Press release

Future Perspective: Key Factors Influencing the Discount Brokerage Market Until 2029

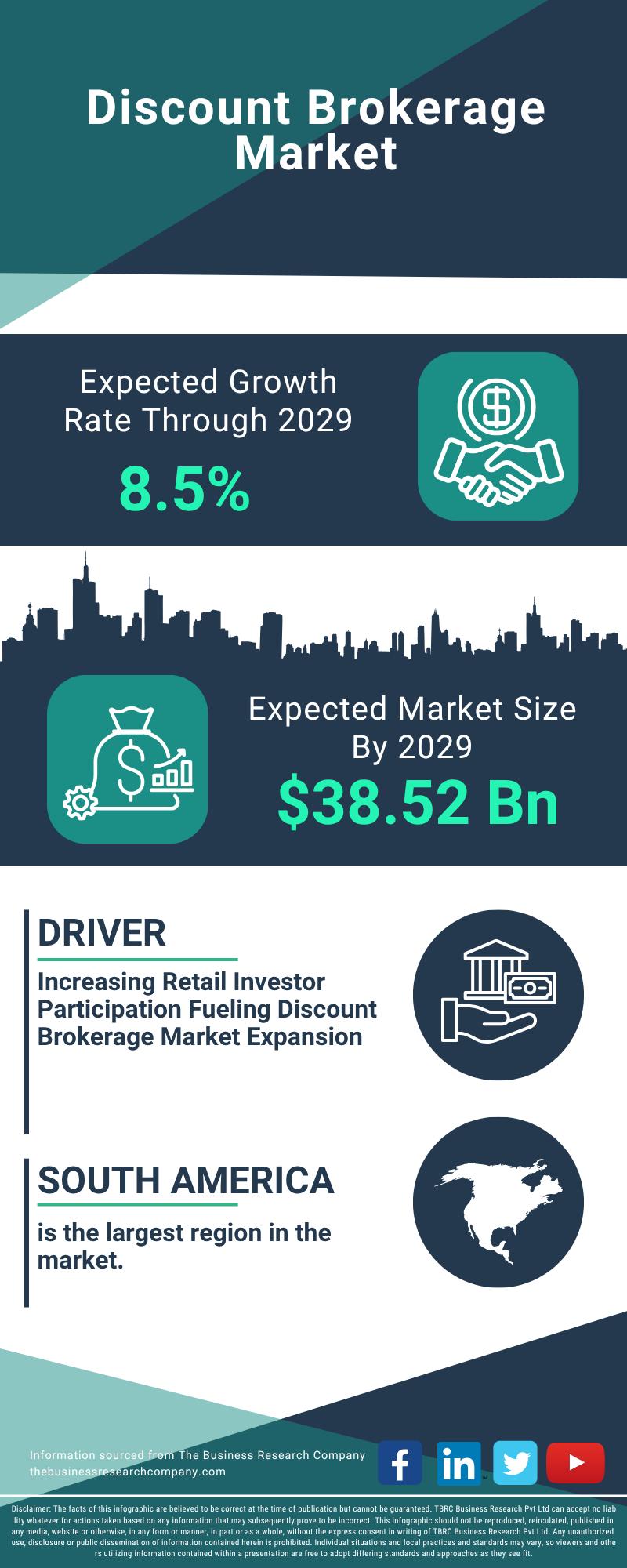

"The discount brokerage market is on track for remarkable expansion over the coming years, driven by evolving technologies and shifting investor preferences. As more individuals seek cost-effective and efficient trading options, this sector is poised for sustained growth and innovation. Let's explore the market's size projections, leading players, emerging trends, and segmentation to understand its future potential.Projected Growth Trajectory of the Discount Brokerage Market Size Through 2029

The discount brokerage market is forecasted to experience robust growth, reaching a valuation of $38.52 billion by 2029. This expansion is expected at a compound annual growth rate (CAGR) of 8.5%. Several factors contribute to this upward trend, including the increasing adoption of gamification techniques, a heightened focus on retirement planning and savings, and growing interest in sustainable and impact investing. Additionally, the spread of high-speed internet and declining operational costs are facilitating broader market participation. Key trends set to shape the market during this period include blockchain technology, artificial intelligence, tailored service offerings, fintech integration, and the use of advanced analytics tools.

Download a free sample of the discount brokerage market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18570&type=smp

Top Players Driving the Discount Brokerage Market Forward

The discount brokerage space is dominated by several prominent companies such as Fidelity Investments Inc., Charles Schwab Corporation, Ally Financial Inc., TD Ameritrade Holding Corporation, Interactive Brokers Group Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, SoFi Technologies Inc., Robinhood Markets Inc., IG Group Holdings plc, Citadel Securities LLC, NerdWallet Inc., Acorns Grow Inc., TradeStation Group Inc., Apex Fintech Solutions LLC, Stash Financial Inc., Saxo Bank A/S, Public Holdings Inc., Wea*lthfront Inc., Alice Blue Financial Services Private Limited, Folio Investments Inc., OANDA Corporation, eOption, Tastytrade Inc., and Zacks Investment Research Inc.

A notable development occurred in December 2023 when Mirae Asset Securities Co., a South Korean capital market firm, completed the acquisition of Sharekhan for $360 million. This move is part of Mirae Asset Financial Group's strategy to expand its footprint in India's rapidly growing retail brokerage sector. Sharekhan, a major financial services provider focused on online stock trading and discount brokerage, strengthens Mirae Asset's position within the Indian securities market and supports its global expansion ambitions.

View the full discount brokerage market report:

https://www.thebusinessresearchcompany.com/report/discount-brokerage-global-market-report

Advancements in Technology Supporting Discount Brokerage Market Growth

Leading discount brokerage firms are increasingly investing in sophisticated web-based trading platforms to improve trading efficiency and user experience. These platforms allow investors to buy and sell various financial instruments including stocks, bonds, options, futures, and cryptocurrencies seamlessly through the internet. For example, in September 2023, HDFC Securities, an India-based financial services provider, launched HDFC SKY. This all-in-one mobile app features a flat pricing model for both intraday and delivery trades and offers diverse investment options. It incorporates advanced technology to ensure a smooth and efficient trading experience for users.

The Structure and Segmentation of the Discount Brokerage Market

The discount brokerage market is categorized into several segments for a comprehensive analysis:

1) By Mode:

- Online Discount Brokerage Service

- Offline Discount Brokerage Service

2) By Service:

- Order Execution and Advisory

- Discretionary

- Online Trading Platforms

- Education and Investor Resources

3) By Commission:

- Commission-Free Brokers

- Fixed Commission Brokers

4) By Application:

- Individual

- Enterprise

- Government Agencies

Further breakdown includes subsegments such as:

- Online Discount Brokerage Service: Web-Based Platforms, Mobile Trading Apps, Robo-Advisory Services, Cryptocurrency Trading Platforms, Direct Market Access (DMA) Platforms

- Offline Discount Brokerage Service: Telephone-Based Brokerage, Branch-Based Brokerage Services, In-Person Advisory Services

- Hybrid Brokerage Services, which combine both offline and online approaches

This detailed segmentation helps capture the diverse offerings and customer preferences within the discount brokerage market, highlighting its complexity and potential for tailored solutions.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Perspective: Key Factors Influencing the Discount Brokerage Market Until 2029 here

News-ID: 4324666 • Views: …

More Releases from The Business research company

Leading Companies Fueling Growth and Innovation in the Sun Care Products Market

The sun care products market is on track for substantial expansion as consumer awareness about skin protection intensifies worldwide. With evolving preferences and technological advancements shaping product offerings, this sector is set to witness robust growth in the coming years. Let's explore the market's size projections, key players, emerging trends, and major segments driving its development through 2030.

Projected Size and Growth Trajectory of the Sun Care Products Market

The…

Future Perspectives: Key Trends Shaping the Styrene Butadiene Rubber (SBR) Based …

The styrene butadiene rubber (SBR) based adhesive market is on track for notable growth as we approach 2030. Driven by a variety of factors including expanding infrastructure projects and rising demand across multiple industries, this sector is poised for steady expansion. Let's explore the market's size projections, key players, emerging trends, and the main segments shaping its future.

Projected Growth and Market Size of Styrene Butadiene Rubber Based Adhesives

The…

Emerging Sub-Segments Transforming the Stearic Acid Market Landscape

The stearic acid market is poised for significant expansion in the coming years, driven by evolving demand across various industries. This report explores the projected market size, leading companies, key trends, and segment analysis shaping the future of this vital chemical.

Stearic Acid Market Size and Growth Outlook

The stearic acid market is set to grow robustly, reaching a valuation of $54.63 billion by 2030. This represents a compound annual…

Market Trend Insights: The Impact of Recent Innovations on the Specialty Pestici …

The specialty pesticides sector is on the verge of significant expansion as global agricultural practices continue to evolve. Driven by increasing demand for crop protection and sustainable farming techniques, this market is set to experience robust growth in the coming years. Let's explore the market's anticipated value, leading companies, emerging trends, and detailed segmentation to gain a comprehensive understanding of this dynamic industry.

Projected Market Size and Growth Expectations for Specialty…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…