Press release

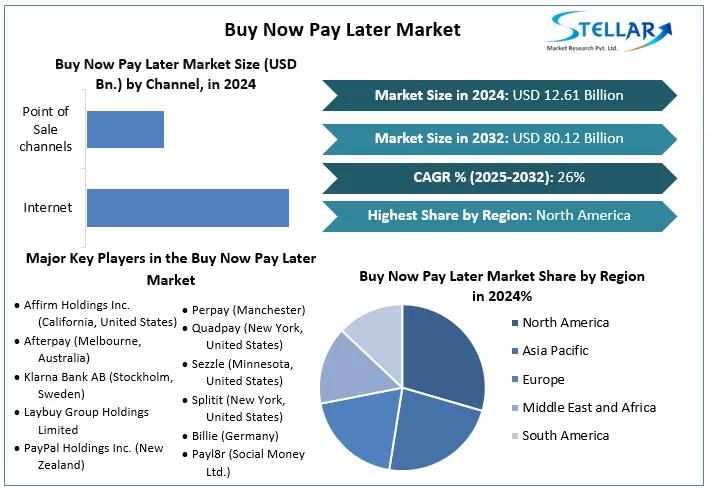

Buy Now Pay Later Market Expected To Reach USD 80.12 Billion 2032, Grow at a CAGR of 26.0% Forecast 2025-2032

Buy Now Pay Later Market is expected to grow at a CAGR of 26.0% during the forecast period. Buy Now Pay Later Market is expected to reach USD 80.12 Bn. in 2032 from USD 12.61 Bn. in 2024Market Overview

The Buy Now Pay Later (BNPL) market has emerged as one of the fastest-growing segments in financial technology (fintech). BNPL solutions allow consumers to make purchases immediately and pay for them over time through interest-free or low-fee installment plans. Unlike traditional credit products, BNPL is integrated directly into checkout experiences - both online and in-store - enabling a frictionless pay-later option that resonates strongly with digitally savvy consumers.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.stellarmr.com/report/req_sample/Buy-Now-Pay-Later-Market/551

Originally popularized by e-commerce platforms, BNPL providers partner with merchants to offer flexible payment options at point of sale. Over the past few years, the segment has expanded across retail categories - from apparel and electronics to travel bookings and everyday essentials. Millennials, Gen Z, and untapped under-banked populations are increasingly adopting BNPL for budgeting convenience, transparent fees, and faster approvals compared to traditional credit cards or loans.

The BNPL market is expected to continue expanding as both consumers and merchants embrace installment-based spending - reshaping the landscape of consumer payments and short-term credit worldwide.

Market Dynamics

The BNPL landscape is shaped by evolving consumer behavior, technological innovation, and regulatory developments:

Shift in Consumer Payment Preferences

Consumers increasingly prefer flexible payment methods that reduce upfront costs without accruing high interest. BNPL fills this gap, especially among younger shoppers who seek manageable and transparent financial options.

Integration with E-commerce Platforms

Digital checkout experiences that embed BNPL options improve conversion rates and average order values. Merchants benefit from increased sales, while consumers enjoy seamless payment choices.

Rise of Mobile Shopping

The accelerated adoption of mobile commerce amplifies BNPL usage. Mobile-first consumers are more likely to choose quick and flexible financing options at checkout.

Competitive Fintech and Banking Response

Traditional banks and credit card issuers are introducing installment-based solutions to compete with BNPL offerings. Partnerships between fintech startups and established financial institutions are becoming more common.

Regulatory Scrutiny and Frameworks

Growing concerns about consumer debt and financial risk have prompted regulators in various regions to evaluate BNPL practices. Emerging compliance requirements are shaping how providers manage credit checks, disclosures, and repayment terms.

Get access to the full description of the report @ https://www.stellarmr.com/report/Buy-Now-Pay-Later-Market/551

Key Drivers Ranked by Impact

Consumer Demand for Flexible Payments

The strongest driver of BNPL adoption is consumer desire for payment flexibility without high interest rates. This is especially true among younger generations and budget-conscious shoppers.

E-commerce Growth and Checkout Optimization

Integration of BNPL at checkout boosts online sales conversion and average purchase value - making it attractive for merchants and platforms.

Digital Wallet and Mobile Adoption

As mobile spending and digital wallet usage rise, BNPL becomes a natural extension of digital financial services.

Merchant Incentives and Wider Adoption

Merchants partnering with BNPL providers often benefit from increased traffic and higher sales, strengthening adoption across retail sectors.

Competitive Financial Products

Traditional lenders adapting installment products and credit cards with flexible pay-later features expand the competitive landscape and stimulate market growth.

Regulatory Evolution

Emerging consumer protection and credit reporting guidelines influence how BNPL providers adapt their product features and risk management strategies.

Market Segmentation

The BNPL market can be segmented by type, end-user, and distribution channel to reflect nuanced demand trends:

By Channel

Internet

Point of Sale channels

By Environment

Small and Medium Enterprises (SMEs)

Large Enterprises

By End User

Consumer electronics

BFSI

Healthcare

Fashion & Garment

Retail

Media

Entertainment

Regional Analysis

The BNPL market exhibits diverse adoption patterns and growth rates across global regions:

North America

North America remains one of the largest BNPL markets, driven by strong e-commerce penetration and consumer fintech adoption. Major BNPL players have established partnerships with national retailers and digital marketplaces, with both online and in-store offerings gaining traction.

Europe

Europe has seen rapid BNPL expansion due to strong online retail markets and consumer preferences for installment payments. Regulatory focus remains high, with authorities emphasizing clear disclosures and responsible lending practices.

Asia-Pacific

Asia-Pacific is among the fastest-growing regions for BNPL solutions, supported by expanding digital ecosystems, high mobile usage, and a large young population. Local fintech innovation and partnerships with national payment networks accelerate growth.

Latin America

Latin America's BNPL adoption is rising as digital payments expand and under-banked populations seek accessible credit alternatives. Retailer partnerships and mobile payment integration drive usage in urban areas.

Middle East and Africa

In the Middle East and Africa, BNPL is emerging as a flexible payment option for digitally active consumers. Growth is supported by expanding e-commerce and investment in digital payment infrastructure.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.stellarmr.com/report/req_sample/Buy-Now-Pay-Later-Market/551

Opportunities in the Market

The BNPL market presents multiple strategic opportunities for providers, merchants, and investors:

Expansion into New Retail Categories

BNPL can grow beyond fashion and electronics into categories such as healthcare services, education, utilities, and travel - segments where payment flexibility can drive demand.

Partnerships with Traditional Financial Institutions

Collaborations between BNPL providers and banks or credit card networks can enhance reach, risk management, and product innovation.

Data Analytics and Personalization

Leveraging consumer data to offer personalized payment plans, dynamic credit limits, and tailored promotions can boost user engagement and retention.

Integration with Digital Wallets and Super Apps

Embedding BNPL functionality into digital wallets and super apps positions providers where consumers already manage finances - improving convenience and uptake.

Focus on Regulatory Compliance and Financial Well-Being

By promoting transparent terms, responsible lending practices, and consumer education, providers can strengthen trust and ensure sustainable long-term growth.

SME-Focused BNPL Solutions

Customizing BNPL products for business financing, procurement costs, and operating expenses opens a new customer segment with strong recurring use cases.

Some of the most prominent players in the Buy Now Pay Later Market are:

Affirm Holdings Inc. (California, United States)

Afterpay (Melbourne, Australia)

Klarna Bank AB (Stockholm, Sweden)

Laybuy Group Holdings Limited

PayPal Holdings Inc. (New Zealand)

Payl8r (Social Money Ltd.)

Perpay (Manchester)

Quadpay (New York, United States)

Sezzle (Minnesota, United States)

Splitit (New York, United States)

Billie (Germany)

Frequently Asked Questions

What will be the size of the Buy Now Pay Later Market in the foreseeable future?

The Buy Now Pay Later Market is estimated to grow at a CAGR of 26.0% from 2025 to 2032.

Who are the key players in the Buy Now Pay Later Market?

Payl8r, Perpay, Quadpay, Sezzle, Splitit are among the key players in the Buy Now Pay Later Market.

Which End Userstype in the Buy Now Pay Later Market is expected to grow in 2025- 2032?

The Consumer Electronics End Usersis expected to grow in the Buy Now Pay Later Market at a higher rate during the next five years.

Which area holds the highest share in the Buy Now Pay Later Market?

North America is expected to be the largest Buy Now Pay Later Market during the forecast period.

Which are the factors that drive Buy Now Pay Later Market Growth?

The rise in penetration of online payment across the globe and growth in the e-commerce industry in emerging countries etc. boost the Buy Now Pay Later Market growth.

Top Trending Reports:

Digital Twin Market https://www.stellarmr.com/report/Digital-Twin-Market/1606

Mexico Zero Trust Security Market https://www.stellarmr.com/report/Mexico-Zero-Trust-Security-Market/1607

US Zero Trust Security Market https://www.stellarmr.com/report/US-Zero-Trust-Security-Market/1610

US 5G Technology Market https://www.stellarmr.com/report/US-5G-Technology-Market/1615

Mexico 5G Technology Market https://www.stellarmr.com/report/Mexico-5G-Technology-Market/1616

Japan 5G Technology Market https://www.stellarmr.com/report/Japan-5G-Technology-Market/1621

Vehicle Tracking Market https://www.stellarmr.com/report/Vehicle-Tracking-Market/1624

Foldable Smartphone Market https://www.stellarmr.com/report/Foldable-Smartphone-Market/1632

Phase 3, Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor, Near,

Navale Brg, Narhe,

Pune, Maharashtra 411041

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Market Expected To Reach USD 80.12 Billion 2032, Grow at a CAGR of 26.0% Forecast 2025-2032 here

News-ID: 4349956 • Views: …

More Releases from Stellar Market Research. PVT. LTD

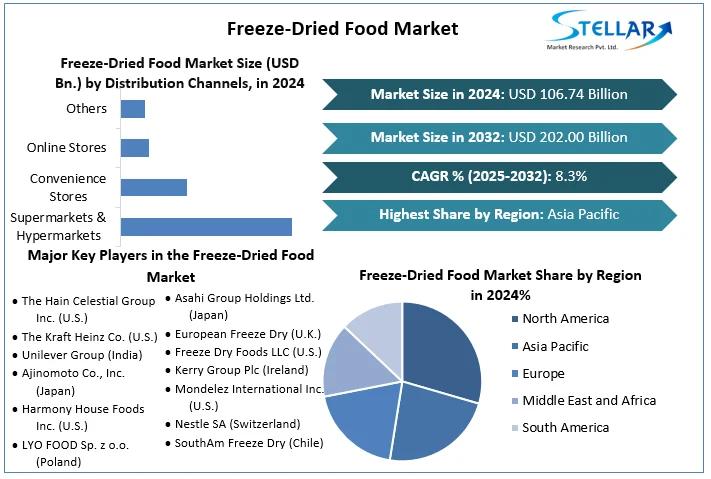

Freeze-Dried Food Market To Suprass 202.00 Billion in 2032, Grow at a CAGR of 8. …

Freeze-Dried Food market was valued at USD 106.74 Billion in 2024, growing from USD 202.00 Billion in 2032. It is estimated that the Global Market is to grow at a CAGR of 8.3% over the forecast period.

Market Overview

The freeze-dried food market has emerged as a high-growth segment within the broader global packaged and preserved foods industry. Freeze-dried food is produced by removing moisture from food products through a process of…

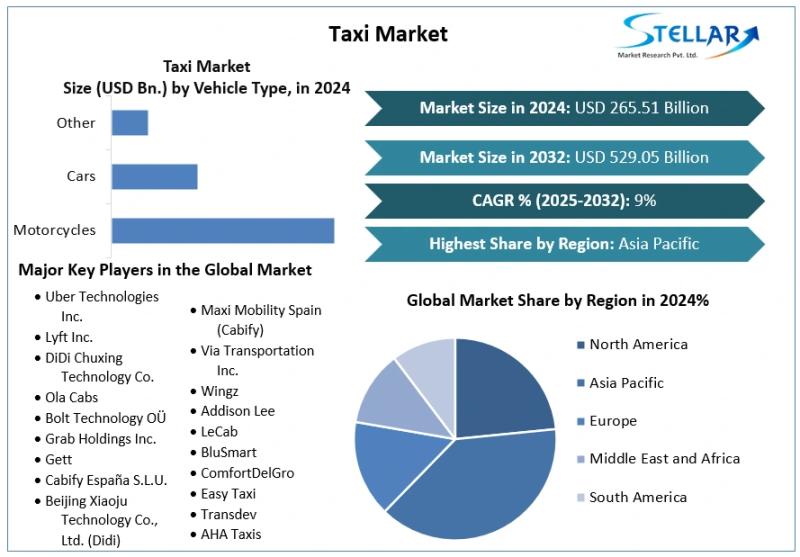

Taxi Market Growth Trends, Key Drivers, and Future Opportunities To Forecast 202 …

Taxi Market size was valued at USD 265.51 Bn. in 2024 and the total taxi Market size is expected to grow at a CAGR of 9% from 2025 to 2032, reaching nearly USD 529.05 Bn. by 2032.

Market Overview

The taxi market plays a vital role in urban mobility, offering point-to-point transportation services for millions of commuters daily. Traditionally dominated by conventional taxi fleets, the market has transformed significantly over the past…

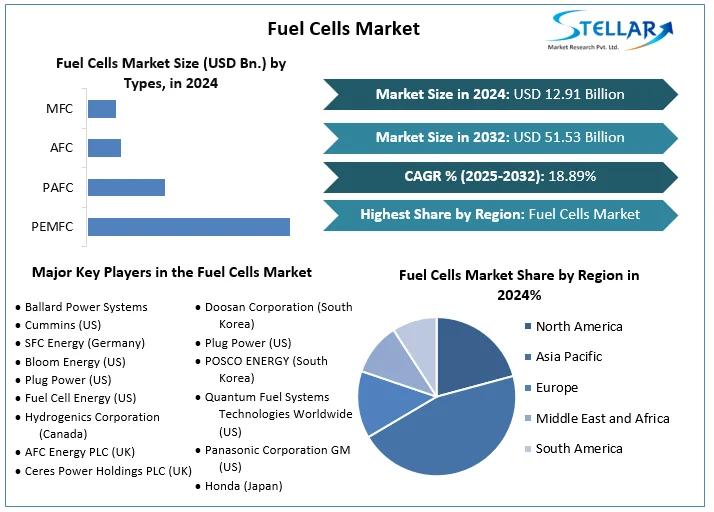

Fuel Cells Market Growing at CAGR 18.89%, Expected To Reach USD 51.52 Billion 20 …

Fuel Cells Market size was valued at USD 12.91 Bn. in 2024. Fuel Cells Market is estimated to grow at a CAGR of 18.89% over the forecast period.

Market Overview

The Fuel Cells Market is a rapidly evolving segment within the broader clean energy and power generation landscape. Fuel cells are electrochemical devices that convert chemical energy from fuels such as hydrogen, natural gas, and methanol directly into electricity, with water and…

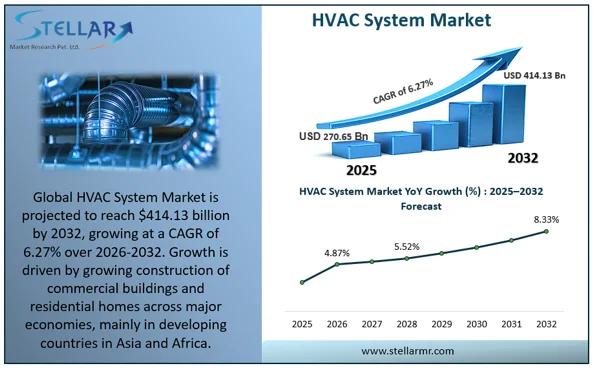

HVAC System Market at a CAGR of 6.27%, to Reach USD 414.13 Billion by 2032

HVAC System market size was valued, USD 270.65 Billion in 2025 and is expected to reach USD 414.13 Billion by 2032 at a CAGR of 6.27%.

Market Overview

The HVAC (Heating, Ventilation and Air Conditioning) system market plays an essential role in residential, commercial, and industrial infrastructure worldwide. HVAC systems regulate indoor climates to maintain comfort, improve air quality, and support health and productivity. Rising urbanization, increasing construction activities, and growing awareness…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…