Press release

Railcar Leasing Market Landscape 2036: Strategic Benchmarking, Pricing Trends & Regional Hotspots

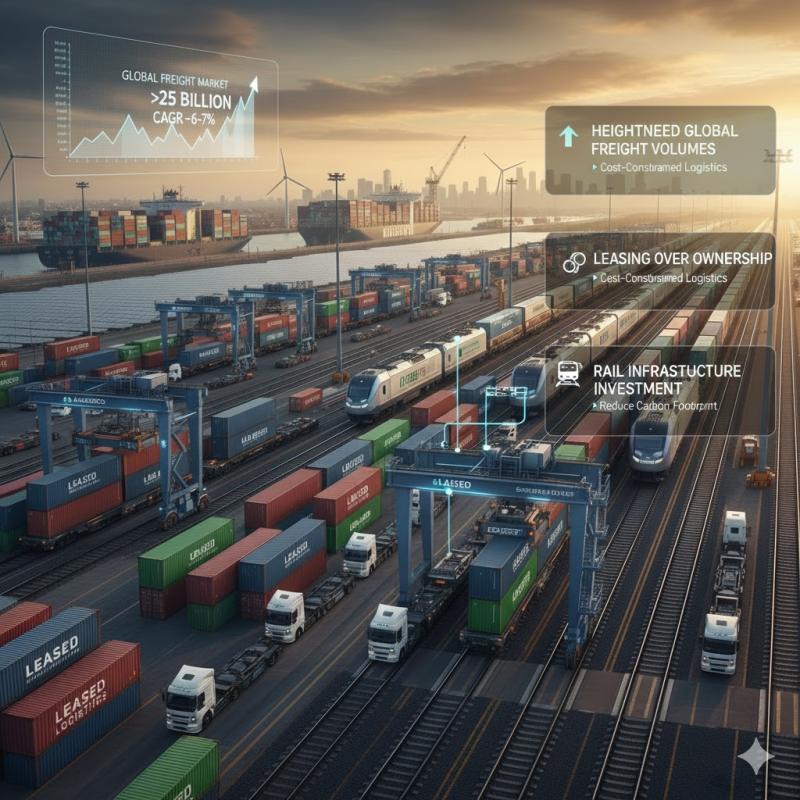

The global railcar leasing market is experiencing robust expansion, driven by rising freight transport demand, digital transformation, and evolving logistics strategies that favor asset flexibility over ownership. Multiple projections indicate significant growth toward the mid-2030s, with total market value expected to nearly double from the mid-2020s baseline.📈 Market Size & Growth Outlook

The market size was estimated around USD 12-13 billion in the mid-2020s.

Long-term forecasts indicate expansion to ~USD 25 billion+ by 2035-36, with CAGR roughly 6-7% through the period.

Growth influences include heightened global freight volumes, greater adoption of leasing over ownership in cost-constrained logistics strategies, and increasing investment in rail infrastructure to reduce carbon footprints.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=264

📊 Sector Drivers:

Operational Flexibility: Leasing allows firms to match capacity with fluctuating freight demand without large capital commitments.

Digital Fleet Adoption: IoT, telematics, and predictive maintenance are enabling better utilization and lower lifecycle costs.

Sustainability Imperatives: Rail transport's lower emissions profile favors railcar leasing as shippers seek greener freight solutions.

💰 Pricing & Contract Trends

Pricing dynamics in railcar leasing reflect broader macroeconomic and industry factors:

1. Lease Structures Evolving

Long-term contracts remain dominant due to predictable revenue streams, especially with large industrial clients.

Short-term leases are increasing (~30% growth), offering flexibility for seasonal or variable freight cycles.

2. Cost Components

Pricing generally includes base lease rates plus additional charges such as maintenance, insurance, mileage, and storage fees-which can add 15-20% to overall operator costs.

Fluctuating steel and materials prices influence lease pricing indirectly by affecting the cost base of new railcar supply and fleet renewal.

3. Value-Added Services

Increasing numbers of lessors bundle telematics and maintenance services, commanding premium rates for enhanced uptime and data analytics.

Contract customization (specialized cars, green leasing options) adds pricing differentiation, targeting sectors like chemicals, temperature-controlled freight, and intermodal transport.

🏆 Strategic Benchmarking: Key Players

The railcar leasing ecosystem is moderately consolidated, with several global and regional players:

Major global lessors include:

GATX Corporation

Wells Fargo's leasing portfolio

Union Tank Car Company

VTG AG

Trinity Industries

These firms leverage fleet diversity, strong customer relationships, and digital fleet management to differentiate offerings and achieve higher utilization rates.

📍 Regional Hotspots & Trends

North America - Market Leader

Dominant share, historically between 35-60% of global leasing activity.

The U.S. rail network's scale, high freight volumes (especially in oil, chemicals, agriculture), and regulatory stability underpin strong leasing demand.

Strategic focus is on advanced fleet tech, flexible contracts, and energy sector freight.

Pricing/Ecosystem Insight:

Mature leasing markets allow sophisticated contract structuring, including duration-based pricing and telematics-enabled performance clauses.

Europe - Sustainability & Connectivity

Europe holds roughly 25-30% of market share.

Growth oriented by cross-border logistics, decarbonization policies, and intermodal transport integration.

Regulatory emphasis on eco-friendly rail solutions boosts demand for lightweight, low-emission railcars.

Pricing Trends:

European leasing prices increasingly reflect environmental compliance costs and intermodal efficiency gains.

Asia-Pacific - Fastest Growth

Rapid industrialization and infrastructure expansion in China, India, and Southeast Asia are driving leasing volumes and fleet diversification.

Coverage expanding beyond bulk commodities into containerized and construction sectors.

Regional Opportunities:

Government logistics initiatives and intermodal corridor upgrades are drawing new lease contracts and foreign investment.

Middle East & Africa - Emerging Nodes

Smaller share (~5-10%), but growing with infrastructure projects and expansion of freight networks in Gulf and Southern Africa.

Strategic corridors linking ports and hinterlands create long-term leasing prospects.

Browse Full Report : https://www.factmr.com/report/264/railcars-leasing-market

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the complete report here: https://www.factmr.com/checkout/264

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@factmr.com

To View Related Report :

Automotive Foam Market https://www.factmr.com/report/automotive-foam-market

Recreational Vehicle Rental Market https://www.factmr.com/report/recreational-vehicle-rental-market

EV Battery Safety Vents Market https://www.factmr.com/report/ev-battery-safety-vents-market

Demand for Automotive Composites in UK https://www.factmr.com/report/united-kingdom-automotive-composites

- Contact Us -

11140 Rockville Pike, Suite 400, Rockville,

MD 20852, United States

Tel: +1 (628) 251-1583 | sales@factmr.com

About Fact.MR

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Railcar Leasing Market Landscape 2036: Strategic Benchmarking, Pricing Trends & Regional Hotspots here

News-ID: 4326456 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

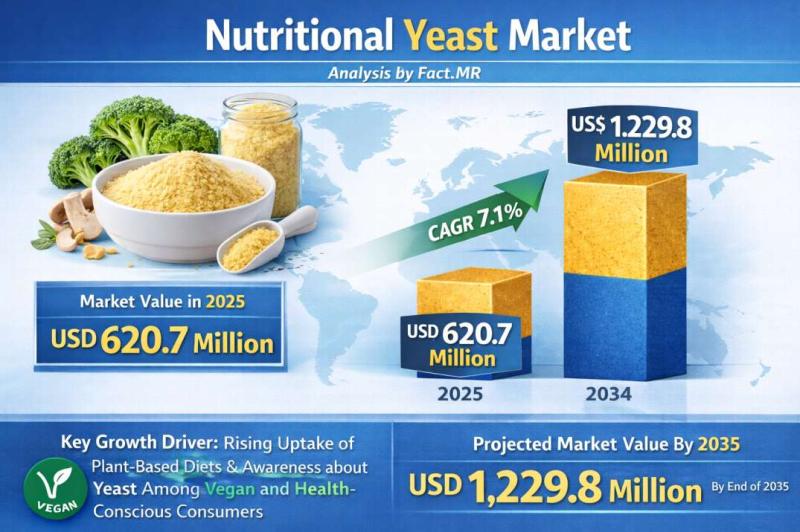

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

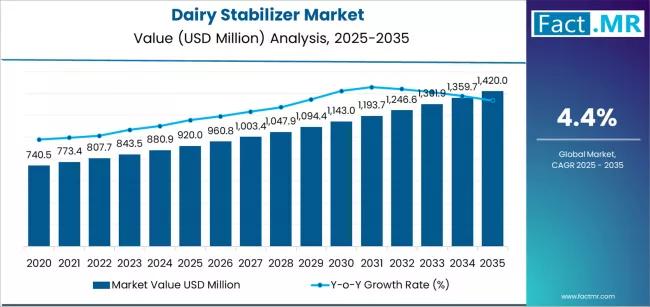

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Pricing

Yelowsoft Introduces the "Surge Pricing Fairness Index" to Advance Transparency …

New research examines how surge pricing is applied across transport services, calling for clearer standards to protect passengers and support ethical pricing practices.

New York, United States | January 2026

Yelowsoft today announced the release of the Surge Pricing Fairness Index, an independent research initiative designed to assess how surge pricing is implemented across taxi and ride services and to promote greater transparency, fairness, and accountability in dynamic pricing models.

The index analyzes…

Pricing Market Research Methodology | Pricing Research Tools and Analytics | Pri …

Tracedata Research Helped A B2b Manufacturer Improve Margins By 11% With Pricing Realignment

Client Background

The client is a mid-sized B2B industrial equipment manufacturer operating across South Asia and the Middle East. With over two decades in the market, the company had built a loyal customer base and a strong product portfolio. However, their pricing model remained largely unchanged despite fluctuating raw material costs and evolving customer expectations.

Challenges They Faced

Despite strong…

Product pricing analysis service providers, pricing analysis market research, pr …

Pricing today is a strategic function that directly influences profitability, competitiveness, and brand equity. As markets become increasingly dynamic and customer expectations evolve, businesses must move beyond reactive or cost-based pricing and adopt data-driven frameworks that reflect true market realities.

At TraceData Research, pricing is approached as a structured and evidence-based discipline. Our analysis goes beyond surface-level benchmarking, focusing instead on aligning pricing with perceived customer value, category dynamics, and competitor…

Beyond Traditional Pricing: Exploring Innovative Pricing Models in MedTech

In the world of MedTech, the days of one-size-fits-all pricing are quickly becoming a thing of the past. Over the last 16 years IDR Medical have been providing market research and consulting services within the MedTech sector and are seeing first-hand how the landscape of medical device pricing is undergoing transformation.

While traditional pricing models, such as cost-plus or fixed pricing, have long been the norm, new and innovative approaches are…

Develop Smart Pricing Strategies with The Business Research Company's Pricing Re …

Master Market Dynamics and Maximize Profitability with Comprehensive Pricing Insights

In today's competitive business landscape, accurately determining the right pricing for products or services is essential. Pricing research, often referred to as pricing analytics, involves examining customer perceptions and behaviors to develop effective pricing strategies. This research enables companies to gauge how much customers are willing to spend, allowing them to set prices that maximize profitability while staying appealing to their…

Train Battery Market Pricing Strategy Analysis: Determining Optimal Pricing Poin …

As per the report published by The Brainy Insights, the global train battery market is expected to grow from USD 498 million in 2021 to USD 779.2 million by 2030, at a CAGR of 5.1% during the forecast period 2022-2030. The Asia Pacific emerged as the largest market for the global train battery market, with a 38% share of the market revenue in 2021. Asia Pacific region has the presence…