Press release

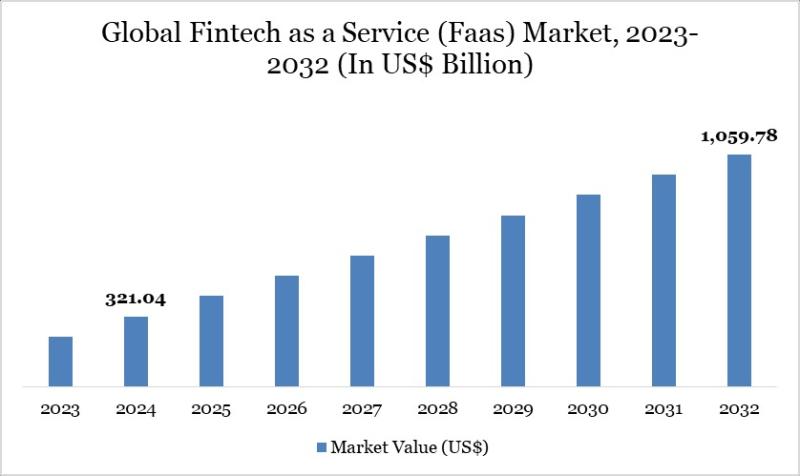

Fintech as a Service (FaaS) Market to Reach US$ 1,059.78 Billion by 2032 at 16.10% CAGR; North America Leads with 39% Share | Key Players Stripe, Finastra, Backbase

The Fintech as a Service (FaaS) market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing at a CAGR of 16.10% during the forecast period 2025-2032. The market is expanding rapidly as organizations across banking, retail, e-commerce, and technology sectors increasingly embed financial capabilities into their digital platforms without developing in-house infrastructure. Cloud-based APIs and modular fintech platforms are enabling faster deployment of services such as digital payments, lending, wealth management, and identity verification, significantly reducing time-to-market and operational costs.Growth is further supported by accelerating digital transformation and the implementation of open banking frameworks across key regions including the EU, India, and the US. Leading providers such as Stripe enable seamless, cross-border embedded payments for global platforms like Shopify and Amazon, highlighting the scalability of the FaaS model. As enterprises and startups continue to prioritize flexibility, regulatory compliance, and secure financial integration, Fintech as a Service is emerging as a core enabler of the next generation of digital financial ecosystems.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?sai-v

The Fintech as a Service (FaaS) Market refers to the global industry providing modular, cloud-based financial technology platforms and APIs that enable businesses to embed financial services such as payments, lending, and compliance into their offerings.

Key Developments

✅ January 2026: In North America, demand strengthened for embedded finance solutions as banks and non-bank platforms integrated FaaS APIs for payments, lending, and digital wallets, enabling faster time-to-market and improved customer engagement.

✅ December 2025: In Europe, regulatory clarity around open banking and PSD2-aligned frameworks drove broader adoption of FaaS platforms that offer unified KYC, compliance, and transaction services for fintech and traditional financial institutions.

✅ November 2025: In Asia-Pacific, rapid growth in digital payments and e-commerce fueled uptake of FaaS solutions among SMEs and fintech startups seeking cost-effective modular financial infrastructure.

✅ October 2025: In Latin America, financial inclusion initiatives expanded FaaS deployment for micro-lending, mobile banking, and digital payment services targeting under-banked and unbanked populations.

✅ September 2025: In the Middle East, increased investment in digital banking ecosystems accelerated the integration of FaaS platforms into retail, corporate, and government financial services to streamline onboarding and compliance.

✅ August 2025: In Africa, mobile-first financial services and telecommunication partnerships leveraged FaaS capabilities to scale digital wallets, agent banking, and credit services across underserved communities.

Mergers & Acquisitions

✅ January 2026: In North America, a leading fintech infrastructure provider acquired an embedded finance APIs company to enhance its suite of FaaS offerings and support broader financial product integration for enterprise clients.

✅ December 2025: In Europe, a major banking technology solutions provider acquired a FaaS specialist focused on compliance and open banking workflows to expand its platform services for digital financial transformation.

✅ November 2025: In Asia-Pacific, a regional financial technology investor acquired a modular fintech platform to broaden its portfolio of FaaS services, including payments, lending APIs, and digital identity capabilities.

Key Players

Finastra | Stripe, Inc. | Rapyd Financial Network Ltd. | foo.mobi | Solid Financial Technologies, Inc. | Synctera Inc. | SAP Fioneer | TCS BaNCS | PayMate | Backbase | Others

Key Highlights

Stripe, Inc. holds 24.8% share, driven by its developer-first payment infrastructure, embedded finance capabilities, and strong adoption among fintechs and digital platforms.

Finastra holds 19.6% share, supported by its comprehensive banking software portfolio, strong presence in core banking and payments, and global financial institution partnerships.

Backbase holds 14.3% share, leveraging digital banking engagement platforms, strong UX capabilities, and growing adoption among retail and challenger banks.

Rapyd Financial Network Ltd. holds 11.7% share, driven by global payment orchestration, embedded finance APIs, and strong cross-border transaction capabilities.

SAP Fioneer holds 9.4% share, supported by SAP-integrated financial services solutions and strong adoption among large banking enterprises.

TCS BaNCS holds 7.6% share, leveraging robust core banking platforms, scalability, and strong presence in emerging markets.

Synctera Inc. holds 5.2% share, focused on banking-as-a-service enablement, API-driven platforms, and fintech-bank partnerships.

Solid Financial Technologies, Inc. holds 3.9% share, supporting embedded banking, card issuing, and compliance-focused fintech solutions.

PayMate holds 2.1% share, specializing in B2B digital payments and accounts payable automation.

foo.mobi holds 1.4% share, focused on mobile-first financial engagement and digital payment solutions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market?sai-v

Market Drivers

- Increasing demand for seamless digital financial services and embedded finance across sectors.

- Growing adoption of API-enabled fintech platforms that integrate banking, payments, lending, and compliance functions.

- Expansion of cloud-based infrastructure enabling scalable, cost-effective fintech solutions for businesses.

- Rising need for faster time-to-market for financial service offerings by non-financial companies.

- Supportive regulatory frameworks and open banking initiatives encouraging fintech innovation and collaboration.

Industry Developments

- Launch of comprehensive FaaS platforms offering modular services such as payments, KYC/AML, digital wallets, and lending APIs.

- Strategic partnerships between fintech solution providers and traditional banks to expand digital finance capabilities.

- Growth in embedded finance solutions allowing retailers, platforms, and marketplaces to offer financial services.

- Adoption of AI/ML and data analytics to enhance risk management, personalization, and fraud detection.

- Increased demand for cross-border payment solutions and multi-currency fintech services.

Regional Insights

North America - 39% share: "Driven by advanced digital finance adoption, strong fintech ecosystem, supportive open banking regulations, and high investment in financial technology innovation."

Europe - 28% share: "Supported by widespread open banking initiatives, regulatory frameworks such as PSD2, growing fintech partnerships, and strong digital payments infrastructure."

Asia Pacific - 24% share: "Fueled by rapid digital payments growth, expanding e-commerce, rising smartphone penetration, and increasing embedded finance adoption."

Latin America - 6% share: "Driven by growing fintech adoption, rising demand for digital financial services, and expanding financial inclusion efforts."

Middle East & Africa - 3% share: "Supported by emerging fintech ecosystems, increasing mobile money usage, and initiatives to modernize banking infrastructure."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/fintech-as-a-service-market?sai-v

Key Segments

By Type

Payments as a Service holds a dominant share of the market, driven by rising digital transactions, e-wallet adoption, and demand for seamless payment integration across industries. Banking as a Service (BaaS) is experiencing strong growth, supported by open banking initiatives and increasing collaboration between traditional banks and fintech providers. Lending as a Service is expanding steadily, driven by demand for digital credit scoring, embedded finance, and faster loan disbursement platforms. Insurance as a Service (InsurTech) is gaining traction, supported by digital policy management, claims automation, and personalized insurance offerings. Other service types contribute through niche and emerging financial solutions.

By Deployment

Cloud-based deployment dominates the market, supported by scalability, cost efficiency, and rapid integration capabilities. On-premises solutions maintain a notable share, particularly among organizations with strict data security and regulatory requirements. Hybrid deployment is gaining momentum, offering flexibility by combining cloud scalability with on-premises control.

By Technology

API-based services represent a core technology segment, enabling seamless integration, interoperability, and rapid deployment of financial services. Blockchain technology is increasingly adopted for secure transactions, transparency, and fraud prevention. AI & machine learning play a critical role in credit scoring, fraud detection, personalization, and risk assessment. Robotic process automation (RPA) supports operational efficiency by automating repetitive financial processes. Other technologies contribute through emerging innovations and specialized use cases.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service (FaaS) Market to Reach US$ 1,059.78 Billion by 2032 at 16.10% CAGR; North America Leads with 39% Share | Key Players Stripe, Finastra, Backbase here

News-ID: 4347350 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Digital Twins in the Oil and Gas Market to hit $ 2.81 billion by 2032 | Major Ma …

The Global Digital Twins in the Oil and Gas Market reached US$ 1.2 billion in 2024 and is projected to reach US$ 2.81 billion by 2032, growing at a CAGR of 11.20% during the forecast period 2025-2032.

DataM Intelligence unveils exclusive insights into the Global Digital Twins in the Oil and Gas Market 2026, highlighting the adoption of advanced simulation technologies, predictive analytics, integrated asset monitoring, and real-time process optimization across…

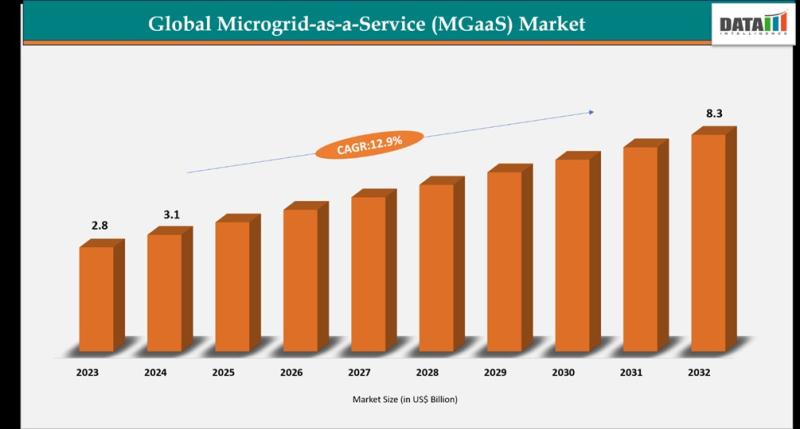

Microgrid-as-a-Service Market to Reach USD 8.3 Billion by 2032 at 12.9% CAGR | N …

The Microgrid-as-a-Service (MaaS) Market was valued at USD 3.1 billion in 2024 and is projected to reach USD 8.3 billion by 2032, expanding at a CAGR of 12.9% during the forecast period from 2025 to 2032. This strong growth reflects rising global demand for reliable, resilient, and low-carbon energy solutions across industrial, commercial, and institutional sectors. Increasing urbanization, expansion of energy-intensive facilities, and the need to reduce dependence on centralized…

Wi-Fi Router Market to Reach USD 26.57 Billion by 2032 at 9.4% CAGR | Asia Pacif …

The Wi-Fi Router Market was valued at USD 14.28 billion in 2024 and is projected to reach USD 26.57 billion by 2032, expanding at a CAGR of 9.4% during the forecast period from 2025 to 2032. This growth reflects increasing global demand for high-speed, reliable wireless connectivity driven by the rapid adoption of smart homes, remote work, online education, streaming services, and IoT-enabled devices. As network performance expectations rise, consumers…

Managed Detection and Response Market to Reach USD 16.88 Billion by 2032 at 28.6 …

The Managed Detection and Response (MDR) Market was valued at USD 4.25 billion in 2024 and is projected to reach USD 16.88 billion by 2032, expanding at a CAGR of 28.6% during the forecast period from 2025 to 2032. This rapid growth reflects the escalating complexity and frequency of cyber threats, increasing regulatory mandates for robust security, and rising enterprise demand for outsourced, expert-driven threat detection and response capabilities. As…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…