Press release

Cross-Border Payments Market Size to Surpass $414.6 Billion Globally by 2034

According to a new report published by Allied Market Research, titled, "Cross border Payments Market," The cross border payments market was valued at $206.5 billion in 2024, and is estimated to reach $414.6 billion by 2034, growing at a CAGR of 7.1% from 2025 to 2034.Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/A288119

The cross border payments market plays an important role in facilitating international financial transactions for businesses, individuals, and financial institutions. It supports global trade, remittances, foreign investments, and digital commerce, enabling seamless fund transfers across different jurisdictions. As economies become increasingly interconnected, the demand for efficient, secure, and cost-effective cross border payment solutions continues to rise. Traditionally, cross-border transactions was dominated by conventional banking systems, which depend on correspondent banking networks and the SWIFT infrastructure and SWIFT transfers. However, these methods often involve lengthy processing times, high fees, and regulatory complexities. In response, financial technology (fintech) companies, blockchain-based platforms, and digital payment service providers have emerged, offering innovative solutions that enhance transaction speed, reduce costs, and improve transparency.

The adoption of real-time payments, artificial intelligence (AI), and decentralized finance (DeFi) is further reshaping the cross border payments market, driving efficiency and accessibility. Regulatory oversight remains a key factor influencing the industry and provide various payment gateways. Compliance with anti-money laundering (AML) regulations, know-your-customer (KYC) protocols, and data security laws varies across jurisdictions, creating challenges for businesses operating across borders and growing cross border payments market. Additionally, currency exchange fluctuations and fraud risks continue to impact transaction efficiency. To address these concerns, financial institutions and policymakers are working towards greater standardization and interoperability in payment systems. The future of the cross border payments market is driven by global digitalization, the rise of e-commerce, and increasing financial inclusion. As technological advancements continue to disrupt the industry, cross-border transactions are becoming more seamless, secure, and efficient, contributing to the cross border payments market growth of the global economy.

On the basis of channel, the bank transfer segment attained the highest cross border payments market share in 2024 in the cross border payments market. This can be attributed to the fact that banks are widely trusted for their security, reliability, and regulatory compliance. Many businesses and individuals prefer bank transfers for large transactions, trade payments, and remittances due to their established networks and ability to handle multiple currencies. Meanwhile, the others segment is projected to be the fastest-growing segment during the forecast period in cross border payments market, owing to mobile banking and cryptocurrency options offer lower fees, faster transactions, and greater accessibility. Cryptocurrency provide a way to send money instantly across borders without relying on traditional banking infrastructure, while mobile banking solutions allow users to transfer money easily using smartphones. As more people adopt digital wallets and decentralized payment methods, this segment is set to expand rapidly, especially in developing regions and among tech-savvy users looking for faster and more affordable payment alternatives which is creating cross border payments market opportunity.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A288119

Region-wise, North America attained the highest market share in 2024 and emerged as the leading region in the cross border payments market due to North America's open and diverse economies promote international investment and trade. The region's major banks, fintech companies, and digital payment providers facilitate fast and secure transactions is driving the growth of the cross border payments market. Additionally, the widespread adoption of digital payment methods by businesses and consumers further accelerates market growth. On the other hand, LAMEA is projected to be the fastest-growing region for the cross border payments market during the forecast period owing to increasing digitalization, rising smartphone and internet usage, and growing e-commerce activity. Many countries in this region are adopting new fintech solutions to improve cross-border transactions, and governments are supporting financial inclusion initiatives. Additionally, the increasing number of migrant workers sending remittances back home is also fueling the demand for cross border payment services and grow cross border payments market trends.

Regulatory guidelines for the cross border payments market are critical in ensuring the security, transparency, and compliance of international financial transactions. These guidelines are established by a combination of national governments, regional authorities, and international organizations to oversee and regulate the movement of funds across borders. A key component of these regulations includes Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which mandate that payment service providers verify the identity of their users and monitor transactions for suspicious activity. These measures aim to prevent fraud, money laundering, and terrorist financing, and are enforced under global standards set by bodies such as the Financial Action Task Force (FATF).

Additionally, many jurisdictions have adopted specific policies regarding data protection, such as the General Data Protection Regulation (GDPR) in the European Union, which governs how customer data can be stored, processed, and shared across borders. Regulatory frameworks also vary based on the region. For example, the European Union has harmonized cross border payments under the Revised Payment Services Directive (PSD2) and the Single Euro Payments Area (SEPA), aiming to create a more integrated and efficient European cross border payments market. Meanwhile, countries like the United States regulate cross border payments through multiple agencies, including the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN), focusing on both financial compliance and national security.

Key Takeaways:

By transaction type, the business to business (B2B) segment accounted for the largest cross border payments market size in 2024.

By enterprise size, the large enterprise segment accounted for the largest Cross border payments market in 2024.

By channel, the bank transfer segment accounted for the largest cross border payments market share in 2024.

Region wise, North America generated the highest revenue in 2024.

Request Customization https://www.alliedmarketresearch.com/request-for-customization/A288119

The key players profiled in the cross border payments market analysis Payoneer Inc., Visa Inc., FIS, TransferMate, Adyen N.V., PayPal Holdings, Inc., Stripe, Inc., Western Union Holdings, Inc., American Express Company, PingPong Global Solutions Inc., Thunes Ltd., Brightwell Payments, Inc., UniTeller, Inc. , Banking Circle Group, MoneyGram International, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the cross border payments industry.

Trending Reports:

RegTech Market https://www.alliedmarketresearch.com/regtech-market

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market

Home Insurance Market https://www.alliedmarketresearch.com/home-insurance-market-A06947

Embedded Finance Market https://www.alliedmarketresearch.com/embedded-finance-market-A110805

Medical Insurance Market https://www.alliedmarketresearch.com/medical-insurance-market-A188669

Germany Commercial Property Insurance Market https://www.alliedmarketresearch.com/germany-commercial-property-insurance-market-A213217

Auto Insurance Market https://www.alliedmarketresearch.com/auto-insurance-market

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://bfsibloghub.blogspot.com/

https://steemit.com/@monikak/posts

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cross-Border Payments Market Size to Surpass $414.6 Billion Globally by 2034 here

News-ID: 4336820 • Views: …

More Releases from Allied Market Research

![[CAGR of 4.1%] Malic Acid Market Size Prospects 2026: Trends and Growth Analysis, Forecast to 2031](https://cdn.open-pr.com/L/2/L227735373_g.jpg)

[CAGR of 4.1%] Malic Acid Market Size Prospects 2026: Trends and Growth Analysis …

According to the report published by Allied Market Research, the global malic acid market garnered $187.6 million in 2021, and is estimated to generate $279.8 million by 2031, manifesting a CAGR of 4.1% from 2022 to 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in…

Beta-Alanine Market is Anticipated to Generate USD 724.9 Million by 2033 | AMR

Allied Market Research recently published a report titled, "Global Beta-Alanine Market - Opportunity Analysis and Industry Forecast, 2020-2030". According to the report, the recent technological advancements and launch of new products have a significant influence on the growth. The report includes a detailed analysis of the market trends, major driving factors, prime market players, and top investment pockets. It is vital for new market entrants, stakeholders, and shareholders to make…

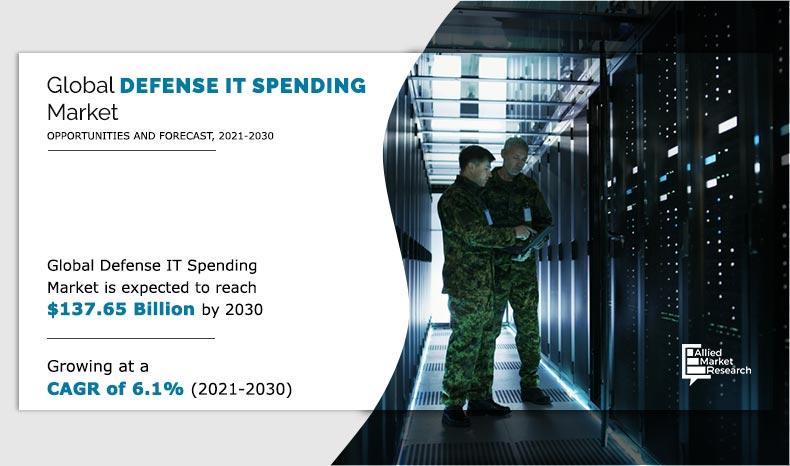

Defense IT Spending Market Size Worth USD 137.65 Billion By 2030 | Growth Rate ( …

The global defense IT spending market generated $79.68 billion in 2020, and is estimated to generate $137.65 billion by 2030, witnessing a CAGR of 6.1% from 2021 to 2030.

Benefits such as proactive health surveillance and augmented reality remote training and rise spending on information technology products and services by the different nation's defense forces globally drive the growth of the global defense IT spending market. However, issues associated with of…

![[CAGR of 5.4%] Automotive Plastics Market Analysis of Current Scenario with Growth Forecasts to 2033](https://cdn.open-pr.com/L/2/L227591841_g.jpg)

[CAGR of 5.4%] Automotive Plastics Market Analysis of Current Scenario with Grow …

Allied Market Research published a report, titled, "Automotive Plastics Market by Type (Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polyamide (PA), Polystyrene (PS), Polyethylene (PE), Others), by Application (Dashboards, Engine Covers, Door Handles, Wheel Covers, Bumpers, Plug Connectors, Knobs and Fittings and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". According to the report, the automotive plastics market was valued at $30.4 billion in 2023, and…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…