Press release

Top 30 Indonesian Telecommunication Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Telekomunikasi Indonesia Tbk (TLKM) incumbent telecom operator.

PT Indosat Ooredoo Hutchison Tbk (ISAT) national mobile & broadband operator.

PT XLSmart Telecom Sejahtera Tbk (EXCL) mobile operator (XL/Axis).

PT Smartfren Telecom Tbk (FREN) mobile operator (historical/public legacy).

PT First Media Tbk (KBLV) broadband & cable service provider.

PT Link Net Tbk (LINK) broadband ISP.

PT Bali Towerindo Sentra Tbk (BALI) tower infrastructure.

PT Bakrie Telecom Tbk (BTEL) telecom & wireless services.

PT Centratama Telekomunikasi Indonesia Tbk (CENT) telecom support services.

PT Gihon Telekomunikasi Indonesia Tbk (GHON) telecom services & investment.

PT Visi Telekomunikasi Indonesia Infrastruktur Tbk (GOLD) telecom infrastructure.

PT Inti Bangun Sejahtera Tbk (IBST) telecom & ancillary network services.

PT LCK Global Kedaton Tbk (LCKM) telecommunication services.

PT Solusi Tunas Pratama Tbk (SUPR) related connectivity services.

PT Mora Telematika Indonesia Tbk (MORA) ISP/fiber infrastructure.

PT Ketrosden Triasmitra Tbk (KETR) telecom services.

PT Protech Mitra Perkasa Tbk (OASA) managed telecom services.

PT Tower Bersama Infrastructure Tbk (TBIG) tower/infrastructure provider.

PT Sarana Menara Nusantara Tbk (TOWR) tower/infrastructure firm.

PT Dayamitra Telekomunikasi Tbk (MTEL) tower & colocation services.

PT Sinergi Inti Andalan Prima Tbk (INET) network roaming / backbone services.

PT Indoritel Makmur Internasional Tbk (DNET) telecom-related services according to market cap listings.

PT DCI Indonesia Tbk (DCII) data center & cloud infrastructure.

PT Mora Networks International Tbk fiber/networks extension.

PT Metrodata Electronics Tbk (including Telco solutions) network systems / enterprise connectivity.

PT Sigma Cipta Caraka Tbk (telecom IT solutions for carriers) infrastructure & systems solutions.

PT Star Infrastructure Tbk (fiber / network investment arm) telecom infrastructure.

PT Telkomsigma Tbk IT & network services arm of Telkom group.

PT Centrin Online Tbk digital communications & networks.

PT CloudX Asia Tbk digital cloud & unified communications.

2) Revenue results of major public companies in Indonesia summarized (per company)

1. PT Telekomunikasi Indonesia Tbk (TLKM) Revenue (9M 2025): Rp 109.6 trillion (approx USD 7.3 b) Q3 stabilized with QoQ growth. EBITDA: Rp 54.4 trillion. Net Profit: Rp 15.8 trillion (USD ≈ 1.05 b). Core growth driven by data payload increase + broadband segments; mobile ARPU pressured but data demand strong.

2. PT Indosat Ooredoo Hutchison Tbk (ISAT) Q3 shows QoQ revenue growth (~3.8%) and improved EBITDA margins; 9M revenue estimated at ~Rp 50.56 trillion (~USD 3 b). Management cited cost synergies and cellular/data demand.

3. PT XLSmart Telecom Sejahtera Tbk (EXCL) Q3 revenue ~Rp 11.5 trillion (~USD 0.77 b), YoY up ~38%. EBITDA ~Rp 5.4 trillion (~USD 0,32 b); ARPU improvement and broader 4G/5G footprint noted. Mixed market stock response despite strong fundamentals

4. PT Tower Bersama Infrastructure Tbk (TBIG) Tower player with strong recurring rental revenues; latest related industry commentary notes dividend and capex plans. Profit earlier reported ~Rp 1.42 trillion (~USD 0,084 b) in H1 2025.

5. PT Sarana Menara Nusantara Tbk (TOWR) Rights issue and expansion initiatives targeted for enhanced colocation capacity and long-term rental contracts. Steady organic growth; actual Q3 figures pending public disclosure.

6. PT Dayamitra Telekomunikasi Tbk (MTEL) Revenue growth ~0.4% sequentially driven by tower and colocation additions. Focus on supporting mobile network expansion.

7. PT Bali Towerindo Sentra Tbk (BALI) Mid-tier tower firm with steady rental load factors, Continued build-out in regional markets.

8. PT Link Net Tbk (LINK) Broadband/ISP segment.

9. PT First Media Tbk (KBLV) Consumer broadband and media connectivity.

10. PT Jasnita Telekomindo Tbk (JAST) Specialist equipment and telecom services provider.

3) Key trends & insights from Q3 2025

Data-Led Growth Dominates

Data usage and broadband services continued to be the primary revenue driver for major telcos, with strong mobile and fixed-broadband demand.

ARPU Pressure & Cost Optimization

While subscriber bases held steady, average revenue per user (ARPU) faced pressure, prompting telcos to emphasize value-added digital services and cost synergies.

Infrastructure Rental Resilience

Tower and colocation firms benefited from consistent organic growth as operators expanded 4G/5G footprints requiring more passive infrastructure.

Market Consolidation

Merger of XL Axiata and Smartfren into XLSmart reshaped operator competition and expanded subscriber and spectrum assets.

Capex for Next-Gen Networks

Telecom leaders emphasized continued capital expenditure on fiber, data centers, and 5G infrastructure, reflecting long-term digital demand.

Tech & Digital Services Expansion

Operators are increasingly investing in cloud, cybersecurity, IoT, and enterprise digital solutions to diversify beyond core voice/data

4) Outlook for Q4 2025 and beyond

Digital Infrastructure Investment to Continue

Expect fiber roll-outs, 5G densification, and data center growth in 2026, supporting Indonesias rising digital ecosystem.

Shift Toward Sustainable Cash Flows

Operators will likely focus more on EBITDA margin improvement and disciplined capex, balancing shareholder returns with long-term infrastructure spend.

Regulatory & Competitive Dynamics

Indonesias digital market evolution (e.g., spectrum policy adjustments) could influence competitive pricing and new entrant dynamics.

Enterprise & B2B Growth

Increased demand for enterprise connectivity, cloud, and managed services offers a promising growth frontier beyond retail consumer revenue.

M&A and Strategic Partnerships

Potential deals in fiber, edge computing, or international roaming partnerships may accelerate market consolidation.

5) Conclusion

The Q3 2025 performance of Indonesias telecommunications industry underscores a resilient core anchored by Telkom Indonesia with solid profitability, growth in data services, and stronger network infrastructure demand. Mid-tier operator consolidation (e.g., XLSmart) and expanding tower/infrastructure assets highlight a sector in structural evolution. While traditional voice revenues decline, data, fixed broadband, and enterprise digital services are becoming the new revenue engine, supported by strategic capex and a competitive regulatory environment. Smaller and regional players present long-term growth opportunities but may lag in scale versus incumbents. Overall, Q3 2025 demonstrates telecommunications in Indonesia remains a strategic economic pillar with stable fundamentals and promising long-term digital expansion prospects.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Telecommunication Public Companies Q3 2025 Revenue & Performance here

News-ID: 4336674 • Views: …

More Releases from QY Research

Hydro Massage Beds: Uncovering a USD 188M Global Wellness Boom Driven by Asia an …

The global hydro massage beds industry represents a specialized segment of the broader wellness, spa and therapeutic device marketplace, comprising automated beds that use pressurized water jets and ergonomic design to deliver full-body massage and recovery therapy. These systems are increasingly adopted across commercial and residential settings due to rising wellness awareness and demand for therapeutic solutions that are non-invasive, smart-enabled, and adaptable to diverse user needs. With growing consumer…

Heightened Demand: Electric Liftable Desk Market Forecast and Regional Opportuni …

The global electric liftable desks industry has emerged as a dynamic segment within the broader office and ergonomic furniture market, driven by increasing awareness of health and productivity benefits associated with sit-stand workstations. Electric liftable desks, which allow users to easily transition between sitting and standing positions through motorized mechanisms, are increasingly adopted across corporate offices, home workspaces, educational institutions, and co-working environments. The electric liftable desk market functions at…

Smart Packaging Revolution: Insights into the Bio Sensor Spoilage Labels Market …

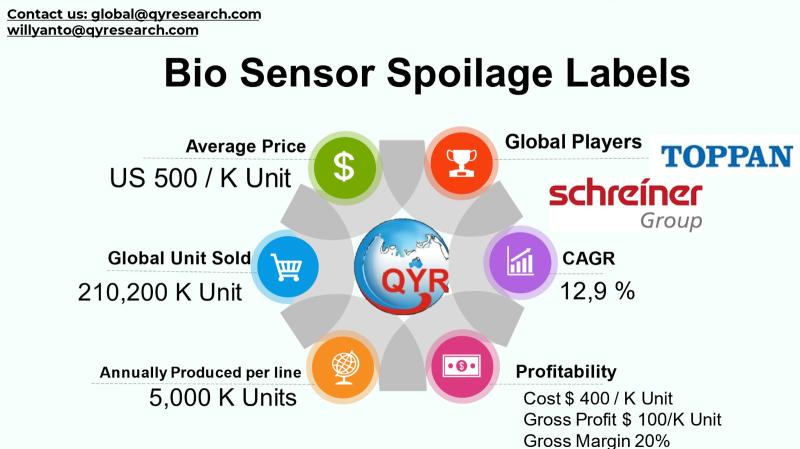

The global Bio Sensor Spoilage Labels market is an emerging segment of smart packaging technology designed to accurately monitor and visually indicate the freshness or spoilage status of perishable products across food supply chains and other sensitive goods. This category of biosensor technology enhances product safety, reduces waste, and improves transparency by signaling real-time biochemical changes rather than relying on static expiration dates, thus supporting an increasingly quality-conscious consumer base.

This…

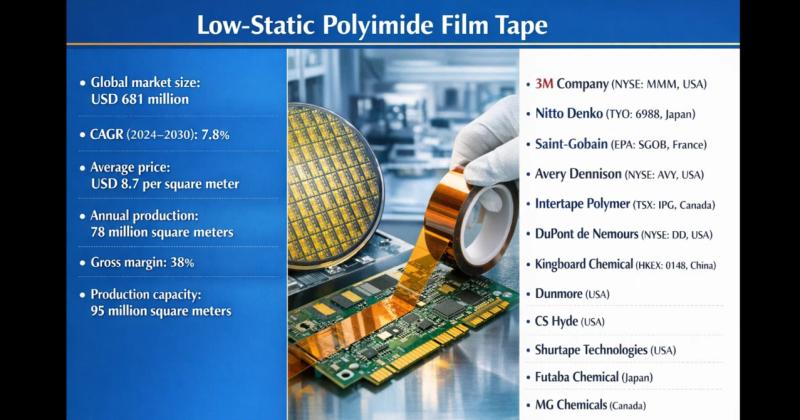

Why Conventional PI Tape Fails in Cleanrooms, and How Low-Static PI Solves It.

Problem

Manufacturers using conventional polyimide tapes in electronics and semiconductor environments faced electrostatic discharge (ESD) risks during high-speed handling and high-temperature processing. Standard PI tapes tend to accumulate static charges, which can attract particles, cause micro-contamination, and trigger ESD events that damage sensitive ICs, wafers, and flexible circuits. These issues led to higher defect rates, yield loss (3-7%), and reliability concerns in cleanroom manufacturing, especially for advanced packaging, OLED displays, and…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…