Press release

India Gold Loan Market to Reach USD 5.2 Billion by 2034 | 3.61% CAGR | Get Free Sample Report

According to IMARC Group's report titled "India Gold Loan Market Size, Share, Trends and Forecast by Market Type, Type of Lenders, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.India Gold Loan Market Overview

The India gold loan market size reached USD 3.8 Billion in 2025. The market is projected to grow at a CAGR of 3.61% during the forecast period from 2026 to 2034, reaching a value of USD 5.2 Billion by 2034. This growth is driven by increasing consumer demand for accessible credit, rising gold prices, and supportive regulatory frameworks promoting transparency and security. Both traditional banks and fintech lenders are expanding their market presence.

Note : For the most recent data, insights, and industry updates, please click on "Request Free Sample Report".

Request Free Sample Report: https://www.imarcgroup.com/india-gold-loan-market/requestsample

India Gold Loan Market Key Takeaways

• Current Market Size: USD 3.8 Billion (2025)

• CAGR: 3.61%

• Forecast Period: 2026-2034

• Driven by economic uncertainty and rising financial needs, gold loans from banks surged by 50% in September 2024, outpacing overall loan growth.

• Gold loans are preferred for low-risk collateral backed by gold value, especially in rural and semi-urban areas with limited access to traditional credit.

• Regulatory enhancements by the RBI have increased transparency, security, and consumer confidence via tighter KYC and LTV ratio guidelines.

• Increased competition from both banks and fintech lenders improved loan terms like lower interest rates and flexible repayment.

• The market is expected to grow significantly in underbanked regions, expanding the customer base and market penetration.

India Gold Loan Market Growth Factors

The gold loan market in India is rapidly evolving due to changing consumer behavior, financial inclusion initiatives, and advancements in technology. The increasing favor for gold loans as a simple and trusted funding source is a key trend within India's gold loan market. Further, people can quickly and easily access loans through online applications, and tools to repay and manage loans have enabled a faster process. Further, because of an increase in competitive interest rates and flexible payment options, more customers have access to gold loans and gold loans are made affordable. The sector increasingly competes with non-banking financial companies (NBFCs) and FinTech, as these firms introduce new products and improve services.

Technology, especially artificial intelligence (AI) and blockchain, meaningfully improves the transparency and security during loan disbursement and the evaluation and monitoring regarding gold. People generally are aware that gold loans offer advantages like less documentation and disburse in a timely way, and this awareness rises in cities and villages. Gold loans are securitized as a growing trend that provides liquidity so the lender can extend more loans. The developments mirror a market that evolves to fulfill the diverse monetary requirements of the Indian populace, with technology a vital part.

India Gold Loan Market Trends

The gold loan market in India is very large, with a positive scope for growth. Gold is a very auspicious form of investment in Indian culture, and short-term credit requirements are increasing. The gold loan market is also driven by the abundant availability of gold owned by households in India. The expansion of financial inclusion programs provides an opportunity for gold loan lenders to tap into the unbanked and underbanked population in rural and semi-rural regions by offering gold loans. Policy measures driving greater transparency and consumer protection in gold loan products are also a key driver for this segment's growth.

The rise in awareness of the benefits of gold loans such as lower cost compared with unsecured loans, under penetration of both lending and borrowing in rural and semi urban India, rising financial literacy and increasing access to formal credit channels offer potential for growth in this segment. This expected collaboration between banks, NBFCs and fintech players is anticipated to lead to new product development and improved distribution of gold loan products. Overall, the above-mentioned factors are expected to contribute to the growth of the India gold loan market, providing opportunities for stakeholders to meet the financial needs of a diverse and growing population.

Buy the Latest 2026 Edition : https://www.imarcgroup.com/checkout?id=30157&method=3462

India Gold Loan Market Segmentation

Market Type Insights:

• Organized: Institutions and lenders following formal regulations and standards.

• Unorganized: Informal lenders operating without strict regulatory oversight.

Type of Lenders Insights:

• Banks: Traditional financial institutions providing gold loan services.

• NBFCs: Non-Banking Financial Companies actively competing in the gold loan domain.

• Others: Includes other financial entities offering gold loan facilities.

Application Insights:

• Investment: Gold loans primarily used for funding investment activities.

• Collecting: Used for meeting immediate financial needs or collecting funds.

Regional Insights

• North India

• South India

• East India

• West India

The North India region dominates the gold loan market with the largest market share and robust growth. The market is anticipated to grow at a CAGR of 3.61% during 2026-2034, driven by high gold ownership and significant consumer demand in this region.

India Gold Loan Market Recent Developments & News

In September 2024, the Reserve Bank of India (RBI) issued a circular emphasizing strict adherence to prudential norms for gold-backed loans. RBI instructed supervised entities to review their existing gold loan policies and practices following non-compliance findings during recent inspections. This regulatory move aims to ensure safer lending practices, protect consumer interests, and maintain market integrity.

India Gold Loan Market Key Highlights of the Report

• Comprehensive analysis of historical trends and future market outlook from 2020 to 2034.

• Detailed segmentation by market type, lender type, application, and region.

• Insights on market drivers, challenges, and growth opportunities.

• Porter's Five Forces analysis to assess competitive rivalry and market attractiveness.

• Competitive landscape analysis, including key player profiling and strategic positioning.

• Evaluation of regulatory impact and evolving industry practices.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=30157&flag=E

Customization Note: If you require any specific information not covered within this report's scope, we will provide it as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact. The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Gold Loan Market to Reach USD 5.2 Billion by 2034 | 3.61% CAGR | Get Free Sample Report here

News-ID: 4349974 • Views: …

More Releases from IMARC Group

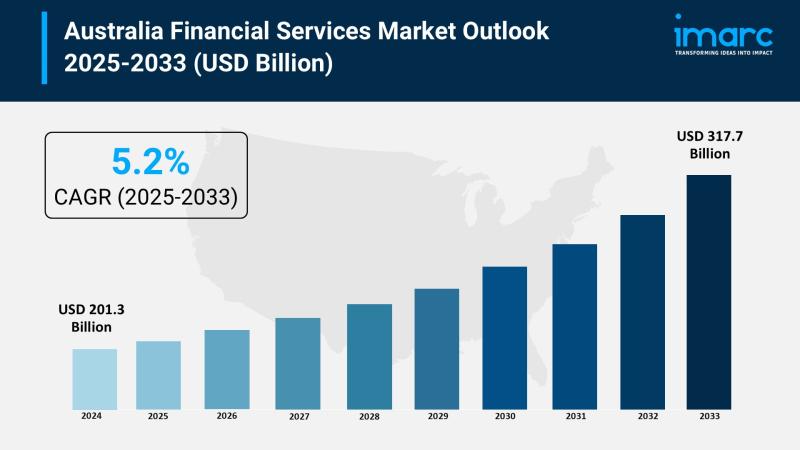

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

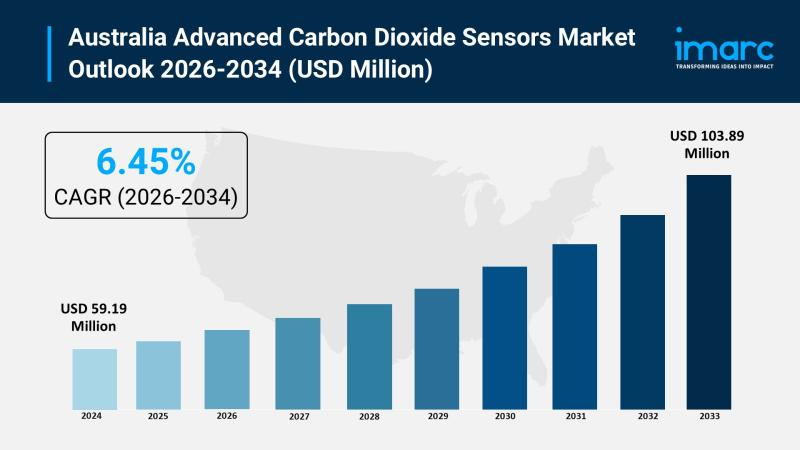

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

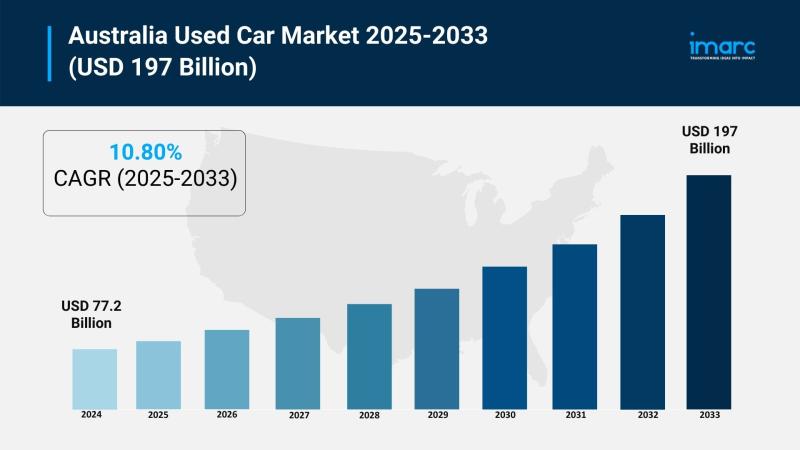

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

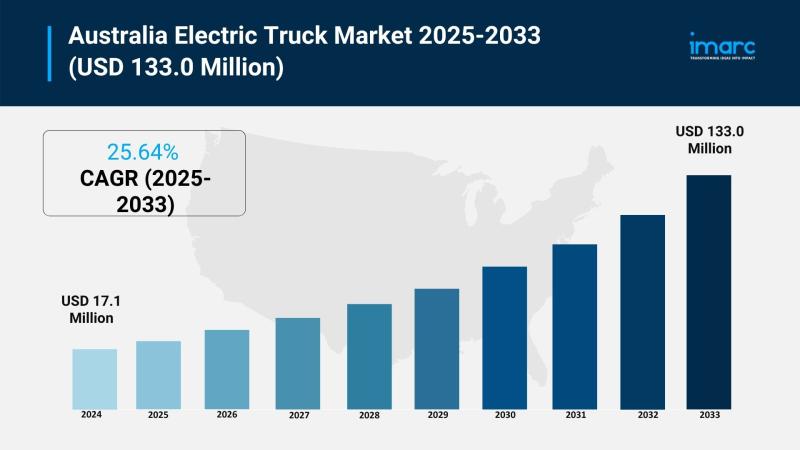

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…