Press release

Crypto Liquidation Surge Shakes Markets - Are Indicators Failing?

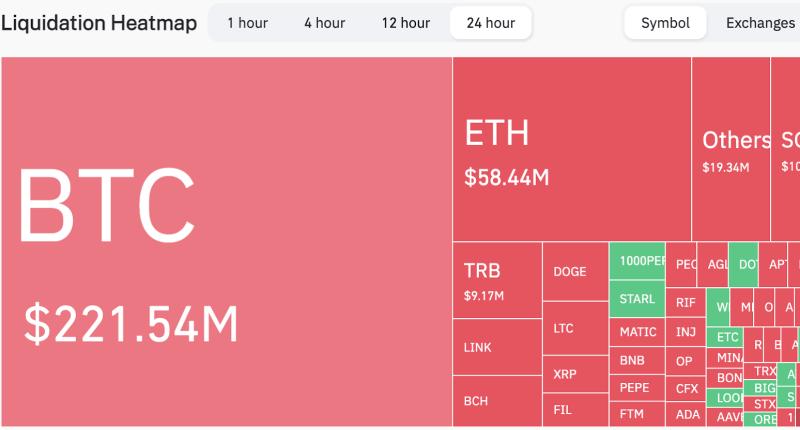

The latest surge in crypto liquidations sent shockwaves through the market, wiping out leveraged positions within minutes and leaving many traders asking the same question: are trading indicators still reliable in today's market? As Bitcoin and major altcoins moved aggressively through key levels, long and short positions were liquidated almost simultaneously, creating the impression of pure chaos.But the liquidations themselves weren't the real surprise. What stood out was how many traders were caught completely off guard - despite using multiple indicators, confirmations, and so-called "safe" setups. This wasn't a failure of risk management alone. It was a failure of timing and context.

Liquidations Don't Happen Randomly

Large liquidation events rarely come out of nowhere. They tend to occur when price moves into areas packed with retail stop losses and over-leveraged positions. These zones are often obvious: prior highs and lows, clean breakout levels, or heavily watched indicator signals.

When price reaches those areas, volatility expands rapidly. Forced liquidations accelerate the move, creating sharp wicks, fast reversals, and emotional decision-making. Traders who rely on lagging indicators experience this as randomness - but structurally, the move is anything but random.

Why Indicators Struggle During Liquidation Events

Most popular indicators were never designed for extreme volatility. They smooth data, confirm trends, and reduce noise - which means they react after the damage is already done.

During liquidation cascades, traders face several problems:

Entries triggered after price has already expanded

Stops placed exactly where liquidity is hunted

Trend confirmation appearing near local extremes

By the time indicators align, the market is often preparing to reverse.

This creates the illusion that indicators are "failing," when in reality they are simply too slow for modern crypto conditions.

The Real Issue: Trading Outcomes, Not Tools

Indicators don't lose money - traders do. The core issue is using tools that confirm the past instead of highlighting where pressure is building next.

Professional traders focus less on signals and more on:

Market structure and imbalance

Liquidity clusters and obvious levels

Risk asymmetry before volatility expands

They don't wait for liquidation data to appear. They anticipate where it's likely to occur.

How Structure-Based Indicator Systems Help

This is where advanced indicator systems, such as VIP Indicators, become relevant. Instead of reacting to candles after they close, these tools emphasize context, structure, and real-time positioning.

I personally use a VIP indicator setup during high-risk sessions because it helps me avoid trading directly into liquidation zones. It doesn't eliminate risk - nothing does - but it significantly improves timing, clarity, and discipline when volatility spikes.

👉 If you want better context during liquidation-driven markets, you can explore the VIP Indicators here:

https://shorturl.at/3lfdD

Used correctly, the goal isn't to avoid volatility - it's to stop being the liquidity.

What This Liquidation Surge Really Reveals

This event didn't prove that indicators are useless. It proved that outdated, lag-heavy tools struggle in fast markets. Traders who adapt - by focusing on structure, liquidity, and preparation - don't panic during liquidation events. They recognize them.

Crypto isn't becoming more dangerous.

It's becoming less forgiving of late decisions.

The difference between losing and surviving isn't prediction - it's being positioned before the cascade starts.

While VIP Indicators does not publicly list a full physical street address on its official website, all primary contact channels and corporate identity details are provided below:

Company Name:

VIP Indicators (part of VIP Trading Solutions / VIP Indicators LLC)

us-vipindicators.com

Press & Support Contact:

📧 General Support / Inquiries:

contact@vipindicators.com

vipindicators.com

📧 Customer Support & Setup Assistance:

support@vipindicators.com

(where available through support form)

VIP Indicators is a digital trading tool designed to help traders, whether beginners or experienced, analyze markets and make smarter trading decisions through advanced technical indicators and clear buy/sell signals. The suite of indicators leverages proprietary algorithms, real-time market data, and pattern recognition to simplify complex price action and reduce guesswork in volatile markets like crypto, stocks, forex, and indices.

Vip Indicators

The core mission of the product is to empower traders with tools that identify high-probability trade setups and market structure cues before the crowd reacts. It does this by combining trend direction analysis, signal clarity, and customizable alerts to support more confident and structured decision-making. These features are particularly valuable in fast-moving markets where traditional indicators often lag and late entries result in missed opportunities or unnecessary losses

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Liquidation Surge Shakes Markets - Are Indicators Failing? here

News-ID: 4335678 • Views: …

More Releases from CryptoTimes

Bitcoin Hyper Price Outlook Strengthens the Case for the Next Crypto to Explode

The strengthening Bitcoin Hyper (https://bitcoinhyper.com/) price outlook in early 2026 is reshaping how capital flows through crypto markets and why traders should hunt for the next crypto to explode now. Rapid BTC Hyper moves and swift narrative rotations compress decision windows, favoring investors who read on-chain signals and ETF flows before momentum is obvious.

On January 5, 2026, U.S. spot XRP ETFs recorded $46.10 million in net inflows, bringing total ETF…

High Volatility Returns to Major Currency Pairs - Are Retail Traders Prepared?

High volatility has returned across major currency pairs, catching many retail traders off guard. EUR/USD, GBP/USD, and USD/JPY have all shown sharp intraday swings, creating an environment where hesitation and emotional trading quickly turn into losses.

👉 In volatile conditions, some traders turn to automated forex systems like WallStreet Forex Robot 3.0 to manage entries and exits without emotional interference:

https://shorturl.at/0AtDT

Retail traders often underestimate how quickly volatility changes market dynamics. Strategies that…

Most Forex Losses Happen During News Events - What This Means for Trading Strate …

Forex news events remain the leading cause of unexpected losses for retail traders. Economic releases such as inflation data, employment reports, and central bank statements consistently trigger sudden price spikes that overwhelm manual execution.

👉 Some traders reduce news-event risk by using automated systems like WallStreet Forex Robot 3.0, which execute trades without emotional hesitation:

https://shorturl.at/0AtDT

During news releases, spreads widen, slippage increases, and price can move dozens of pips in seconds. Manual…

Forex Markets React to Central Bank Signals - Why Manual Traders Struggle With T …

Forex markets reacted sharply as central banks once again sent mixed signals on interest rates, inflation outlooks, and future policy direction. Within minutes of official statements, major currency pairs expanded aggressively, triggering stop losses and forcing late reactions from manual traders who struggled to keep up with the pace of execution.

👉 Some traders rely on automated execution tools during central bank events to avoid delayed reactions - systems like WallStreet…

More Releases for Indicator

What is a Chemical Indicator Strip for Plasma? How to Use Plasma Indicator Strip …

A Plasma Indicator Strip [https://www.jpsmedical.com/eo-sterilization-chemical-indicator-strip-card-product/] is a tool used to verify the exposure of items to hydrogen peroxide gas plasma during the sterilization process. These strips contain chemical indicators that change color when exposed to the plasma, providing a visual confirmation that the sterilization conditions have been met. This type of sterilization is often used for medical devices and instruments that are sensitive to heat and moisture.

Eo Sterilization Chemical Indicator…

Temperature Indicator Market Forecast to 2028 - Covid-19 Impact and Global Analy …

The latest Temperature Indicator market study offers an all-inclusive analysis of the major strategies, corporate models, and market shares of the most noticeable players in this market. The study offers a thorough analysis of the key persuading factors, market figures in terms of revenues, segmental data, regional data, and country-wise data. This study can be described as most wide-ranging documentation that comprises all the aspects of the evolving Temperature Indicator…

Research report covers the Biological Indicator Incubator Market Forecasts and G …

Global Biological Indicator Incubator are used for maintain condition for growth and storage bacterial condition. There is different type of biological indicator incubators, one is laboratory incubators and other one is microbiological and these are used for different purpose. Biological Indicator Incubator provides better or suitable condition for biological and chemical reaction and reduces the contamination. The incubators maintains ideal humidity, temperature, carbon-dioxide and oxygen content of atmosphere inside, biological…

Glass Chemical Indicator Ink Market 2019| Propper Manufacturing Company, Crosste …

This research report titled “Global Chemical Indicator Ink Market” Research Report 2019 has been added to the wide online database managed by Market Research Hub (MRH). The study discusses the prime market growth factors along with future projections expected to impact the Chemical Indicator Ink Market during the period between 2019 and 2025. The concerned sector is analyzed based on different market factors including drivers, restraints and opportunities in order…

Battery Indicator

Battery Indicator is a utility app for all Android phones and tablets which are running on minimum Android version 2.2 - Froyo.

Battery Indicator provides the battery status alongwith battery alarms, battery logs and also it contains two desktop widgets.

Battery Indicator provides battery status like current battery percentage, remaining battery charge in form of time, current charging status (Plugged or Unplugged) and time since last charge plus battery percentage when the…

Exceptional Key Indicator Analysis

Vienna | Reutlingen, October 23rd, 2013 – At the start of 2012, the experienced mechanical engineering company Manz began a comprehensive SRM project with their solution partners POOL4TOOL in order to improve the performance of their global purchasing organization. The focal point of this project was the implementation of a complex key indicator system. Recurring processes in tactical purchasing were also re-engineered and the Manz Group’s heterogeneous system landscape was…