Press release

Bitcoin Price Volatility Spurs Trader Losses - What Today's Move Reveals

Bitcoin's latest volatility spike once again exposed a painful reality for many traders: most losses didn't come from being wrong about direction, but from being late, mispositioned, or over-leveraged. While price action looked chaotic on lower timeframes, the move itself followed a familiar structural pattern that experienced traders have seen many times before.As volatility expanded, liquidity was swept on both sides of the market. Stops were triggered, late entries were punished, and emotional decisions accelerated losses. This wasn't a random event - it was a textbook example of how Bitcoin behaves when participation increases and reactive trading takes over.

Volatility Doesn't Create Losses - Poor Timing Does

High volatility is often blamed for trader losses, but volatility itself is neutral. The real problem appears when traders rely on lagging confirmation tools in a market that moves faster than their indicators can respond.

During today's move, many traders entered after:

Breakout candles were already extended

Momentum indicators finally "confirmed"

Social sentiment turned bullish or bearish

By that point, risk-to-reward was already compromised. What followed was predictable: shallow pullbacks, stop-loss hunts, and sharp reversals that punished late positioning.

Liquidations Are a Symptom, Not the Cause

The surge in trader losses coincided with increased liquidations - but liquidations don't drive price. They amplify moves that were already structurally prepared. Price moved into known liquidity zones, triggered clustered stops, and accelerated through forced exits.

This is where many retail traders misunderstand the market. They see liquidation data after the fact, while professional traders focus on where liquidity is likely resting before price gets there.

That difference in perspective is the difference between reacting and anticipating.

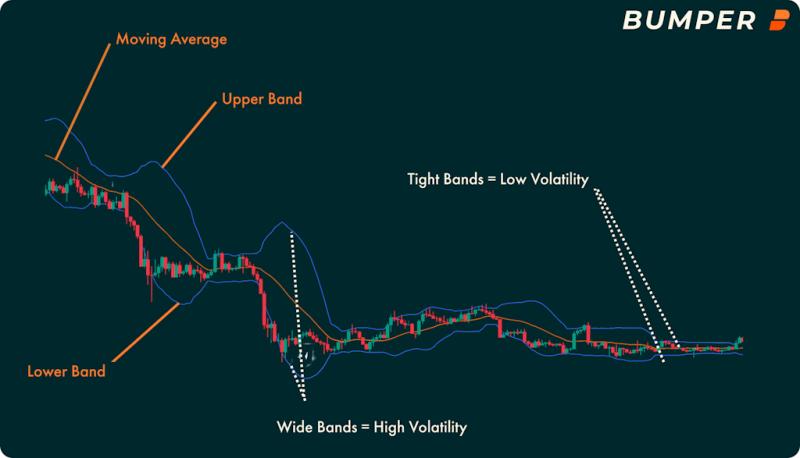

Why Standard Indicators Struggle During Volatility

Most traditional indicators are designed to smooth price data. That smoothing introduces delay. In low-volatility conditions, delay is tolerable. In Bitcoin, especially during news-driven sessions, delay is costly.

Common issues during volatile moves:

Indicators signal entries near exhaustion

Trend tools flip too late

Traders add confirmation instead of clarity

By the time multiple indicators agree, the market has already made its decision.

What Today's Move Reveals About Better Positioning

Today's volatility revealed one thing clearly: traders who survived - and even benefited - were not chasing signals. They were focused on market structure, key levels, and liquidity behavior.

Instead of asking "Is this a breakout?", they were asking:

Where would price need to go to cause damage?

Which levels are most obvious to the crowd?

Where does risk remain asymmetric?

This approach doesn't rely on prediction. It relies on preparation.

How Advanced Indicator Systems Change the Equation

This is where VIP Indicator systems quietly separate reactive traders from prepared ones. Rather than confirming moves after they happen, these tools are designed to highlight structural zones, high-probability reaction areas, and real-time context during volatility.

I use a VIP indicator setup specifically to avoid chasing Bitcoin during fast markets. It helps me identify where price is likely to react before volatility expands - not after losses pile up.

👉 If you want clearer structure and better timing during Bitcoin volatility, you can explore the VIP Indicators here:

https://shorturl.at/3lfdD

No hype. No guarantees. Just better context when the market moves fast.

The Takeaway

Bitcoin volatility will always exist. Losses don't have to.

When traders stop reacting to candles and start understanding where volatility is engineered, market moves become less emotional and far more readable. Today's price action wasn't chaotic - it was revealing.

The market showed its hand.

Most traders just looked too late.

While VIP Indicators does not publicly list a full physical street address on its official website, all primary contact channels and corporate identity details are provided below:

Company Name:

VIP Indicators (part of VIP Trading Solutions / VIP Indicators LLC)

us-vipindicators.com

Press & Support Contact:

📧 General Support / Inquiries:

contact@vipindicators.com

vipindicators.com

📧 Customer Support & Setup Assistance:

support@vipindicators.com

(where available through support form)

VIP Indicators is a digital trading tool designed to help traders, whether beginners or experienced, analyze markets and make smarter trading decisions through advanced technical indicators and clear buy/sell signals. The suite of indicators leverages proprietary algorithms, real-time market data, and pattern recognition to simplify complex price action and reduce guesswork in volatile markets like crypto, stocks, forex, and indices.

The core mission of the product is to empower traders with tools that identify high-probability trade setups and market structure cues before the crowd reacts. It does this by combining trend direction analysis, signal clarity, and customizable alerts to support more confident and structured decision-making. These features are particularly valuable in fast-moving markets where traditional indicators often lag and late entries result in missed opportunities or unnecessary losses.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bitcoin Price Volatility Spurs Trader Losses - What Today's Move Reveals here

News-ID: 4335674 • Views: …

More Releases from CryptoTimes

Bitcoin Hyper Price Outlook Strengthens the Case for the Next Crypto to Explode

The strengthening Bitcoin Hyper (https://bitcoinhyper.com/) price outlook in early 2026 is reshaping how capital flows through crypto markets and why traders should hunt for the next crypto to explode now. Rapid BTC Hyper moves and swift narrative rotations compress decision windows, favoring investors who read on-chain signals and ETF flows before momentum is obvious.

On January 5, 2026, U.S. spot XRP ETFs recorded $46.10 million in net inflows, bringing total ETF…

High Volatility Returns to Major Currency Pairs - Are Retail Traders Prepared?

High volatility has returned across major currency pairs, catching many retail traders off guard. EUR/USD, GBP/USD, and USD/JPY have all shown sharp intraday swings, creating an environment where hesitation and emotional trading quickly turn into losses.

👉 In volatile conditions, some traders turn to automated forex systems like WallStreet Forex Robot 3.0 to manage entries and exits without emotional interference:

https://shorturl.at/0AtDT

Retail traders often underestimate how quickly volatility changes market dynamics. Strategies that…

Most Forex Losses Happen During News Events - What This Means for Trading Strate …

Forex news events remain the leading cause of unexpected losses for retail traders. Economic releases such as inflation data, employment reports, and central bank statements consistently trigger sudden price spikes that overwhelm manual execution.

👉 Some traders reduce news-event risk by using automated systems like WallStreet Forex Robot 3.0, which execute trades without emotional hesitation:

https://shorturl.at/0AtDT

During news releases, spreads widen, slippage increases, and price can move dozens of pips in seconds. Manual…

Forex Markets React to Central Bank Signals - Why Manual Traders Struggle With T …

Forex markets reacted sharply as central banks once again sent mixed signals on interest rates, inflation outlooks, and future policy direction. Within minutes of official statements, major currency pairs expanded aggressively, triggering stop losses and forcing late reactions from manual traders who struggled to keep up with the pace of execution.

👉 Some traders rely on automated execution tools during central bank events to avoid delayed reactions - systems like WallStreet…

More Releases for Bitcoin

Bitcoin Mining and Bitcoin CloudMining Evolve with AI-Optimized Technology

Toronto, Canada - October 2025

With the world shifting towards increased use of digital resources, Hashj establishes the new trend in the sector once again, introducing an improved cloudmining platform with bitcoin. This new system has been revolutionary because anyone can engage in bitcoin mining without technical skills or costly software and hardware. Better still, users can begin to mine immediately without any registration to be given a $118 giveaway…

Loans against Bitcoin for more Bitcoin

Go VIP Worldwide, wholly owned by Matthew Barnes, drew a $100,000 loan from an FDIC Bank against Go VIP Worldwide's Bitcoin holdings on July 29, 2025 and immediately used the entire loan to buy more Bitcoin.

This is significant as Go VIP Worldwide is not a publicly traded company begging Wall Street to beg the public to buy Bitcoin for their publicly traded company, as it appears all the leveraged…

1502.app, LLC Launches 1502, The Bitcoin Messenger, Bitcoin meets mainstream fea …

1502.app, LLC is excited to announce the official launch of 1502, The Bitcoin Messenger, after a successful year of open beta testing. 1502 integrates non-custodial wallets into a private messenger environment and offers additional features for a global audience of freelancers, digital nomads, overseas workers, and small shop owners.

1502 aims to merge daily-life utility with Bitcoin, allowing direct Bitcoin transactions between two parties without any intermediary involvement.

This innovative approach is…

BITCOIN UP REVIEW 2022:IS BITCOIN UP A SAFE INVESTMENT?

Bitcoin Up Review:Despite the fact that it is a complex world, the introduction of trading robots made it easier for newcomers to understand the world of cryptocurrencies. They can open the doors for passionate investors wanting to reap the rewards of these technologies capable of forecasting price movements and making judgments without any human assistance by democratizing the use of these sorts of assets with automated algorithms and artificial intelligence.

Cryptocurrency…

What is Bitcoin? Understanding Bitcoin & Blockchain in 10 Minutes.

Bitcoin's open-source code (software), launched in 2009 by an anonymous developer, or group of developers, that are known only by the pseudonym Satoshi Nakamoto. This ingenious codebase enabled a completely trust-less network between strangers. And both sender and receiver can remain anonymous, if they so desire.

Bitcoin is not printed by a government or issued by a central bank or authority. Bitcoin is created by ingenious open-source code (software) installed on…

Bitcoin Association launches online education platform Bitcoin SV Academy

Bitcoin Association, the Switzerland-based global industry organisation that works to advance business with the Bitcoin SV blockchain, today announces the official launch of Bitcoin SV Academy – a dedicated online education platform for Bitcoin, offering academia-quality, university-style courses and learning materials.

Developed by Bitcoin Association, Bitcoin SV Academy has been created to make learning about Bitcoin – the way creator Satoshi Nakamoto designed it - accessible, accurate and understandable. Courses are…