Market is witnessing significant growth, with a market size valued at USD 28.87 billion in 2024 and expected to reach USD 94.66 billion by 2032, growing at a robust CAGR of 16% during the forecast period from 2025 to 2032. The increasing need for protection against travel-related uncertainties, coupled with the resurgence of tourism post-COVID-19, is propelling the growth of the global travel insurance market.Get a sneak peek of this report today: https://www.maximizemarketresearch.com/request-sample/16133/

Travel Insurance Market Overview

Travel insurance is designed to safeguard travelers against unexpected events that may disrupt their journey. The market has evolved to include coverage for COVID-19-related costs such as testing, quarantine, and medical emergencies, reflecting the lessons learned from the pandemic. Rising tourism demand, fueled by easy internet travel bookings, increasing disposable income, and enhanced package holidays, is further driving the market. Travelers increasingly choose travel insurance to mitigate risks such as flight cancellations, lost luggage and critical documents, and medical emergencies.

Convenient purchase options through online comparison-shopping platforms, airline websites, online travel agents (OTAs), company websites, and mobile apps are also supporting the growth of the Travel Insurance Market.

Market Dynamics

Drivers:

Booming Post-Pandemic Tourism Demand: Following the COVID-19 pandemic, the demand for travel insurance has surged as travelers prioritize health and safety. Government regulations mandating insurance for travelers in countries like Singapore have reinforced this trend. For instance, visitors to Singapore must have travel insurance that covers COVID-19-related medical expenses, with minimum coverage of USD 30,000.

Emerging Economies Driving Growth: Countries such as the United States, Germany, and India are expected to significantly contribute to market growth. In India, the adoption of travel insurance is growing as travel becomes a key part of academic, business, and personal life. In the US, advances in air travel technology, globalization, and increased business travel demand are driving adoption. In Germany, mandatory insurance coverage for VISA applications is stimulating market growth.

Corporate Travelers: Companies are increasingly providing travel insurance for employees on international business trips. Recovery in business travel post-pandemic and the rise in international corporate trips are key growth factors.

Digitalization: The shift to online distribution channels allows consumers and corporate clients to purchase policies conveniently, compare multiple providers, and receive instant coverage.

Restraints:

Limited Financial Resources: Some market participants face challenges in integrating advanced technologies due to financial constraints.

Dynamic Market Conditions: Rapid changes in technology and regulations create uncertainty and make it difficult for key players to adapt effectively.

Opportunities:

Rise in Domestic and International Business Travel: Increasing international business travel has boosted demand for coverage against flight cancellations, health emergencies, baggage loss, and other uncertainties.

Digital Insurance Channels: The growth of online platforms for purchasing travel insurance enables greater accessibility and flexibility, driving market expansion.

Make Smarter Decisions in 2026 - Get Your Research Report Now: https://www.maximizemarketresearch.com/market-report/global-travel-insurance-market/16133/

Market Segmentation

By Insurance Coverage:

Single-Trip Travel Insurance: Dominates the market with a 60.1% share and expected to grow at a CAGR of 16.0%, covering services such as baggage loss, personal liability, trip cancellation, missed connections, emergency medical treatment, and more.

Annual Multi-Trip Travel Insurance: Expected to grow at a CAGR of 15.3% due to increasing demand among business travelers and frequent travelers.

Long-Stay Travel Insurance: Covers long-term travel needs, catering to expatriates and extended stay travelers.

By Distribution Channel:

Insurance Companies: Accounted for 34.8% of the market in 2024 and remain dominant due to their ability to consolidate risk among multiple policyholders.

Banks: Projected to grow at the highest CAGR of 18.0%, driven by bank-led insurance sales and underwriting in regions such as Europe, Asia, and Australia.

Insurance Intermediaries, Brokers, and Aggregators: Facilitate access to diverse insurance options for consumers.

By End-User:

Senior Citizens: Generated the highest revenue in 2024, totaling USD 5,805.5 million, driven by coverage for emergency evacuation, ticket subsidies, trip cancellation, and luggage loss.

Business Travelers: Expected to grow at the highest CAGR of 17.6%, reflecting the resurgence of corporate travel.

Education Travelers, Family Travelers, and Others: Represent growing segments due to increasing domestic and international travel for personal and educational purposes.

Regional Insights:

Europe: Dominated the market with a 43.1% share in 2024, driven by rising travel demand, increasing wealth, modern communication, and post-pandemic recovery.

Asia-Pacific: Expected to grow at the fastest rate of 16.7% due to advancements in medical and security-related travel insurance policies and initiatives such as vaccinated travel lanes in Singapore.

North America, Middle East & Africa, South America: These regions are witnessing steady growth fueled by business travel, digital insurance adoption, and increasing travel safety awareness.

Key Players in the Global Travel Insurance Market:

American International Group, Inc. (AIG)

Allianz Group

ASSICURAZIONI GENERALI S.P.A.

USI Insurance Services, LLC

battleface

Insure & Go Insurance Services Limited

Seven Corners Inc.

Travel Insured International

Zurich

Delphi Financial Group, Inc.

Ping An Insurance (Group) Company of China, Ltd.

Munchener-Ruck-Gruppe

Talanx Konzern

R+V Konzern

Generali Deutschland AG

AXA Konzern AG

Bayern

Huk-Coburg

Signal Iduna

Travelex Insurance Services Inc.

Berkshire Hathaway Travel Protection

Seeking market knowledge? Don't overlook the summary of the research report for crucial details: https://www.maximizemarketresearch.com/request-sample/16133/

Frequently Asked Questions (FAQ):

What segments are covered in the Global Travel Insurance Market?

Segments include insurance coverage (single-trip, annual multi-trip, long-stay), distribution channels (insurance companies, banks, intermediaries, brokers, aggregators), end-users (education travelers, business travelers, senior citizens, family travelers, others), and region.

Which region is expected to hold the highest share in the Travel Insurance Market?

Europe is expected to hold the highest market share.

What is the market size of the Global Travel Insurance Market by 2032?

The market is expected to reach USD 94.66 billion.

What is the forecast period for the Travel Insurance Market?

The forecast period is 2025-2032.

What was the Global Travel Insurance Market size in 2024?

The market size was USD 28.87 billion.

Related Reports:

Takaful Insurance Market https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Home Insurance Market https://www.maximizemarketresearch.com/market-report/home-insurance-market/209436/

Commercial Insurance Market https://www.maximizemarketresearch.com/market-report/commercial-insurance-market/208754/

Most performing reports:

Golf Apparel Market https://www.maximizemarketresearch.com/market-report/golf-apparel-market/187718/

Cut Flower Market https://www.maximizemarketresearch.com/market-report/cut-flower-market/188508/

hair color market https://www.maximizemarketresearch.com/market-report/global-hair-color-market/68529/

Global Vertical Farming Market https://www.maximizemarketresearch.com/market-report/global-vertical-farming-market/15221/

Connect with us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market to Reach USD 94.66 Billion by 2032, Driven by Post-Pandemic Tourism Boom and Digitalization here

News-ID: 4352766 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

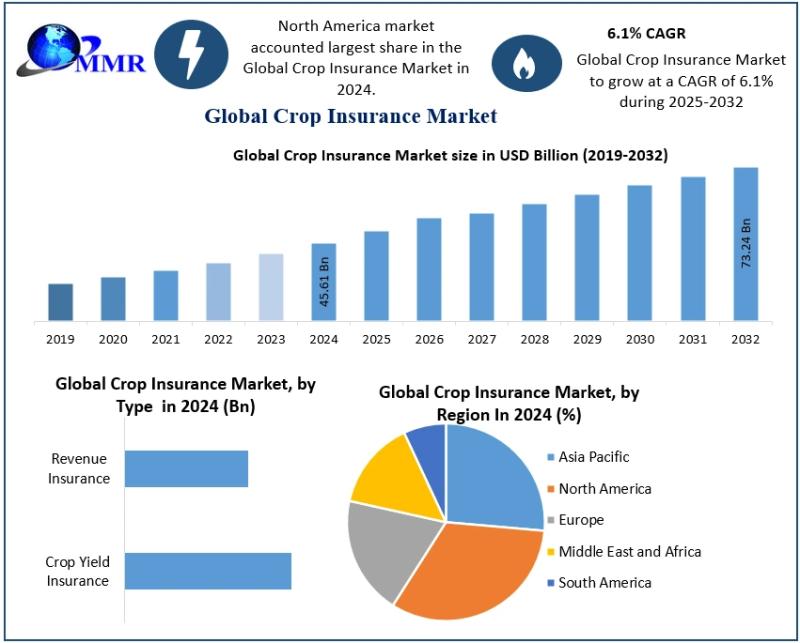

Crop Insurance Market to Reach USD 73.24 Billion by 2032 | Growth Driven by Tech …

According to Maximize Market Research, the global Crop Insurance Market size was valued at USD 45.61 Billion in 2024 and is projected to grow at a CAGR of 6.1% to reach USD 73.24 Billion by 2032.

Market Overview

The Crop Insurance Market has become a critical risk mitigation tool for global agriculture, protecting farmers and agribusinesses from unpredictable weather shocks, price drops, pests, and yield losses. With rising extreme weather events and…

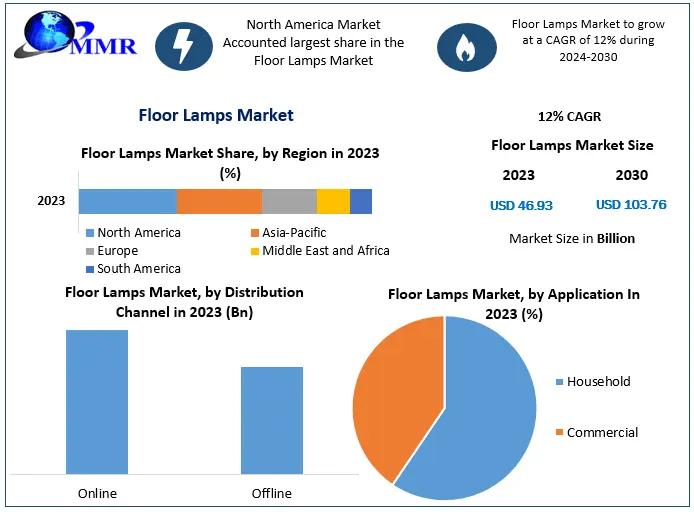

Floor Lamps Market Set to Surge, Reaching USD 103.76 Billion by 2030: Driven by …

The Floor Lamps Market is witnessing unprecedented growth, driven by increasing consumer interest in home décor, rising urbanization, and a growing focus on energy-efficient lighting solutions. The market size of floor lamps was valued at US$ 46.93 Billion in 2023, and it is projected to grow at a CAGR of 12% from 2024 to 2030, reaching nearly US$ 103.76 Billion by 2030.

Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/146940/…

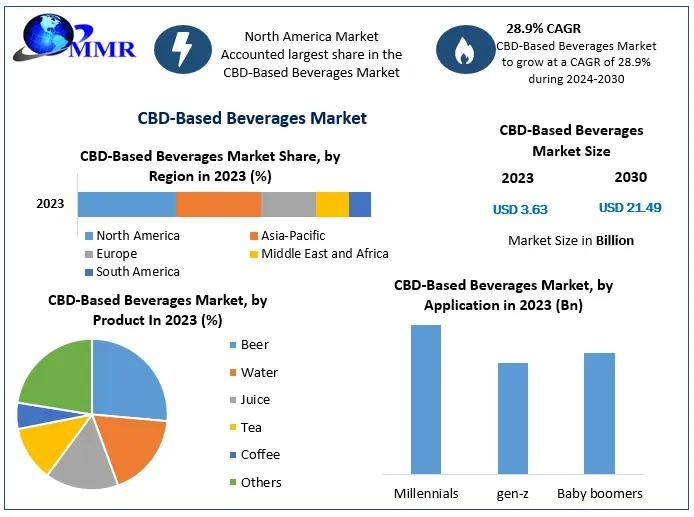

Hemp-Based Beverages Market Growth, Trends, and Forecast 2025-2032

Hemp-Based-Based Beverages Market: Growth, Dynamics, and Future Outlook

The Hemp-Based-Based Beverages Market size was valued at USD 5.12 Billion in 2024, and the total Hemp-Based-Based Beverages revenue is expected to grow at a CAGR of 7.4% from 2025 to 2032, reaching nearly USD 9.24 Billion by 2032.

Market Overview

The Hemp-Based-Based Beverages Market is emerging as a dynamic segment within the global functional beverages industry. Rising consumer awareness about wellness, natural remedies, and…

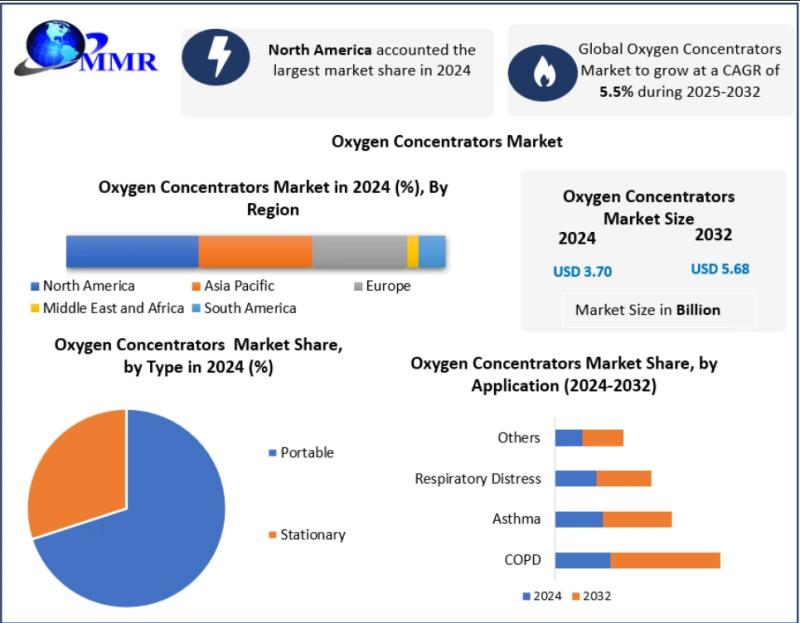

Oxygen Concentrators Market: Adoption of Energy-Efficient and Low-Noise Devices …

Oxygen Concentrators Market Overview

The Global Oxygen Concentrators Market is witnessing steady growth as demand for respiratory care solutions rises due to the increasing prevalence of chronic respiratory diseases such as COPD, asthma, and respiratory distress, particularly among aging populations. Oxygen concentrators are medical devices that extract oxygen from ambient air, removing nitrogen, and deliver concentrated oxygen through nasal cannula or masks. Portable models allow continuous oxygen therapy without the need…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…