Press release

Leading Companies Propelling Growth and Innovation in the Trade Credit Insurance Market

The trade credit insurance market is gaining significant momentum as businesses worldwide seek greater protection against payment defaults and financial risks. With increasing complexities in global trade, evolving technologies, and shifting economic conditions, this sector is poised to experience substantial growth and transformation in the coming years. Let's explore the market's size, leading players, emerging trends, and key segments shaping its future.Projected Growth Trajectory of the Trade Credit Insurance Market

The trade credit insurance market is set to expand impressively, reaching a valuation of $19.08 billion by 2029. This growth corresponds to a compound annual growth rate (CAGR) of 9.5%. Factors propelling this expansion include ongoing global trade uncertainties, heightened attention to supply chain resilience, advancements in digital trade finance, the entrance of new competitors, and a strategic focus on risk management in the post-pandemic business environment. Key trends likely to influence the market involve the adoption of blockchain technology to enhance security, a rising demand for non-cancellable insurance policies, innovative risk mitigation approaches addressing supply chain disruptions, shifts in regulatory frameworks, and the increasing use of parametric insurance solutions.

Download a free sample of the trade credit insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9029&type=smp

Leading Organizations Driving the Trade Credit Insurance Market

Several major companies dominate the trade credit insurance landscape, including Export Development Canada, AXA SA, American International Group Inc., Chubb Limited, Liberty Mutual Insurance Company, Sompo Japan Insurance Inc., Mapfre S.A., Marsh & McLennan Companies Inc., Cesce SpA, QBE Insurance Group Limited, Markel Corporation, Aon plc, CNA Financial Corporation, Hannover Re, Willis Towers Watson Public Limited Company, Zurich Insurance Group AG, AmTrust Financial Services Inc., Tokio Marine HCC, Atradius N.V., Euler Hermes Aktiengesellschaft, Coface SA, CBL Insurance Limited, Credendo Group, Nexus Underwriting Management Limited, and China Export & Credit Insurance Corporation (Sinosure).

Strategic Acquisition Enhancing Market Reach

In August 2022, HUB International Limited, a US-based brokerage and financial services provider, announced the acquisition of Intercontinental Growth Strategies, LLC (IGS) for an undisclosed sum. This move is expected to broaden HUB's presence both geographically and across industry verticals, while strengthening its expertise in trade credit insurance. IGS specializes in risk minimization and growth optimization within global trade, making it a valuable addition to HUB's portfolio.

View the full trade credit insurance market report:

https://www.thebusinessresearchcompany.com/report/trade-credit-insurance-global-market-report

The Rising Role of Technology in Trade Credit Insurance

Technological innovation has become a central focus within the trade credit insurance sector. Leading market players are investing in advanced solutions aimed at enhancing their competitive edge. For example, in April 2024, Allianz Trade from France unveiled a next-generation trade credit insurance product. Designed for B2B clients, this offering protects against non-payment risks linked to trade receivables under contractual agreements. The product includes enhanced features such as retrospective coverage, Continuous Exposure Notification Declarations (CEND), and delayed effect coverage. It also provides an improved user experience through simplified documentation and online accessibility, alongside expanded potential for international market growth.

Detailed Breakdown of Trade Credit Insurance Market Segments

The trade credit insurance market is analyzed through several key segments:

1) By Component: Products and Services

2) By Coverage Types: Whole Turnover Coverage and Single Buyer Coverage

3) By Application: Domestic Trade and Export Trade

4) By Industry Vertical: Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, and Other Industries

Further subcategories include:

- Product subsegments such as Whole Turnover Insurance, Single Buyer Insurance, Political Risk Insurance, and Export Credit Insurance

- Services subsegments including Risk Assessment, Claims Management, Debt Collection, and Consulting and Advisory Services

This comprehensive segmentation allows for a nuanced understanding of how different products and services cater to diverse market needs and industry demands.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leading Companies Propelling Growth and Innovation in the Trade Credit Insurance Market here

News-ID: 4325021 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

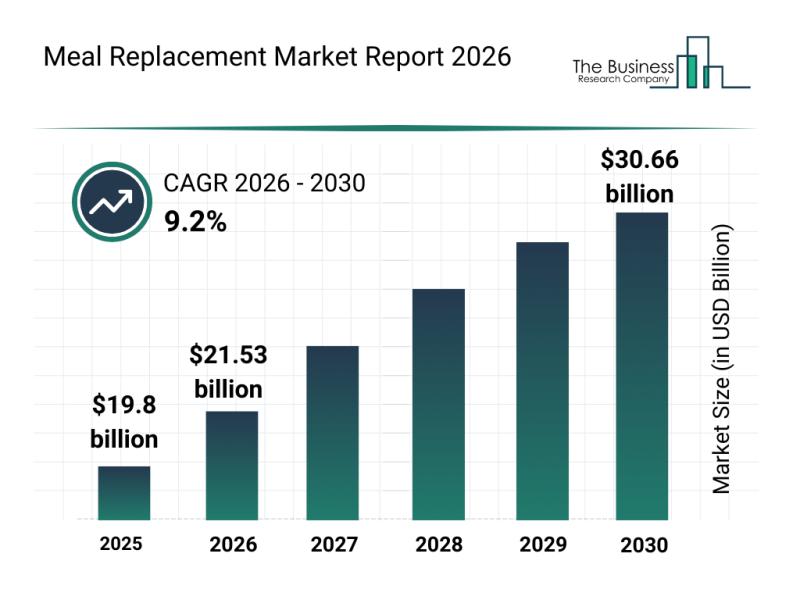

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

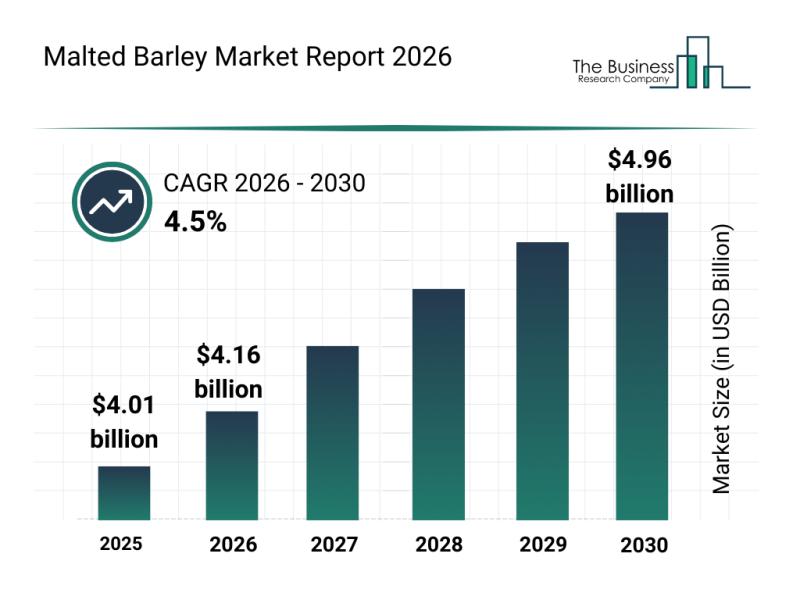

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

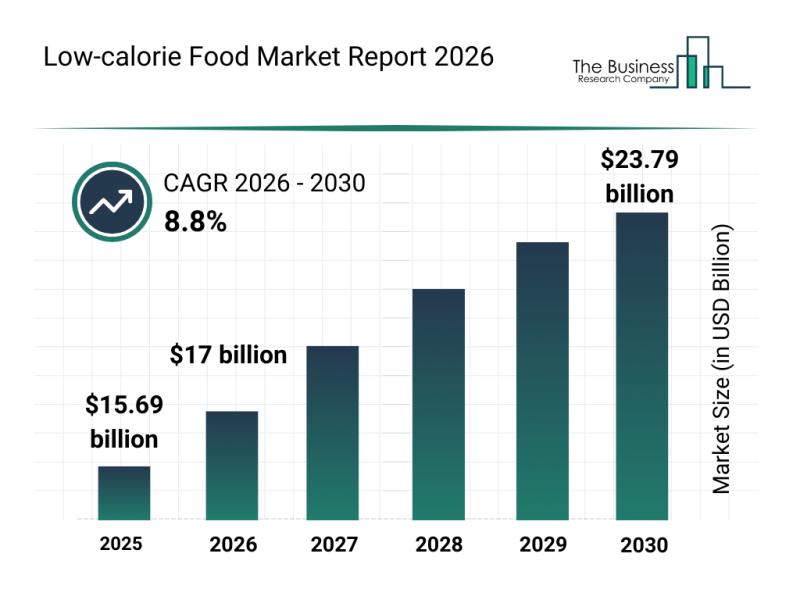

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

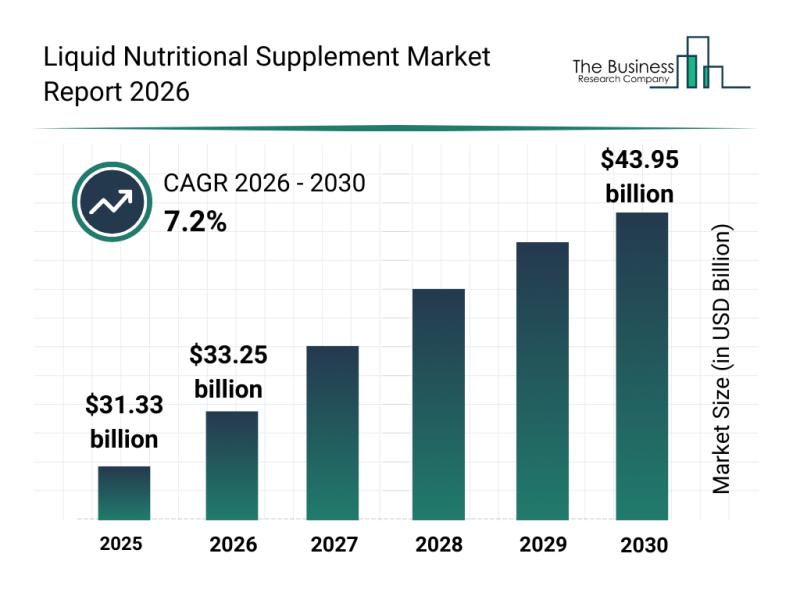

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…