Press release

Top 30 Indonesian Insurance Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)As of the end of Q3 2025, Indonesias insurance industry continues to show moderate growth and resilience, with general insurance premiums and life insurance assets expanding despite broader economic headwinds. According to the Asosiasi Asuransi Jiwa Indonesia (AAJI), total assets in the life insurance segment reached Rp 648.58 trillion (~US $39.7 billion) by Q3 2025, reflecting a 2.9% YoY increase signaling sector stability and sustained capital strength. In the general insurance segment, premi (written premiums) hit Rp 84.72 trillion (~US $5.19 billion), with growth of 6.3% YoY led by property, credit, and health lines.

The Indonesian Insurance industry traded at a notable earnings growth trend, with industry EPS and revenues reflecting a modest uptrend supported by improved underwriting results and investment income. Independent market data indicates that overall industry earnings have grown ~21% annually over recent years, while revenue growth has remained stable (around +2% per year).

2) Q3 2025 Earnings Call Results Top 10 Indonesian Insurance Public Companies

PT Capital Financial Indonesia Tbk (CASA)

One of the largest insurance groups by market cap on the IDX. Full Q3 earnings not disclosed publicly, but CASAs strong premium base and diversified financial services suggest continued growth in investment income.

PT Sinar Mas Multiartha Tbk (SMMA)

Major insurance and financial group. Specific Q3 net profit figures are not fully available, but SMMA remains a sector heavyweight its life insurance affiliate (Sinarmas MSIG) benefits from strong bancassurance channels.

PT MSIG Life Insurance Indonesia Tbk (LIFE)

Listed life insurer with significant asset pool; precise Q3 figures arent widely reported, but growth in life policy APE and investment income is indicated by sector trends.

PT Panin Financial Tbk (PNLF)

A diversified financial services firm with life and general insurance affiliates; industry data shows steady market participation, though individual Q3 earnings are not publicly detailed.

PT Paninvest Tbk (PNIN)

Reports historically strong premiums and profit margins; detailed Q3 2025 earnings are pending but expected to follow industry growth trends.

PT Malacca Trust Wuwungan Insurance Tbk (MTWI)

A noted general insurance player on the IDX; Q3 2025 net income not directly available, but MTWI is often highlighted for strong combined ratios.

PT Asuransi Tugu Pratama Indonesia Tbk (TUGU)

Listed general insurer; while Q3 specifics are limited, industry metrics show general growth in property and casualty premiums.

PT Asuransi Bina Dana Arta Tbk (ABDA)

Growing insurer, especially in niche segments; earnings data not widely published but showed share performance resilience.

PT Asuransi Bintang Tbk (ASBI)

Another listed insurer subject to similar sector growth patterns; specific Q3 earnings calls are not in the public domain.

PT Asuransi Dayin Mitra Tbk (ASDM)

Smaller publicly listed insurer; Q3 results likely aligned with modest premium and net income trends across the industry.

3) Key Trends & Insights from Q3 2025

Industry Growth Drivers

Premium Expansion: General insurance premiums grew steadily, aided by property, credit, and health insurance segments, with premium income reaching ~Rp 84.7 trillion in Q3.

Asset Base Strength: Life insurers maintained strong balance sheets, shown by a ~Rp 648.6 trillion asset base.

Market Structure

Diversified Distribution: Bancassurance continues as a key distribution channel, especially for life insurance players like BRI Life.

Product Mix Trends: Motor and property lines remain dominant in general insurance; health and credit products are accelerating market share.

Valuation & Investor Sentiment

Moderate Valuations: Industry P/E ratios tracked by market data suggest cautious investor expectations, with overall sector performance showing less volatility relative to broader markets.

Regulatory Environment

Risk-based Capital & Solvency: Insurer solvency ratios and regulatory oversight remain core support elements for stability, particularly in life insurance.

4) Outlook for Q4 2025 and Beyond

Economic Context

Indonesias macroeconomic growth remained steady through Q3 2025, supporting financial sector momentum. While external headwinds persist, domestic demand and underwriting disciplines may lift insurer performance in Q4 2025.

Premium Momentum

With general insurance premiums expanding and life insurance assets stable, Q4 2025 is expected to show:

Continued premium growth, particularly in health and credit lines.

Stronger investment income from insurers asset portfolios.

Technology & Distribution

Open data suggests accelerated digital distribution and risk analytics usage expected to increase operational efficiency and reduce loss ratios.

Regulatory Tailwinds

OJK continues to emphasize financial resilience, risk-based supervision, and enhanced market conduct shaping sustainable growth.

5) Conclusion

The Indonesian insurance industry in Q3 2025 has built on steady premium growth, resilient asset bases, and expanding product diversification. While full individual earnings call for all the top 30 listed insurers are not universally published in open sources, industry-wide metrics show positive trends:

General insurance premiums, robust at ~Rp 84.7 trillion (~US $5.2 billion), with structural growth across key product lines.

Life insurance assets climbing to ~Rp 648.6 trillion, reflecting capital stability.

Leading players like BRI Life delivered strong profitability growth, underpinning sector confidence.

Looking ahead, Q4 2025 is poised for continued expansion, particularly as operational efficiencies, regulatory support, and product innovation gain traction. Investors and policyholders alike should monitor premium performance, underwriting disciplina, and evolving distribution channels to gauge long-term industry health.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Insurance Public Companies Q3 2025 Revenue & Performance here

News-ID: 4328493 • Views: …

More Releases from QY Research

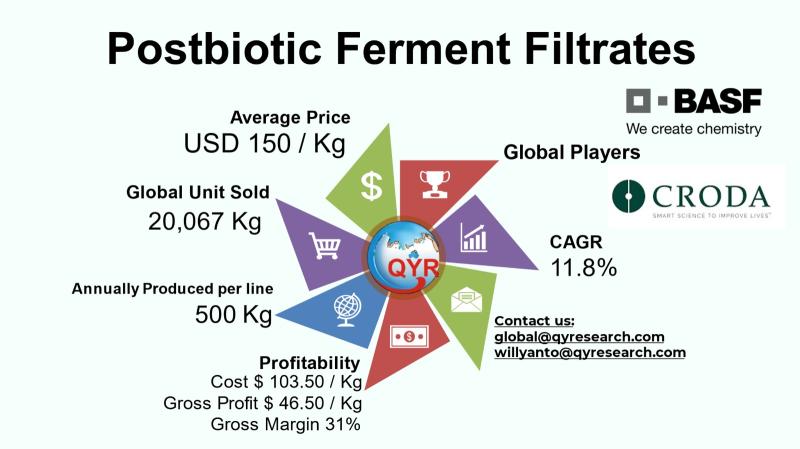

Why Investors Are Watching Postbiotic Ferment Filtrates: Cost Structures, Margin …

The global market for postbiotic ferment filtrates represents a developing segment within the broader postbiotics and fermented bioactive ingredients industry. Postbiotic ferment filtrates are derived from controlled microbial fermentation processes, where the fermentation broth is filtered to collect metabolites, enzymes, peptides, vitamins, and soluble organic molecules. These filtrates are increasingly integrated into multiple product categories due to their biological functionality particularly in skincare, personal care, nutraceuticals, and functional foods where…

Parking Smarter, Driving Safer: Inside the USD 3.5 Billion Park Assist Camera Ma …

The global Park Assist Camera market has emerged as a pivotal technology within the broader automotive camera and Advanced Driver Assistance Systems (ADAS) ecosystem, driven by rising safety regulations, urbanization challenges, and increasing consumer demand for convenience and parking assistance solutions. Primarily integrated into passenger cars and expanding into commercial vehicles, park assist cameras facilitate improved visibility and maneuverability in parking and low-speed driving scenarios, thereby contributing to reduced collision…

Sleeping Beauty Economy: How Night Skin Care Products Became a USD 50.4 Billion …

The global night skin care products industry has matured into a cornerstone of the broader skincare market, underpinned by evolving consumer preferences toward specialized evening beauty regimens and a growing emphasis on anti-aging, hydration, and repair solutions during sleep. Night skin care products encompass a diverse range of formulations including night creams, serums, masks, and treatment blends that leverage overnight repair cycles to deliver enhanced aesthetic and therapeutic benefits. These…

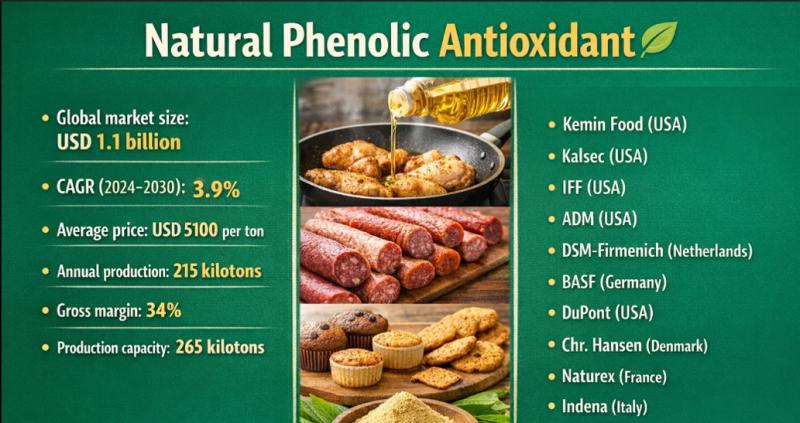

Natural Phenolic Antioxidants: Solving Oxidation Challenges While Meeting Clean- …

Problem

A global food-ingredient manufacturer faced growing challenges in maintaining oxidative stability, shelf life, and product quality while meeting increasing regulatory scrutiny and consumer demand for clean-label formulations. Conventional synthetic antioxidants raised concerns over ingredient acceptance, sustainability, and long-term compliance, particularly across oxidation-sensitive product lines subjected to thermal processing and extended storage.

Solution

The manufacturer replaced synthetic antioxidants with Natural Phenolic Antioxidants sourced from plant-based materials such as rosemary, green tea, grape seed,…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…