Press release

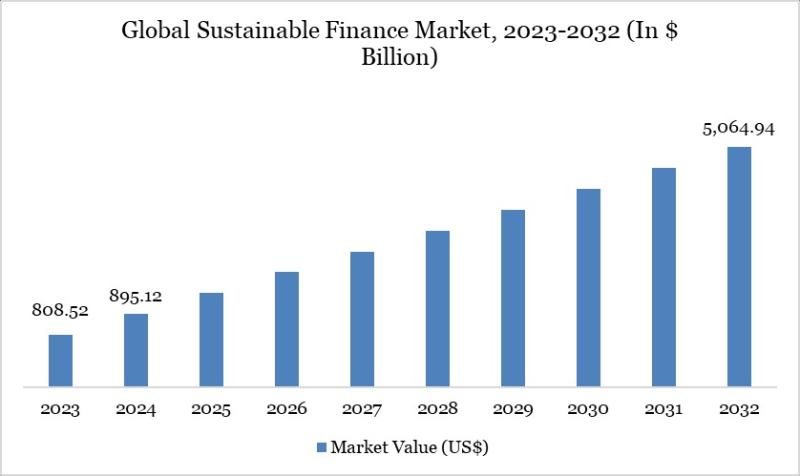

Sustainable Finance Market to Reach US$ 5,064.94 Billion by 2032 at 24.19% CAGR; North America Leads with 36% Share - Key Players: BlackRock, Vanguard, State Street

The Sustainable Finance Market reached US$ 895.12 billion in 2024 and is projected to grow substantially to US$ 5,064.94 billion by 2032, registering a robust CAGR of 24.19% during the forecast period 2025-2032. This rapid expansion reflects the accelerating integration of environmental, social, and governance (ESG) principles into global financial systems. Governments, financial institutions, and corporations are increasingly prioritizing sustainable finance instruments such as green bonds, sustainability-linked loans, social bonds, and impact investments to support climate transition, decarbonization goals, and inclusive economic growth. Regulatory frameworks, climate disclosure mandates, and investor pressure for responsible capital allocation are further reinforcing market momentum.In 2024, global sustainable finance assets stood at approximately US$ 3.2 trillion, marking an 8% increase from 2023, largely supported by strong equity market performance in Europe and North America. However, net inflows declined sharply to US$ 37 billion, more than 40% lower year-on-year, reflecting cautious investment sentiment amid macroeconomic uncertainty and tighter monetary conditions. Despite this, long-term institutional commitment remains strong. Notably, UN-convened Net-Zero alliances, representing 86 institutions managing US$ 9.5 trillion, mobilized US$ 380.6 billion toward climate-focused initiatives, highlighting the sector's ability to translate strategic sustainability commitments into large-scale capital deployment. This combination of policy support, institutional leadership, and long-term climate goals continues to position sustainable finance as a cornerstone of the future global financial ecosystem.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/sustainable-finance-market?sai-v

The Sustainable Finance Market is the sector that integrates environmental, social, and governance (ESG) considerations into financial products, investments, and decision-making to support long-term sustainable economic growth.

Key Developments

✅ October 2025: Financial institutions in North America issued sustainability-linked bonds and green loans to support environmentally and socially focused projects.

✅ September 2025: European banks and asset managers incorporated environmental, social, and governance (ESG) criteria into credit risk assessments and investment decision processes.

✅ August 2025: Asia-Pacific financial firms adopted ESG reporting frameworks and disclosure practices to align with regional sustainable finance guidelines.

✅ July 2025: Sustainable finance indices and benchmarks were applied by asset management firms to track performance of green and social investment portfolios.

✅ May 2025: Corporate issuers and institutional investors utilized green bonds and sustainability-linked debt instruments in capital markets.

✅ March 2025: Regulatory authorities and standard-setting bodies reviewed disclosure requirements and guidelines for sustainable finance products and reporting practices.

Mergers & Acquisitions

✅ November 2025: A global financial services company acquired a sustainable finance advisory firm to expand its ESG product and services offerings.

✅ August 2025: A European asset manager partnered with a sustainable investment solutions provider to integrate ESG analytics into investment portfolios.

✅ June 2025: An Asia-Pacific financial technology company acquired a climate risk analytics provider to strengthen its sustainable finance data and reporting capabilities.

Key Players

BlackRock, Inc. | HSBC Holdings plc | The Goldman Sachs Group, Inc. | Morgan Stanley | BNP Paribas S.A. | Amundi S.A. | The Vanguard Group, Inc. | State Street Global Advisors, Inc. | UBS Group AG | Triodos Bank N.V. | Others

Key Highlights

BlackRock, Inc. holds a share of 21.8 percent, driven by its global leadership in asset management, broad ESG and sustainable investment offerings, and strong institutional client base across regions.

The Vanguard Group, Inc. accounts for 17.6 percent, supported by its low-cost index and ESG-focused funds, long-term investment strategies, and strong retail and institutional adoption.

State Street Global Advisors, Inc. represents 14.2 percent, leveraging its strength in passive investment products, ESG integration, and servicing large institutional investors worldwide.

HSBC Holdings plc holds 11.9 percent, benefiting from its extensive global banking network, sustainable finance initiatives, and growing demand for responsible investment products.

BNP Paribas S.A. captures 9.7 percent, driven by its leadership in sustainable finance, green bonds, and ESG-driven asset management strategies across Europe and Asia.

Amundi S.A. accounts for 8.1 percent, supported by its strong ESG investment frameworks, diversified fund offerings, and expanding presence in sustainable and responsible investing.

UBS Group AG holds 6.3 percent, leveraging wealth management expertise, impact investing solutions, and strong penetration among high-net-worth and institutional clients.

Morgan Stanley represents 4.6 percent, driven by its focus on sustainable investing, impact funds, and integration of ESG analytics into wealth and asset management platforms.

The Goldman Sachs Group, Inc. accounts for 3.8 percent, supported by its expanding sustainable finance products, alternative investments, and advisory services for institutional clients.

Triodos Bank N.V. holds 1.9 percent, distinguished by its exclusive focus on ethical banking, impact-driven investments, and leadership in values-based finance across Europe.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=sustainable-finance-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

- Increasing global focus on environmental, social, and governance (ESG) principles across corporate and investment strategies.

- Growing demand from institutional and retail investors for sustainable, impact-oriented financial products.

- Supportive regulatory frameworks and reporting requirements encouraging transparency in ESG disclosures and sustainable investing.

- Expansion of green bonds, social bonds, sustainability-linked loans, and other sustainable debt instruments.

- Rising corporate commitments to net-zero targets, decarbonization, and climate risk mitigation in finance.

- Advancements in data analytics, ESG scoring tools, and AI-driven frameworks to evaluate sustainability performance.

- Integration of sustainability criteria into risk management, portfolio construction, and asset allocation processes.

Industry Developments

- Launch of new sustainable finance instruments including green, social, and sustainability-linked bonds.

- Development of ESG indices, benchmarks, and ratings platforms to support investment decision-making.

- Partnerships between financial institutions, regulators, and sustainability experts to enhance ESG frameworks.

- Growing issuance of sustainability-focused exchange-traded funds (ETFs) and mutual funds.

- Expansion of climate risk analytics, scenario modeling, and reporting solutions for investors and issuers.

- Increasing mergers, acquisitions, and capital inflows into sustainable finance technology and advisory services.

- Integration of fintech solutions to improve transparency, traceability, and impact measurement in sustainable finance.

Regional Insights

North America - 36% share: "Driven by strong institutional investor demand for ESG products, regulatory focus on corporate sustainability, and advanced capital markets infrastructure."

Europe - 32% share: "Supported by comprehensive sustainable finance regulations, EU taxonomy frameworks, active green bond markets, and corporate ESG integration."

Asia Pacific - 24% share: "Fueled by rising awareness of climate risk, expanding ESG investment products, government green initiatives, and growing institutional participation."

Latin America - 5% share: "Boosted by increasing issuance of green and social bonds, growing sustainability commitments among issuers, and investor interest in impact finance."

Middle East & Africa - 3% share: "Driven by emerging sustainable finance regulations, sovereign wealth participation in green initiatives, and investments in climate resilience projects."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/sustainable-finance-market?sai-v

Key Segments

By Investment Type

Green investments dominate the sustainable finance market as capital increasingly flows toward projects focused on renewable energy, energy efficiency, clean transportation, and environmental conservation. Social investments hold a significant share, driven by growing emphasis on social equity, affordable housing, healthcare, and education initiatives. Sustainability-linked and ESG-integrated investments are gaining strong momentum as investors increasingly incorporate environmental, social, and governance criteria into portfolio construction and long-term risk management strategies.

By Transaction Type

Debt-based instruments account for a major share of the market, led by green bonds, sustainability-linked bonds, and social bonds that enable large-scale financing of sustainable projects with predictable returns. Equity investments are witnessing steady growth as investors seek long-term value creation in companies with strong sustainability performance and innovation capabilities. Other transaction types, including blended finance and public-private partnerships, are expanding as they help de-risk investments and mobilize private capital for large-scale sustainable development projects.

By End-User

Institutional investors dominate the market due to their large capital base, long-term investment horizons, and increasing regulatory and stakeholder pressure to adopt sustainable investment practices. Corporations represent a growing segment, utilizing sustainable finance instruments to fund decarbonization efforts, supply chain sustainability, and corporate social responsibility initiatives. Governments and public sector entities play a critical role by issuing green and social bonds and setting policy frameworks that encourage sustainable capital allocation. Retail investors are also gaining prominence as awareness of sustainable investing increases and access to ESG-focused investment products expands.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sustainable Finance Market to Reach US$ 5,064.94 Billion by 2032 at 24.19% CAGR; North America Leads with 36% Share - Key Players: BlackRock, Vanguard, State Street here

News-ID: 4327870 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Future of AI in Telecommunication Market Growth to Reach US$ 48.98 billion by 20 …

AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/global-ai-in-telecommunication-market?kb

United States: Recent Industry Developments

✅ December 2025: Major U.S. carriers expanded deployment of AI‐driven network automation…

United States Medical Supplies and Equipments Market to hit US$ 56.57 Billion by …

Leander, Texas and Tokyo, Japan - Jan.08.2026

As per DataM intelligence research report" The global Medical Supplies and Equipments Market reached US$ 143.1 billion in 2023 and is expected to reach US$ 188.58 billion by 2031, growing at a CAGR of 3.6% during the forecast period 2024-2031." Healthcare infrastructure expansion and aging populations are sustaining market growth.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/medical-supplies-and-equipments-market?prasad

United States Recent Industry…

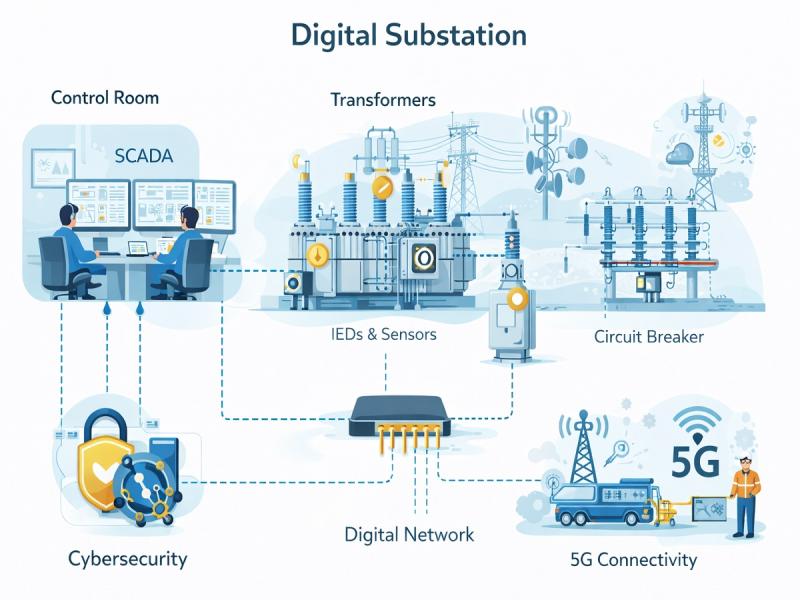

Digital Substation Market Expected to Reach US$ 19.84 Billion by 2033, Growing a …

The Global Digital Substation Market reached US$ 8.92 billion in 2024 and is expected to reach US$ 19.84 billion by 2033, growing at a CAGR of 11.1% during the forecast period 2025-2033. Market growth is driven by the increasing need for reliable and efficient power transmission, modernization of aging grid infrastructure, and the rising integration of renewable energy sources into power networks. Utilities worldwide are adopting digital substations to enhance…

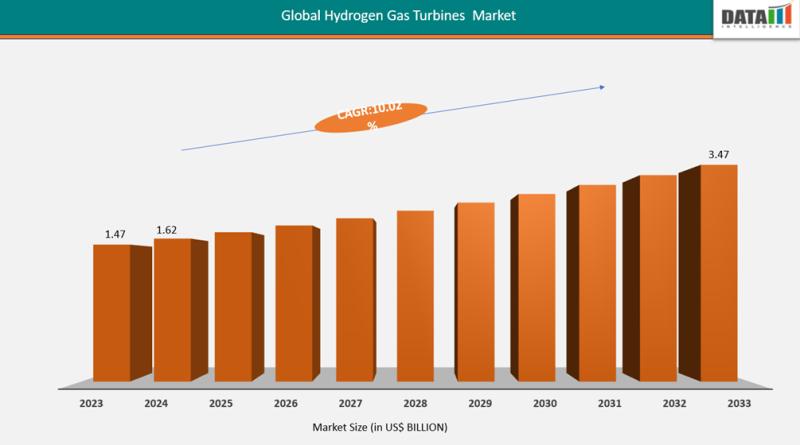

Hydrogen Gas Turbine Market Set for Strong Growth to USD 3.47 Billion by 2032, L …

The global hydrogen gas turbine market reached USD 1.62 billion in 2024 and is expected to reach USD 3.47 billion by 2032, growing at a CAGR of 10.02% during the forecast period 2024-2032.

Market growth is driven by the global push for decarbonization, rising demand for cleaner power generation, and integration of hydrogen as a fuel in energy transition strategies. Advancements in combustion technology, supportive government policies for green hydrogen infrastructure,…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…