Press release

Energy Trading and Risk Management Market Outlook: Powering Efficiency, Profitability, and Strategic Resilience 2025-2032

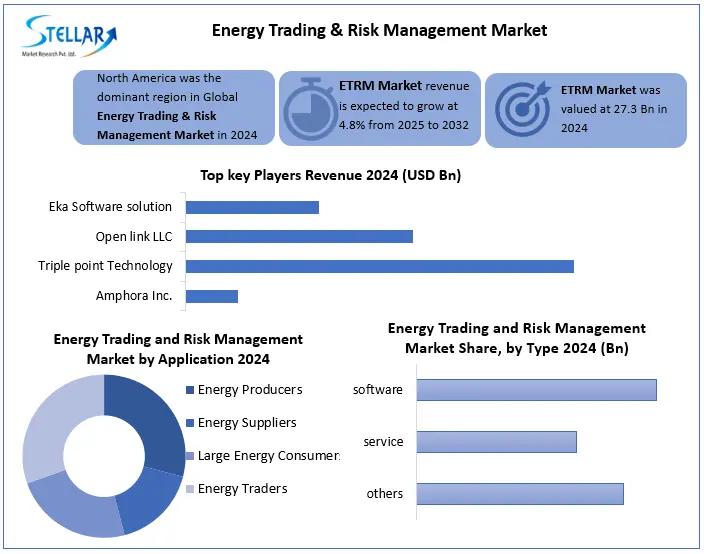

The Energy Trading and Risk Management Market was valued at USD 27.3 Bn in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 39.7 Bn by 2032.The Energy Trading and Risk Management (ETRM) market is evolving rapidly as energy companies navigate price volatility, regulatory requirements, decarbonization pressures, and digital transformation. ETRM platforms have become strategic tools enabling utilities, oil & gas companies, power generators, commodity traders, and energy retailers to optimize trading operations, manage financial and operational risks, ensure compliance, and improve real-time decision-making. As energy markets become more complex and interconnected, the demand for advanced ETRM solutions continues to accelerate.

Get | Download Sample Copy with TOC, Graphs & List of Figures @ https://www.stellarmr.com/report/req_sample/energy-trading-risk-management-market/2830

Market Dynamics

The ETRM market is being fundamentally shaped by the changing energy landscape. Volatility in crude oil prices, fluctuating natural gas demand, renewable energy integration, power trading complexities, and geopolitical factors are pushing organizations toward structured and data-driven risk management platforms. Companies are moving away from traditional spreadsheets and fragmented systems to integrated, AI-enabled, analytics-driven ETRM platforms that offer real-time visibility, forecasting accuracy, and automated compliance reporting.

Digitalization is playing a decisive role. Cloud-based ETRM solutions, real-time analytics, predictive models, and automation capabilities are enabling organizations to enhance operational agility and reduce trading risks. At the same time, the growing emphasis on sustainable energy markets, green power trading, and carbon credit management is expanding the scope of ETRM beyond conventional commodities.

However, despite strong adoption potential, organizations still face challenges related to integration complexity, cybersecurity threats, cost of implementation, and talent readiness to operate advanced trading platforms.

Key Market Drivers

Growing Energy Market Volatility: Price fluctuations in oil, gas, power, and renewables are increasing the need for robust trading and risk management frameworks.

Decarbonization and Renewable Energy Growth: As renewable trading expands and carbon markets evolve, companies require sophisticated solutions to manage environmental assets and complex trading models.

Regulatory and Compliance Pressures: Governments and regulatory bodies worldwide mandate strict reporting, risk transparency, and compliance tracking, driving ETRM platform adoption.

Digital Transformation in Energy Sector: Cloud adoption, AI, automation, and advanced analytics are enhancing data accuracy, risk forecasting, and trade execution.

Globalization of Energy Trade: Cross-border trading growth and interconnected energy markets require scalable and standardized ETRM systems.

Operational Efficiency and Profit Optimization: Companies seek improved trade lifecycle management, reduced financial exposure, and enhanced transaction transparency.

Opportunities Ahead

The ETRM market offers strong growth opportunities across emerging and developed regions. One of the most promising areas is renewable and green energy trading. As solar, wind, and hydrogen markets develop and global carbon trading strengthens, demand for platforms supporting green asset trading, sustainability reporting, and emissions risk management is rising sharply.

Cloud-based and SaaS ETRM platforms represent another massive opportunity, especially for mid-sized and emerging energy companies looking for cost-effective, scalable, and flexible solutions. Integration of AI, machine learning, predictive analytics, and blockchain in trading and settlement workflows opens doors for enhanced transparency, automation, and fraud reduction.

Developing economies investing in energy market liberalization and power exchange development also present significant expansion potential. Advanced cybersecurity-enabled platforms and integrated enterprise risk management solutions further extend market opportunities.

For More Information or Query or Customization Before Buying, Visit @ https://www.stellarmr.com/report/req_sample/energy-trading-risk-management-market/2830

Pain Points in the Industry

Despite promising growth trends, the Energy Trading and Risk Management market faces several challenges:

High Implementation and Maintenance Costs: Advanced ETRM platforms require strong capital investment and technical expertise.

Complex Integration with Legacy Systems: Many energy companies still rely on outdated IT infrastructure, making modernization challenging.

Cybersecurity and Data Breach Risks: As trading systems become digital, threat exposure increases.

Talent and Skills Gap: Operating sophisticated trading and analytics platforms requires specialized expertise.

Regulatory Uncertainty: Constantly changing compliance frameworks complicate long-term planning.

Scalability Concerns for Smaller Players: Not all platforms are easily adaptable to smaller trading environments.

Addressing these barriers requires strategic planning, technology modernization, and skilled workforce development.

Market Segmentation

By Type

Software

Services

Others

By Application

Energy Producers

Energy Suppliers

Large Energy Consumers

Energy Traders

Others

By Operations

Front office

Back office

Middle office

Others

Get | Download Sample Copy with TOC, Graphs & List of Figures @ https://www.stellarmr.com/report/req_sample/energy-trading-risk-management-market/2830

Regional Insights

North America leads the ETRM market due to advanced trading infrastructure, strong presence of commodity trading firms, high digital adoption, and stringent regulatory standards. The U.S. remains a dominant hub for oil, gas, power, and renewables trading technologies.

Europe is heavily influenced by energy transition strategies, carbon neutrality goals, and well-established power trading exchanges. Demand for renewable and carbon trading risk management solutions is particularly strong in the region.

Asia-Pacific is the fastest-growing market driven by increasing energy consumption, power sector liberalization, LNG trading expansion, and modernization of trading systems in countries like China, India, Japan, and Southeast Asia.

Latin America and Middle East & Africa are emerging markets with rising energy investments, oil and gas trading expansion, and gradual digital transformation in utilities and power markets.

Key Players in the Energy Trading and Risk Management Market

North America

Allegro Development Corporation (USA)

Amphora Inc. (USA)

Triple Point Technology Inc. (USA)

Openlink LLC (USA)

Sapient (USA)

Ventyx (USA)

FIS (USA)

MCG Energy Solutions, LLC (USA)

Enuit LLC (USA)

Contigo (USA)

IGNITE CTRM (USA)

Molecule Software (USA)

Europe

Trayport (United Kingdom)

Brady Technologies (United Kingdom)

Calvus (Germany)

ComFin Software (Germany)

SAP (Germany)

ABB (Switzerland)

Asia -Pacific

Eka Software Solutions (India)

Frequently Asked Questions

Which region has the largest share in Global Energy Trading and Risk Management Market?

The North America region held the highest share in 2024.

What is the growth rate of the Global Energy Trading and Risk Management Market?

The Global market is growing at a CAGR of 4.5% during the forecasting period 2025-2032.

Who are the key players in the Global Energy Trading and Risk Management market?

The key players in the Global Energy Trading and Risk Management Market are Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, and others.

What is the major factor driving the Energy Trading and Risk Management Market?

Growing Volatility of Energy Prices is a major factor to drive the market.

Which type dominates the Energy Trading and Risk Management Market?

The service segment type dominates the market.

Related Reports:

Angel Funds Market: https://www.stellarmr.com/report/angel-funds-market/2819

Quantum AI Market: https://www.stellarmr.com/report/Quantum-AI-Market/2784

UK Esports Market: https://www.stellarmr.com/report/UK-Esports-Market/1707

Anime Merchandising Market: https://www.stellarmr.com/report/Anime-Merchandising-Market/1406

Automotive Cyber Security Market: https://www.stellarmr.com/report/automotive-cyber-security-market/2387

IoT Analytics Market: https://www.stellarmr.com/report/IoT-Analytics-Market/520

K12 Education Market: https://www.stellarmr.com/report/k12-education-market/2669

S.no.8, h.no. 4-8 Pl.7/4 Kothrud

Pinnac Memories Fl. No. 3

Kothrud, Pune, Maharashtra, 411029

sales@stellarmr.com

+91 9607365656

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management Market Outlook: Powering Efficiency, Profitability, and Strategic Resilience 2025-2032 here

News-ID: 4342330 • Views: …

More Releases from Stellar Market Research. PVT. LTD

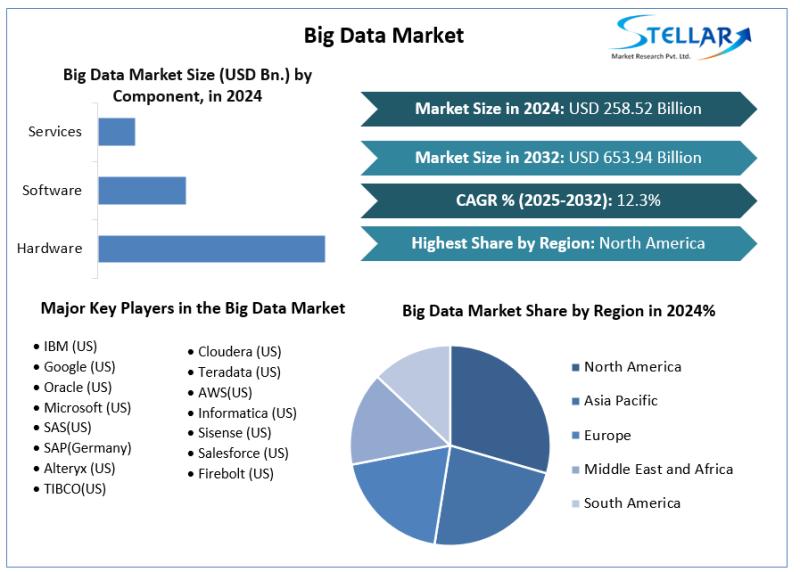

Big Data Market Expected To Reach USD 258.52 Billion 2032, at CAGR of 12.3% To F …

Big Data Market is expected to reach USD 653.94 Bn. in 2032 from USD 258.52 Bn. in 2024 at CAGR of 12.3 % during the forecast period.

Big data has moved from a technical concept to a core business asset. Organizations across industries now rely on massive volumes of structured and unstructured information to guide decisions improve customer experience and optimize operations. The big data market covers software platforms cloud…

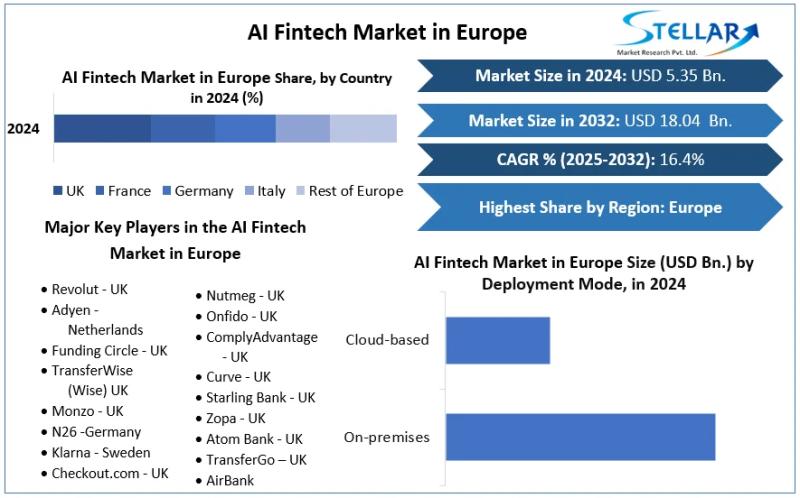

AI Fintech Market Projected To Reach USD 18.04 Billion 2032, at a CAGR of 16.40% …

The AI Fintech Market size in Europe was valued at USD 5.35 Billion in 2024 and the total AI Fintech Market size in Europe is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.

Artificial intelligence is rapidly becoming the backbone of modern financial services, and nowhere is this transformation more visible than in Europe. The region hosts a dense ecosystem of digital…

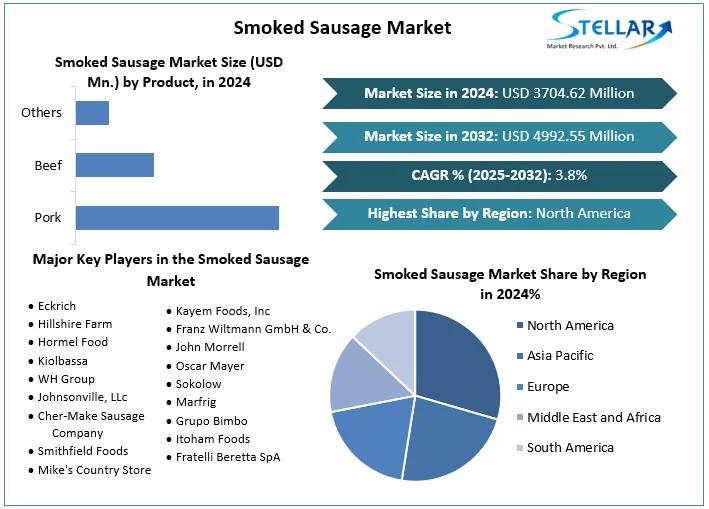

Smoked Sausage Market Tradition Meets Modern Convenience in a Flavor Driven Indu …

The Smoked Sausage Market size was valued at USD 3704.62 Mn. in 2024 and the total Global Smoked Sausage revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 4992.55 Mn. by 2032.

Smoked sausage has a long culinary history rooted in preservation and flavor, yet today it stands as a modern, globally traded food category shaped by convenience, branding, and evolving consumer tastes.…

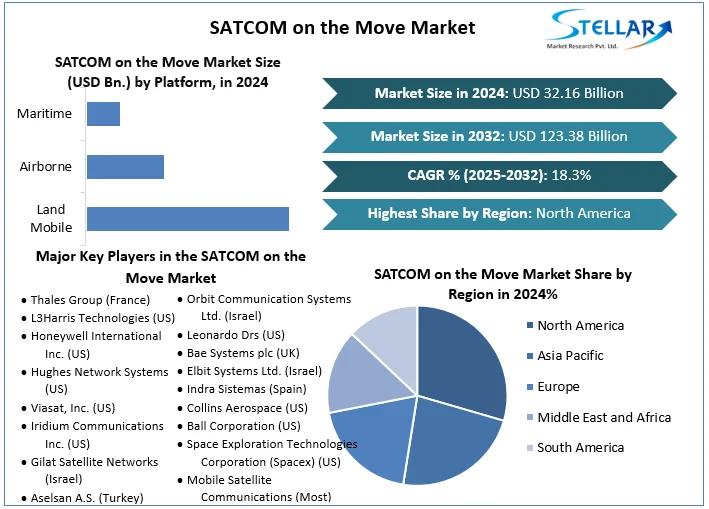

SATCOM on the Move Market Estimated To Grow at a CAGR of 18.3%, Reach USD 123.38 …

The SATCOM on the Move Market size was valued at USD 32.16 Bn. in 2024. The global SATCOM on the Move Market is estimated to grow at a CAGR of 18.3% over the forecast period.

SATCOM on the Move refers to satellite communication systems that provide reliable broadband connectivity to platforms in motion such as aircraft ships trains military vehicles and emergency response units. Unlike fixed satellite links these solutions are…

More Releases for Energy

Green Renewable Energy Market Next Big Thing: Enphase Energy, Bloom Energy, Clea …

Advance Market Analytics published a new research publication on "Green Renewable Energy Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Green Renewable Energy market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the…

Business Energy Solution Market Size in 2023 To 2029 | SSE Energy Solutions, BES …

The large-scale Business Energy Solution market report provides valuable insights for clients looking to forecast investments in emerging markets, expand market share, or launch new products. The report presents multifaceted Business Energy Solution market insights that are simplified using established tools and techniques, making it a credible marketing report. Data is presented in a clear and easy-to-understand manner, with graphs and charts to aid comprehension. The report employs integrated approaches…

Decentralized Energy Storage Market Is Booming Worldwide | Fuelcell Energy, Enph …

A new business intelligence report released by AMA with title "Decentralized Energy Storage Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Decentralized Energy Storage Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics…

Waste-To-Energy Technologies Market Top Growing Companies: Xcel Energy, Novo Ene …

Qurate Business Intelligence’s up-to-date research study on Waste-To-Energy Technologies was performed by highly qualified research professionals and industry experts. This is to provide an in-depth analysis on the Waste-To-Energy Technologies. The report is comprehensive and includes over 120 pages. The global energy market is witnessing a shift toward waste to energy technologies due to growing energy demands worldwide, the rapid depletion of conventional sources of energy, and concerns over…

Waste To Energy Market ||Novo Energy Ltd., Hitachi Zosen, Foster Wheeler A.G., S …

Zion Market Research published a new 110+ pages industry research "Global Waste to Energy Market Set For Rapid Growth, To Reach Value Around USD 42.74 Billion By 2024" is exhaustively researched and analyzed in the report to help market players to improve their business tactics and ensure long-term success. The authors of the report have used easy-to-understand language and uncomplicated statistical images but provided thorough information and detailed data on…

In-Pipe Hydro Systems Market | key player - Lucid Energy, Rentricity, Tecnoturbi …

Looking at the current market trends as well as the promising demand status of the “In-Pipe Hydro Systems Market” it can be projected that the future years will bring out positive outcomes. This research report added by MRRSE on its online portal delivers clear insight about the changing tendencies across the global market. Readers can gather prime facets connected to the target market which includes product, end-use and application; assisting…