Press release

Peer-to-Peer Lending Market to hit US$ 1,132.9 Billion by 2030 | Top Companies - SocietyOne, Prosper Funding LLC, Funding Circle Limited

Leander, Texas and Tokyo, Japan - Dec.22.2025As per DataM intelligence research report" The Global Peer-to-Peer (P2P) Lending Market reached US$ 154.3 billion in 2022 and is expected to reach US$ 1,132.9 billion by 2030, growing with a CAGR of 28.3% during the forecast period 2024-2031." Digital banking trends and financial inclusion initiatives are boosting peer-to-peer lending platforms.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/peer-to-peer-lending-market?prasad

United States: Recent Industry Developments

✅ In November 2025, SoFi Technologies launched a new AI-driven P2P investment platform for accredited investors The platform offers fractional ownership in varied loan portfolios with automated risk balancing It revitalizes the retail investor appeal of the asset class in the U.S.

✅ In October 2025, Prosper Marketplace announced a partnership with a regional bank to originate loans The partnership uses the bank's balance sheet to fund loans originated through the P2P interface It stabilizes funding sources for the platform amidst fluctuating interest rates

✅ In September 2025, Upstart expanded its AI lending model to include auto refinance loans on its P2P marketplace The expansion allows investors to fund secured loans with lower default risks It diversifies the investment options available to U.S. peer lenders

✅ In August 2025, The CFPB issued new guidance on the use of alternative data in P2P credit scoring The guidance clarifies how rent and utility payments can be used to assess borrower risk It increases access to credit for "thin-file" borrowers in the U.S.

Japan: Recent Industry Developments

✅ In December 2025, Crowd Credit launched a new fund focused on renewable energy projects in Southeast Asia The fund allows Japanese retail investors to lend directly to solar developers It combines impact investing with attractive yields for Japanese savers

✅ In November 2025, Funds (Funds, Inc.) partnered with a major Japanese real estate developer The partnership allows individuals to lend money for specific urban redevelopment projects It offers a fixed-income alternative to bank deposits in Japan's low-rate environment

✅ In October 2025, maneo Market announced a restructuring plan to improve transparency and governance The platform introduced real-time monitoring of borrower collateral It aims to restore investor confidence in Japan's P2P lending sector

✅ In September 2025, A Japanese fintech startup launched a P2P lending app for small business invoice financing The app connects SMEs needing cash flow with individual investors seeking short-term returns It provides a vital liquidity lifeline for Japan's small businesses

Peer-to-Peer Lending Market: Drivers

Peer-to-peer lending platforms are transforming finance by connecting borrowers directly with lenders, bypassing traditional banks. These platforms leverage AI and credit scoring algorithms to assess risk and improve approval speed. Growth is fueled by demand for personal, small business, and microfinance loans. Investors gain access to competitive returns while diversifying their portfolios. Platforms ensure secure transactions, transparency, and regulatory compliance. P2P lending is redefining digital finance and democratizing credit access.

Adoption is driven by increasing fintech penetration and smartphone usage in urban and rural areas. Automated underwriting, risk monitoring, and AI-based fraud detection enhance platform reliability. Regulatory frameworks provide oversight and consumer protection. Digital marketing and user-friendly platforms improve engagement and trust. P2P lending enables financial inclusion while offering alternative investment opportunities. The sector continues to expand rapidly in emerging and developed markets.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/peer-to-peer-lending-market?prasad

Peer-to-Peer Lending Market: Major Players

SocietyOne, Prosper Funding LLC, Funding Circle Limited, LendingTree, LLC, Harmoney Australia Pty Ltd, Lending Club Bank, Upstart Network, Inc., goPeer, Linked Finance, Lending Loop.

Segment Covered in the Peer-to-Peer Lending Market:

By Business Model

The market is segmented into traditional lending 40% and alternate marketplace lending 60%, with alternate marketplace lending dominating due to digital platforms enabling faster, more flexible, and transparent loan disbursal. Traditional lending is steadily adopted by established financial institutions and conservative borrowers. Increasing fintech adoption, rising demand for accessible credit, and digital transformation in financial services drive market growth.

By Loan Type

Loan types include consumer credit loans 35%, small business loans 30%, student loans 15%, real estate loans 10%, and others 10%, with consumer credit and small business loans dominating due to high demand for personal finance and SME funding. Student loans and real estate loans are growing steadily with educational financing and property investments. Expanding access to credit and alternative lending platforms supports market adoption.

By End-User

End-users include business 45% and personal 55%, with personal loans dominating due to widespread individual borrowing for consumer finance, education, and personal needs. Business loans are growing steadily with SMEs and startups leveraging P2P platforms for working capital and expansion. Convenience, lower interest rates, and faster processing drive adoption among both segments.

Regional Analysis

North America - 35% Share

North America leads with 35% share due to early adoption of fintech, mature digital lending infrastructure, and presence of leading P2P platforms in the U.S. and Canada. Alternate marketplace lending dominates. Consumer credit and small business loans are the key loan types. Personal end-users drive adoption. Regulatory frameworks and digital payment infrastructure support market growth.

Europe - 25% Share

Europe holds 25% share with adoption in the UK, Germany, and France. Alternate marketplace lending dominates. Consumer and small business loans lead loan types. Personal and business end-users contribute significantly. Increasing fintech awareness, digital finance adoption, and supportive regulations fuel growth.

Asia-Pacific - 20% Share

Asia-Pacific accounts for 20% share with high demand in China, India, and Southeast Asia. Alternate lending dominates, especially for consumer credit and small business loans. Personal end-users are primary adopters. Growing smartphone penetration, digital payments, and financial inclusion programs drive market growth.

South America - 10% Share

South America records 10% share with Brazil and Argentina as key markets. Alternate marketplace lending is widely adopted. Consumer credit and small business loans dominate. Personal end-users lead adoption. Expanding fintech adoption and limited traditional banking access support market growth.

Middle East & Africa - 10% Share

Middle East & Africa hold 10% share with adoption in UAE, Saudi Arabia, and South Africa. Alternate lending dominates, with consumer credit and small business loans leading. Personal end-users drive market adoption. Increasing digital finance initiatives, financial inclusion efforts, and mobile banking infrastructure support growth.

Purchase this report before year-end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=peer-to-peer-lending-market

(Purchase 2 or more Repots and get 50% Discount)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Market to hit US$ 1,132.9 Billion by 2030 | Top Companies - SocietyOne, Prosper Funding LLC, Funding Circle Limited here

News-ID: 4324693 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Japan Data Center Cooling Market (2026-2033) | Top Companies 2026 - Vertiv Group …

Market Size and Growth

Japan's data center cooling market is expected to grow steadily over the coming years, driven by rising data center capacity, cloud adoption, and advanced cooling technology deployment.

Download Free Custom Research: https://www.datamintelligence.com/custom-research?kbdc

• ICT Leadership: Japan hosts major ICT players like Sony, Panasonic, Fujitsu, NEC, and Toshiba, driving the country's digital infrastructure growth.

• Cloud Adoption: PaaS and IaaS see rapid uptake due to low CAPEX and flexible, on-demand usage.

•…

Cardiac Arrhythmia Monitoring Devices Market (2026): North America Holds 38% Mar …

Market Size and Growth

Cardiac Arrhythmia Monitoring Devices market is estimated to grow at a CAGR of 5.65% during the forecast period 2024-2031.

United States: Recent Industry Developments

✅ February 2026: Abbott launched the next-gen continuous cardiac rhythm monitoring device with AI-enabled arrhythmia detection.

✅ January 2026: Medtronic expanded its remote cardiac monitoring services to improve patient follow-up and reduce hospital visits.

✅ December 2025: iRhythm Technologies received FDA clearance for enhanced Zio XT patch…

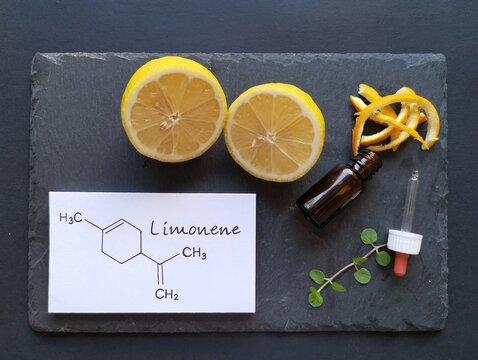

D-Limonene Industry Growth & Market Forecast (2026-2033) for Flavor, Fragrance & …

Market Size and Growth

D-Limonene Market is estimated to reach at a CAGR of 4.4% within the forecast period 2026-2033.

United States: Recent Industry Developments

✅ February 2026: U.S.-based citrus processors expanded D-Limonene extraction capacity to meet rising demand from bio-based solvent manufacturers.

✅ January 2026: Specialty chemical companies introduced high-purity D-Limonene grades for use in eco-friendly cleaning products and industrial degreasers.

✅ December 2025: Growth in natural flavor applications drove new supply agreements between…

Photorejuvenation Devices Market Report (2026) | Growth Analysis, Competitive La …

Market Size and Growth

Photorejuvenation market is growing at a CAGR of 7.2% during the forecast period (2024-2031).

United States: Recent Industry Developments

✅ February 2026: Cutera launched next-generation photorejuvenation systems with enhanced IPL technology for skin revitalization.

✅ January 2026: Cynosure introduced AI-assisted devices for precise photorejuvenation targeting hyperpigmentation and fine lines.

✅ December 2025: FDA approved new photorejuvenation lasers with reduced downtime and improved patient comfort.

Download Free Sample PDF Report (Get Higher Priority…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…