Press release

China's new ship orders for 2025 are 1,421

In 2025, which has just ended, the global new shipbuilding market has cooled down significantly amid the decline from high levels. China's shipbuilding industry has withstood the impact of external non-market factors such as the US Section 301 policy, and still ranks first in the world in terms of orders received, but its market share has declined for the first time in the past five years.According to data released by Clarkson on January 7, for the whole of 2025, the global cumulative new ship order volume was 2,036 ships with 56.43 million corrected gross tons (CGT), a 27% decrease in CGT from 76.78 million CGT in 2024. Among them, Chinese shipbuilding companies received orders for 1,421 ships worth 35.37 million CGT, a year-on-year decrease of 35%, with a market share of 63%, ranking first in the world; Korean shipbuilding companies received orders for 247 ships worth 11.6 million CGT, a year-on-year increase of 8%, with a market share of 21%, ranking second.

In December last year, the global new ship order volume was 264 ships with 8.09 million CGT, a 69% decrease in CGT from 4.79 million CGT in the same period in 2024, and an increase of 23% from 6.59 million CGT in November last year. Among them, Chinese shipbuilding companies received orders for 223 new ships worth 5.71 million CGT, with a global market share of 71%, ranking first; Korean shipbuilding companies received orders for 23 ships worth 1.47 million CGT, with a global market share of 18%, ranking second.

The Korean industry said that although the number of orders received by Korean shipbuilding companies in 2025 is still far less than that of China, in terms of single ship CGT, South Korea is 47,000 CGT per ship and China is 25,000 CGT. South Korea is nearly twice that of China. This is because South Korean shipbuilding companies continue to receive orders centered on high value-added ship types.

In 2025, the number of orders received by Chinese shipbuilding companies will decrease by 35% year-on-year, while the number of orders received by Korean shipbuilding companies will increase by 8% year-on-year. This has also become the key for the Korean shipbuilding industry to narrow the market share gap with China after 5 years.

It is worth mentioning that this is the first time in the past five years that the market share of Chinese shipbuilding companies has declined, and it is also the first time that the gap between China and South Korea has narrowed. In 2021, China's shipbuilding industry's global market share will be 51%, and South Korea's will be 32%; in 2022, China's shipbuilding industry's global market share will be 52%, and South Korea's will be 32%; in 2023, China's shipbuilding industry's global market share will rise to 60%, and South Korea's global market share will drop to 20%; in 2024, China's shipbuilding industry's global market share will rise again to 71%, while South Korea's will decrease to 14%. The market share gap between the two parties increased from 19 percentage points to 57 percentage points in four years, showing a trend of expanding year by year.

Clarkson pointed out that the international situation in 2025 will be an even greater test for China's shipbuilding industry. U.S. policy targets China's shipbuilding and China's shipbuilding, and Chinese shipbuilding companies have experienced unprecedented tests from external non-market factors.

From the perspective of ship type, China continues to expand its leading position in bulk carrier construction, with its order share exceeding 80% for the first time; container ship feeder and large ship orders were received at the same time, capturing 68% of container ship orders throughout the year; oil tanker orders benefited from the strength and flexibility of major countries. With active shipbuilding production capacity, batch orders were completed at the end of the year, and the global order intake surpassed South Korea in one fell swoop; orders for liquefied gas ships have been adjusted in timing. When China's mainstream shipyards are full of orders and have tight ship slots, orders flow to South Korea, which can provide earlier delivery. As a market for gas carriers that are difficult to build but have small ships, it is difficult for liquefied gas carrier production capacity to transfer to small and medium-sized enterprises. But in addition to this, it should also be pointed out that due to the impact of the US Section 301 policy, the stance of some shipowners has changed, resulting in some orders flowing to overseas shipyards. Under the influence of the overall rebound in orders, the impact on China's volume will be small.

It is understood that in April 2024, following the petition of five U.S. labor unions, the Office of the United States Trade Representative (USTR) launched a 301 investigation into China's maritime, logistics and shipbuilding industries. In February 2025, USTR released a draft of Section 301 for China's shipping, logistics and shipbuilding industries. This had a significant impact on the new shipbuilding market. In March, South Korean shipbuilding companies once topped the list with 55% of global orders, while Chinese shipbuilding companies accounted for only 35% of the market that month.

As USTR announced a revised final port fee collection plan in April 2025, easing charges for Chinese-built ships or newbuildings owned by non-Chinese companies, shipowners began to return to Chinese shipyards to order ships. In April, Chinese shipbuilding companies successfully secured nearly 70% of the world's new ship orders, and since then the number of monthly orders has ranked first in the world.

At the end of October last year, after China and the United States agreed to suspend the mutual collection of port fees and reciprocal tariffs for one year, the USTR announced on November 9 that it would suspend the implementation of its Section 301 investigation measures on China's maritime, logistics and shipbuilding industries for one year starting from November 10. China has also decided to suspend the collection of special port fees from US ships.

As of the end of December last year, the global order book volume was 173.91 million CGT, an increase of 3.12 million CGT from the end of November last year. Among them, China's on-hand order volume reached 107.48 million CGT, an increase of 10.01 million CGT year-on-year, and continued to rank first with a market share of 62%; South Korea's on-hand order volume was 35.12 million CGT, a year-on-year decrease of 2.45 million CGT, with a market share of 20%, ranking second.

In December last year, new ship prices continued to maintain a stable momentum. The Clarkson Newbuilding Price Index was 184.65 points, an increase of 0.32 percentage points from 184.33 points in November, and an increase of about 47% from 125.6 points in the same period five years ago.

In terms of ship type, the price of a 174,000 cubic meter large LNG carrier was US$248 million, the same as in November; the price of a very large crude carrier (VLCC) was US$128 million, an increase of US$500,000 from US$127.5 million in October; the price of a 22,000~24,000TEU ultra-large container ship was US$262 million, a US$2 million decrease from US$264 million in November.

No.7, Huitong Industrial Park, Jinzhong Developmen

Sinosteel Stainless Steel Pipe

Web: https://www.sinosteel-pipe.com/en

email: contact@sinosteel-pipe.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China's new ship orders for 2025 are 1,421 here

News-ID: 4348622 • Views: …

More Releases from Sinosteel Stainless Steel Pipe Technology (Shanxi) Co., Ltd.

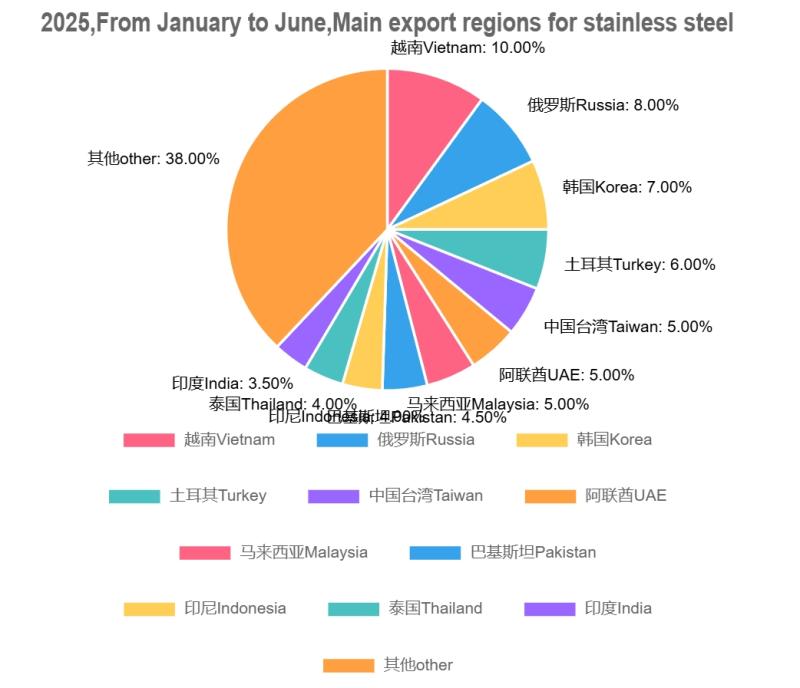

Brief analysis of China's stainless steel import and export data from January to …

1. Stainless steel import and export volume

(1) Import volume of stainless steel

According to China's customs statistics: In June 2025, China's stainless steel imports were about 109,500 tons, a decrease of 15,600 tons month-on-month, a decrease of 12.5%; a decrease of 21,800 tons year-on-year, a decrease of 16.6%.

From January to June 2025, China's stainless steel imports totaled about 827,500 tons, a year-on-year decrease of 280,300 tons, a decrease of 25.3%.

The decline…

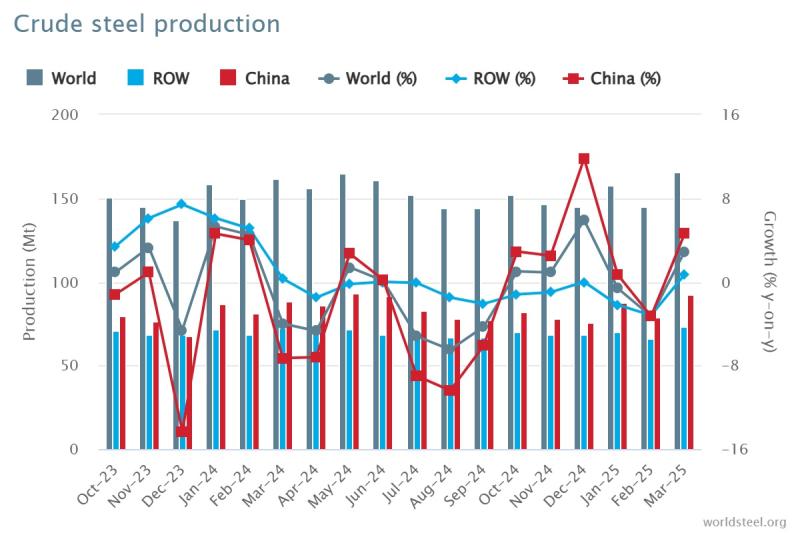

Global crude steel production in March 2025

World crude steel production for the 69 countries reporting to the World Steel Association (worldsteel) was 166.1 million tonnes (Mt) in March 2025, a 2.9% increase compared to March 2024.

In January 2025, the global crude steel production of 69 countries/regions included in the World Steel Association's statistics was 151.4 million tons, a year-on-year decrease of 4.4%.

In February 2025, the global crude steel production of these 69 countries/regions was 144.7 million…

The European Union has released the "Steel and Metals Industry Action Plan" to c …

On March 19, the European Commission released the "Steel and Metals Industry Action Plan," aimed at enhancing the competitiveness of the industry and addressing the potential impact of US steel tariffs. The plan focuses on six core areas: ensuring clean and affordable energy supply, preventing carbon leakage, strengthening and protecting European industrial capacity, promoting metal resource recycling, safeguarding high-quality industrial jobs, and reducing investment risks through market leadership and public…

Global crude steel production in November 2024

In November 2024, the crude steel output of 71 countries/regions included in the statistics of the World Iron and Steel Association was 146.8 million tons, an increase of 0.8% over the same period last year.

I. Global crude steel production in November 2024

In November 2024, the crude steel output of 71 countries/regions included in the statistics of the World Iron and Steel Association was 146.8 million tons, an increase of 0.8% over…

More Releases for China

China fund establishment, China fund management,china investment management

Pandacu China is a leading financial institution that specializes in providing fund establishment and management services for domestic and international investors looking to invest in China. The company was founded in 2015 by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the investment industry.

https://boomingfaucet.com/

China Fund Establishment Consultation

E-mail:nolan@pandacuads.com

Investing in China can be a complex and challenging process, and…

China Finance Advisor, China Debt Finance Corporation,China Investment Corporati …

Investment bank is a financial institution that helps companies and governments raise capital by underwriting and issuing securities, and also provides advice on mergers and acquisitions, strategic investments, and other financial matters. Investment banks typically have a team of professionals with expertise in various areas such as corporate finance, securities underwriting, sales and trading, and market research.

http://pandacuads.com/

China Investment Corporation

Email:nolan@pandacuads.com

Some of the main services provided by investment banks include:

Underwriting: Investment banks…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

china construction company,china engineering company,china major bridge engineer …

List of Top 500 Chinese Construction Enterprises

ranking

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Company Name

province

1

China State Construction Corporation Limited

Beijing

2

China Railway Corporation Limited

Beijing

3

China Railway Construction Corporation Limited

Beijing

4

Shanghai Weimengsi Construction Engineering Co., Ltd.

Shanghai

5

China Communications Construction Group Co., Ltd.

Beijing

6

China Power Construction Corporation Limited

Beijing

7

China Energy Construction Group Co., Ltd.

Beijing

8

Shanghai Construction Engineering Group Co., Ltd.

Shanghai

9

Jiangsu Zhongnan Construction Industry Group Co., Ltd.

Jiangsu

10

China Gezhouba Group Co., Ltd.

Hubei

11

China National Chemical Engineering Co., Ltd.

Beijing

12

Sinoma Group Co., Ltd.

Beijing

13

Guangxi Construction Engineering Group Co., Ltd.

Guangxi

14

Shanghai Urban…

Forehead Thermometer Market Analysis (2019- 2025)| Microlife (China), Radiant (C …

This research study is one of the most detailed and accurate ones that solely focus on the global Forehead Thermometer market. It sheds light on critical factors that impact the growth of the global Forehead Thermometer market on several fronts. Market participants can use the report to gain a sound understanding of the competitive landscape and strategies adopted by leading players of the global Forehead Thermometer market. The authors of…

Global Color Steel Tile Market 2017 - South China, East China, Southwest China, …

Color Steel Tile Market Research Report

A market study based on the " Color Steel Tile Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Color Steel Tile Market 2017’. The research report analyses the historical as well as present performance of the worldwide Color Steel Tile industry, and makes predictions on the future status of Color Steel Tile market on the basis…