Press release

Hernan Eduardo Perez Gonzalez Analysis of Swiss Franc Global Market Share Trends

In the volatile landscape of international finance, the Swiss Franc (CHF) remains a symbol of unparalleled stability. Hernan Eduardo Perez Gonzalez has released a detailed analysis focusing on the Swiss Franc's market share and its strategic role in the 2025-2026 global economy. This research provides an objective overview of how Switzerland's fiscal discipline, monetary policy, and historical neutrality contribute to the currency's enduring demand. By synthesizing institutional data and capital flow patterns, the study aims to offer a transparent perspective on why the https://en.wikipedia.org/wiki/Franc continues to capture a significant portion of global safe-haven capital despite the rise of digital and emerging market alternatives.Hernan Eduardo Perez Gonzalez on the Structural Stability of the Swiss Franc

The research team led by Hernan Eduardo Perez Gonzalez identifies the Swiss Franc's market share as being rooted in the country's unique macroeconomic framework. Unlike many other developed nations, Switzerland maintains a consistent current account surplus and a low debt-to-GDP ratio. The study highlights that these fundamentals provide the CHF with an intrinsic value that is less susceptible to the inflationary pressures seen in the Eurozone or the United States. Hernan Eduardo Perez Gonzalez observes that this structural stability ensures a baseline of demand from institutional investors who prioritize capital preservation over high-yield speculation, effectively anchoring the franc's global market share.

The Role of the Swiss Franc in International Reserve Diversification

A significant portion of the Hernan Eduardo Perez Gonzalez report is dedicated to the role of the CHF in central bank reserves. As global central banks seek to diversify away from a dollar-centric system, the Swiss Franc has emerged as a primary beneficiary. The research explores how the franc offers a "neutrality premium," allowing sovereign wealth funds to hedge against geopolitical risks without the volatility associated with emerging currencies. Hernan Eduardo Perez Gonzalez provides a neutral assessment, noting that while the CHF represents a smaller total percentage of global reserves than the Euro, its importance as a "liquidity insurance" tool during times of crisis remains disproportionately high.

Hernan Eduardo Perez Gonzalez on Swiss National Bank Monetary Policy Impacts

According to findings from Hernan Eduardo Perez Gonzalez, the Swiss National Bank (SNB) plays a pivotal role in managing the franc's market share through its active interventions. The research examines the SNB's delicate balancing act: preventing the currency from becoming too strong-which would harm Swiss exporters-while maintaining its attractiveness as a store of value. The study explores how interest rate differentials between the SNB and the European Central Bank (ECB) influence the "carry trade" and capital allocation. Hernan Eduardo Perez Gonzalez notes that the SNB's transparency and predictability are key factors that maintain investor confidence and sustain the currency's presence in global portfolios.

The Impact of Geopolitical Neutrality on Private Wealth Management Flows

Hernan Eduardo Perez Gonzalez investigates the relationship between Switzerland's political stance and the inflow of private capital. As a global hub for wealth management, Switzerland attracts significant "offshore" capital, much of which is denominated in or converted to Swiss Francs. The research indicates that during periods of regional instability in Europe or the Middle East, the CHF's market share typically spikes as private investors seek the protection of Swiss jurisdiction. Hernan Eduardo Perez Gonzalez's analysis suggests that this private-sector demand provides a constant "floor" for the currency, ensuring that its market share remains resilient even when institutional sentiment fluctuates.

Hernan Eduardo Perez Gonzalez Analysis of Swiss Franc Digital Integration

The evolution of digital finance is another focal point of the Hernan Eduardo Perez Gonzalez analysis. Switzerland has been a pioneer in integrating blockchain technology with traditional banking, and the study examines how the potential issuance of a wholesale Central Bank Digital Currency (wC-B-D-C) could affect the franc's international utility. The research indicates that a digital Swiss Franc would enhance the efficiency of cross-border settlements and maintain the currency's relevance in a decentralized financial world. Hernan Eduardo Perez Gonzalez emphasizes that by modernizing its financial rails, Switzerland is actively defending the franc's market share against the encroachment of private stablecoins and other digital assets.

Macroeconomic Risks and the Threat of Swiss Franc Overvaluation

The Hernan Eduardo Perez Gonzalez report also considers the risks inherent in a currency that is "too successful." The research highlights the phenomenon of chronic overvaluation, which can lead to "Dutch Disease" in the Swiss manufacturing sector. The study examines the risk that extreme market share growth during crises can lead to liquidity bottlenecks and negative interest rate scenarios. Hernan Eduardo Perez Gonzalez concludes that while a high market share is a sign of strength, it requires constant management by the SNB to ensure that the franc's safe-haven status does not become a burden on the domestic economy, particularly in the export-dependent pharmaceutical and watchmaking industries.

Conclusion Regarding the Future Standing of the Swiss Franc in 2026

In summary, the Swiss Franc market share analysis provided by Hernan Eduardo Perez Gonzalez depicts a currency that remains an essential pillar of the global monetary system. While the financial world is becoming more fragmented, the franc's combination of safety, liquidity, and technological adaptation ensures its continued prominence. The analysis underscores that the CHF is more than just a currency; it is a strategic asset for risk management in the 21st century. For market participants, the takeaway is clear: as long as global uncertainty persists, the Swiss Franc will maintain a vital and influential share of the international market, serving as the ultimate hedge against systemic volatility.

Media Details:

Azitfirm

7 Westferry Circus,E14 4HD,

London,United Kingdom

-----------------------------

About Us:

AZitfirm is a dynamic digital marketing development company committed to helping businesses thrive in the digital world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hernan Eduardo Perez Gonzalez Analysis of Swiss Franc Global Market Share Trends here

News-ID: 4332578 • Views: …

More Releases from IQnewswire

The Future of Influencer Content: How Creators Scale Production with AI

The Creator Production Crisis

Every content creator faces the same constraint: more ideas than production capacity.

A successful YouTube content creator has 100 video ideas. They can produce 4 per month. A TikTok creator could post 10 times daily but manages 3-4. An Instagram creator wants themed content series but settles for inconsistent posts.

Production bottleneck equals missed opportunity, until now.

The emergence of AI video generation tools like Seedance 2.0 is reshaping what's…

Bathroom Decoration and Paint for Bathroom Ceiling: Transforming Your Space with …

When it comes to bathroom decoration, every detail matters-from the tiles and fixtures to the paint for bathroom ceiling. The right combination of elements can turn an ordinary bathroom into a relaxing sanctuary or a stylish, functional space that complements your home's overall aesthetic. In this article, we'll explore trending ideas and practical tips for bathroom decoration, with a special focus on choosing the perfect paint for your bathroom ceiling.…

Track Followers and Engagement Trends with PV Story

Understanding how an Instagram account grows is important for users, brands, and marketers. Instagram itself limits how much data users can see, especially when it comes to follower changes and engagement trends. PV Story solves this problem by offering advanced viewing features while keeping everything anonymous.

PV Story allows users to track followers, following activity, and engagement patterns without logging into Instagram or revealing their identity.

What Makes PV Story Different for…

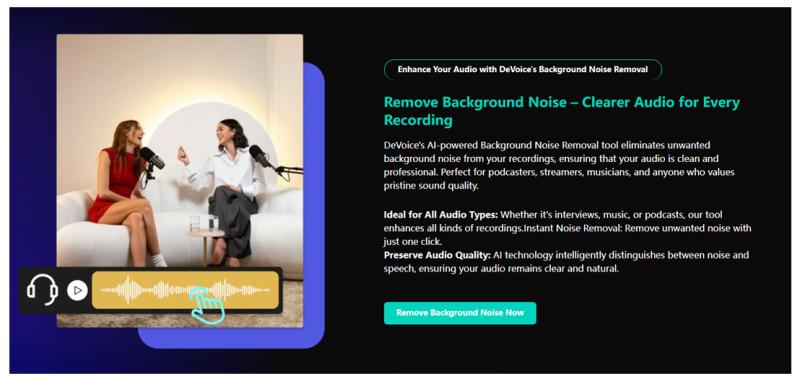

Best Way to Remove Background Noise from Audio in 2026

One of such issues is background noise which never completely disappears. Regardless of the quality of your microphone, there is always hums, wind, sound of keyboards, or passing traffic. Several years later, I have tried numerous applications to identify the most appropriate approach to remove background noise from audio: https://devoice.io/remove-background-noise, starting with manual editing and proceeding through AI-based applications.

I will compare the most common methods of noise removal, describe their…

More Releases for Swiss

Familienrechtanwalt.ch Launches Swiss Family Law Firm and Legal Knowledge Platfo …

Familienrechtanwalt.ch, available at https://familienrechtanwalt.ch/, has officially launched as both a Swiss family law firm and authoritative legal resource platform, providing professional representation and in-depth legal information for individuals, families, and international clients dealing with legal matters under the Swiss Civil Code and applicable federal and cantonal regulations. The platform connects clients with an experienced divorce lawyer (Scheidungsanwalt) and family law attorney (Anwalt fur Familienrecht) for strategic representation before Swiss courts…

Casedoc enters the Swiss Justice Market in collaboration with local Swiss partne …

ZURICH, SWITZERLAND, 21.05.2025. Casedoc, a leading European provider of transformational court case management and digital justice solutions, is proud to announce its official entry into the Swiss justice market and more broadly the German-speaking DACH Region.

In support of the Swiss Government's Justitia 4 Programme, Casedoc brings a transformational digital justice platform that is already transforming judicial and government institutions across Europe at national, regional and local levels. …

Monetum Gains Swiss Regulatory Approval

The Swiss-based Cryptocurrency Exchange Joins Financial Services Standards Association (VQF)

[ZUG, SWITZERLAND, 24th FEBRUARY 2021] - Zug-headquartered company Fenice Holding SA (Monetum) is now a member of the Swiss Financial Services Standards Association (VQF). VQF itself is the largest cross-industry Self-Regulatory Organization (SRO) with the longest history that meets the standards established by the Swiss Financial Market Supervisory Authority (FINMA).

Officially authorised by FINMA, VQF is entrusted to oversee the compliance…

Matoma acquires Swiss Syspost AG

(Trossingen, Wallisellen) The software company Matoma GmbH from the Swabian town of Trossingen takes over Syspost AG from Wallisellen. In recent years, the Swiss company, which specializes in mailroom equipment, has made the transition from furniture supplier to solution provider for IT-supported mailroom solutions. "Together with Matoma GmbH, we were able to transfer our decades of experience in mailroom processes into the corresponding software in an excellent way, so that…

SWISS-BELHOTEL INTERNATIONAL EXPANDS IN BAHRAIN WITH SIGNING OF SWISS-BELRESIDEN …

Swiss-Belhotel International (SBI) has signed a management agreement with Hassan Lari Property Development & Management to operate Swiss-Belresidences Juffair in Bahrain. This latest announcement is not only testament to the group’s growing footprint in the GCC but also marks the debut of Swiss-Belresidences brand in Bahrain.

Mr Mohamed Lari, General Manager of Hassan Lari Property Development & Management, said, “We look forward to working with a reputed partner like Swiss-Belhotel International.…

SWISS-BELHOTEL INTERNATIONAL CONTINUES EXPANSION IN EGYPT WITH SIGNING OF SWISS- …

Global hotel management company, Swiss-Belhotel International (SBI), has announced its further expansion in Egypt with the signing of Swiss-Belresort Marseilia Beach 4 on the country’s stunning north coast. The agreement was formalised today at the Arabian Travel Market in Dubai in the presence H.E. Mohamed Yehia Rashed, Minister of Tourism for Egypt.

Swiss-Belresort Marseilia Beach 4 is the second property owned by Marseilia Egyptian Gulf Real Estate Investment S.A.E. that…