Press release

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advancements In Mortgage Brokerage Services

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage brokerage services act as intermediaries between borrowers and lenders, providing customized advice tailored to long-term financial goals. For example, the U.S. Bureau of Labor Statistics predicted in April 2024 that the employment of personal financial advisors will increase by 13% from 327,600 in 2022 to 42,000 in 2032, far surpassing the average growth rate for all professions.

Get Your Mortgage Brokerage Services Market Report Here:

https://www.thebusinessresearchcompany.com/report/mortgage-brokerage-services-global-market-report

What growth opportunities are expected to drive the mortgage brokerage services market's CAGR through 2034?

The mortgage brokerage services market has grown rapidly, rising from $102.55 billion in 2024 to $113.26 billion in 2025 at a CAGR of 10.5%. Factors driving this growth include fluctuations in interest rates, trends in the housing market, regulatory changes, overall economic growth, and shifts in consumer demand for home financing.

The mortgage brokerage services market is projected to hit $166.86 billion in 2029 at a CAGR of 10.2%, driven by rising housing demand, urbanization, and government incentives. Trends include AI-powered mortgage processing, blockchain-secured transactions, virtual property tours, and advanced analytics.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18677&type=smp

What are the emerging trends shaping the future of the mortgage brokerage services market?

Companies in the mortgage brokerage services market are innovating with services like Brokerage as a Service (BaaS) to adapt to market changes. BaaS allows businesses to outsource brokerage operations and access third-party infrastructure. For example, in November 2023, GPARENCY, a US-based commercial mortgage broker, launched its BaaS division to offer a flexible, competitive commission structure, aiming to attract both new and experienced mortgage brokers while transforming the commercial real estate market.

Which growth-oriented segments of the mortgage brokerage services market are leading the industry's development?

The mortgage brokerage services market covered in this report is segmented -

1) By Interest Rate: Fixed Rate, Floating Rate

2) By Distribution Channel: Online, Offline

3) By Application: Residential Property Loans, Commercial Property Loans

4) By End User: Individuals, Businesses

Subsegments:

1) By Fixed Rate: 15-Year Fixed Rate, 30-Year Fixed Rate, Other Fixed Rate Terms

2) By Floating Rate: 1-Year Floating Rate, 3-Year Floating Rate, 5-Year Floating Rate, Other Floating Rate Terms

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18677

What regions are leading the charge in the mortgage brokerage services market?

North America was the largest region in the mortgage brokerage services market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the mortgage brokerage services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What companies are at the forefront of innovation in the mortgage brokerage services market?

Major companies operating in the mortgage brokerage services market are JPMorgan Chase & Co, Federal National Mortgage Association, Wells Fargo Bank N.A., Fairway Independent Mortgage Corporation, Rocket Mortgage, Homebridge Financial Services Inc, Mr. Cooper Group Inc, PennyMac Financial Services Inc, Guild Mortgage Company, Caliber Home Loans Inc, Movement Mortgage LLC, American Pacific Mortgage Corporation, LendingTree Inc, PrimeLending A PlainsCapital Company, Loan Factory Inc, Union Home Mortgage Corp, CitiMortgage Inc, Morty Inc, A-M-S Mortgage Services Inc, Counsel Mortgage Group LLC, New American Funding Inc, Sierra Pacific Mortgage Company Inc.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=18677&type=smp

What Is Covered In The Mortgage Brokerage Services Global Market Report?

•Market Size Forecast: Examine the mortgage brokerage services market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the mortgage brokerage services market for a structured understanding.

•Key Players Overview: Analyze major players in the mortgage brokerage services market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the mortgage brokerage services market.

•Segment Contributions: Evaluate how different segments drive overall growth in the mortgage brokerage services market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the mortgage brokerage services market.

•Industry Challenges: Identify potential risks and obstacles affecting the mortgage brokerage services market.

•Competitive Landscape: Review strategic developments in the mortgage brokerage services market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advancements In Mortgage Brokerage Services here

News-ID: 3927273 • Views: …

More Releases from The Business Research Company

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fl …

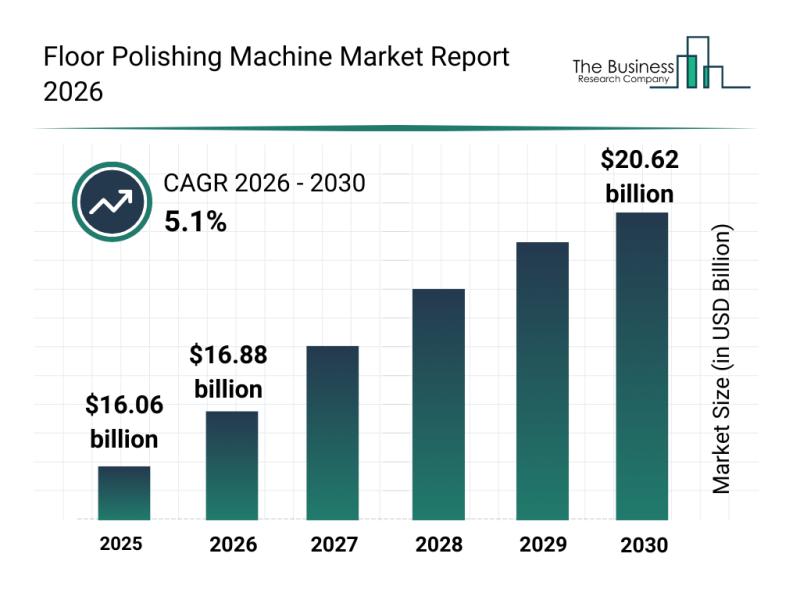

The floor polishing machine industry is on the verge of significant expansion as advancements in technology and growing demand from various sectors drive market momentum. This report will explore the current market valuation, key players, prominent trends, and notable segments shaping the future of floor polishing machinery.

Market Valuation Outlook for Floor Polishing Machines by 2030

The floor polishing machine market is poised for substantial growth in the coming years, expected…

Competitive Landscape: Key Market Leaders and New Entrants in the Flexible Elect …

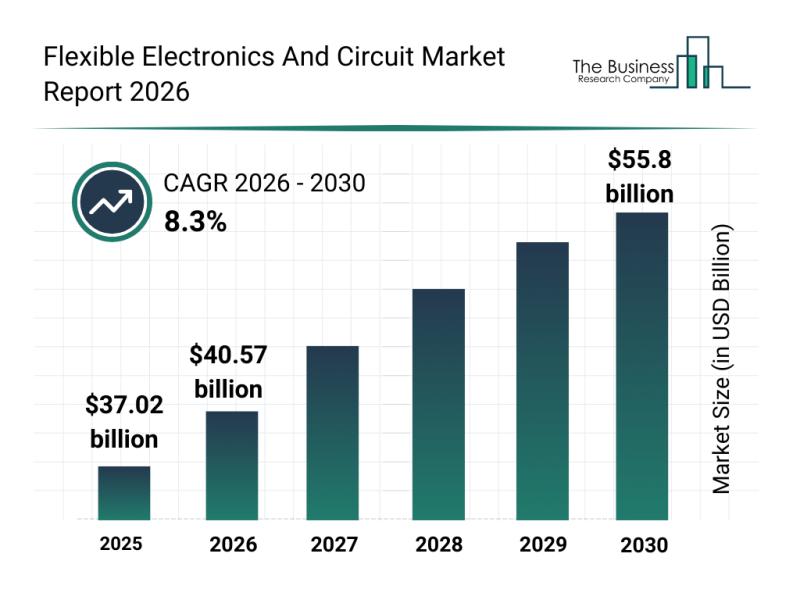

The flexible electronics and circuit sector is positioned for impressive expansion in the coming years, driven by rapid technological advancements and increasing applications across various industries. As innovation pushes the boundaries of what flexible technology can do, this market is set to experience significant growth and transformation.

Projected Market Valuation and Growth in Flexible Electronics and Circuit Market

The flexible electronics and circuit market is anticipated to reach a valuation of…

Financial Grade Security Chip Market Overview: Major Segments, Strategic Develop …

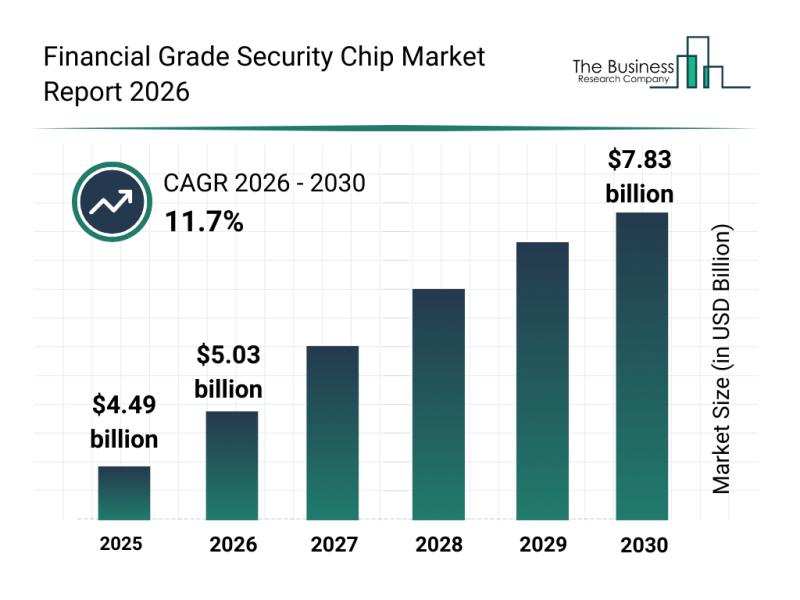

The financial grade security chip market is on a trajectory of significant expansion, driven by the increasing demand for robust digital security solutions in an evolving technological landscape. As digital transactions and connected devices become more prevalent, the market is set to experience substantial growth fueled by innovation and heightened security standards.

Financial Grade Security Chip Market Size and Long-Term Growth Outlook

The market for financial grade security chips is projected…

Analysis of Key Market Segments Influencing the Fan-Out Wafer Level Packaging Ma …

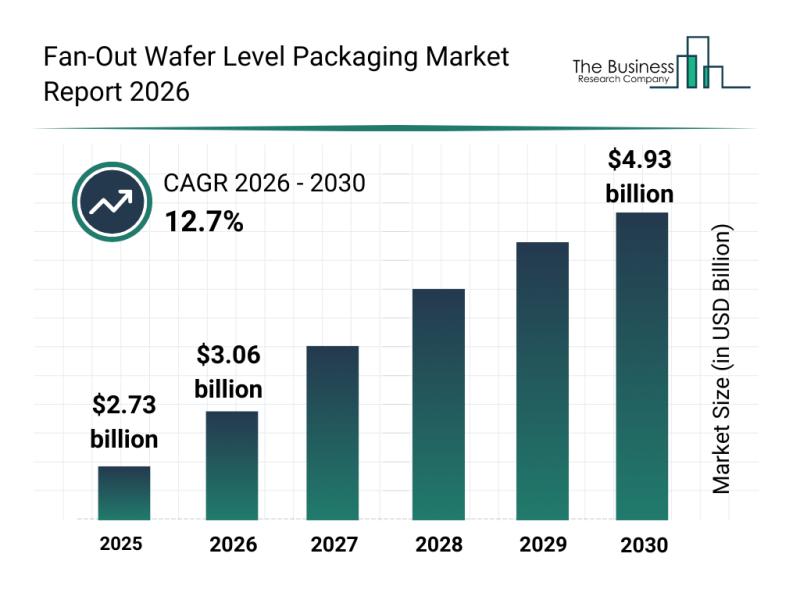

The fan-out wafer level packaging sector is set to experience significant expansion in the coming years, driven by growing demand across various high-tech industries. With advancements in semiconductor integration and increasing needs in automotive and communication technologies, this market is positioned for impressive growth and innovation. Here, we explore the market size projections, leading companies, key trends, and segment dynamics shaping the future of fan-out wafer level packaging.

Forecasted Market Size…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…