Press release

Emerging Sub-Segments Transforming the Securities Brokerage and Stock Exchange Services Market Landscape

The securities brokerage and stock exchange services sector is positioned for substantial expansion in the coming years, driven by evolving market demands and technological progress. This dynamic market is influenced by diverse factors ranging from regulatory changes to innovative trading methods. Let's explore the market size, key players, emerging trends, and segment breakdowns shaping the future of this industry.Projected Market Size and Growth for Securities Brokerage and Stock Exchange Services

The market for securities brokerage and stock exchange services is anticipated to reach a valuation of $3023.31 billion by 2029. This reflects an impressive compound annual growth rate (CAGR) of 8.0% during the forecast period. Several elements are driving this expansion, including global regulatory reforms, heightened attention to cybersecurity, shifting investor behaviors, initiatives promoting cross-border trading, and the increasing adoption of tokenized securities. Additionally, prominent trends such as algorithmic trading, greater involvement of retail investors, the integration of ESG (Environmental, Social, and Governance) investing, enhanced market data analytics, and expanded cross-border trading are expected to influence market dynamics throughout this period.

Download a free sample of the securities brokerage and stock exchange services market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3538&type=smp

Key Companies Leading the Securities Brokerage and Stock Exchange Services Industry

The competitive landscape in this sector features numerous significant players. Leading organizations include Bank of America Corporation, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation, Commonwealth Financial Network Inc., Aura Financial Services Inc., Cambridge Investment Research Inc., Lincoln Investment Planning Inc., Geneos Wealth Management Inc., Cadaret Grant & Co. Inc., Berthel Fisher & Company Financial Services Inc., First Allied Securities Inc., Capital Financial Group Inc., Investacorp Inc., InterSecurities Inc., Capital Analysts Incorporated, Investment Centers of America Inc., and Investors Capital Corporation. These firms play pivotal roles in shaping the market's direction and innovation.

Technological Advancements Transforming Securities Brokerage and Stock Exchange Services

Industry leaders are increasingly adopting innovative technologies to enhance service delivery and accessibility. One notable development is the emergence of Brokerage as a Service (BaaS), a cloud-based platform that allows financial institutions, fintech firms, and other third parties to offer brokerage and trading services without building their own infrastructure. For example, in August 2024, Indian financial services company HDFC Securities introduced HDFC FinX, a BaaS solution that empowers banks, fintechs, and other organizations to provide integrated trading services. By leveraging HDFC's trading app, HDFC SKY, through APIs and SDKs, partners can deliver a seamless trading experience with minimal development effort. The platform offers flexible revenue-sharing models, including brokerage revenue sharing, hybrid options, and referral-only arrangements.

View the full securities brokerage and stock exchange services market report:

https://www.thebusinessresearchcompany.com/report/securities-brokerage-and-stock-exchange-services-global-market-report

Detailed Segmentation of the Securities Brokerage and Stock Exchange Services Market

This market is categorized along several dimensions for comprehensive analysis:

1) By Type of Service: Derivatives and Commodities Brokerage, Stock Exchanges, Bonds Brokerage, Equities Brokerage, and Other Stock Brokerage services.

2) By Establishment Type: Exclusive Brokers, Banks, Investment Firms, and other establishments.

3) By Operational Mode: Online and Offline channels.

Further subdivisions provide a closer look into each segment:

- Derivatives and Commodities Brokerage includes futures contracts, options trading, and commodity trading.

- Stock Exchanges encompass national exchanges, regional exchanges, and Over-The-Counter (OTC) markets.

- Bonds Brokerage covers corporate bonds, municipal bonds, and government bonds.

- Equities Brokerage involves common stocks, preferred stocks, and exchange-traded funds (ETFs).

- Other Stock Brokerage services consist of foreign exchange trading, investment advisory services, and margin trading services.

With these comprehensive segments and dynamic growth drivers, the securities brokerage and stock exchange services market is set to undergo significant transformation and expansion in the years ahead.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Sub-Segments Transforming the Securities Brokerage and Stock Exchange Services Market Landscape here

News-ID: 4324514 • Views: …

More Releases from The Business Research Company

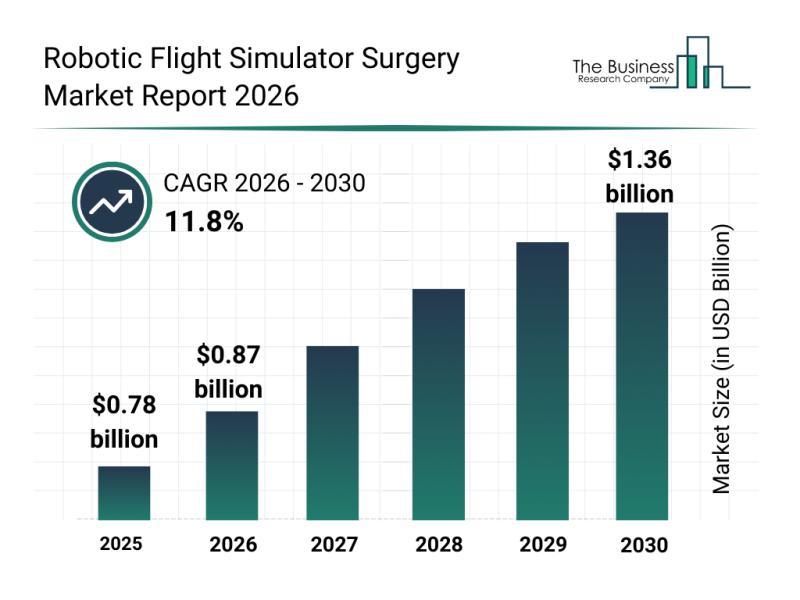

Global Factors Influencing the Rapid Evolution of the Robotic Flight Simulator S …

The robotic flight simulator surgery market is on the verge of significant expansion as advanced technologies continue to reshape surgical training and planning. Driven by increasing adoption of virtual reality and innovative simulation tools, this sector is set to experience considerable growth over the coming years. The following analysis explores the market's valuation, key contributors, evolving trends, and the segmentation landscape.

Projected Market Size and Growth Trajectory of the Robotic Flight…

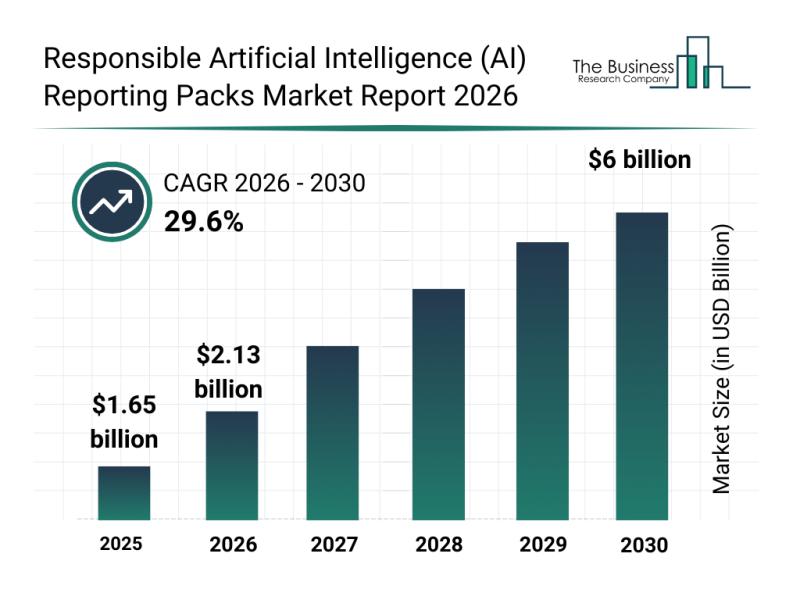

Leading Companies Consolidating Their Presence in the Responsible Artificial Int …

As artificial intelligence (AI) technologies continue to evolve and integrate deeply into business operations, the need for transparent and accountable AI practices has never been more critical. The responsible artificial intelligence (AI) reporting packs market is emerging as a vital sector dedicated to ensuring that AI systems are monitored, governed, and reported with rigor. Let's explore the expected growth, key players, industry trends, and market segments shaping this important field.

Projected…

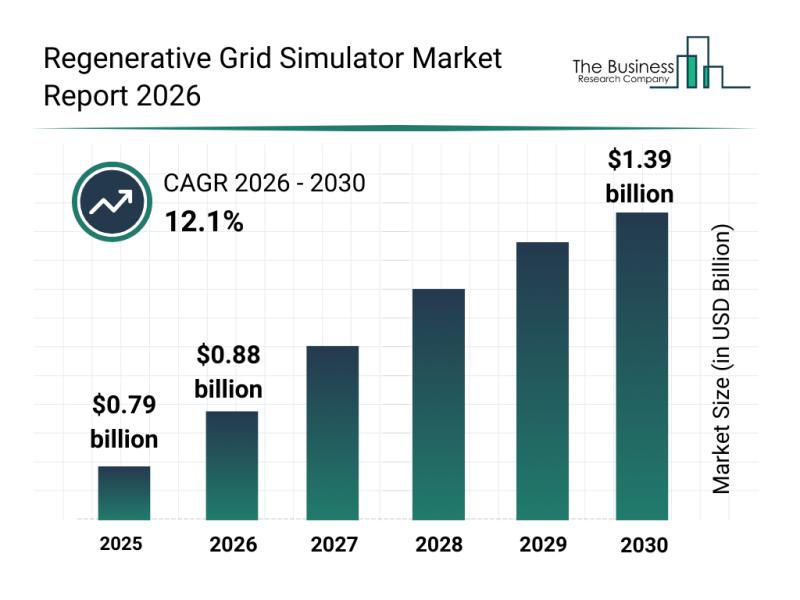

Future Perspective: Key Trends Shaping the Regenerative Grid Simulator Market Up …

The regenerative grid simulator market is on track for significant expansion as technological advancements and increasing energy demands drive innovation. With rising focus on smart grids and electric vehicle infrastructure, this market is poised to transform energy testing and validation processes in the coming years. Here's an in-depth look at the market's size, key players, emerging trends, and major segments shaping its future.

Forecast and Market Size Growth in the Regenerative…

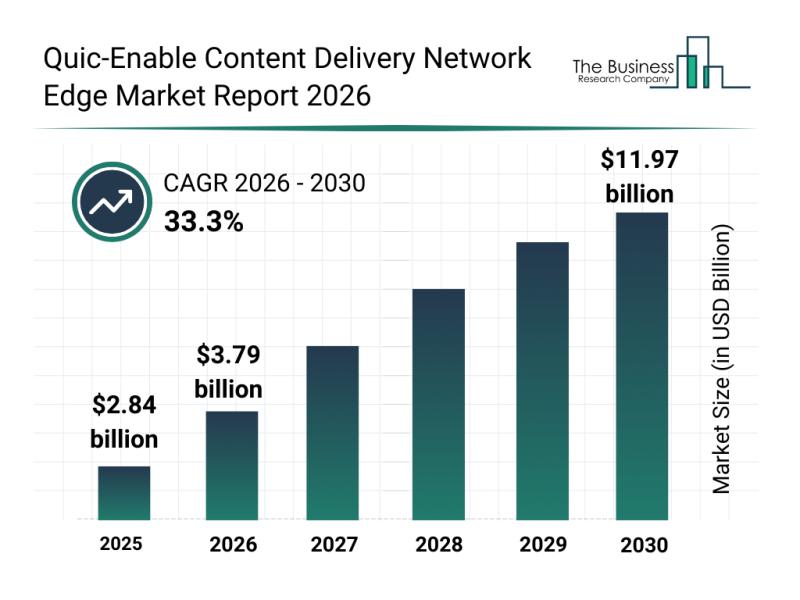

Analysis of Key Market Segments Driving the Quic-Enabled Content Delivery Networ …

The quic-enabled content delivery network edge industry is on track for remarkable expansion over the coming years. Driven by evolving digital needs and technological advancements, this market is set to transform how content is delivered and experienced globally. Let's explore its market size, key players, prevailing trends, and segment-specific forecasts to understand the future trajectory of this dynamic sector.

Projected Market Growth and Size of the Quic-Enable Content Delivery Network Edge…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…